When you search for a BitFlyer exchange review, the same strengths usually appear: regulation, security, and low trading costs. Founded in Tokyo in 2014, BitFlyer quickly established itself as Japan’s leading crypto exchange, later expanding into the U.S. and Europe. Moreover, with approvals from regulators such as Japan’s FSA and New York’s DFS, it stands out as one of the few platforms trusted across multiple regions. But in 2025, the critical question is this: can BitFlyer’s conservative model compete with larger exchanges offering hundreds of tokens and advanced derivatives?

BitFlyer Exchange Review: Regulation and Security

First and foremost, BitFlyer is a regulated crypto exchange. It holds licenses from the Financial Services Agency in Japan, a BitLicense in New York, and regulatory approval in Luxembourg for EU users. This multi-jurisdiction oversight provides reassurance, especially after several unregulated platforms collapsed in recent years.

In terms of safety, BitFlyer has built a strong record. More than 80% of assets remain in cold storage, 2FA is mandatory, and institutional-grade security audits are conducted regularly. Unlike some exchanges, BitFlyer has avoided major hacks, which reinforces its reputation. Therefore, for investors who place safety at the top of their checklist, BitFlyer is a strong candidate.

BitFlyer Exchange Review: Supported Assets

Created From: marketplacefairness

On the other hand, BitFlyer’s limited asset range is often seen as its biggest drawback. The exchange lists around 10 major cryptocurrencies, including Bitcoin (BTC), Ethereum (ETH), Litecoin (LTC), and a handful of others. For conservative investors, this is not necessarily a weakness—many traders only want exposure to BTC and ETH anyway.

However, altcoin traders who enjoy chasing new projects will feel restricted. While platforms like Binance and KuCoin list hundreds of coins, BitFlyer deliberately chooses not to follow that route. In fact, this strategy reflects its compliance-first approach: fewer listings, but stronger regulatory comfort.

BitFlyer Exchange Review: Fee Structure

Created From: finance.yahoo

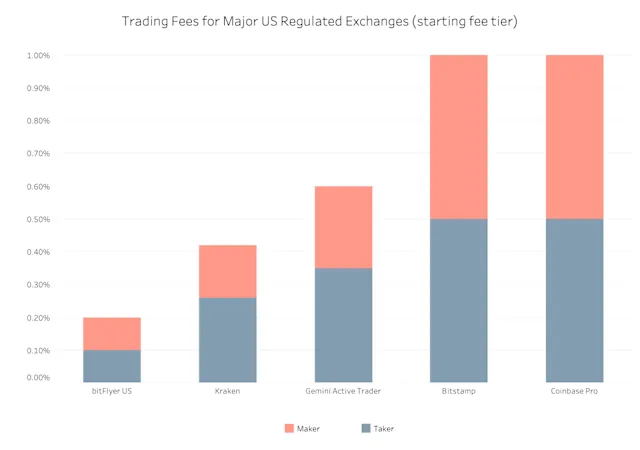

BitFlyer’s fees are another highlight. On its Lightning Exchange, both maker and taker fees begin at 0.10%, with discounts for higher monthly volumes. This is considerably lower than Coinbase and similar to Binance in competitive tiers.

Here’s a simplified breakdown of trading fees:

| Monthly Trading Volume (USD) | Maker Fee | Taker Fee |

|---|---|---|

| 0 – 50,000 | 0.10% | 0.10% |

| 50,000 – 500,000 | 0.07% | 0.07% |

| 500,000+ | 0.05% | 0.05% |

Nevertheless, users who rely on the instant buy option should note that spreads there are higher. Therefore, active traders are better off using Lightning to maximize cost savings.

Platform and User Experience

Created From: coingeek

BitFlyer provides two main experiences: the standard platform, designed for beginners, and the Lightning Exchange, which caters to advanced users. The regular interface is simple—ideal for small trades or quick purchases. In contrast, Lightning offers features like order books, candlestick charts, and API support for algorithmic trading.

The BitFlyer mobile app extends this experience. It allows deposits, withdrawals, and spot trading in fiat currencies like JPY, USD, and EUR. Many reviews highlight its stability, though others argue it lacks the polish of Coinbase’s app. Even so, it gets the essentials right, making it a practical option for long-term traders.

Pros and Cons

Like every platform, BitFlyer has advantages and limitations.

Pros:

- Regulated in Japan, the U.S., and EU

- Extremely low Lightning Exchange fees

- Strong track record of security with cold storage and 2FA

- Mobile app is stable and supports fiat deposits

- Appeals to Bitcoin and Ethereum-focused traders

Cons:

- Limited selection of cryptocurrencies (~10)

- Instant buy carries higher spreads

- Interface feels basic compared to Binance or Bybit

- Not suitable for altcoin or DeFi-focused strategies

Final Verdict

In conclusion, this BitFlyer exchange review highlights a platform that excels in security, compliance, and affordability. Moreover, for traders who mainly invest in Bitcoin and Ethereum, BitFlyer offers one of the cheapest and safest regulated paths in 2025. On the other hand, those seeking hundreds of tokens, derivatives, or DeFi tools will likely feel limited.

Overall, BitFlyer’s position is clear: it is a conservative, compliance-driven platform that continues to serve institutions and long-term investors. Therefore, while it may not be the most exciting exchange in the world, it remains one of the most trustworthy.