In today’s volatile crypto market, security is no longer just an optional layer but the very foundation of trust. Investors are aware that every year brings new stories of hacked exchanges and stolen assets. This is why a fresh Ledger exchange review is so valuable in 2025. Unlike many custodial services, Ledger combines offline hardware-level protection with integrated exchange access, creating a hybrid approach that continues to attract both beginners and advanced users.

Key Takeaways

- Ledger provides a hybrid model: hardware wallets connected with exchange integration.

- Pricing starts at USD 79, placing it in the premium yet accessible category.

- Security remains its strongest selling point, backed by offline key management.

- Best suited for long-term holders, NFT collectors, and DeFi users.

Ledger Exchange Review: Background and Development

Ledger was founded in France in 2014 and rapidly became one of the most recognized names in crypto security. It introduced the Ledger Nano S, followed by the more advanced Nano X, both of which allowed investors to store private keys offline.

Over the years, Ledger evolved from a wallet maker into a broader ecosystem. With Ledger Live, users could buy, sell, and stake assets while retaining self-custody. The introduction of NFT management and DeFi compatibility reinforced its role as a multi-purpose gateway rather than a simple storage device. Consequently, Ledger became the middle ground between custodial exchanges and cold storage vaults.

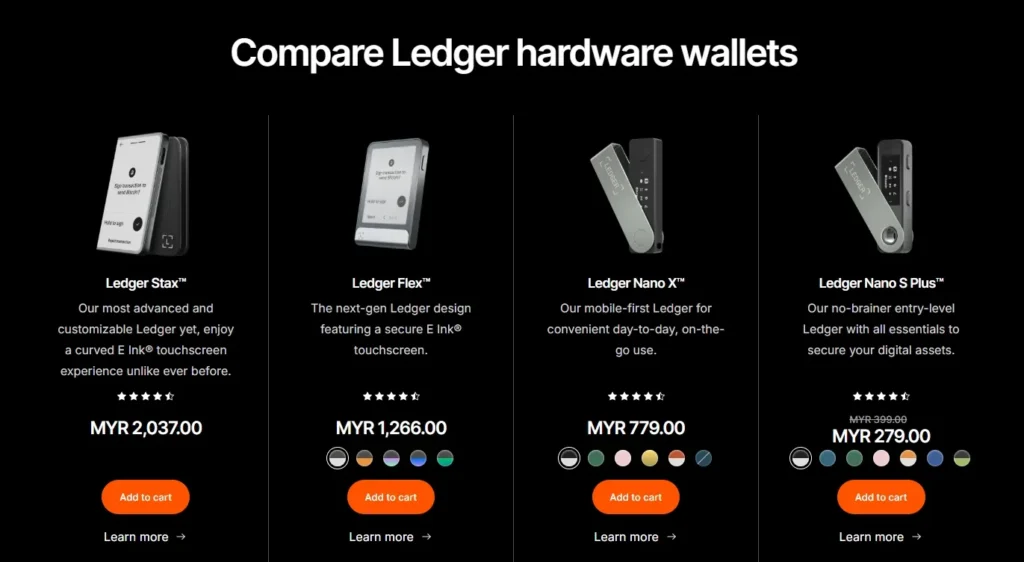

Pricing and Market Positioning

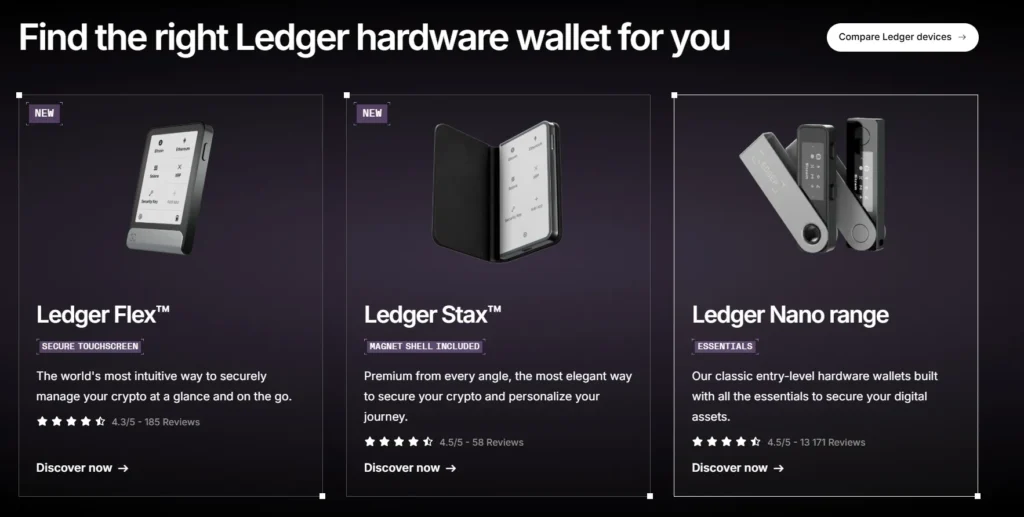

When considering Ledger, cost is often the first concern. The Nano S Plus is priced at about USD 79, while the Nano X costs around USD 149. Although this upfront cost may deter beginners, it is small compared to the potential losses from a hacked hot wallet or compromised exchange account.

| Product | Price | Supported Assets | Target User |

|---|---|---|---|

| Ledger Nano S Plus | USD 79 | 5,000+ coins | Entry-level investors |

| Ledger Nano X | USD 149 | 5,000+ coins + Bluetooth | Advanced & mobile users |

| Trezor Model T | USD 219 | 3,000+ coins | Security-focused traders |

In short, Ledger positions itself as a premium but affordable security solution.

