Forex Indonesia: In 2025, the meaning of Forex Indonesia depends on whom you ask. For a student in Jakarta, it might refer to online trading apps used to speculate on currency movements. For a traveler in Surabaya, it’s the neighborhood money changer that handles yen or dollar exchanges for an overseas trip. While the term remains the same, the functions have split dramatically. Forex has grown into two paths — digital trading and physical money exchange — each responding to different user needs, behaviors, and financial goals.

Rather than replacing one another, these two systems are evolving side by side. Their divergence isn’t a conflict but a reflection of Indonesia’s shifting financial landscape: increasingly digital, yet still grounded in everyday realities.

The Digital Trader: Speed, Speculation, and Strategy

Source: Investopedia

Online forex trading has carved out a fast-growing niche among young Indonesians. Apps and web-based platforms, especially those registered under BAPPEBTI, are becoming common tools for those who want more control over their finances. Here, users aren’t exchanging money for practical use — they’re trading currency pairs like EUR/USD or USD/JPY in real-time, attempting to profit from small shifts in value.

This form of trading is speculative by nature. It requires a degree of technical understanding, from reading charts to managing leverage and setting stop-loss orders. Many users begin with demo accounts or minimal capital, testing the waters before fully committing. It’s not about exchanging money to spend overseas; it’s about interpreting the market and reacting in time.

While the risks are clear — market volatility, losses, emotional pressure — the appeal remains strong. For users looking to build an active, hands-on investment habit, forex trading is a digital frontier that offers excitement and financial literacy in one package.

The Physical Money Changer: Stability and Daily Necessity

Source: The Conversation

Meanwhile, physical money changers continue to thrive — not as outdated relics, but as essential services. These outlets, licensed and monitored by Bank Indonesia, serve a wide range of practical users: travelers converting rupiah into foreign notes, business owners handling cross-border payments, parents paying for children’s tuition abroad.

The process is straightforward. Walk in, check the displayed rates, show your ID, and complete the exchange. There are no apps, no market speculation, and no waiting periods. You get physical currency on the spot, with receipts and transparency guaranteed by regulation.

In cities like Medan, Denpasar, and Makassar, money changers remain trusted pillars of the community. Their physical presence and face-to-face service still hold strong appeal — especially for older users or those with limited digital exposure. For these customers, Forex Indonesia is a grounded experience, not a market bet.

Comparing Purposes: Speculation vs. Utility

Though they both involve currency exchange, forex trading and money changing serve very different functions. Online trading is about prediction — users try to anticipate price movements and make strategic decisions to earn returns. It’s abstract, fast-paced, and data-driven.

Money changing, in contrast, is about conversion — turning one form of money into another for immediate, practical use. There’s no speculation involved, no timing the market, and no analysis. The outcome is predictable: you exchange, you receive.

This difference in purpose is why the two models are unlikely to merge. Each is anchored in its own ecosystem, shaped by different expectations, behaviors, and levels of financial risk tolerance.

Forex Indonesia: How Users Decide Where to Go

Source: Finansial

The deciding factor between these two systems often boils down to intent. If you need foreign currency for a trip or to send overseas, the convenience and clarity of a money changer make perfect sense. If your goal is to grow capital, test market theories, or diversify your income, forex trading becomes a more relevant option.

Age and financial familiarity also influence the choice. Digital-native Indonesians are more likely to explore forex apps, while more traditional users prefer the tangibility of in-person transactions. But across both groups, the keyword is trust — and in that sense, both BAPPEBTI and Bank Indonesia play critical roles in legitimizing the services under their watch.

Forex Indonesia: Different Pricing Models, Different Expectations

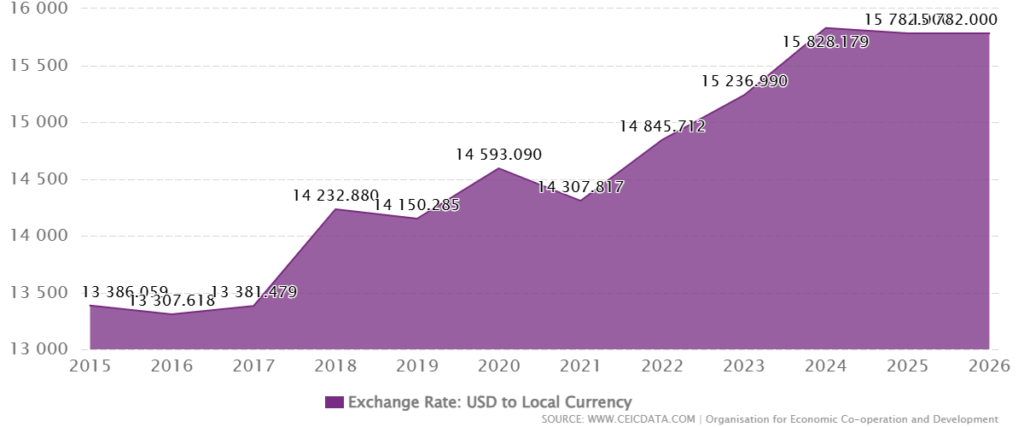

Source: ceicdata

One of the most noticeable differences between forex trading and money changers is how exchange rates are handled. Forex trading platforms operate on live, interbank rates. The spreads are tight, often changing by the second, and can be affected by global events and market liquidity. But traders also face additional costs — commissions, swap fees, and occasional slippage due to volatility.

Money changers, by contrast, offer fixed daily rates. These include a margin, which reflects operational costs and profit. The rate might be slightly less favorable, but it’s guaranteed — no sudden shifts, no conditional pricing. For the average consumer, this certainty is often more valuable than saving a few extra rupiah.

These differences aren’t just technical; they reflect the expectations of their respective audiences. Forex traders expect agility and cost-efficiency. Money changer customers expect clarity and assurance. Both systems deliver — but on different terms.

Forex Indonesia: Regulation Keeps the System Balanced

In a growing and increasingly fragmented forex environment, oversight is critical. Fortunately, Indonesia has clear frameworks in place. BAPPEBTI oversees online forex trading, ensuring that platforms are licensed, transparent, and compliant. Traders can consult official listings to confirm which brokers are legally operating in the country.

Likewise, Bank Indonesia monitors licensed money changers and enforces strict requirements, from customer documentation to rate disclosure. These regulations not only protect users but maintain stability in what could otherwise be a chaotic and risky marketplace.

With scams still circulating — especially in digital spaces — regulation is the invisible backbone of Forex Indonesia. It’s what allows these two models to grow safely, even as they drift further apart in style and function.

Final Thoughts: A Currency Ecosystem That Reflects Its People

The most important takeaway from observing Forex Indonesia today is that it reflects a society with diverse financial needs. There’s room for both fast, speculative traders and careful, cash-focused exchangers. Neither system is inherently better — they are simply different answers to different questions.

As Indonesia continues to modernize its financial systems and raise its national financial literacy, we can expect each service to become even more refined. Trading platforms will evolve with smarter tools and localized education. Money changers may add digital features while retaining their personal touch. The future won’t be about one replacing the other, but about giving people the right service at the right time — based on who they are and what they need.

In this way, Forex Indonesia is more than a market term. It’s a mirror of financial behavior in transition.