Introduction: Understanding Altcoins and Their Growing Importance

As the world of cryptocurrency expands beyond Bitcoin, many first-timers are hearing a new term: altcoins. A beginner’s guide to altcoins isn’t just helpful—it’s essential for understanding the broader crypto landscape. Altcoins, short for “alternative coins,” refer to any cryptocurrency that isn’t Bitcoin. From Ethereum to Solana, Cardano to Avalanche, these digital assets have become integral to discussions about blockchain, investment, and innovation.

This guide will take you through the fundamentals: what altcoins are, how they differ from Bitcoin, where to buy and trade them, and why they’ve become a vital part of the crypto ecosystem.

What Are Altcoins? A Simple Explanation

Altcoins are digital currencies that exist as alternatives to Bitcoin. While Bitcoin was the first and still the most well-known cryptocurrency, its limitations—such as slow transaction times and limited programmability—created a need for others to step in and offer different solutions.

Ethereum, for instance, introduced smart contracts, which allow developers to build decentralized apps (dApps). Ripple (XRP) focuses on fast international payments. Others, like Dogecoin, started as a joke but gained popularity for their community-driven approach.

There are thousands of altcoins, and they fall into categories like utility tokens, stablecoins, governance tokens, and meme coins. Each serves a specific purpose and is often built on a unique blockchain or platform.

Altcoin vs Bitcoin: What’s the Difference?

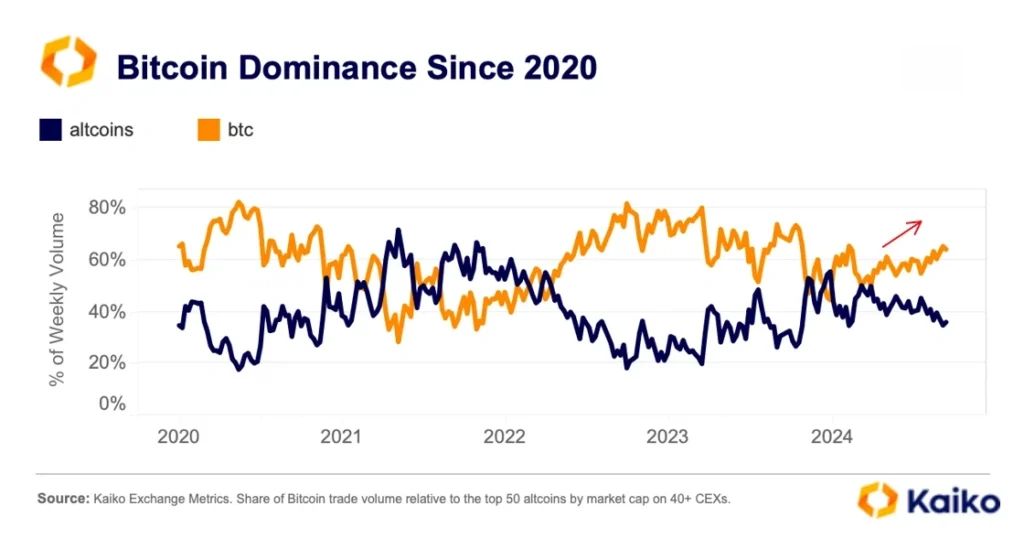

Credit from Kaiko – Research

While Bitcoin is largely seen as a store of value—often called “digital gold”—altcoins have more diverse use cases. Some aim to solve Bitcoin’s problems, such as scalability or energy consumption. Others offer unique features:

- Bitcoin: Focuses on decentralization and limited supply (21 million coins).

- Ethereum: Powers smart contracts and dApps, forming the backbone of decentralized finance (DeFi).

- Solana and Avalanche: Offer faster transactions and lower fees, making them popular for developers.

- Stablecoins like USDT or USDC: Pegged to fiat currencies to reduce volatility.

Altcoins can often be more volatile but also offer higher potential gains—or losses—than Bitcoin. That’s why understanding them is crucial before investing.

