At a time when traditional savings accounts yield minimal returns, crypto staking for beginners is drawing attention as a safer, eco-conscious method to earn passive income. Staking involves locking up your cryptocurrency to support blockchain operations like transaction validation, and in exchange, you receive periodic rewards—somewhat like earning interest.

While the concept may sound technical, staking has become increasingly accessible, with platforms catering specifically to first-time users. In this guide, we unpack the essentials, the risks, and the safest ways to begin staking crypto in 2025.

Crypto Staking for Beginners: What Is Crypto Staking?

Credit from The Motley Fool

Staking is how Proof-of-Stake (PoS) blockchains secure their networks. When you stake your crypto, you’re helping validate transactions and maintain the system’s integrity. In return, the network rewards you with additional tokens. The process replaces traditional crypto mining, which consumes massive amounts of electricity and hardware resources.

Unlike mining, staking doesn’t require any specialized equipment. You simply hold coins in a wallet or on an exchange that supports staking, and the blockchain takes care of the rest.

Why More People Are Staking in 2025

There are several reasons staking is gaining popularity, especially among those new to the crypto world. First and foremost is the opportunity to earn passive income. Many PoS-based coins offer attractive annual percentage yields (APYs), often ranging from 3% to over 10% depending on the asset and method used.

Besides returns, staking gives users a chance to support blockchain technology without the environmental burden associated with mining. It also opens doors to participating in the governance of some networks, giving stakeholders a voice in future developments.

Most importantly, staking is approachable. Beginners no longer need to manage complicated nodes or worry about the technical details. Platforms now offer guided processes that make staking as easy as clicking a button.

Crypto Staking for Beginners: What Are the Risks?

Credit from Atomic Wallet

Despite its advantages, staking isn’t risk-free. The most obvious is market volatility. Even if you’re earning rewards, the underlying asset’s value could drop. A 10% return doesn’t mean much if your token loses 50% of its value.

Lock-up periods can also be problematic. Some staking systems require you to keep your crypto locked for weeks or even months, during which you can’t access or sell it. This can be frustrating if the market changes suddenly or you need liquidity.

A more technical risk is “slashing,” which happens when a validator behaves maliciously or fails to validate correctly. In such cases, a portion of staked assets can be lost. This risk is generally low if you’re using reputable validators or platforms.

And of course, using unreliable exchanges or DeFi protocols can expose you to hacks or fraud. Choosing trusted platforms is key.

How to Stake Crypto: A Simple Beginner Path

Step 1: Choose the Right Cryptocurrency

Start by selecting a coin that supports staking. Ethereum (ETH) is one of the most well-known, especially after its full transition to Proof-of-Stake. Other beginner-friendly options include Solana (SOL), Cardano (ADA), and Polkadot (DOT). These coins are widely available and supported across major exchanges.

Step 2: Acquire the Crypto

Once you’ve chosen a coin, buy it through a reputable exchange. Binance, Coinbase, and Kraken are among the most trusted options globally. You can also transfer coins from a personal wallet if you already own them elsewhere.

Step 3: Decide Where to Stake

You now need to pick a staking platform. Exchanges are the easiest place to start, especially for those who prefer a hands-off approach. Binance and Coinbase allow users to stake directly from their exchange wallet.

Wallet-based platforms like Trust Wallet and Ledger Live give you more control and higher potential returns, but require slightly more technical understanding. Some users also opt for staking pools, which combine funds from multiple people to increase reward chances, or DeFi protocols that offer flexible options like liquid staking.

Step 4: Choose a Staking Method

There are several ways to stake, depending on how much control and flexibility you want.

Direct staking allows you to stake from your wallet and interact with the network yourself—more complex, but higher control.

Delegated staking is easier: you assign your coins to a validator who does the work and shares the rewards.

Then there’s liquid staking, which lets you earn rewards while keeping access to your funds via derivative tokens, such as stETH (staked ETH).

Step 5: Monitor and Adjust

After staking, keep an eye on your rewards and network changes. Some platforms charge fees, while others might require re-staking or validator switching. Monitoring your portfolio helps you maximize your returns and avoid unnecessary risks.

Staking Yields by Coin (2025 Snapshot)

Here’s a real-world comparison of staking returns to help you choose wisely:

| Cryptocurrency | Estimated APY | Lock-up Required | Staking Method |

|---|---|---|---|

| Ethereum (ETH) | 3%–5% | Yes (variable) | Direct / Liquid |

| Solana (SOL) | 5%–7% | Optional | Delegated |

| Cardano (ADA) | 4%–6% | No | Delegated |

| Polkadot (DOT) | 8%–10% | Yes | Nominated PoS |

Always verify APY rates and platform fees before staking, as conditions change frequently.

Crypto Staking for Beginners: How to Stay Safe While Staking

Security is paramount. The first step is to use only trusted and regulated platforms. Stick to well-known names, read platform reviews, and avoid services with little documentation or public history.

Be cautious with private keys. If you’re using wallet-based staking, never share your recovery phrase and always store it securely offline. Enabling two-factor authentication (2FA) on exchanges adds another layer of protection.

Understand what happens during the unbonding or withdrawal process. Some networks require a waiting period—up to 21 days—before you can move your funds again. Make sure you’re aware of these terms so you’re not caught off guard.

And finally, diversify. Don’t stake all your crypto in one place or one coin. Spread your assets to reduce exposure to risks like validator slashing or network-specific issues.

