Forex Trading Hours for Asians – 7 Essential FAQs

The forex market never sleeps, but successful traders know when to stay active — and when to wait. Timing is often more important than frequency, especially when working across global time zones. For Asian traders, and particularly those based in Vietnam, navigating the forex market means understanding how time zones overlap, and how trading sessions affect currency movement.

This FAQ-style article answers some of the most common and practical questions traders in Asia ask about the best trading hours, forex time zones, and how to trade more effectively in local time.

1. What are the main forex time zones traders should know?

Credit from Titan FX

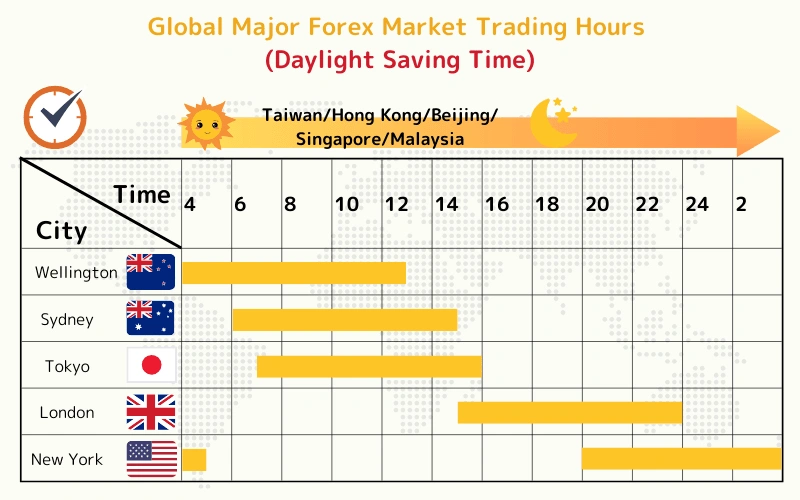

The global forex market is divided into four primary trading sessions: Sydney, Tokyo, London, and New York. These sessions overlap at certain points in the day, creating windows of higher liquidity and movement. For Asian traders, the Tokyo session is most accessible, but overlaps — like the Tokyo–London or London–New York periods — often provide more dynamic trading environments.

Understanding these forex time zones helps traders anticipate when currency pairs are most active, which is key for timing entries and exits.

2. When does the Vietnam forex session typically start and end?

Credit from The Investor

Vietnam is in the GMT+7 time zone, so the trading day typically begins with the Tokyo session around 6:00 AM local time. From there, traders can stay active through the London open (around 2:00 PM) and, if preferred, into the New York session in the evening (from 7:00 PM onward).

While Vietnam doesn’t have an official “forex market,” local traders tend to operate within these global windows. The Vietnam forex session can extend into the early morning hours depending on the strategy.

3. What is the best forex time for traders in Vietnam?

Credit from The Star

The best time depends on both the trader’s availability and the market’s liquidity. Many active Vietnamese traders find the London–New York overlap, which runs from 7:00 PM to 11:00 PM local time, to be the most productive. This period sees high trading volume, particularly in major pairs like EUR/USD and GBP/USD.

For those who prefer calmer market conditions, the Tokyo–London overlap (around 2:00 PM to 5:00 PM Vietnam time) may be a better fit.

4. Why are overlap sessions considered ideal for trading?

Credit from Blueberry Markets

When two markets are open at once, there’s a noticeable increase in trade volume and price activity. These periods — called overlaps — are when buyers and sellers from multiple regions interact, tightening spreads and accelerating price changes.

For example, during the Tokyo–London overlap, pairs like EUR/JPY or GBP/JPY are often more active. During the London–New York overlap, nearly all major pairs see greater movement. These are considered the best trading hours for those seeking volatility with strong liquidity.

5. Are there specific forex pairs that suit Vietnam’s time zone better?

Yes. During the early part of the day — especially within the Tokyo session — traders in Vietnam may focus on pairs like USD/JPY, AUD/JPY, or NZD/USD. These reflect regional economic data and align with Asian session sentiment.

Later in the day, particularly in the London and New York overlaps, pairs like EUR/USD, GBP/JPY, and USD/CAD come into focus. Understanding forex time zones for traders in Vietnam helps align currency selection with peak activity.

6. How do lifestyle and routine affect trading hours in Vietnam?

Your daily rhythm matters. Forex may be global, but every trader needs to build a schedule that works locally. In Vietnam, some prefer to trade early in the morning before work, while others log in at night to catch the U.S. market.

Aligning your trading session with your focus hours is often more effective than trying to catch everything. Knowing when to trade forex in Vietnam time becomes a balancing act between opportunity and personal consistency.

7. What’s the optimal forex trading time in Vietnam for beginners?

Beginners are often advised to start with slower sessions, such as the Tokyo session, where volatility is manageable and sudden price swings are less common. That typically means trading from 6:00 AM to 10:00 AM Vietnam time.

As confidence builds, many move into more active windows, such as the Vietnam time zone forex market overlap between Tokyo and London, or the London–New York overlap. The goal is not to trade more — but to trade smarter, when conditions favor your strategy.

Conclusion: Timing Is Strategy

For Asian traders, especially in Vietnam, mastering the forex time zones is a key part of building a long-term trading routine. The most successful traders often aren’t the busiest — they’re just the most timely. By aligning personal schedules with session overlaps and understanding when currency pairs are most active, traders can make more informed decisions. In the world of forex, timing is not just tactical — it’s strategic.