Not every crypto exchange has managed to survive regulatory scrutiny and shifting market demand, but Gemini has. This gemini exchange review explores how the New York-based platform positions itself in 2025. While other exchanges chase new listings and aggressive marketing, Gemini doubles down on compliance, strong gemini security features, and services like the gemini custody service for institutions.

For many traders, it’s less about hype and more about trust. Gemini’s reputation for regulatory clarity and reliability makes it a strong option, even if its gemini trading fees aren’t the lowest.

Gemini Exchange Review: Opening an Account

Account creation is straightforward, but serious trading requires full verification. The gemini KYC process involves submitting ID and proof of address. For me, the process was complete within a day.

If you’re unsure about committing funds, Gemini offers a gemini demo account, allowing you to test trading instruments on Gemini and the gemini active trader platform without financial risk.

Gemini Exchange Review: Market Coverage

Gemini focuses on carefully selected supported assets on Gemini. Unlike some rivals that list hundreds of tokens, Gemini emphasizes reliability. You’ll find BTC, ETH, stablecoins, and a range of vetted altcoins.

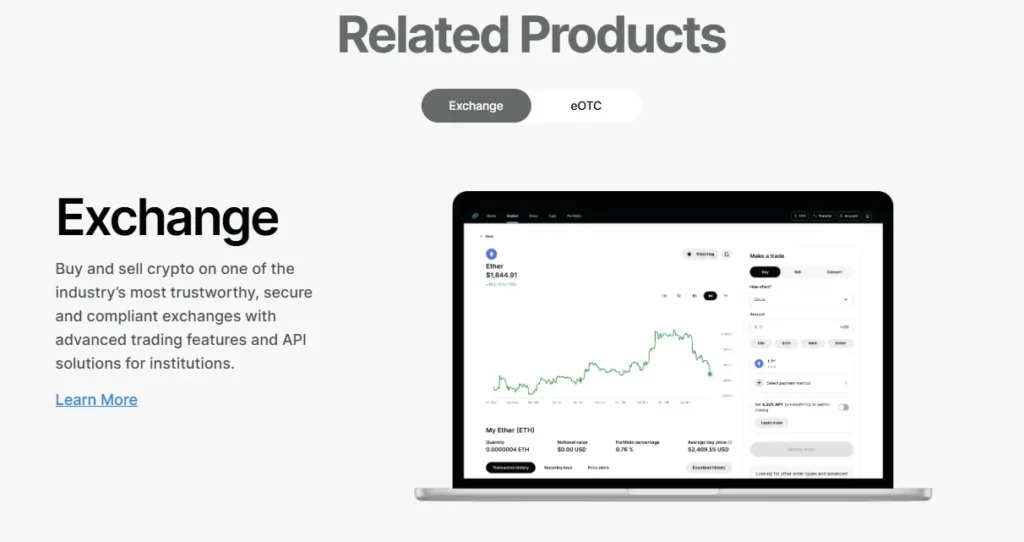

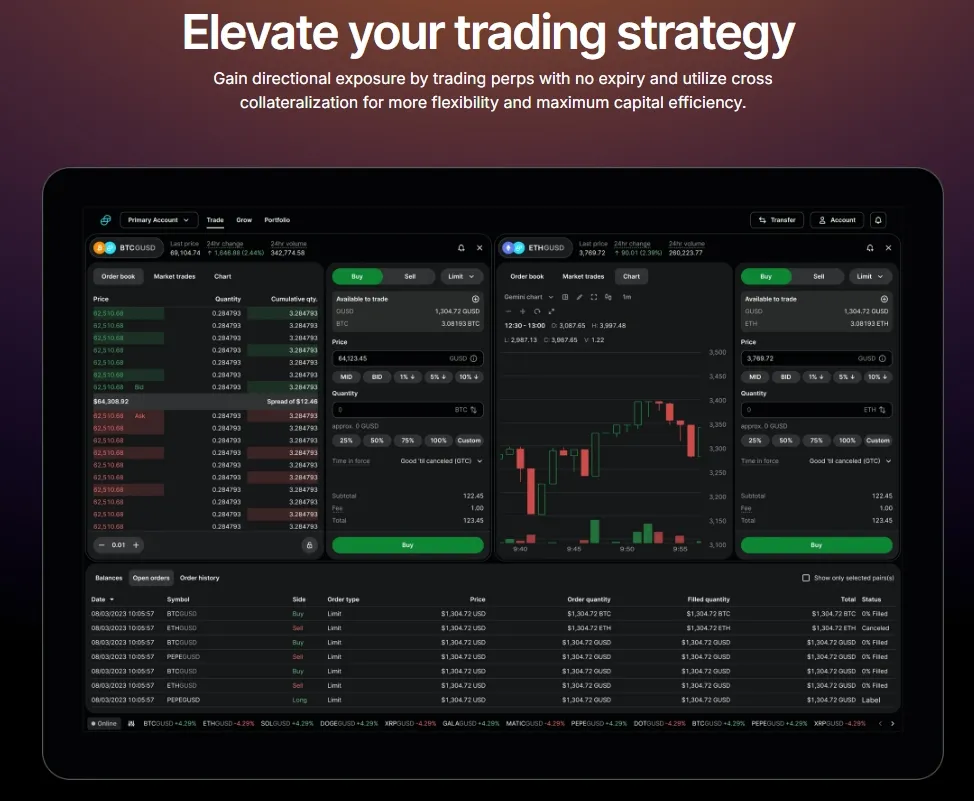

Gemini spot trading is liquid for major pairs, while smaller assets have less depth. Gemini futures trading is still limited, but there’s clear demand for expansion, especially among institutional users.

