In the fast-changing exchange market, platforms come and go. Bitget, however, has stayed relevant by strengthening its bitget futures trading offerings while expanding into spot and passive income services. This bitget exchange review is based on consistent use over several months – enough time to test bitget trading fees, interface stability, and the value of its extra tools.

Getting Started – Registration and Verification

The initial sign-up is quick: just an email and password. To unlock higher limits and leverage options, you’ll need the bitget KYC process, which means providing ID, address proof, and sometimes a selfie. My approval came through within the same day.

If you want to explore without pressure, the bitget demo account lets you practice with real-time data and test the trading instruments on Bitget before funding.

Market Coverage – More Than Just Futures

While it’s best known for bitget futures trading, the platform has put serious work into bitget spot trading. The list of supported assets on Bitget includes all major coins and a steady stream of new listings. For traders seeking more aggressive plays, bitget margin trading offers leverage with variable interest rates.

The combination means I can manage both long-term positions and short-term speculation without moving assets to another platform.

Costs – Where Bitget Competes Hard

Pricing is one of Bitget’s selling points. As a low fee trading platform, bitget trading fees start at 0.1% for spot, with even lower futures rates. Discounts apply when paying fees in BGB tokens.

Here’s the 2025 structure:

| Market Type | Maker Fee | Taker Fee | Notes |

|---|---|---|---|

| Spot | 0.1% | 0.1% | Lower with BGB |

| Futures | 0.02% | 0.06% | Volume-based tiers |

| Margin | Varies | Varies | Interest on borrowed assets |

| Withdrawal | Network fee | — | Depends on coin |

In the bitget vs binance comparison, Binance remains stronger in fiat markets, but Bitget takes the edge in futures fees and rebate programs.

Security – Keeping Funds Protected

The bitget security features include multi-factor authentication, cold wallet storage for the majority of assets, withdrawal address whitelisting, and anti-phishing settings. The regulatory status Bitget varies depending on region, but it operates with AML/KYC compliance and conducts ongoing audits.

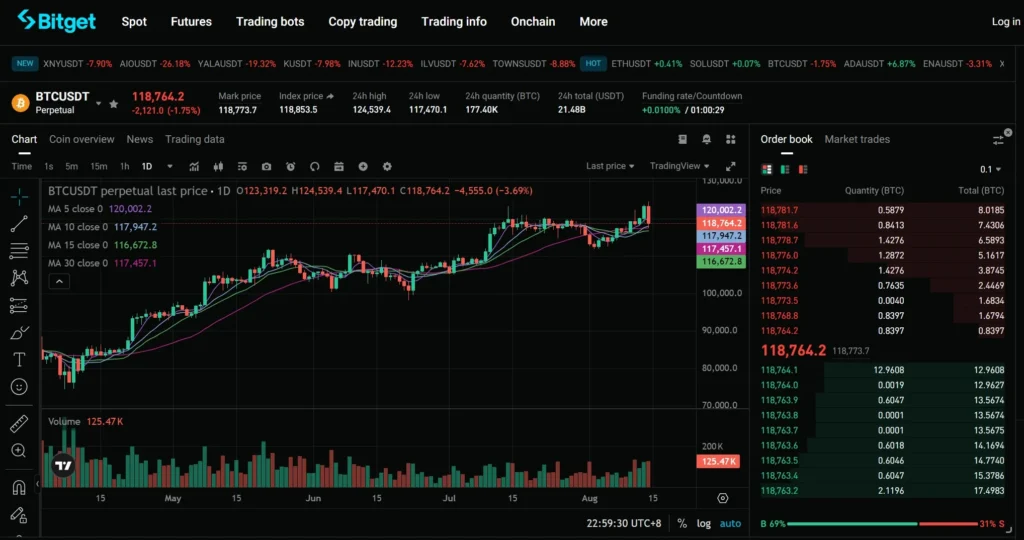

Bitget Exchange Review: Day-to-Day Trading Experience

On desktop, the interface is clean and responsive, with a deep order book and customizable chart layouts. The mobile trading app Bitget mirrors this usability, so switching between devices is seamless.

In my experience, liquidity and execution speed are reliable across both spot and futures. Advanced traders can leverage bitget API trading for automation and more complex setups.

