In 2025, talking about BEXBACK Crypto Exchange review means talking about frictionless entry, extreme leverage, and an unapologetically unregulated corner of the crypto world. It’s the kind of platform that attracts traders who move fast and don’t want to wait for permission. But that same freedom comes with real consequences.

Summary

What Sets BEXBACK Apart This Year

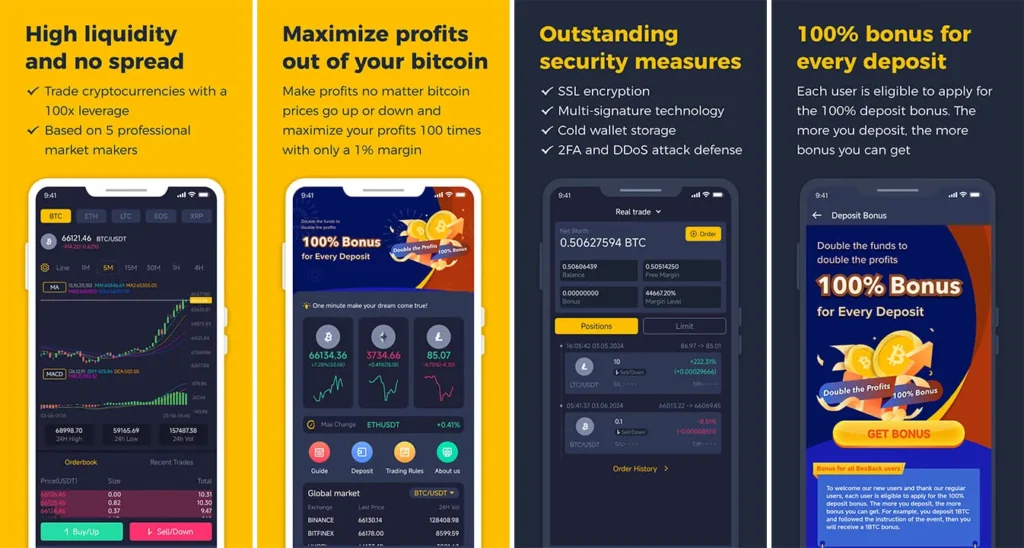

BEXBACK hasn’t changed its core formula. You still get instant sign-up, no identity verification, and a clean focus on altcoin derivatives. What’s new is the broader range of blockchains it now accepts for deposits—BNB Chain, AVAX, TRON. It’s a small shift, but one that appeals to users used to hopping between ecosystems.

There’s also a subtle evolution in its UI. The platform has tweaked performance speeds for high-frequency trading and quietly introduced copy trading in beta. While it’s not a complete overhaul, it shows that BEXBACK is still iterating.

BEXBACK Crypto Exchange review: No-KYC and the Regulatory Dilemma

Most platforms now choose the regulatory route—they apply for licenses, coordinate with regional watchdogs, and publish transparency reports. BEXBACK takes a different approach. It lists a U.S. MSB registration, yes, but doesn’t present any audit documentation, doesn’t introduce its team publicly, and refuses to clarify where client funds are kept. This kind of opacity may attract users seeking privacy, but it also raises critical red flags for anyone prioritizing accountability.

This approach appeals to users who value privacy and don’t want their names tied to every wallet. But that anonymity can backfire when issues arise. Without jurisdiction or legal recourse, users carry all the risk themselves.

Security and Support: What You Actually Get

| Security Feature | Claimed | Audited |

|---|---|---|

| 2FA | Yes | Not Verified |

| Cold Wallet | Yes | Unknown |

The platform talks about cold wallet storage and two-factor authentication—features that have become standard across most modern exchanges. This BEXBACK Crypto Exchange Review finds that more importantly, there’s no sign of third-party testing or proof-of-reserve disclosures, both of which are now seen as essential for trust and transparency. When there’s no obligation to verify, traders are left exposed—especially when dealing with platforms that operate outside well-defined regulatory systems.

Support remains minimal. Email and in-app chat are available, but don’t expect fast replies during volatile periods.

BEXBACK Crypto Exchange Review: Who Gains the Most?

Credit From: forbes

The ideal BEXBACK user is someone who values speed, autonomy, and is used to trading under pressure. It’s not the place for long-term investors or those relying on regulated fiat ramps. For short-term traders and crypto-native users, though, it still checks a lot of boxes.

At the same time, the platform’s structure naturally filters for users with a high tolerance for risk. There’s no hand-holding or learning curve support—this isn’t where you come to learn trading; it’s where you go once you already know the game. That makes BEXBACK more of a niche option, appealing mostly to those who prefer speed and self-direction over guardrails and guidance.

Final Thoughts: Should You Still Consider BEXBACK?

Credit From: morningstar

BEXBACK isn’t mainstream, and it never tried to be. In 2025, it continues to exist in a grey zone—offering speed and simplicity at the cost of regulation and security.

If you’re okay with that trade-off, there’s still value to extract. Just know what you’re signing up for. This is a platform for fast hands and thick skin, not beginners or those chasing long-term growth. And in a post-regulatory world, that line matters more than ever.