BI forex intervention: As financial conditions tighten globally in 2025, regional currencies have once again come under stress—triggered by shifting U.S. monetary policy, global growth downgrades, and persistent energy price uncertainty. Indonesia, despite sound fundamentals, has seen the rupiah waver near psychologically sensitive levels, particularly in the face of large portfolio outflows.

In this context, BI forex intervention has become a recurring theme, not just as a short-term fix, but as part of Bank Indonesia’s broader strategy to restore order, contain inflation risk, and maintain macroeconomic stability. The difference this year? BI is intervening more assertively—but with a better playbook.

BI forex intervention: From Passive Oversight to Active Navigation

Source: Business Indonesia

Throughout early 2025, it’s become increasingly clear that BI is shifting from reactive defense to proactive navigation. The central bank no longer waits for the rupiah to hit a threshold before stepping in. Instead, it is intervening based on forward-looking indicators—capital flow projections, risk sentiment data, and demand for offshore hedging instruments.

This trend signals a maturation in policy response. By anticipating pressure and intervening early, BI not only reduces market panic but also preserves the credibility of its floating exchange rate regime.

BI forex intervention: Intervention Has Grown More Frequent—But Less Visible

In contrast to dramatic moves seen during past periods of stress, BI’s currency interventions this year have been frequent, but less theatrical. Rather than dominating headlines with multi-billion dollar spot operations, the central bank now prefers tactical moves in off-peak hours, and indirect market shaping through Domestic Non-Deliverable Forwards (DNDFs).

This more surgical approach allows BI to cool volatility without signaling fear. In fact, market watchers in 2025 report steadier intraday pricing and reduced speculative buildup, largely thanks to this more consistent presence in the FX market.

DNDFs Dominate the 2025 Toolkit

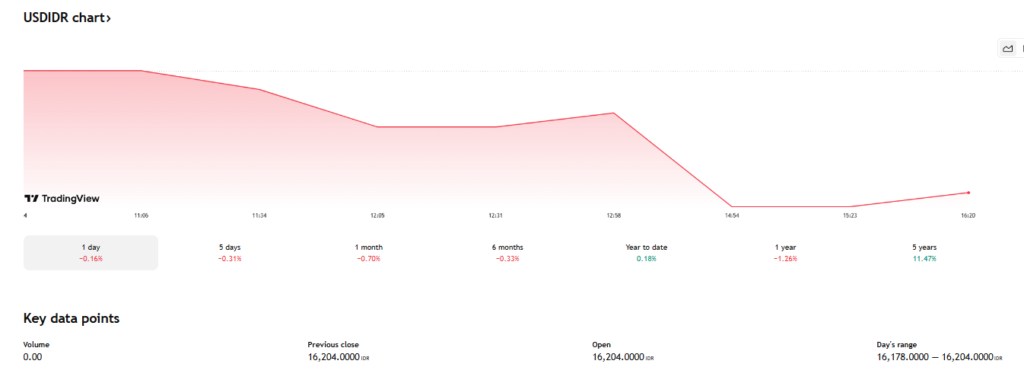

Source: TradingView

If one theme defines BI forex intervention in 2025, it’s the institutionalization of DNDFs. What began as an emergency hedge tool during previous global disruptions has now evolved into a mainstay of BI’s operations.

Every few weeks, BI auctions DNDF contracts to eligible participants, giving the market a structured way to manage expectations around rupiah depreciation. This keeps FX volatility lower, cushions banks’ forward exposures, and reduces the central bank’s need to sell USD directly.

Reserves Are Used Selectively—But Strategically

Source: TradingEconomics

Another trend this year is BI’s more disciplined reserve deployment. As of Q2 2025, Indonesia’s foreign reserves have remained stable above USD 135 billion. Instead of using them for blunt-force defense, BI taps into them tactically—offering temporary liquidity or using swap lines with local banks during short-term demand spikes.

This method not only stretches the longevity of the reserves but also signals to the market that Indonesia is not draining its defenses unnecessarily. In a time when confidence is currency, this matters.

Investors Applaud Predictability Over Perfection

Source: Me.nyala

Interestingly, even with some weakening in the rupiah, investors have not panicked. In fact, many analysts argue that BI’s more predictable approach in 2025 has helped anchor foreign investment more effectively than trying to maintain artificial price floors.

By managing volatility instead of eliminating it, BI reassures markets that it understands the dynamics at play—and knows when to step back. This layered approach to intervention has been cited as one reason why Indonesian government bonds have remained relatively stable compared to regional peers.

Looking Ahead: Will the Strategy Hold?

There’s little sign that BI will deviate from this more agile style of intervention in the months ahead. The second half of 2025 could see new challenges—U.S. rate path surprises, a faltering Chinese recovery, or domestic election jitters. Still, the central bank seems positioned to react quickly, without overcommitting resources or disrupting market trust.

The key trend to watch isn’t whether BI intervenes, but how: Will it continue leaning on DNDFs? Will communication remain opaque to deter speculation, or more transparent to anchor sentiment?

Conclusion: BI Forex Intervention in 2025 Is Sharper, Quieter, and More Strategic

This year’s BI forex intervention in 2025 reveals a central bank that is no longer playing catch-up. Instead, Bank Indonesia is adapting to the reality of a multipolar, fast-moving financial world by blending forward-looking data, risk-based strategies, and flexible instruments.

The result isn’t a fixed exchange rate—but a better-buffered one. And in 2025, that’s exactly what a resilient economy needs.