The rise of Bitcoin, Ethereum, and other digital currencies has captured global attention. While seasoned investors have become accustomed to the tools and risks of cryptocurrency, many newcomers are still figuring out how to enter the space securely. If you’re about to buy cryptocurrency for the first time, learning to do it safely is essential.

This guide explains how beginners can make their first crypto purchase confidently—while minimizing mistakes that could cost money or compromise security.

The Basics of Buy Cryptocurrency Safely: What You Need to Know Before You Start

Cryptocurrencies are digital assets that operate on decentralized networks, meaning they’re not controlled by banks or governments. Bitcoin was the first, but thousands of other tokens have followed.

What makes crypto appealing is also what makes it risky. You have full control over your funds—but that also means you bear full responsibility for protecting them. Unlike traditional finance, there’s no hotline to reverse a transaction.

To buy cryptocurrency safely, the first thing to understand is this: choosing the right platform and tools can make all the difference.

Step One: Use a Reputable Exchange That Meets Regulatory Standards

Exchanges are where most people start. These online platforms allow you to convert traditional currency (such as USD, EUR, or MYR) into crypto. But not all exchanges are equally safe.

You should prioritize:

- Regulatory compliance (is the exchange registered or licensed?)

- Transparent security policies

- Easy identity verification

- Support for local payment methods

Below is a comparison of some well-known platforms used by beginners around the world:

| Exchange | Regulator/Compliance Status | Security Features | Best For |

|---|---|---|---|

| Coinbase | Registered with FinCEN (USA) | Cold storage, insurance, 2FA | Beginners in US/EU |

| Luno | Registered with SC (Malaysia) | Multi-signature wallets, ISO certified | Beginners in SEA |

| Kraken | FinCEN (US), FCA (UK) | Security audits, proof-of-reserves | Tech-savvy users |

| Gemini | Licensed by NYDFS (USA) | SOC 2 compliance, insurance | Institutional users |

| Binance | Global with mixed licensing | SAFU fund, device management | Low-fee traders |

Always check if the platform is licensed in your country. Malaysia, for instance, requires exchanges to be registered with the Securities Commission (SC).

Step Two: Understand the Identity Verification Process (KYC) to Buy Cryptocurrency Safely

Credit from Investopedia

Most reputable platforms will ask you to complete KYC (Know Your Customer) procedures. This includes uploading your identification and sometimes proof of residence. While this step may feel intrusive, it’s part of keeping both you and the platform safe from fraud.

Fake exchanges often skip this step altogether. That’s usually a red flag.

Once verified, you can link your bank account or card to deposit money and make your first purchase.

Step Three: Make Your First Purchase — But Start Small

Most cryptocurrencies are divisible. You don’t need to buy a whole Bitcoin. Start with what you’re comfortable losing—say, $20 or RM50.

Popular beginner-friendly tokens include:

- Bitcoin (BTC): Considered the most stable long-term.

- Ethereum (ETH): Widely used for smart contracts and apps.

- USD Coin (USDC): A stablecoin tied to the US dollar, ideal for testing transfers.

Buying involves a simple click, but there are options: market orders (instant purchase) or limit orders (buy only at a certain price). Beginners are usually fine with the market order option initially.