How to Buy Altcoins: A Step-by-Step Guide

Buying altcoins in 2025 is easier than ever, but choosing the right platform and method is critical for safety and accessibility. Here’s a general process for beginners:

- Choose a Reliable Exchange

Platforms like Binance, Coinbase, Kraken, and KuCoin support a wide variety of altcoins. Look for user-friendly interfaces, regulatory compliance, and strong security measures. - Set Up a Crypto Wallet

While most exchanges offer built-in wallets, consider a private wallet—hardware or software—for added security. Wallets like MetaMask, Trust Wallet, or Ledger allow you to manage your altcoin holdings independently. - Verify and Fund Your Account

Most exchanges require identity verification (KYC). You can fund your account using bank transfers, credit cards, or stablecoins. - Select Your Altcoin and Trade

Once you’ve deposited funds, search for the altcoin you want. You can buy at market price or place a limit order for a specific price. - Withdraw to Your Wallet (Optional)

For long-term storage, move your coins to a private wallet. This step reduces your exposure to exchange-related risks like hacks or downtime.

Beginner’s Guide to Altcoins: Where to Trade Altcoins in 2025

In 2025, centralized exchanges still dominate the landscape due to ease of use, while decentralized exchanges (DEXs) have grown in popularity among experienced users. Here’s a breakdown:

- Centralized Exchanges (CEX): Coinbase, Binance, Kraken, Bitstamp

- Decentralized Exchanges (DEX): Uniswap, PancakeSwap, SushiSwap

CEXs are recommended for beginners, but DEXs offer greater privacy and access to newer, less mainstream altcoins. Always check fees, liquidity, and reputation before trading.

Why Altcoins Matter: Beyond Bitcoin’s Shadow

Altcoins play a vital role in expanding what blockchain technology can do. While Bitcoin primarily serves as a digital currency, altcoins fuel broader innovations:

- Smart Contracts: Ethereum and similar platforms allow automation of agreements.

- Decentralized Finance (DeFi): Altcoins are used in lending, borrowing, staking, and yield farming.

- NFT and Gaming Ecosystems: Tokens like AXS (Axie Infinity) power entire gaming economies.

- Governance: Some altcoins allow holders to vote on project decisions, shaping the platform’s future.

These developments demonstrate that altcoins aren’t just Bitcoin alternatives—they’re central to the crypto ecosystem’s evolution.

Beginner’s Guide to Altcoins: How to Stay Safe and Smart

Credit from SimpleFX

Investing in altcoins involves more risk than traditional assets. Here are a few tips for first-time investors:

- Start small and never invest money you can’t afford to lose.

- Research the project’s fundamentals—read whitepapers, explore the team, assess the use case.

- Be cautious with hype coins. Popularity doesn’t equal sustainability.

- Understand tokenomics, such as supply limits and inflation models.

- Beware of scams and rug pulls. Only use verified platforms and double-check contract addresses.

Altcoin Wallet Guide: Keeping Your Assets Safe

Choosing the right wallet is as important as selecting an exchange. There are three main types:

- Hot Wallets (Online): Convenient but vulnerable. Good for short-term trades.

- Cold Wallets (Offline/Hardware): Safer for long-term storage.

- Custodial Wallets: Provided by exchanges, easy to use, but you don’t control the private keys.

For new users, a hot wallet like Trust Wallet or MetaMask is a good start. Eventually, consider a cold wallet like Ledger or Trezor for larger holdings.

How to Research Altcoins (And Avoid Scams)

Not all altcoins are created equal. Some are backed by solid teams and tech, while others are built purely for speculation. Use these research strategies:

- Check CoinMarketCap or CoinGecko for rankings, volumes, and history.

- Read the whitepaper to understand the purpose and roadmap.

- Investigate the development activity on GitHub or similar platforms.

- Engage with the community on forums like Reddit, Twitter, or Discord.

- Watch out for unrealistic promises, anonymous founders, or sudden pump campaigns.

Conclusion: A Beginner’s Guide to Altcoins is Your First Step

Altcoins are more than just Bitcoin’s younger siblings—they are powerful tools that help shape the future of finance, gaming, governance, and more. A beginner’s guide to altcoins helps you navigate this fast-moving space with more clarity and confidence. Whether you’re exploring altcoin trading basics, evaluating top altcoins in 2025, or just setting up your first wallet, start small, stay informed, and move at your own pace. The altcoin market offers both risk and opportunity—and your journey starts with knowledge.