If you’re new to blockchain or decentralized apps, the term “gas fee” can seem both technical and frustrating. You might wonder why sending tokens or trading on a platform like Uniswap could cost more in fees than the value of the asset itself. This article breaks down crypto gas fees explained simply and practically—covering what they are, why they change, and how you can reduce the cost.

What Are Gas Fees and Why Do They Exist?

Credit from Investopedia

On blockchains like Ethereum, every transaction—whether it’s transferring tokens, executing a smart contract, or minting NFTs—requires a fee. This is known as a gas fee. The purpose is to compensate the network’s validators (or previously miners) who use computing power to process your request and keep the blockchain secure.

Gas is a unit that measures the computational effort needed to perform a specific operation. Each action has a gas cost, and the total fee you pay depends on:

- How much gas the transaction uses

- The current gas price

- How congested the network is

Unlike bank fees that are flat and predictable, gas fees fluctuate based on market conditions and technical factors. When many users interact with the blockchain at once, gas prices spike due to increased demand.

Understanding the Mechanics of Ethereum Gas

Let’s look at how gas fees work more technically, especially on Ethereum:

Before Ethereum’s EIP-1559 upgrade in August 2021, users had to guess the right gas price to get their transactions accepted by miners. The system was unpredictable. EIP-1559 introduced a base fee that automatically adjusts based on network activity and a priority fee (or tip) that users can add to speed up processing.

The cost formula is now:

Total Fee = Gas Used × (Base Fee + Priority Fee)

This helps users avoid overbidding, though it doesn’t necessarily reduce fees during high demand.

For example, a standard ETH transfer may require 21,000 gas units. If the base fee is 30 gwei and the priority fee is 3 gwei, and ETH is $3,000, the fee would be:

- 21,000 × (30 + 3) gwei = 693,000 gwei = 0.000693 ETH ≈ $2.08

But the same transfer could cost over $10 during peak hours, or less than $1 during off-peak periods.

When and Why Gas Fees Rise

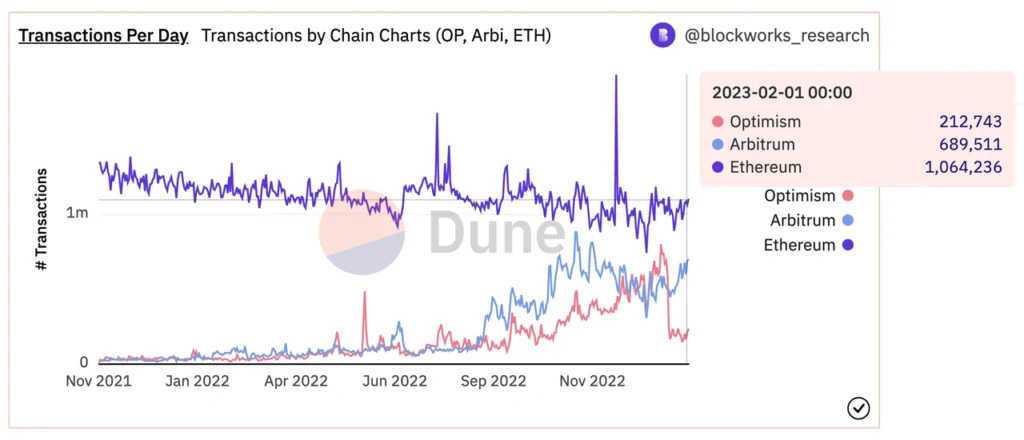

Credit from Bitcoin.com News

Gas fees fluctuate, often sharply. The reasons can be grouped into a few categories:

High Network Activity

When more users are active—especially during events like NFT launches or major airdrops—gas demand increases. Validators prioritize transactions offering higher fees, so the market becomes competitive.

Smart Contract Complexity

Some transactions are more resource-intensive than others. Transferring ETH is simple and uses little gas, but interacting with complex smart contracts (e.g., DeFi lending platforms) may use five or ten times as much gas.

Market Behavior and Timing

Just like airline tickets, timing matters. Transactions sent during high-traffic times (e.g., weekday afternoons in the U.S. or Asia) often face higher fees than those submitted during early morning hours or weekends.

