The world of cryptocurrency offers exciting opportunities, but it can also be unpredictable and confusing for first-time investors—which is why a crypto portfolio for beginners is essential. Between market volatility, endless token choices, and a fast-moving ecosystem, beginners often don’t know where to start—or how to protect their money once they do.

Creating a well-balanced, secure crypto portfolio doesn’t require insider knowledge or financial degrees. It simply requires a thoughtful strategy, basic risk awareness, and a willingness to learn. This guide will walk you through how to build a beginner-friendly portfolio that is diversified, easy to manage, and aligned with your financial goals.

Crypto Portfolio for Beginners: Start with a Purpose, Not with a Coin

Credit from Bitsgap

Before choosing any coins, ask yourself: why are you investing in crypto?

Some investors are looking for long-term growth, hoping to hold assets like Bitcoin or Ethereum for years. Others aim for short-term gains through trading altcoins or new tokens. There’s no right or wrong answer—but defining your objective is essential. It determines how much risk you can take, how often you’ll need to adjust your portfolio, and which types of coins make sense for your situation.

Time horizon matters too. A college student saving over the next 10 years might build differently than someone looking for quick returns within six months. Emotional tolerance for losses is also key. If you can’t handle the idea of your portfolio dropping 30% in a week—which happens often in crypto—you’ll want a more conservative allocation.

Crypto Portfolio for Beginners: Understand What You’re Investing In

Jumping into crypto without understanding the technology is risky. You don’t need to become a developer, but you should know the basics.

At its core, cryptocurrency is powered by blockchain technology, a decentralized system that stores and verifies transactions. Bitcoin was the first cryptocurrency and is often seen as digital gold. Ethereum introduced the idea of smart contracts—programmable agreements that allow developers to build decentralized apps (dApps). Many newer tokens are built on Ethereum or similar platforms.

Equally important is knowing how to store your assets. Cryptocurrency wallets come in two main types: hot wallets (connected to the internet) and cold wallets (offline storage like hardware devices). Cold wallets are much safer for long-term holdings.

Security should never be taken lightly. A surprising number of losses happen not from market drops but from simple mistakes—such as losing your wallet password or falling for phishing scams. Always keep your private keys and seed phrases offline and backed up securely.

Focus on Research Before You Buy Anything

It’s tempting to jump on a trending coin based on social media hype. But sustainable investment requires more than buzzwords. Every time you consider adding a coin to your portfolio, ask:

- What problem does this project solve?

- Who is behind it? Are they credible and transparent?

- Is there actual adoption or community activity?

- Does the token have clear use cases and reasonable supply mechanisms?

You should be cautious of assets that promise guaranteed returns, show massive price spikes with no explanation, or hide key information about the team or project. Use trusted sources like CoinGecko, Messari, or project whitepapers to verify data.

Build a Strategy That Fits Your Personality

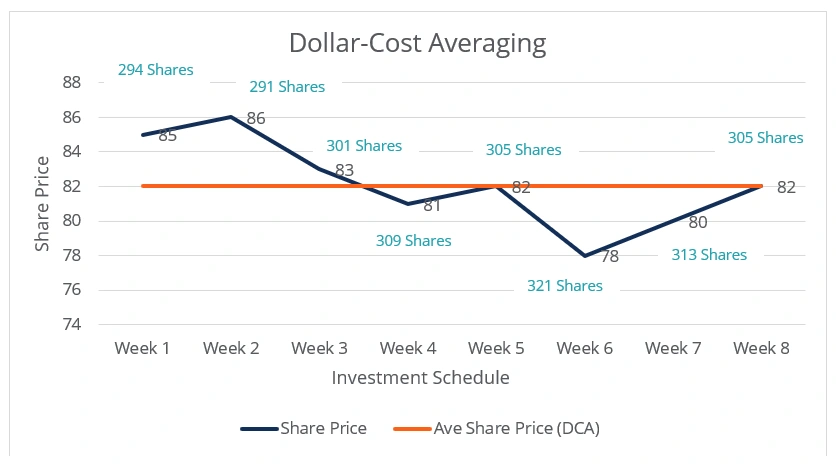

Credit from Corporate Finance Institute

The best crypto portfolios aren’t built overnight, and they definitely aren’t based on lucky guesses. A reliable investment strategy helps guide decisions during both bull and bear markets.

One of the most popular methods among beginners is Dollar-Cost Averaging (DCA). This involves investing a fixed amount regularly—weekly or monthly—regardless of the coin’s price. It reduces the emotional pressure of market timing and protects against buying in at a peak.

Another option is building a core-and-satellite portfolio. This means holding strong, stable coins as your foundation (e.g., BTC, ETH) and adding smaller amounts of riskier or growth-oriented tokens around that core.

Some beginners like to keep a portion of their funds in stablecoins like USDT or USDC. These tokens are tied to the value of fiat currency and help preserve capital during volatile periods. They can also be used to buy dips without needing to deposit new cash.

Diversification: The Key to Stability

No matter how much you believe in one project, never invest all your money in a single asset. Even the most established coins can lose value quickly due to market shifts or regulatory news.

