Introduction: Why Market Cycles Matter

Crypto market cycles for beginners can seem chaotic at first glance. Prices spike and drop, news headlines change daily, and social media hype adds to the confusion. Yet, these fluctuations follow patterns known as bull and bear cycles. Understanding these cycles helps newcomers make informed choices and manage risk in a highly volatile environment.

How Bull Markets Shape Crypto Growth

Credit from CoinDesk

A bull market is defined by sustained upward price movement, high trading volumes, and growing optimism among investors. In cryptocurrencies, bull phases are often intensified by rapid adoption, media coverage, and investor excitement.

Notable examples include:

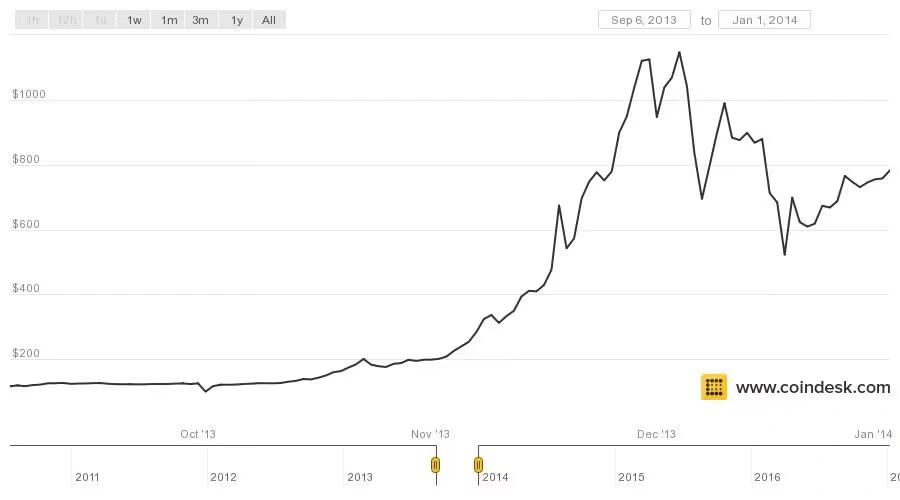

- 2013 Bitcoin Rally: Price rose from $13 to $1,150 as public interest increased and early adoption surged.

- 2017 Bull Run: Bitcoin climbed from $1,000 to nearly $20,000, largely driven by ICO speculation and retail frenzy.

- 2020–2021 Surge: Bitcoin and Ethereum hit all-time highs, supported by institutional investment and global economic stimulus.

During bull markets, volatility can increase, creating opportunities for gains but also risks for those who enter late in the cycle.

Bear Markets and Market Corrections

Credit from Webopedia

Bear markets are characterized by extended periods of falling prices and diminished investor confidence. They often follow prolonged bull runs and serve as a market “reset,” exposing weak projects and speculative investments.

Examples of notable bear phases:

- 2014–2015 Crypto Winter: Bitcoin dropped from $1,150 to around $200, caused by exchange hacks and regulatory uncertainty.

- 2018 Market Correction: Bitcoin fell from nearly $20,000 to $3,200 after the ICO boom ended.

- 2022 Downturn: Bitcoin declined from $69,000 to $15,500 amid macroeconomic uncertainty and major failures in crypto ecosystems like Terra.

Bear markets test investor discipline and emphasize the importance of research and long-term strategy.

Historical Overview of Crypto Market Cycles

Table 1 summarizes key bull and bear cycles for Bitcoin over the past decade:

| Year(s) | Bitcoin Price Range | Market Type | Key Drivers |

|---|---|---|---|

| 2013 | $13 → $1,150 | Bull | Early adoption, media coverage |

| 2014–2015 | $1,150 → $200 | Bear | Exchange security issues, regulatory scrutiny |

| 2017 | $1,000 → $19,783 | Bull | ICO craze, retail hype |

| 2018 | $19,783 → $3,200 | Bear | Market correction, regulation tightening |

| 2020–2021 | $7,000 → $69,000 | Bull | Institutional adoption, stimulus measures |

| 2022 | $69,000 → $15,500 | Bear | Inflation concerns, Terra collapse |

By examining these cycles, beginners can see that cryptocurrency volatility is predictable to some extent and part of a larger pattern.

Spotting Market Phases in Real Time

Credit from Crypto News

Beginners can observe certain indicators to identify bull or bear markets:

- Trading Volume: Rising volumes often suggest bullish momentum; falling volumes may signal bearish conditions.

- Price Trends: Rapidly increasing prices indicate a bull market, while steady declines suggest a bear trend.

- Market Sentiment: Monitoring news, social media chatter, and institutional moves provides insights into collective investor behavior.

Awareness of these signals can help new investors avoid reactive mistakes like panic selling or buying at peaks.

The Psychology Behind Crypto Cycles

Investor psychology heavily shapes market cycles. Emotional responses such as greed and fear frequently drive extreme price movements.

- Greed: During bull markets, investors may chase profits, inflating prices beyond fundamental value.

- Fear: In bear markets, panic selling can exacerbate price declines, sometimes creating buying opportunities for long-term investors.

Understanding these dynamics helps beginners maintain discipline and adhere to investment strategies, rather than following crowd behavior.

Strategies for Navigating Bull and Bear Markets

Practical approaches to managing crypto market cycles include:

- Diversification: Reduces risk by spreading investments across multiple assets.

- Dollar-Cost Averaging (DCA): Invest fixed amounts regularly to mitigate timing risk.

- Fundamental Analysis: Evaluate projects based on technology, adoption, and team strength, rather than hype.

- Long-Term Perspective: Viewing cycles as temporary phases prevents impulsive trading decisions.

Adopting these strategies allows investors to participate in both bull and bear phases with more confidence.

External Factors Influencing Crypto Market Cycles

Market cycles are also shaped by external events:

- Regulatory Developments: Stricter or unclear regulations can depress markets.

- Macroeconomic Trends: Interest rates, inflation, and monetary policy influence liquidity and investor behavior.

- Technological Advancements: New blockchain innovations and adoption trends can trigger bullish phases.

For instance, the 2020–2021 bull market coincided with massive institutional inflows and global economic stimulus, while the 2022 downturn reflected rising inflation and liquidity tightening.

Conclusion of Crypto Market Cycles for Beginners

Crypto market cycles for beginners are natural and recurrent, featuring both bull runs and bear phases. Recognizing these cycles, understanding historical trends, and observing market signals can help newcomers make informed decisions. Coupled with disciplined strategies and psychological awareness, this knowledge allows investors to navigate volatility more effectively and approach the crypto market with confidence and patience.