As of 2025, crypto e-commerce in Thailand is moving from experimental to practical. More Thai online shops, especially small to mid‑sized ones, are now quietly enabling crypto checkout options. It’s not widespread yet—but it’s real. The info below addresses what entrepreneurs and curious consumers might ask.

Credit from : SP Here Agency

Crypto E-Commerce Thailand: What’s really happening—are Thai merchants actually accepting crypto now?

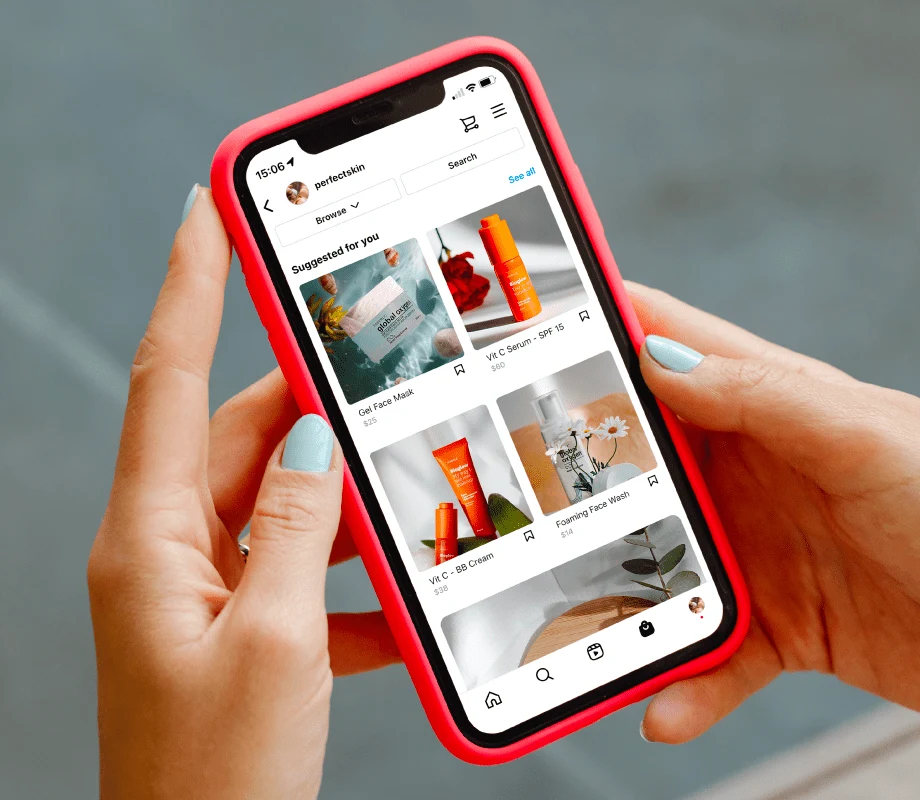

Yes, they are. Mostly smaller, agile shops using platforms like Shopify, WooCommerce, IG shops, or Line Shop. According to eFinanceThai, companies like Bitazza and Zipmex are partnering with Thai SMEs to integrate crypto payment solutions and fiat conversion services to baht. This marks a tangible shift in payment flexibility.

Credit from : Later

Crypto E-Commerce Thailand: Why are Thai shops interested in crypto payments right now?

Several drivers:

- Lower transaction fees: Traditional Thai payment gateways charge around 2–3%, while stablecoin payments typically run under 1%.

- Borderless capability: Crypto enables smoother international sales without FX or SWIFT delays.

- Digital-native buyers: As reported by The Standard, younger Thai consumers regularly use wallets like Bitkub NEXT and MetaMask—viewing crypto as a normal tool, not a tech oddity.

- Marketing edge: Offering crypto can signal modernity and attract tech-savvy shoppers.

Which cryptocurrencies are most Thai shops accepting?

Common options:

- USDT (Tether) and USDC—chosen for their stability.

- Bitcoin (BTC)—still widely recognized.

