Over the last few years, NFTs Explained for Beginners in everyday conversations has shifted from a niche concept to a cultural phenomenon. From digital art and music to collectibles and video game assets, these blockchain-based tokens have redefined how we think about ownership in the digital age.

But for beginners, the terminology, hype, and fast-moving trends can be overwhelming. This article will guide you through the fundamentals: what NFTs are, how they work, why they’re valuable, and how to evaluate them critically.

NFTs Explained for Beginners: What Is an NFT?

NFT stands for Non-Fungible Token — a type of digital certificate stored on a blockchain that represents ownership of a unique asset. Unlike cryptocurrencies, which are interchangeable (1 ETH = 1 ETH), NFTs are non-fungible, meaning each token is distinct and cannot be replaced by another.

They can represent ownership of:

- Digital artworks

- Collectible cards

- Music and video files

- Tweets, GIFs, memes

- Virtual real estate or game items

Each NFT contains metadata and a unique ID that makes it distinguishable from every other token on the same blockchain.

NFTs Explained for Beginners: How NFTs Work

NFTs are primarily powered by blockchain technology, the same distributed ledger system that supports cryptocurrencies. Most NFTs today are built on Ethereum using standards like ERC-721 or ERC-1155. These standards define how tokens are created and managed.

Here’s what happens in the background:

- Minting: The digital file is converted into an NFT using smart contracts.

- Storage: The NFT metadata is stored on-chain or off-chain (e.g., IPFS).

- Proof of Ownership: Ownership history and transactions are publicly recorded.

- Transfer/Sale: NFTs can be listed and sold on marketplaces; ownership is transferred on purchase.

Table: Popular NFT Blockchains and Their Characteristics

| Blockchain | Token Standard | Main Features | Popular NFT Projects |

|---|---|---|---|

| Ethereum | ERC-721, ERC-1155 | Largest ecosystem, high security, but high gas fees | CryptoPunks, Bored Ape Yacht Club |

| Solana | Metaplex | Low fees, fast transactions, growing user base | Degenerate Ape Academy, y00ts |

| Polygon | ERC-721 compatible | Ethereum-compatible, low cost, eco-friendly | Lens Protocol NFTs, DraftKings NFTs |

| Tezos | FA2 | Environmentally friendly, lower transaction costs | fx(hash), Objkt |

| BNB Chain | BEP-721, BEP-1155 | Low fees, connected to Binance ecosystem | Pancake Squad, MOBOX |

NFTs Explained for Beginners: What Gives NFTs Value?

The value of NFTs is often subjective, much like physical art or collectibles. Several factors contribute to how the market perceives a token’s worth:

- Scarcity: Limited editions or unique one-of-one pieces are more appealing.

- Authenticity: Verified creators and original ownership histories increase trust.

- Utility: Some NFTs offer benefits such as access to events, voting rights, or in-game perks.

- Community: Strong, active communities behind collections often boost demand.

- Cultural Relevance: NFTs that tie into memes, internet history, or major events often gain attention.

Yet not every NFT holds value. In fact, many lose their resale worth once hype fades.

NFT Marketplaces: Where Buying and Selling Happens

Credit from NFTify

To buy or sell NFTs, you’ll need access to a digital wallet and a compatible marketplace. Each platform offers different features, audience sizes, and blockchain support.

Some widely used platforms include:

- OpenSea: The largest NFT marketplace; supports Ethereum, Polygon, and more.

- Blur: Gained traction among professional NFT traders; optimized for bulk transactions.

- Magic Eden: Popular for Solana-based NFTs and gaming assets.

- Rarible: Community-centric, multi-chain, with its own governance token (RARI).

- Foundation: Art-focused and curated, with high-quality original pieces.

Before engaging, it’s important to verify collections and check transaction histories on-chain using tools like Etherscan or Solscan.

How NFTs Differ from Cryptocurrencies

Many newcomers confuse NFTs with regular cryptocurrencies. Here’s a clear distinction:

| Aspect | NFTs | Cryptocurrencies |

|---|---|---|

| Uniqueness | Each token is unique | All tokens of a type are identical |

| Main Use | Represents ownership of digital items | Acts as a medium of exchange |

| Examples | BAYC, Azuki, Moonbirds | Bitcoin, Ethereum, Solana |

| Marketplace | NFT-specific platforms like OpenSea | Crypto exchanges like Binance, Coinbase |

