2025 Gold Forecast: Myths and Realities in Vietnam’s Shifting Market

The year 2025 brings both anxiety and speculation to Vietnam’s gold market. From whispers of an economic gold rush to fears of a dramatic crash, it’s easy to get caught in headlines rather than hard data. This article dives into the gold forecast for Vietnam, separating myth from reality in a market shaped by inflation, policy, and public psychology.

Myth 1: “Gold Always Rises During Inflation”

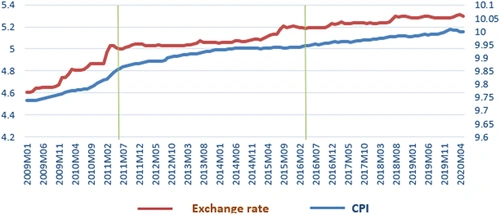

It’s a long-held belief — when inflation spikes, gold prices soar. While this has historical merit, the reality is more nuanced. In Vietnam, gold vs inflation remains a key relationship, but it doesn’t guarantee a linear price climb.

In fact, gold prices have occasionally stagnated or declined even as inflation remained high. Why? Because inflation isn’t the only variable. Interest rates, foreign exchange policies, and real estate market movements all influence investor behavior. In 2025, Vietnam’s inflation has cooled slightly, and gold prices have shown volatility rather than a clear upward trend.

Myth 2: “The Vietnam Gold Price 2025 Will Mirror Global Trends”

Credit from Taylor & Francis Online

This assumption doesn’t hold up under scrutiny. While international spot prices play a role, Vietnam’s gold market is shaped by local regulations and consumer behaviors that diverge from global norms.

Due to import restrictions and state-managed bullion policies, domestic prices in Vietnam often run higher than global rates. Additionally, cultural demand — such as buying gold during Tet or weddings — creates a steady, less speculative demand base. As a result, while global prices may drop slightly in 2025, local prices might remain stable or even rise.

Myth 3: “A Crash Is Imminent”

The phrase “Will gold crash in 2025?” is circulating in forums and investor chat groups. But context is key. A dramatic collapse is unlikely unless paired with a major economic event — such as a central bank policy shock or currency crisis.

More realistically, gold in Vietnam may adjust or correct, but not crash. Vietnamese investors, who often see gold as a long-term store of value, aren’t quick to sell off. Gold is also frequently passed down through generations, adding a layer of emotional value that prevents market panic.

Myth 4: “Only the Wealthy Buy Gold in Vietnam”

Credit from Bloomberg

Another misconception is that gold investment is reserved for Vietnam’s upper class. In truth, gold ownership is widespread, often seen as a safer alternative to volatile real estate or crypto. Even rural households may hold gold bars or jewelry as savings.

This widespread participation adds stability to the market. When everyday people hold small amounts for security — not for speculative profit — the likelihood of a bubble is reduced.

Myth 5: “2025 Is Too Risky to Buy Gold”

Credit from AInvest

The final myth suggests that potential volatility makes 2025 a poor year for entering the gold market. But risk is always relative. Compared to speculative assets or unstable currencies, gold may still serve as a stabilizing force in a diversified portfolio.

For Vietnamese investors, especially those looking for medium- to long-term preservation, 2025 might actually be a good time to enter gradually — especially if global prices dip, offering better local entry points.

Conclusion: Gold Forecasts Are Just That — Forecasts

In Vietnam, the gold forecast for 2025 doesn’t point to extreme highs or devastating lows. Rather, it suggests moderation. Inflation, government policy, and cultural values all support a fairly resilient market. While myths of booming gains or looming crashes make headlines, the truth — as always — is more balanced.

Investors should look beyond fear or hype and assess their own goals, risk tolerance, and the actual data. Because in 2025, the biggest myth might just be that anyone can fully predict what gold will do next.