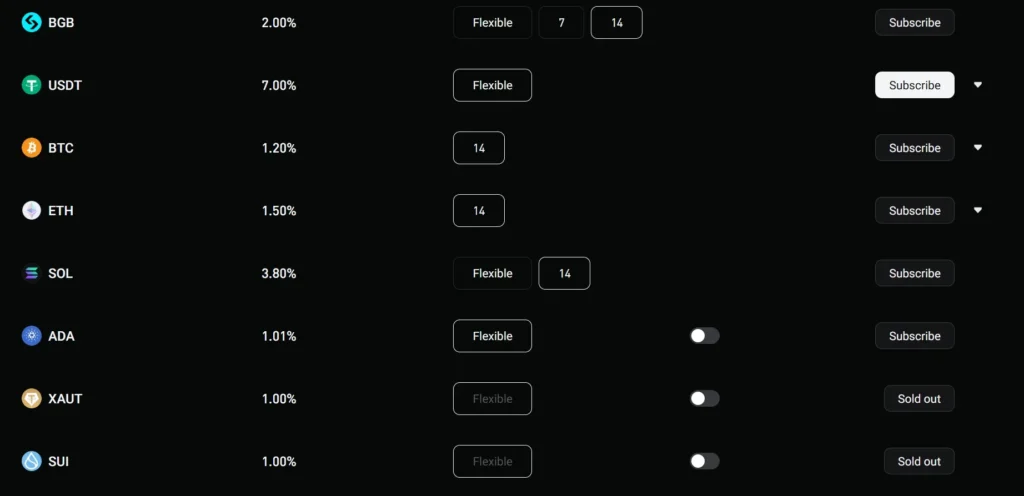

Bitget Exchange Review: Earn and Copy Trading

The Bitget Earn program offers flexible and fixed-term staking options, along with lending products for passive returns. I’ve used it to make idle assets work while waiting for better market entries.

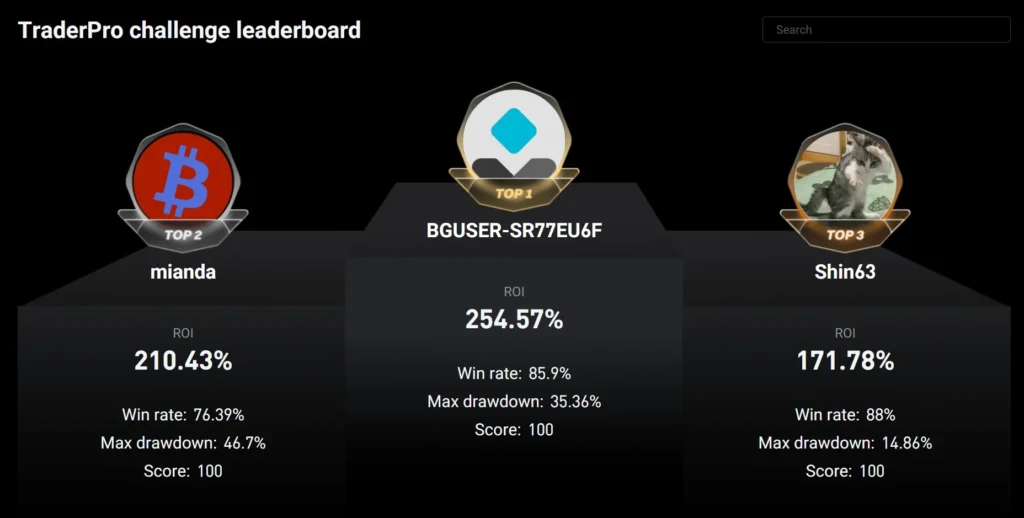

The bitget copy trading system allows you to follow top traders and automatically replicate their positions, which is useful for those who can’t watch the markets full-time.

Bitget Exchange Review: Deposits and Withdrawals

The deposit and withdrawal process is straightforward. Fiat deposit options Bitget include bank transfers, cards, and selected payment providers. Crypto deposits usually arrive within minutes, while fiat can take up to three business days. My last USDT withdrawal was processed in under an hour.

Bitget Exchange Review: Is a Good Choice in 2025?

From this bitget exchange review, it’s clear that Bitget is more than just a futures specialist. With competitive bitget trading fees, strong bitget security features, diverse supported assets on Bitget, and tools like Bitget Earn and bitget copy trading, it’s a versatile platform for both active and passive crypto strategies.

For traders who prioritize derivatives and cost efficiency, it’s worth keeping Bitget in your regular rotation.