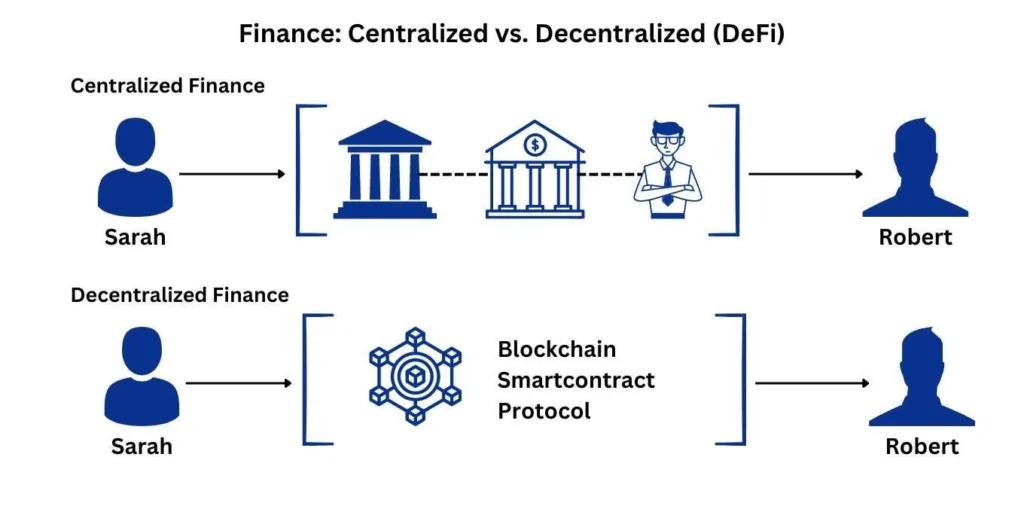

Decentralized finance for beginners can feel like stepping into a foreign world filled with unfamiliar jargon. But beneath the surface, DeFi offers a surprisingly human goal: giving people around the globe direct, borderless access to financial tools without relying on banks or brokers. Built on blockchain technology, DeFi lets users borrow, lend, trade, and earn yield — all from their own wallets.

Understanding DeFi: What Makes It Different

DeFi, short for decentralized finance, is a collection of blockchain-based protocols that replace traditional financial intermediaries with programmable smart contracts. Instead of asking a bank for a loan, users can lock up cryptocurrency as collateral and receive funds from a decentralized pool. Instead of trusting a broker to handle a trade, users can swap tokens directly on a decentralized exchange — often within seconds.

Because these systems run on open-source code, anyone can inspect, use, or improve them. Transparency and autonomy are key features. In a typical DeFi app (or dApp), your funds remain in your control — no account signup, no middlemen, and no office hours.

How Decentralized Finance Works

Credit from SDLC Corp

Smart contracts are the backbone of DeFi. These self-executing programs live on public blockchains and are triggered automatically when predefined conditions are met. Want to earn passive income? Provide liquidity to a protocol. Looking to borrow stablecoins? Deposit some ETH as collateral and receive DAI without ever speaking to a banker.

Instead of relying on trust in people, DeFi relies on trust in code. Ethereum remains the most popular ecosystem, but alternatives like Solana, Avalanche, and Arbitrum are gaining traction due to lower fees and faster speeds.

DeFi vs Traditional Finance: A Real Comparison

To understand DeFi’s significance, it helps to compare it with traditional finance:

| Feature | Traditional Finance | Decentralized Finance (DeFi) |

|---|---|---|

| Accessibility | Often limited by region or regulation | Global and permissionless |

| Control | Managed by banks or institutions | Controlled by users and smart contracts |

| Transparency | Limited (closed-source systems) | Full (open-source code on blockchains) |

| Speed | Days for settlement | Minutes or seconds |

| Fees | Institutional fees, commissions | Network fees (gas), often lower |

| Risk Profile | Backed by regulation | High smart contract and market risks |

While DeFi opens financial access, it also brings new responsibilities — and vulnerabilities — to the user.

Real-World Applications for DeFi Newcomers

Getting started in DeFi no longer requires deep technical expertise. Beginner-friendly platforms and wallets have made access much more intuitive.

For instance, decentralized exchanges like Uniswap allow anyone to swap tokens directly from their wallet. Lending platforms such as Aave let users earn interest or take out overcollateralized loans without a credit check. Even first-timers can explore yield-generating strategies like staking or liquidity mining by connecting their wallet to a trusted protocol.

These services are fast, efficient, and global. But it’s not all upside — risks still apply.