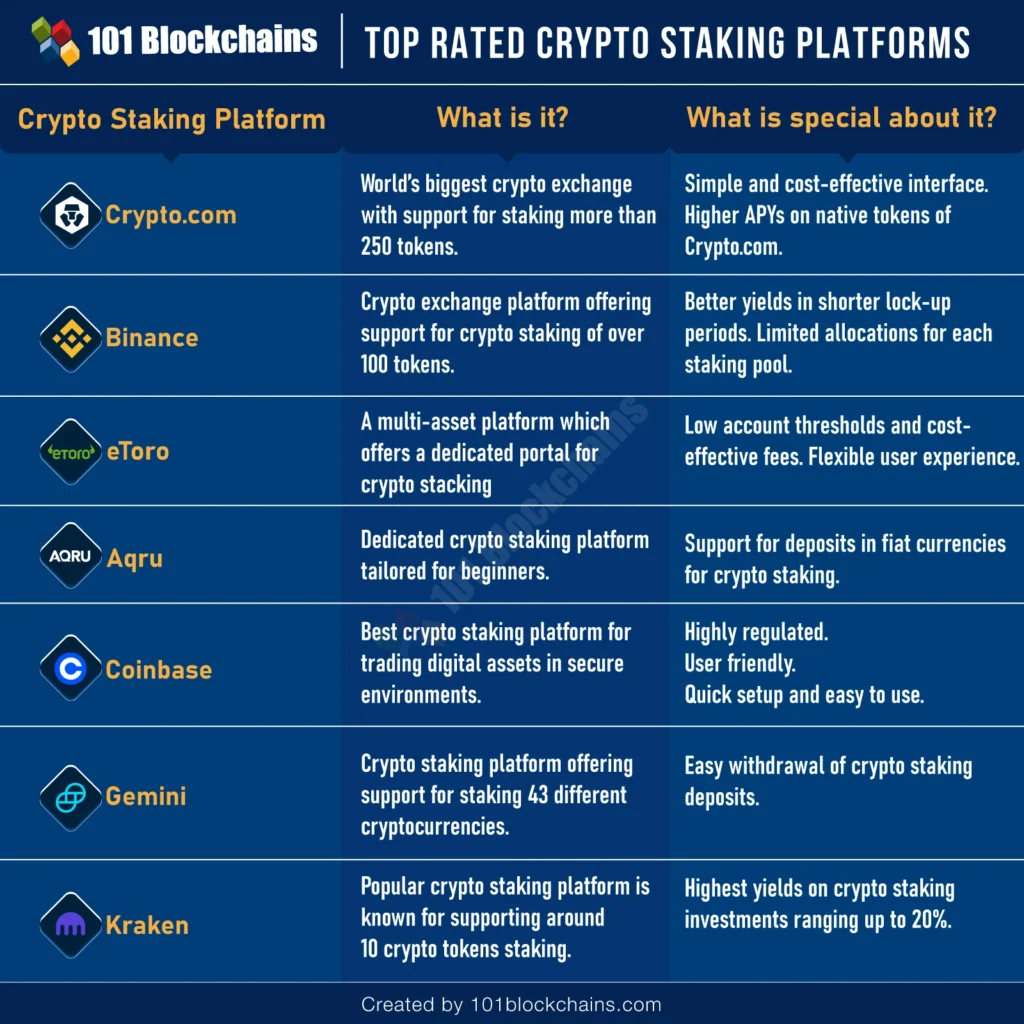

Crypto Staking for Beginners: Platforms to Consider in 2025

Credit from 101 Blockchains

Centralized exchanges remain the easiest option for beginners. Coinbase offers a clean interface and handles technical tasks behind the scenes. Kraken and Binance provide both flexible and locked staking choices, often with detailed tutorials.

Wallet platforms such as Ledger Live and Trust Wallet give you more autonomy. They’re ideal if you want to keep control of your private keys while staking directly or delegating.

For those comfortable with DeFi, platforms like Lido Finance and Rocket Pool offer liquid staking options. These allow you to stake assets like ETH and receive a token in return (e.g., stETH), which can be traded or used in DeFi protocols while still earning yield.

Key Terms Beginners Should Know

Before you begin, it helps to familiarize yourself with a few essential staking terms:

- APY (Annual Percentage Yield): The yearly interest earned from staking.

- Validator: A participant in a PoS network who confirms transactions.

- Delegator: Someone who assigns their tokens to a validator for staking.

- Slashing: A penalty for validators who fail to follow the network’s rules.

- Unstaking Period: The time required to withdraw staked crypto.

Is Staking Better Than Mining?

For most users, yes—especially beginners. Mining requires expensive equipment and significant power consumption. Staking, by contrast, is low-maintenance, cost-effective, and far more eco-friendly. It’s also easier to understand and manage using modern staking tools.

Final Thoughts on Crypto Staking for Beginners

With accessible platforms, diversified options, and improved safety measures, crypto staking for beginners in 2025 is more viable than ever. By choosing the right coin, understanding the mechanics, and following sound security practices, anyone can start earning passive income from their digital assets.

Whether you’re holding Ethereum long-term or exploring alternatives like Cardano or Solana, staking offers a way to put your assets to work while supporting the decentralized ecosystem. Just remember: stay informed, stake wisely, and treat security as your highest priority.