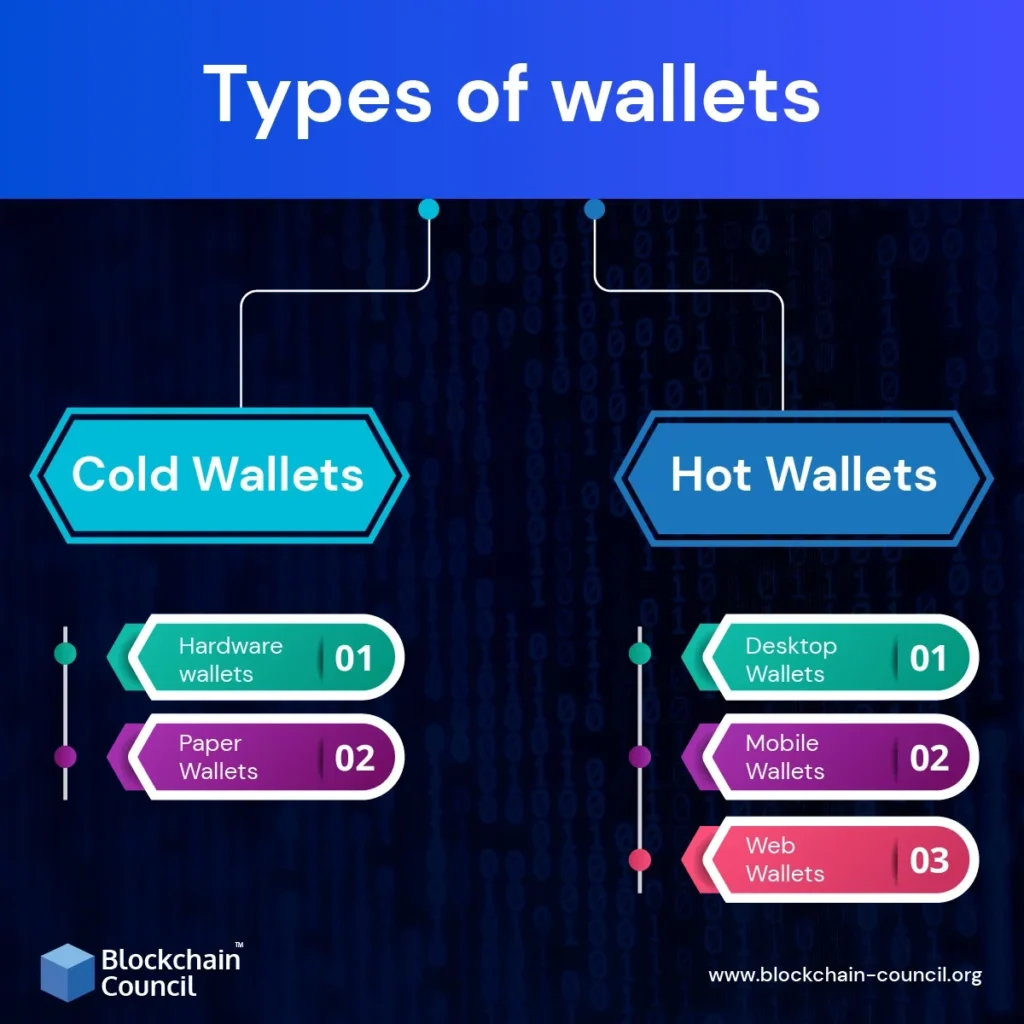

Step Four: Store Your Crypto — Don’t Leave It on the Exchange

Credit from Blockchain Council

Leaving your crypto on the exchange can be convenient, but it also means you don’t fully control your funds. Hackers often target centralized exchanges.

There are three common wallet options:

- Mobile wallets (e.g., Trust Wallet, Coinbase Wallet): Good for small amounts and casual use.

- Hardware wallets (e.g., Ledger, Trezor): Physically secure and offline. Best for large sums or long-term storage.

- Desktop wallets: Installed on your computer. Balance of security and convenience.

When setting up a wallet, you’ll be given a seed phrase—a string of 12 or 24 words that serves as a master key. Write it down and store it offline. If you lose this phrase, your funds are gone.

Step Five: Be Aware of Fraud and Social Engineering

Credit from Sanction Scanner

Scams in the crypto space come in many forms, from fake investment platforms to impersonators claiming to be customer support.

Common signs of a scam:

- Promises of guaranteed returns

- High-pressure messages asking for crypto payments

- Requests for your seed phrase or wallet password

- Social media accounts impersonating trusted figures

Even experienced users have fallen for phishing websites that look nearly identical to real exchanges. Always type the URL directly and bookmark official pages.

Step Six: Choose Safe Payment Methods for Deposits

Different platforms support various deposit methods. Each has its pros and risks.

- Bank transfers: Safe and cost-effective but may take a day or two.

- Credit/Debit cards: Fast, but higher fees and risk of chargebacks.

- FPX (Malaysia): A secure, direct online bank transfer used in local exchanges like Luno.

- Peer-to-Peer (P2P): Available on Binance and others. Lower fees but higher risk; only use with escrow.

Avoid using unfamiliar third-party payment services or sending money to individuals via WhatsApp, Telegram, or Facebook.

Step Seven: Practice Safe Habits Going Forward

Once you own crypto, safety becomes a continuous practice. Some key habits:

- Enable Two-Factor Authentication (2FA) on all accounts.

- Review account activity regularly.

- Never share your private keys or recovery phrase.

- Use strong, unique passwords for crypto-related sites and wallets.

- Avoid checking your wallet on public Wi-Fi.

If you plan to invest more over time, consider setting up a cold storage system and even consulting with a cybersecurity professional.

Real-World Insight: What Happens If You Get It Wrong?

There are many cautionary tales in crypto. In 2021, a Malaysian user lost over RM50,000 after clicking on a fake Binance app ad from Facebook. He entered his login credentials and received a call from a fake support agent who asked for a verification code. Within minutes, his account was drained.

The lesson? Always use official apps and websites, and never share verification codes—even with someone who seems legitimate.

Final Words on Buy Cryptocurrency Safely: Make Your First Crypto Buy a Safe One

It’s easy to get swept up in the excitement of buying your first cryptocurrency. But excitement should never replace caution.

The good news is, the tools and infrastructure for safe investing are improving. From licensed exchanges like Luno and Coinbase to hardware wallets and regulated stablecoins, beginners today have access to more secure options than ever before.

If you’re careful, well-informed, and deliberate in your steps, you can buy cryptocurrency safely and build a secure entry point into the world of digital assets.