| Tradability | Sold individually | Traded in fractional amounts |

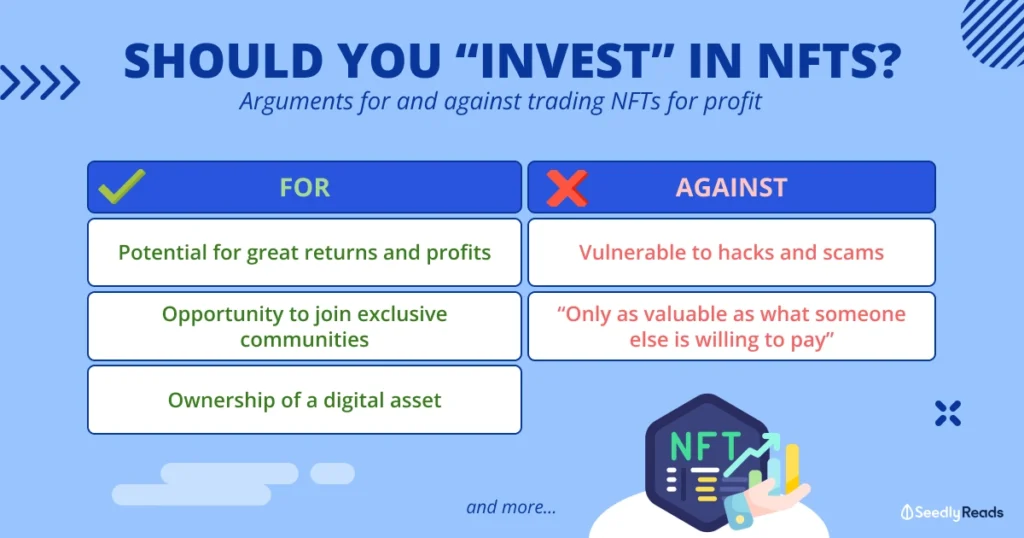

Should You Invest in NFTs?

Credit from Seedly

The decision to invest in NFTs depends on your financial goals, interests, and risk tolerance. While some early adopters saw massive returns, the market has matured — and in some cases, cooled.

Reasons people invest:

- To support digital artists

- For potential appreciation in value

- To access gated content or communities

- As part of Web3 identity or branding

Things to be cautious of:

- Overvaluation and hype-driven pricing

- Projects without clear roadmaps

- Scams, rug pulls, or fake collections

- High gas fees during transactions

Treat NFT investing like collecting — value may lie more in personal or cultural meaning than pure monetary return.

NFTs Explained for Beginners: Common Risks for Newcomers

Credit from Forbes

Just like any emerging technology, NFTs come with risk. Here are some of the most critical to understand:

- Scams & Counterfeits: Fake projects or imposter accounts are common.

- Lack of Liquidity: Selling NFTs can take time; buyers aren’t guaranteed.

- Loss of Wallet Access: If you lose your private key, your NFTs are unrecoverable.

- Volatile Prices: NFT values can swing drastically within days or even hours.

- Regulatory Uncertainty: Legal status of NFTs remains murky in many countries.

Due diligence — reading whitepapers, exploring project communities, and reviewing transaction histories — is key to staying safe.

How to Get Started with NFTs (Step-by-Step)

If you’re ready to begin exploring NFTs, here’s a simplified process:

- Set up a crypto wallet (e.g., MetaMask for Ethereum, Phantom for Solana).

- Buy crypto on a trusted exchange and transfer it to your wallet.

- Connect your wallet to a reputable NFT marketplace.

- Browse projects and research creators, roadmaps, and previous sales.

- Buy your first NFT and confirm the transaction on the blockchain.

- Store the NFT securely in your wallet or move it to cold storage for safety.

NFT Trends to Watch in 2025

As the market shifts, here are some emerging developments worth keeping an eye on:

- NFTs tied to physical goods: Luxury brands like Gucci and Nike are issuing NFTs as digital certificates for real-world items.

- Generative AI in NFT art: Tools like Art Blocks and fx(hash) allow artists to collaborate with algorithms.

- Dynamic NFTs (dNFTs): Tokens that evolve based on user input or real-world data.

- Integration with social platforms: Platforms like X (formerly Twitter) and Instagram allow users to display NFTs as profile badges.

- Cross-chain NFTs: Increasing interoperability between blockchains may reduce fragmentation and open broader access.

These trends reflect NFTs’ shift from static art objects to functional pieces of online infrastructure.

Conclusion: NFTs Are a Tool, Not a Shortcut

For those new to digital assets, NFTs explained means more than just defining acronyms. It’s about recognizing a changing internet landscape where ownership, creativity, and identity merge on-chain.

While the NFT space holds potential, it’s essential to approach it with a clear mind and critical thinking. Not every token will appreciate, and not every project will succeed. But the broader movement — toward digital autonomy and creator empowerment — is likely to stay.

Whether you’re collecting art, exploring Web3 communities, or investing for the long term, understanding how NFTs work is the first step toward making informed decisions in a tokenized world.