Cryptocurrency has introduced an entirely new way of thinking about money, investing, and digital ownership. Yet with innovation comes risk—and one of the biggest dangers for new users is fraud. Understanding the crypto scams to avoid in 2025 can help protect your assets, privacy, and trust in the system.

Scammers are not just opportunists; they are organized, adaptive, and often tech-savvy. They use sophisticated tactics to trick people into giving up control over their funds—especially those still learning how wallets, tokens, and platforms work.

Why Are Beginners the Most Frequent Targets?

The crypto space can feel overwhelming at first. Terms like “DeFi,” “staking,” and “airdrops” may not be familiar, and tools such as hardware wallets or smart contracts can seem complicated. Scammers exploit this learning curve.

First-time investors are more likely to:

- Click links from unofficial sources

- Trust influencers without verification

- Use mobile apps without checking reviews or permissions

- Fall for pressure tactics (“Only 10 minutes left!”)

Scammers study beginner behavior. They often join public forums, Telegram groups, or Discord servers disguised as helpers or moderators. Their goal is simple: gain your trust, then steal your funds.

The Changing Landscape of Crypto Scams

Credit from Kaspersky

In 2025, crypto fraud goes far beyond basic phishing emails. Scams now range from deepfake videos and fraudulent DeFi protocols to fake NFT drops and AI-generated wallet apps. Below are some of the most alarming formats circulating in the market.

1. Fake Token Presales

Scammers create coins with legitimate-sounding names and set up presale campaigns that imitate real ICOs (Initial Coin Offerings). They advertise on social media with fake charts, whitepapers, and endorsements. Once enough people invest, the creators dump the token and shut down the site.

2. Social Engineering via Messaging Apps

Telegram and Discord are major hubs for crypto discussion—and fraud. You may receive private messages offering investment tips, recovery services, or “urgent” support. In some cases, scammers even impersonate well-known wallet teams or founders.

3. Rogue dApps

Scammers now deploy malicious decentralized apps (dApps) that look and function like real platforms. Once you connect your wallet, you may unknowingly sign transactions that give them access to your assets.

4. NFT Phishing

Links promising exclusive NFTs often lead to phishing sites. These sites may trick you into signing a “mint” transaction that actually drains your wallet.

Recent Examples of Major Crypto Scams (2022–2024)

Here’s a data-backed look at real scams that have affected the global crypto community:

| Scam Type | Incident | Losses | Key Details |

|---|---|---|---|

| Fake DeFi Platform | Fintoch (rug pull) | Over $30 million | Pretended to be backed by Morgan Stanley; vanished with investor funds |

| Chrome Extension Scam | Ledger phishing plugin | $600,000 | Posed as official Ledger Live extension; stole recovery phrases |

| Deepfake Giveaway | YouTube ETH promotion | $500,000+ | Used AI-generated video of Vitalik Buterin to promote fake ETH doubling scam |

| Wallet App Scam | Fake MetaMask on Android | $1.5 million+ | Identical UI; stole seed phrases from new wallet users |

| Ponzi Token Scheme | HyperVerse | $1.3 billion (est.) | Allegedly paid early investors with new deposits; collapsed under scrutiny |