Ledger Exchange Review: Key Features

Ledger’s appeal comes from its features, which extend far beyond simple storage.

- Ledger Live: A management platform that allows portfolio tracking, staking, and integration with partner exchanges.

- NFT Support: Users can store and view NFTs directly in Ledger Live.

- Multi-chain Access: Ledger supports Bitcoin, Ethereum, Solana, and thousands of altcoins.

- Recovery Key: A backup method that ensures access even if the device is lost.

- Staking Access: Secure staking without compromising private keys.

Moreover, Ledger continuously updates its system to remain compatible with emerging crypto assets, ensuring long-term usability.

Ledger Exchange Review: Pros and Cons

Pros

- Hardware-level offline security

- Supports over 5,000 assets including NFTs

- Exchange integration via Ledger Live

- Strong reputation and customer support

- Regular updates for new tokens

Cons

- Requires upfront cost compared to free wallets

- Less convenient for high-frequency traders

- Users bear full responsibility for backup phrases

Step-by-Step Guide: How to Use Ledger with Exchanges

- First, purchase and initialize your Ledger device.

- Next, install Ledger Live and set up apps for your chosen coins.

- After that, link Ledger Live with a partner exchange.

- Then, transfer funds into your Ledger-secured wallet.

- Finally, authorize every transaction directly on the hardware device for maximum protection.

As a result, users enjoy the benefits of exchange access without losing custody of their keys.

Ledger Exchange Review: Security and Risk Analysis

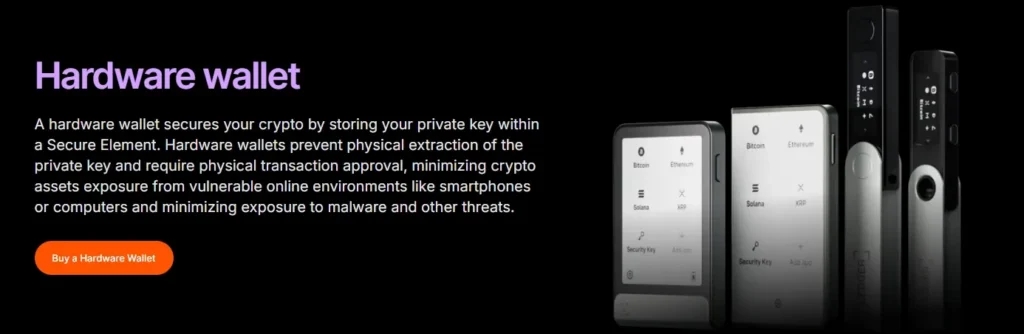

Ledger’s reputation is built on security. By storing keys offline and requiring physical confirmation for transactions, it reduces exposure to malware and phishing. Therefore, even if a computer is compromised, funds remain protected.

However, Ledger is not immune to risk. The 2020 data leak exposed customer contact information, although wallets themselves were safe. This event highlighted that while hardware protection is strong, user vigilance is still necessary. In conclusion, investors should combine Ledger’s tools with careful online habits.

Who Should and Shouldn’t Use Ledger

Ledger is best suited for investors with mid-to-large portfolios who value long-term safety over day-to-day speed. NFT collectors also benefit, since the system supports direct viewing and storage of digital assets. DeFi participants can access staking opportunities without surrendering private keys.

On the other hand, Ledger may not appeal to beginners hesitant about hardware costs. Active day traders may also find the extra approval steps inconvenient. Additionally, users who prefer custodial solutions may find Ledger too demanding, since it requires personal responsibility for recovery keys.

Alternatives to Ledger

Ledger faces competition from both hardware and software solutions. For instance, Trezor offers comparable offline protection but comes at a higher price. SafePal appeals to cost-conscious users, though its ecosystem is less developed. Meanwhile, Coinbase Wallet and other custodial services focus on convenience but expose users to third-party risks.

In comparison, Ledger’s balance between security, affordability, and ecosystem features makes it stand out. Thus, it remains an attractive option for users unwilling to compromise on custody.

Conclusion: Is Ledger Worth It in 2025?

Ultimately, this Ledger exchange review demonstrates that Ledger continues to lead the market in security and usability. While it requires an upfront cost and some responsibility, the benefits of offline key storage, exchange integration, and multi-chain support outweigh the drawbacks. Therefore, for investors serious about protecting their digital wealth, Ledger is not simply a wallet but a long-term safeguard against the uncertainties of the crypto landscape.