Gold Hedge Rupiah: Let’s not sugarcoat it — the rupiah has been under pressure, and for many Indonesians, that means one thing: your savings might not stretch as far as they used to. If you’re still keeping all your money in IDR without any hedge, you’re taking on more risk than you may realize.

This is where the idea of a gold hedge rupiah strategy becomes more than just financial theory — it becomes a practical necessity.

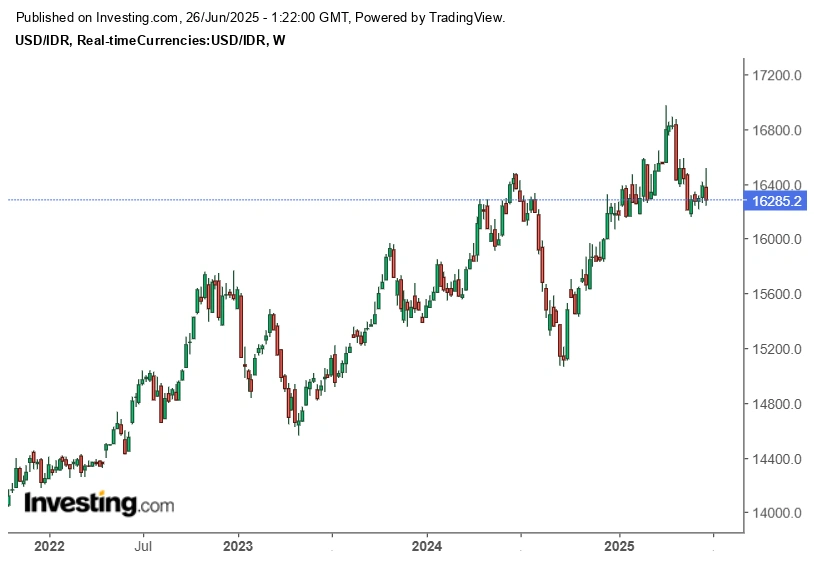

Risk #1: Gold Hedge Rupiah- Currency Devaluation Eats Away Your Savings

You’ve saved up millions in rupiah — but then the currency drops. Suddenly, imported goods cost more, fuel prices spike, and your buying power quietly disappears. This isn’t hypothetical — it’s happened before, and it’s happening again.

The solution? Gold, which often moves in the opposite direction of the rupiah. When IDR falls, gold (priced in USD) typically rises in local currency terms.

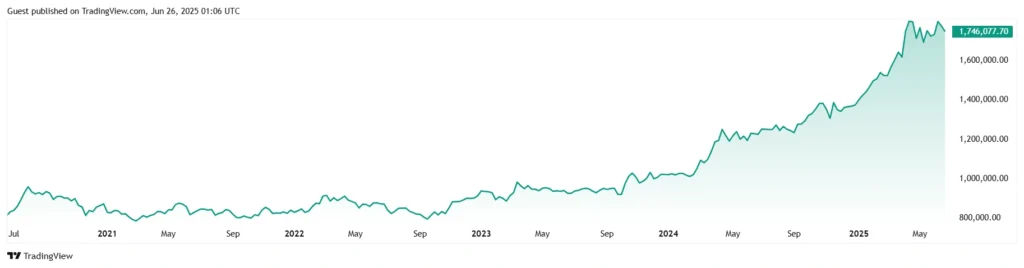

Risk #2: Gold Prices React Fast — Hesitating Might Cost You

Once people notice the rupiah weakening, gold demand shoots up — and so do prices. By the time you’re ready to buy, you might already be late. This is what’s happening right now in 2025:

- Global gold prices are high

- IDR is sliding

- Retail gold outlets are seeing surges in purchases

A gold hedge only works before the panic buying begins.

Risk #3: Most Savings Accounts Don’t Keep Up with Inflation

Source: Investing.com

Your bank deposit might be safe — but is it growing? In many cases, interest rates are lower than inflation. That means your money in IDR is slowly shrinking in real value.

Gold doesn’t pay interest, true — but it holds value. Historically, it rises during inflationary periods and currency drops. That makes it a stabilizer, not a profit play.

Why a Gold Hedge Rupiah Strategy Still Makes Sense in 2025

Source: TradingView

Let’s be clear: gold won’t fix everything. But here’s what it can do:

- Offset losses from a weakening IDR

- Store value when inflation rises

- Provide liquidity when you need to cash out fast

- Act as a hedge — not a primary investment, but a safety net

Even putting 5–15% of your savings in gold can go a long way toward protecting your future.

How to Start Hedging Without Overcomplicating Things

You don’t need to be a financial expert to hedge with gold. Here’s the simplest route:

- Pick your format: Digital gold (via apps like Tokopedia Emas, Pluang), physical gold bars (Antam), or gold ETFs

- Buy gradually: Start small — you can buy gold gram by gram

- Watch IDR trends: Don’t panic, but don’t ignore patterns

- Don’t wait for the headlines: If you’re seeing early warning signs, act before the market does

Final Warning: Doing Nothing Is the Bigger Risk

It’s easy to delay — to tell yourself you’ll hedge later. But the cost of inaction is higher when inflation and currency devaluation move fast.

A gold hedge rupiah strategy isn’t about fear — it’s about smart defense. You don’t need to go all in. Just take the first step. Because when the value of money changes overnight, gold is often one of the few things that doesn’t.