Diversification means spreading your investment across:

- Asset types (e.g., large-cap coins, altcoins, stablecoins, speculative tokens)

- Use cases (e.g., DeFi, infrastructure, gaming, metaverse)

- Risk levels (balancing safer, proven projects with a small amount of high-risk tokens)

Here’s a simple, beginner-friendly allocation:

| Category | Examples | Suggested Allocation |

|---|---|---|

| Major Coins | Bitcoin, Ethereum | 40–60% |

| Altcoins | Solana, Polkadot, LINK | 20–30% |

| Stablecoins | USDT, USDC | 10–20% |

| Speculative Assets | DOGE, SHIB, NFTs | 5–10% |

This balance gives you exposure to growth while protecting your portfolio from being overly reliant on untested projects. As you gain confidence, you can shift your percentages slightly, but it’s wise to keep speculative tokens below 10%.

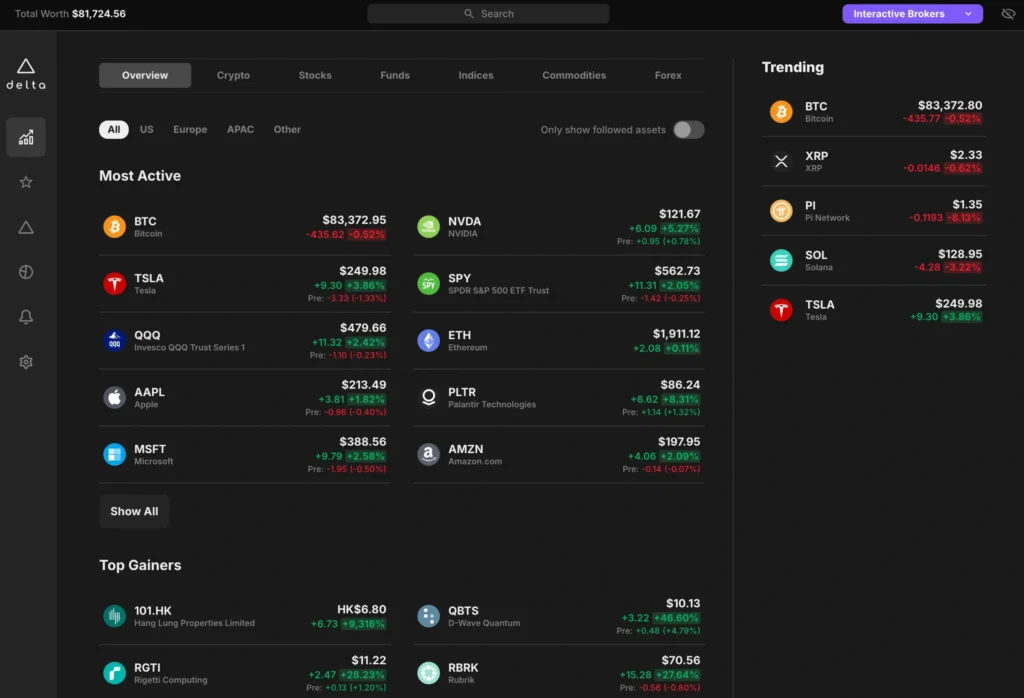

Crypto Portfolio for Beginners: Track and Rebalance Over Time

Credit from MatchMyBroker

Once your portfolio is set up, the next step is keeping it on track. This doesn’t mean checking prices daily—but it does mean reviewing your holdings regularly.

Many beginners find it useful to use a portfolio tracker. Apps like Delta, CoinStats, or the CoinGecko Portfolio tool can help you monitor allocations, profits/losses, and market movements.

If one asset grows faster than the others, your original balance can shift. For instance, if Bitcoin’s price rises significantly, it may become 70% of your portfolio—exposing you to more risk than you intended. Rebalancing means selling part of that asset and reallocating it to other categories to restore your target ratios.

You might choose to rebalance monthly, quarterly, or after big price moves. The frequency is less important than being consistent and avoiding emotional decisions.

Stay Informed but Avoid the Hype

One of the most challenging parts of being a beginner in crypto is information overload. There’s no shortage of predictions, influencers, or viral coins. But not all sources are trustworthy.

Instead of reacting to Twitter trends, follow respected publications like CoinDesk, The Block, or Messari. You can also join project communities on Reddit or Discord, but take everything with a healthy dose of skepticism.

Try to stay up to date on government policy and regulation in your region as well. Some countries tax crypto differently or have restrictions on certain activities like staking or token sales.

Markets evolve quickly. The best portfolios are flexible—but not reactive.

Prioritize Security Before Anything Else

Even if your strategy is perfect and your assets are diversified, poor security can undo everything. Always treat your digital assets like real money—because that’s what they are.

Use strong, unique passwords. Store your seed phrases offline. Use hardware wallets for anything you plan to hold long term. Avoid connecting your wallet to unfamiliar websites, and don’t click on random airdrop offers or investment pitches sent via social media.

It’s also important not to invest more than you can afford to lose. Crypto is a high-risk asset class, and while returns can be strong, the downside is real and fast.

Final Thoughts: A Foundation for Future Growth

Creating a crypto portfolio for beginners isn’t about chasing trends or finding the next big token. It’s about laying a foundation that reflects your goals, protects your capital, and leaves room for growth.

Start slow, focus on research, and build your confidence over time. A well-diversified, carefully monitored portfolio can help you navigate the ups and downs of the crypto market with clarity—and with far fewer regrets.

As you gain experience, your strategy can evolve. But the principles—clear goals, basic knowledge, diversification, and strong security—will always remain relevant.