Comparing Gas Fees Across Popular Blockchains

Ethereum may be the most well-known blockchain for smart contracts, but it’s not the only one. Other chains and Layer 2 networks offer lower fees by design.

Here’s a comparison table showing how different blockchains stack up in terms of average gas or transaction fees:

| Blockchain | Average Fee (USD) | Fee Model | Notable Attributes |

|---|---|---|---|

| Ethereum (L1) | $1–$50+ | Base fee + priority fee | Secure, most used, often congested |

| Solana | <$0.01 | Fixed low fee | Fast, scalable, less decentralized |

| Polygon (L2) | ~$0.01 | Ethereum-compatible, cheaper gas | Works with ETH apps, much lower costs |

| Arbitrum (L2) | $0.03–$0.10 | Optimistic rollup | Reduces Ethereum fees, same functionality |

| Binance Smart Chain | ~$0.05 | Delegated PoS | Fast, low-cost, widely adopted |

Note: Fee ranges vary with market activity and usage volumes.

How Gas Fees Affect New Users

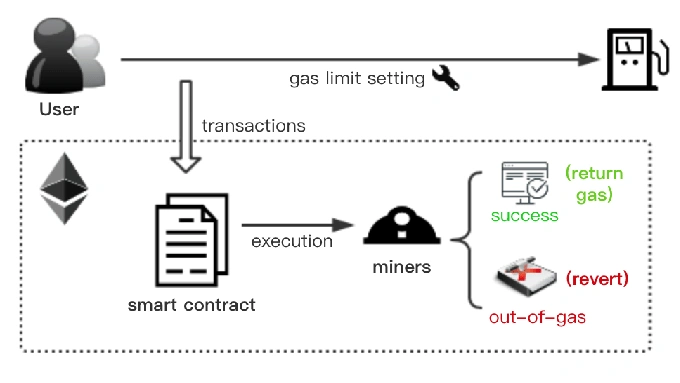

Credit from ResearchGate

For beginners, gas fees can be confusing and discouraging. You might go to trade a $10 token, only to discover the transaction will cost $20 in fees. Or worse, you try to send a transaction, it fails, and you still lose money on gas used.

Without understanding how gas works, users risk overpaying, delaying important transactions, or experiencing failed attempts. That’s why it’s crucial to learn how to navigate fees, even for basic tasks like transferring crypto or claiming tokens from an airdrop.