Key Risks in DeFi and How to Manage Them

Using DeFi isn’t risk-free. Smart contracts can contain bugs. Protocols can be exploited. And since there’s no customer support hotline, any mistakes or scams may be irreversible.

The most common risks include:

- Code vulnerabilities: A single bug in a contract can lead to stolen funds.

- Rug pulls: In unaudited projects, developers can suddenly withdraw liquidity and disappear.

- Impermanent loss: When providing liquidity, your holdings may lose value compared to simply holding.

- Phishing scams: Fake DeFi sites and malicious tokens often target newcomers.

To reduce exposure, start small, use only audited platforms, and stick with protocols that have established communities and transparent documentation.

How to Start With DeFi

The process to onboard into DeFi is surprisingly straightforward:

Start by setting up a crypto wallet like MetaMask or Trust Wallet. These wallets connect directly to DeFi apps and allow you to sign transactions securely. After that, purchase some ETH or another base cryptocurrency using a reputable exchange, then transfer it to your wallet.

From there, you can visit decentralized platforms like Uniswap to trade tokens or Aave to explore borrowing and lending. Always check that you’re on the official domain and avoid clicking on unknown links or popups. DeFi rewards attention and caution in equal measure.

DeFi Wallets and Interfaces

A DeFi wallet is more than just a storage tool — it’s your gateway into the entire decentralized economy. Unlike custodial wallets offered by exchanges, DeFi wallets give you full control of your private keys, meaning only you can access your assets.

Wallets like MetaMask, Rabby, and Ledger (hardware wallet) allow users to:

- Connect to DeFi apps with one click

- Sign transactions and interact with smart contracts

- View token balances and transaction history

- Switch between blockchains and Layer 2 networks

Interface platforms like Zapper and DeBank aggregate your holdings across multiple protocols, offering a dashboard view of your yield, risks, and positions.

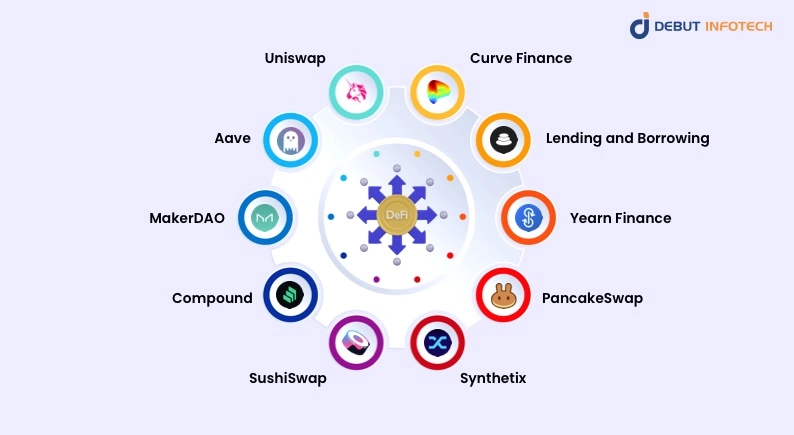

What Are the Best DeFi Platforms for Beginners?

Credit from Debut Infotech

While thousands of DeFi apps exist, only a few stand out for usability, transparency, and security — important qualities for beginners.

Aave and Compound are two leading lending platforms with audited code and community governance. Uniswap offers seamless token swaps without logins. Curve Finance is known for stablecoin efficiency. Others, like Zerion or Instadapp, simplify DeFi portfolio management.

Use platforms that display clear fees and have visible audit histories. Even experienced users avoid unaudited projects, so beginners should do the same.

Decentralized Finance for Beginners: Emerging DeFi Trends to Watch

Several DeFi trends are gaining traction in 2025, shaping the future of this ecosystem. Layer 2 solutions such as Arbitrum and Base are significantly reducing transaction costs and congestion. Meanwhile, tokenized real-world assets — including invoices, bonds, and even real estate — are coming on-chain.

Another promising trend involves decentralized identity (DID), which enables users to prove reputation or trustworthiness without exposing personal data. And as NFTs are being integrated into DeFi as collateral or yield-bearing assets, the crossover potential is expanding rapidly.

Understanding these developments will help you stay ahead of the curve and use DeFi tools with greater confidence.

Decentralized Finance for Beginners Conclusion

Decentralized finance for beginners offers more than a tech revolution — it invites users to rethink how financial access can work. With no need for permission, no institutional gatekeeping, and full user control, DeFi presents an open alternative to traditional banking.

That said, understanding how decentralized finance works is essential before diving in. With the right wallet, a few trusted platforms, and a cautious mindset, anyone can start experimenting with DeFi tools — whether for passive income, trading, or borrowing. The journey begins with curiosity, but it thrives on knowledge.