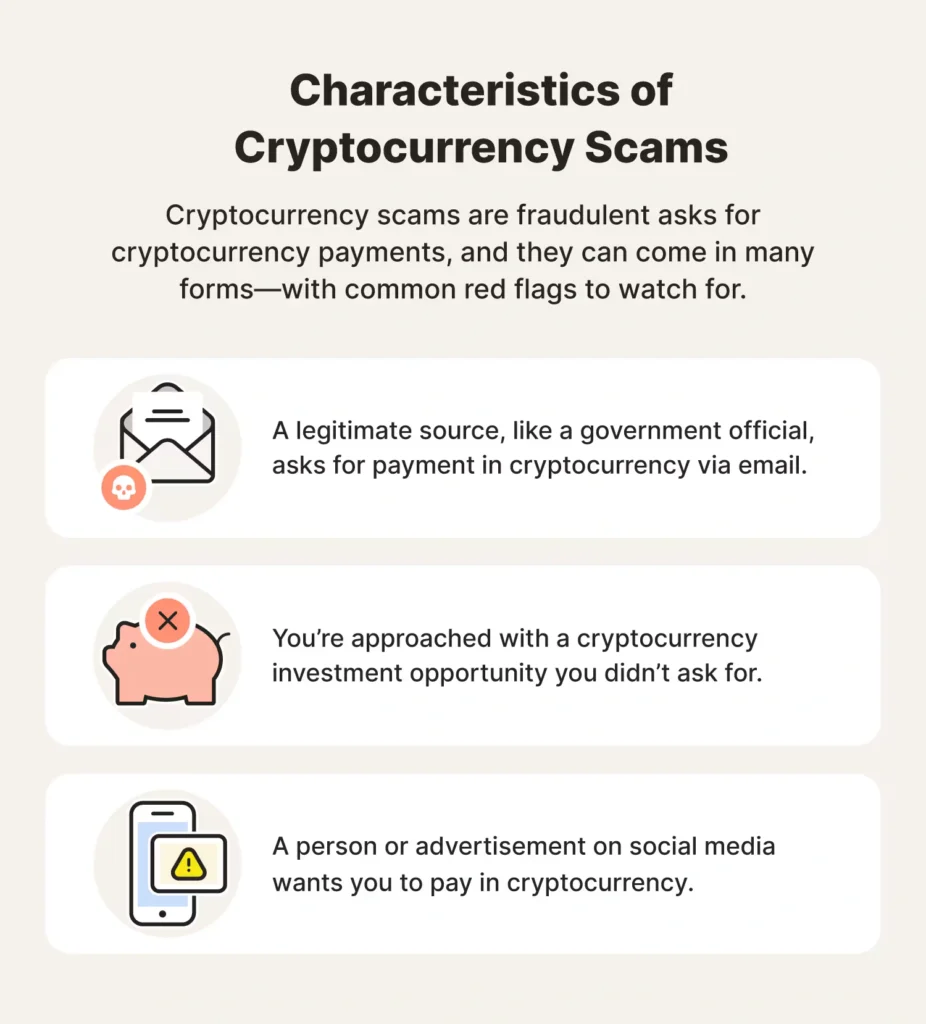

Telltale Signs of a Crypto Scam

Credit from Norton

Even without technical expertise, there are behavioral patterns that should raise immediate concern. Here are some subtle cues:

- Pressure to act quickly: Scammers often urge you to “act now” or miss out.

- Promises of guaranteed returns: No investment is risk-free, especially not in crypto.

- Unverifiable team members: No trace of developers or founders on GitHub or LinkedIn.

- No audit reports: Legitimate DeFi and token projects often undergo smart contract audits.

- Generic or duplicated whitepapers: A lack of original ideas or a copied document is a major red flag.

How to Stay Safe: Habits Every New Investor Should Build

Credit from www.ifec.org.hk

You don’t need advanced tech skills to protect yourself. Consistent, cautious habits go a long way.

Double-Check Everything

Before interacting with a new wallet, exchange, or dApp, make sure you’re on the correct domain. Bookmark trusted sites, and don’t rely on search engine ads.

Protect Your Private Keys

Your seed phrase or private key should never be typed into a website or shared with anyone. If someone asks for it—even support staff—they’re trying to scam you.

Use Cold Storage for Long-Term Holdings

Hardware wallets like Ledger and Trezor keep your crypto offline. They’re not foolproof, but they’re much safer than browser extensions or mobile apps for storing large amounts.

Research Every Project

Look for:

- Transparent team bios

- Open-source code

- Active social communities

- Audit reports from reputable firms (e.g., CertiK, SlowMist, Trail of Bits)

How to React if You Suspect a Crypto Scams

If something feels suspicious, trust that instinct. Here’s how to respond quickly:

- Disconnect your wallet immediately using your wallet’s settings or tools like Revoke.cash

- Report the incident to the platform involved (e.g., MetaMask, Binance, OpenSea)

- Submit a fraud report to your local authorities:

- USA: IC3.gov

- UK: actionfraud.police.uk

- Malaysia: cybersecurity.my

- Use a public reporting site like Chainabuse.com to flag addresses and warn the community

Time is critical. The faster you act, the higher your chances of limiting the loss or tracing the funds.

Misplaced Trust: Don’t Fall for Appearance or Popularity

Many scams are polished. They have sleek websites, fake “verified” Twitter accounts, and even paid actors on YouTube pretending to be happy investors. But appearances can be engineered.

Influencer marketing is not due diligence. Scammers often pay influencers, especially micro-influencers, to promote tokens or platforms without disclosing the risks. Always treat marketing as marketing—not truth.

Airdrops and Giveaways: Free Isn’t Always Free

In crypto, free tokens are sometimes real. But scam versions vastly outnumber them. If you receive a surprise token in your wallet, don’t interact with it. These “dusting attacks” are designed to bait users into signing malicious smart contracts.

Legitimate giveaways usually:

- Come from verified sources

- Don’t ask for a payment to participate

- Provide clear terms and conditions

If the event requires you to send crypto to receive more, it’s almost certainly a scam.

The Role of Communities in Scam Prevention

Crypto can be isolating if you only follow price charts and headlines. Joining trustworthy communities—on Reddit, Discord, or Telegram—can offer extra eyes and experience.

But even within communities:

- Don’t trust unsolicited DMs

- Don’t click on random links

- Ask publicly, not privately

If you’re unsure, ask questions. There are no stupid questions in crypto security—only expensive mistakes.

Crypto Scams Conclusion: The First Step to Safety Is Awareness

The most effective protection against scams is not a device or a platform—it’s your mindset. In 2025, the range of crypto scams to avoid is wide, but the methods of detection remain simple: take your time, question everything, and secure your keys.

Every scam relies on a user taking action without understanding the consequences. By reading this guide, you’ve already taken an important step toward protecting your assets and investing with confidence.