Strategies to Reduce Crypto Gas Fees

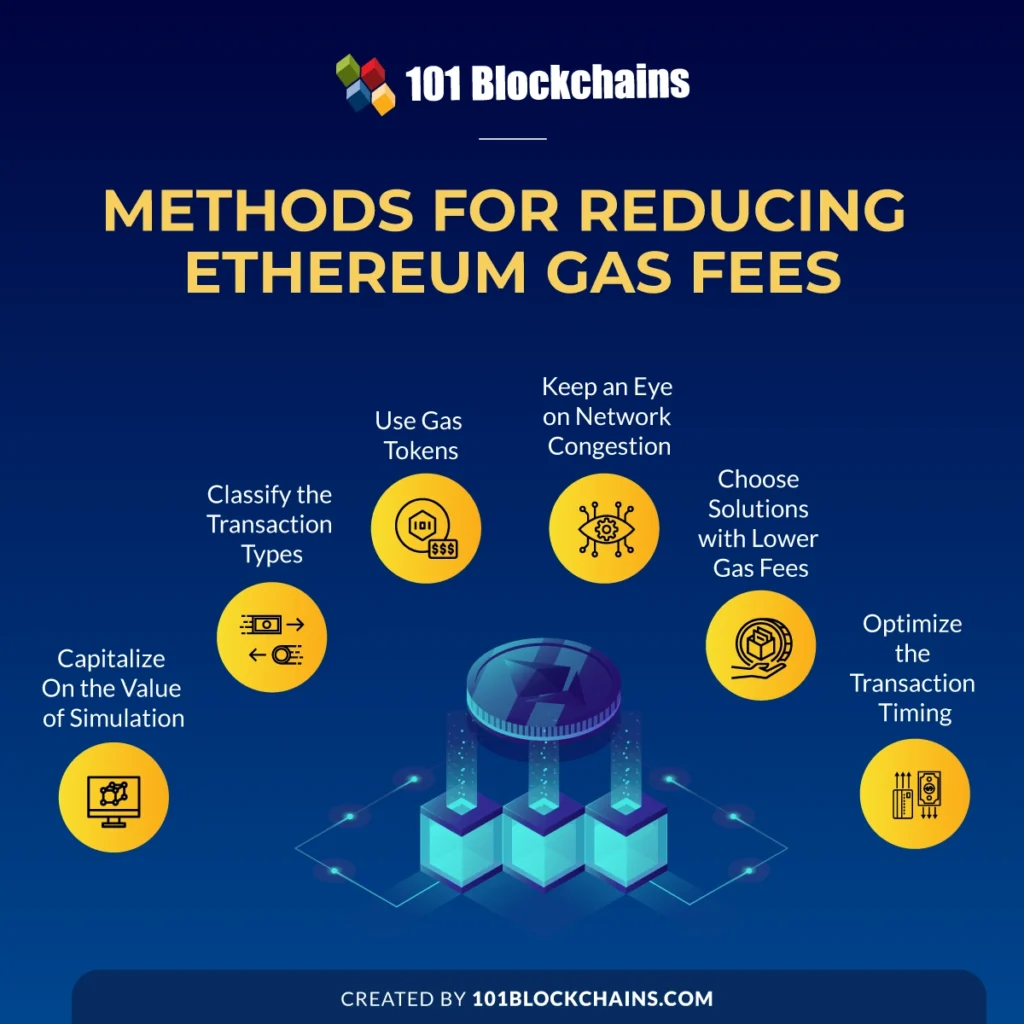

Credit from 101 Blockchains

Gas fees can’t be eliminated entirely, but you can take steps to reduce them significantly.

Choose the Right Time of Day

Timing matters. Early mornings (UTC time) or weekends typically see lower network activity. Scheduling non-urgent transactions during these windows can save you a lot.

Use a Gas Tracker

Platforms like Etherscan Gas Tracker, GasNow, and Blocknative allow you to check real-time gas prices and plan accordingly. These trackers also estimate how long your transaction will take at different fee levels.

Explore Layer 2 Solutions

Layer 2 networks like Arbitrum, Optimism, and zkSync bundle multiple transactions together and settle them on Ethereum later, offering the same functionality at a fraction of the cost.

Adjust Wallet Settings

Most crypto wallets (e.g., MetaMask) let you customize gas price and limit. By choosing slower speeds, you can lower costs—especially during quiet periods.

Avoid Complex Contracts Unless Necessary

Keep it simple. If you’re only transferring tokens or interacting with basic apps, stick to operations that use minimal gas. Avoid actions that involve multiple steps or external calls unless absolutely needed.

Common Misunderstandings About Crypto Gas Fees

Let’s clarify a few popular misconceptions:

- “Gas fees are always the same.”

In fact, they can vary minute-by-minute based on demand. - “You only pay if the transaction goes through.”

Not true. Even failed transactions can cost gas if the blockchain had to compute part of it. - “Ethereum is always expensive.”

While Ethereum fees are often higher than competitors, they can drop significantly at night or on weekends, especially with Layer 2 solutions.

Real-World Scenario: Token Swap on Ethereum

Let’s say you want to swap tokens on a DEX like Uniswap. This type of transaction might use 100,000 gas units, depending on the complexity of the swap.

If the base fee is 40 gwei and you add a 10 gwei tip, the total cost is:

- 100,000 × (40 + 10) gwei = 5,000,000 gwei = 0.005 ETH

With ETH priced at $3,200, that’s $16 per transaction—possibly more than the token value.

However, if you perform the same swap on Polygon or Arbitrum, the total fee might be less than $0.50. The functionality is almost identical, but you save significantly just by choosing a different network.

Final Thoughts: Making Informed Crypto Decisions

Gas fees are a core part of how decentralized systems like Ethereum remain secure and functional. But that doesn’t mean you have to overpay.

By understanding how gas works, tracking prices, using Layer 2 networks, and choosing the right time and method, you can minimize gas fees without sacrificing performance.

As the ecosystem matures, innovations like proto-danksharding, zk-rollups, and fee optimizers will likely make transactions even more affordable. Still, for now, mastering gas fees remains one of the most valuable skills for any crypto beginner looking to save time, money, and frustration.