In 2025, Indonesian forex traders are increasingly relying on data-driven tools to stay ahead in the market. As price swings in the USD/IDR, EUR/IDR, and other key pairs remain highly reactive to economic and political signals, traders are adapting by using trusted indicators that deliver consistent analysis. One of the most talked-about combinations this year is MACD RSI for Forex Indonesia — a setup that provides both directional momentum and strength confirmation in one framework. Traders are focusing on precision more than ever, and this indicator pair is helping reduce guesswork.

How MACD Helps Clarify Directional Momentum

The MACD (Moving Average Convergence Divergence) is one of the most respected indicators in forex trading. It captures momentum by comparing short-term and long-term exponential moving averages, which helps traders spot trend changes early. In the Indonesian market context, where macroeconomic data and central bank interventions frequently shift the landscape, MACD allows traders to stay aligned with the bigger picture. When the MACD line crosses above the signal line with a rising histogram, it often points to emerging bullish trends that many Indonesian traders consider actionable.

RSI as a Confirming Indicator for Trade Strength

Source: LiteFinance

RSI (Relative Strength Index), on the other hand, plays the role of confirming whether a trend identified by MACD has enough strength behind it. The RSI moves between 0 and 100, highlighting overbought and oversold conditions. In 2025, RSI is being used by Indonesian traders not just to time reversals, but to evaluate whether a MACD signal is strong or weak. A MACD bullish signal with an RSI above 50 gives stronger confirmation, while RSI divergence can serve as a warning to avoid a potentially misleading signal. Together, RSI and MACD form a dual layer of market interpretation.

Combining MACD and RSI: How Indonesian Traders Are Building Systems

The synergy between MACD and RSI lies in their complementary design. While MACD defines trend direction and potential shifts, RSI shows how reliable the trend might be. In Indonesia’s active forex market, especially during periods of thin liquidity or post-news volatility, traders often use MACD crossovers as an initial alert and then cross-check with RSI behavior. If both indicators support the same signal, traders gain greater conviction. This approach is particularly popular among traders using swing or intraday timeframes, where false breakouts are common.

MACD RSI for Forex Indonesia: Bollinger Bands Add a Volatility-Based Layer

Source: TrueData

To increase the accuracy of their MACD-RSI setups, Indonesian traders in 2025 are turning to Bollinger Bands. These bands expand and contract based on market volatility, giving a visual signal for when price may be reaching extreme levels. A breakout beyond the upper band accompanied by a bullish MACD crossover and RSI above 60 is often seen as a powerful momentum play. Conversely, if RSI and MACD signal weakness while the price touches the upper band, it can suggest an exhaustion move. Bollinger Bands act as a reality check — are moves sustainable or just short-term spikes?

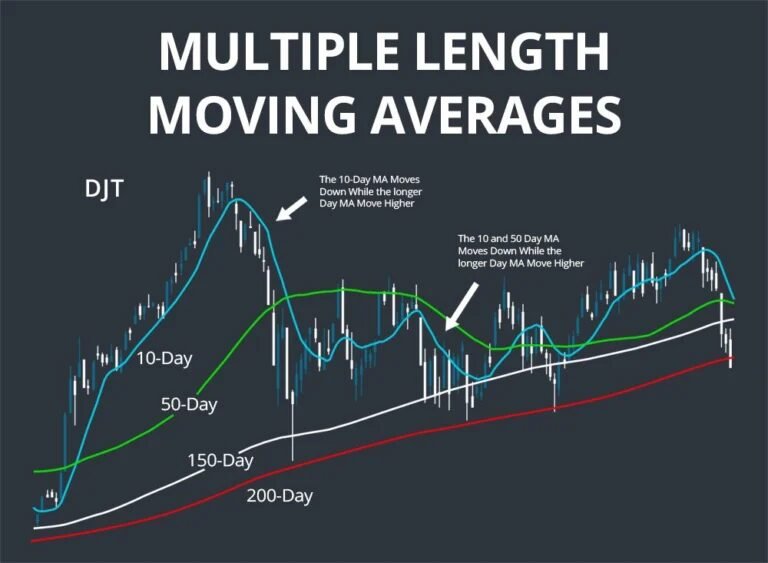

MACD RSI for Forex Indonesia: Why Moving Averages Still Anchor the Setup

Source: SCANZ

Traders are also incorporating moving averages — especially the 50 EMA — to confirm the general direction of the market before placing trades. In 2025, using the 50-period EMA has become a common technique among Indonesian forex traders. It acts as a directional filter. If MACD and RSI indicate a bullish setup but the price is below the EMA, some traders choose to wait. But if all three align — price above EMA, MACD crossing up, RSI rising — then it often signals a high-probability entry. This layered validation is reducing risky decisions and improving trade consistency.

MACD RSI for Forex Indonesia: Stochastic Oscillator Adds Entry Precision

Source: EWM Interactive

Some Indonesian forex traders are going a step further and integrating the stochastic oscillator for timing entries with greater precision. While MACD and RSI build the foundation of a setup, the stochastic oscillator, which reacts faster to price changes, helps determine the exact moment to enter. For example, if MACD gives a bullish signal and RSI is trending upward, the stochastic being in oversold territory and turning up can act as a green light to enter. This triple-indicator strategy has been popular among day traders in 2025 who seek tighter risk management.

The Human Element: News and Fundamentals Still Influence Success

Source: The Economist

Despite the strength of technical tools like MACD and RSI, traders in Indonesia recognize that they must still consider macroeconomic data, market sentiment, and geopolitical events. BI announcements, global interest rate decisions, and commodity trends (like palm oil and coal prices) continue to influence IDR pairs. In 2025, savvy traders are using MACD-RSI setups as a framework, but adjusting position size and stop loss depending on current news flow. The indicators help create structure, but fundamentals remind traders that the market is always dynamic.

Final Thoughts: MACD and RSI Provide Structure in an Uncertain Market

Indonesian forex traders in 2025 are operating in a market that demands both flexibility and structure. The MACD RSI for Forex Indonesia combination is gaining popularity because it provides exactly that — structure to interpret charts, flexibility to adapt to new information. Whether you’re trading part-time or managing a professional portfolio, integrating this indicator setup into your strategy may help you see the charts with greater clarity. The key lies in understanding how the tools interact and applying them with discipline in real-time conditions.