- BNB or ETH—used by sellers familiar with certain wallet ecosystems.

Many shops price products in Thai baht and calculate crypto equivalents at checkout to minimize volatility risk.

Credit from : Decrypt

How do shops actually implement crypto checkouts?

There are a few methods:

- Manual wallet transfer: Shops display a QR code for USDT/BTC; once confirmed, the item ships. Common on IG and Line Shop.

- Shopify/WooCommerce plugins: Tools like CoinPayments, BitPay or NOWPayments automate address generation and payment confirmation.

- Wallet-based checkout: Sellers using Binance Pay or Bitkub NOW integrate crypto payment into their existing wallet infrastructure.

One skincare brand mentioned on my-best Thailand rolled out a 5% crypto-checkout discount via Bitkub NEXT. It generated buzz and repeat buyers without public announcement.

Is accepting crypto legal in Thailand?

Yes, with caveats. Thai regulations do not prohibit crypto payment acceptance, but businesses must:

- Report crypto income properly for tax purposes.

- Comply with price equivalency rules if listing in THB.

- Register if they operate a crypto exchange—though standard sellers don’t qualify.

Additionally, Thailand is launching a crypto sandbox for tourists, allowing foreign visitors to convert digital assets for spending in zones like Phuket, showcasing regulatory support for crypto payments.

Credit from : Travel Weekly Asia

What risks should sellers be aware of?

Be aware of:

- Price volatility: Unless using stablecoins, crypto value can shift before conversion.

- Customer confusion: Some buyers may not understand gas fees, wallet addresses, or confirmation steps.

- Irreversible transactions: No chargebacks or refunds once a transfer is sent.

- Tax complexity: Sellers must track transaction times and value for accurate reporting.

Most Thai merchants mitigate these by using custodial services (Bitkub NOW, Binance Pay) and clearly explaining steps at checkout.

What tools are Thai merchants using?

| Purpose | Tools in Use |

|---|---|

| Crypto wallets | Bitkub NEXT, Trust Wallet, MetaMask |

| Checkout integration | NOWPayments, CoinPayments, BTCPay |

| Tax tracking | Binance tax reports, CoinTracking.info |

| Customer support | Line OA support, Telegram channels |

Many sellers begin with free wallets and manual transfers before moving to plugins and automation.

What do Thai consumers think about crypto payments?

It varies:

- Gen Z / crypto-savvy buyers like the speed and novelty.

- Everyday users might be hesitant or unfamiliar—finding it unnecessarily complex.

- International shoppers appreciate crypto for avoiding currency exchanges and banking delays.

As reported by The Standard, crypto payments are seen by young users as a futuristic norm rather than a niche novelty.

Credit from : Lumina Foundation

Crypto E-Commerce Thailand: Is it worth trying for my shop?

Consider it if you:

- Serve customers under 35 or tech-savvy niches.

- Ship internationally.

- Want faster payment resolution and lower fees.

Begin small: offer crypto for select products or customer segments. Track transactions carefully. And consider incentives like small discounts to test uptake.

What future changes could accelerate adoption?

- Stablecoin infrastructure: Government-supported pilot projects, especially in tourist hubs like Phuket, are underway (Source: Crypto Ninjas).

- Tax incentives: Thailand approved a five-year capital gains tax exemption on crypto trades through licensed platforms, effective 2025–2029, signaling national support (Source: BitcoinMagazine).

Such moves may spur wider mainstream interest from both businesses and consumers.

Final Thoughts: Crypto E-Commerce Thailand Is Emerging—And Evolving

In 2025, crypto e-commerce in Thailand is still mostly in pilot mode—still niche, still quiet—but undeniably present. Shops are testing, customers are trying, regulators are softening, and incentives are aligning.

It may feel experimental… but sometimes that’s where real opportunities hide.

If you’re running an online store in Thailand—or just considering adding crypto as a payment option—it may be worth giving it a modest test run. The landscape is shifting, and early movers may find themselves ahead of the curve.