Introduction: Understanding the Foundations of Crypto Payments

Cryptocurrency payments can sound complicated if you’re new to the space. But when you strip it down, crypto payment systems follow a clear, structured process — from wallet initiation to blockchain verification.

Let’s break it down step-by-step.

Step 1: Wallet Setup and Payment Initiation

Crypto payments start with a digital wallet — software that stores your cryptocurrencies securely. Popular wallets include Coinbase Wallet, MetaMask, and Trust Wallet.

When you’re ready to make a purchase, the merchant provides a wallet address or a QR code. You, the buyer, initiate a transaction from your wallet, specifying:

- The merchant’s public address

- The amount of cryptocurrency to send

- A small network fee to process the transaction

Your wallet then broadcasts this transaction to the network.

Step 2: Transaction Propagation Across the Blockchain Network

Once broadcasted, the transaction enters the “mempool” — a waiting area where unconfirmed transactions sit until they are picked up by network validators (miners or nodes).

Validators review transactions to ensure:

- The sender has sufficient funds

- There’s no double-spending attempt

- The transaction follows the network’s rules

This verification happens in seconds or minutes depending on the network’s congestion and the cryptocurrency used (e.g., Bitcoin vs. Solana).

Step 3: Validation and Blockchain Confirmation

Here’s where the blockchain magic happens:

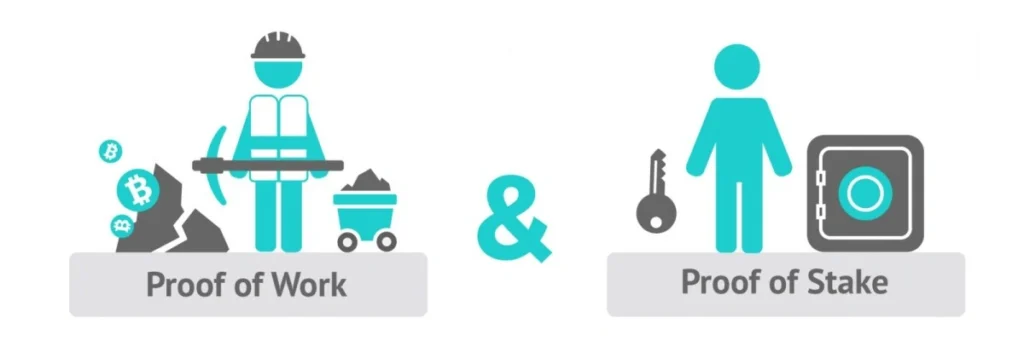

- In Proof of Work (PoW) systems like Bitcoin, miners compete to solve a complex cryptographic puzzle.

- In Proof of Stake (PoS) systems like Ethereum 2.0, validators are selected based on the amount of crypto they “stake” as collateral.

Once validated, your transaction is added to a new block on the blockchain — an unchangeable record. Confirmation times vary:

- Bitcoin: ~10 minutes per block

- Solana: <1 second per block

- Ethereum: ~15 seconds per block

Most merchants require 1–6 confirmations before considering the payment finalized.

Crypto Payment Explained: Merchant Notification and Fund Settlement

Once the blockchain confirms the transaction, the merchant’s system gets an update — usually through a payment processor like BitPay, Coinbase Commerce, or directly via APIs connected to their wallet.

Funds either:

- Stay in the form of cryptocurrency

or - Get instantly converted to local currency (USD, EUR, etc.) through the merchant’s service provider, reducing the risk of price volatility.

The customer gets a receipt, and the payment is complete.

Crypto Payment Explained: Why Crypto Payment Systems Are Gaining Momentum

Several technical and practical factors explain why crypto payments are trending:

- Global Access: Crypto wallets work anywhere with an internet connection, bypassing traditional banking systems.

- Lower Costs: Transaction fees are often lower than the 2–3% cut taken by credit card processors.

- Security: Blockchain’s decentralized structure makes fraud and chargebacks much harder.

- Programmable Money: Smart contracts enable automatic payment rules — think subscription services or escrow arrangements.

Crypto Payment Explained: Challenges of Crypto Payment Adoption

Despite the innovation, crypto payments aren’t without hurdles:

- Volatility: Rapid price changes mean both merchants and consumers face value risk.

- Usability: Non-tech-savvy users may find wallet setup, private key management, and transaction tracking intimidating.

- Scalability: Some networks, like Bitcoin, face limitations on transaction throughput compared to Visa or Mastercard.

- Regulatory Uncertainty: Different countries apply different (and sometimes unclear) rules about crypto transactions.

Solutions like Layer 2 networks (e.g., Lightning Network for Bitcoin) and stablecoins (crypto pegged to fiat currencies) are helping address these challenges.

Final Thoughts: Crypto Payments Moving Forward

Crypto payment systems are evolving fast. As user experience improves and blockchain networks become more scalable, everyday adoption is likely to grow.

From tapping a QR code for coffee to signing smart contracts for major purchases, crypto payments are unlocking new possibilities for peer-to-peer, borderless transactions.

While the technology is still maturing, its potential to reshape how we handle money is hard to ignore.

Relevent News: Here