Fees – A Two-Tiered Experience

One of the first things I noticed is how much fees vary depending on which interface you use. Casual users on the mobile or web app pay higher gemini trading fees, while professionals using the gemini active trader platform enjoy lower rates.

Here’s the 2025 fee snapshot:

| Service | Fee | Notes |

|---|---|---|

| Spot (Standard) | ~1.49% | Applies on retail trades |

| Active Trader | 0.25% maker / 0.35% taker | Designed for pros |

| Futures | Contract-based | Still in limited rollout |

| Withdrawal | Free up to 10/month | Network fee afterward |

| Earn | 0% fee | Interest-bearing option |

In gemini vs coinbase, Coinbase has slightly more assets, but Gemini’s Active Trader rates are more appealing for volume traders.

Security and Regulation – Where Gemini Excels

The gemini security features are among the strongest in the industry. Two-factor authentication, device management, hardware keys, and insured custody help protect client funds.

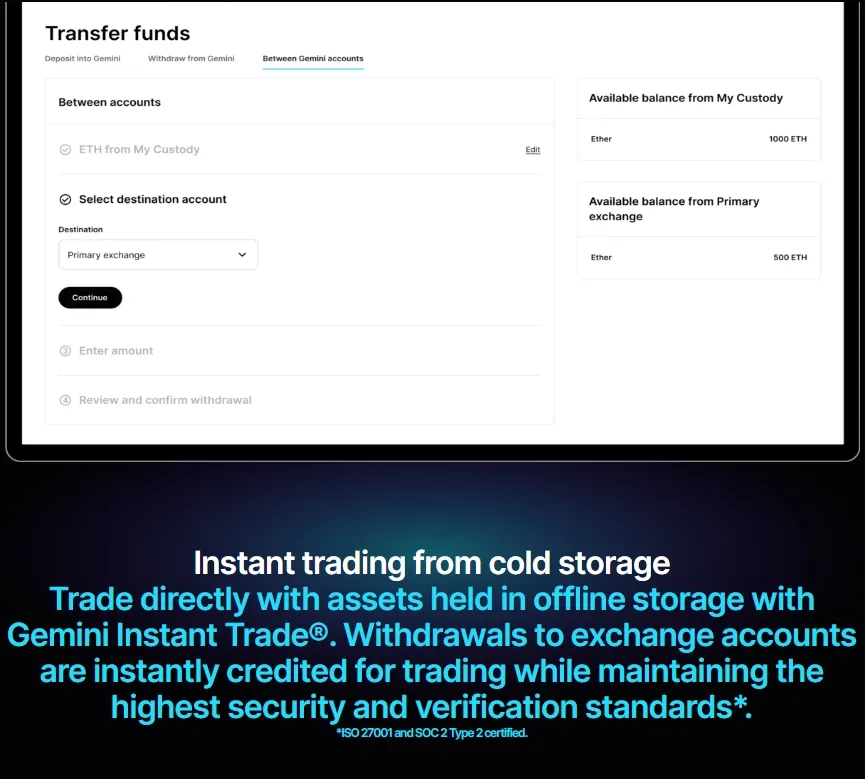

The regulatory status Gemini is also a differentiator. As a New York trust company under NYDFS supervision, Gemini is subject to some of the strictest financial rules. The gemini custody service, with insurance and cold storage, attracts institutional investors seeking compliance.

Trading Experience – Desktop and Mobile

On desktop, Gemini is straightforward. The regular interface is beginner-friendly, while the gemini active trader platform offers advanced charting, faster order routing, and lower costs.

The gemini mobile app is clean and responsive, making it easy to manage positions anywhere. In terms of liquidity and execution speed, BTC/USD and ETH/USD pairs run smoothly, though niche altcoins can feel thin compared to larger exchanges like Binance.

Gemini Exchange Review: Passive Income and Tools

The Gemini Earn Program allows users to earn yield by lending or staking assets. Rates depend on the token and region but provide a way to make holdings work for you.

On top of that, investment tools on Gemini include price alerts, portfolio analytics, and account statements useful for tax reporting. For serious traders, Gemini’s institutional reports and APIs are also valuable.

Deposits and Withdrawals

The deposit and withdrawal process is predictable and transparent. Fiat deposit options Gemini include ACH, wire transfer, and debit card purchases. Withdrawals are smooth, with 10 free per month before network fees apply. This perk sets Gemini apart from rivals who charge per transaction.

Final Verdict – Is Gemini Worth Using?

After weeks of testing, this gemini exchange review shows that Gemini is best suited for traders who value safety and regulation over chasing hundreds of altcoins. While gemini trading fees can be high for casual users, the gemini active trader platform solves this with lower rates. Add in the Gemini Earn Program, gemini custody service, and clear regulatory status Gemini, and it’s easy to see why institutions and cautious investors stick with it.

In 2025, Gemini remains one of the most trustworthy exchanges, even if it’s not the flashiest.