Privacy coins for beginners operate differently from standard cryptocurrencies because not all blockchains provide the same level of transparency. While Bitcoin and Ethereum are built on open ledgers anyone can examine, privacy coins take a very different approach: they hide transaction details from public view.

For newcomers to crypto, this might sound unnecessary — after all, aren’t digital wallets anonymous? In reality, most cryptocurrencies are only pseudonymous. If a wallet address is ever linked to your identity, every past and future transaction tied to that address can be traced. Privacy coins exist to prevent that.

Why Privacy Matters Before You Start Investing

Credit from Ikigai Law

Financial privacy isn’t a new concept. In the traditional world, using cash leaves little evidence of the transaction. Digital payments, however, almost always create a permanent record. Blockchains like Bitcoin make those records visible to everyone.

For some, this is fine. For others — journalists, political activists, small business owners, or simply individuals who prefer discretion — public ledgers pose risks. Privacy coins restore the ability to keep certain transactions confidential without giving up the benefits of cryptocurrency.

How Privacy Coins Differ from Standard Cryptocurrencies

Credit from HackerNoon

At first glance, privacy coins function much like any other cryptocurrency. They can be sent, received, stored in wallets, and traded on exchanges. The difference lies in what information is visible on the blockchain.

| Feature | Bitcoin / Ethereum (Public) | Monero / Zcash / Dash (Private) |

|---|---|---|

| Ledger Access | Fully transparent | Hidden or encrypted |

| Sender/Receiver Identity | Visible wallet addresses | Concealed |

| Transaction Amounts | Publicly recorded | Obscured |

| Fungibility | Can be “tainted” by history | Fully interchangeable |

While Bitcoin transactions can be linked together with blockchain analysis tools, privacy coins aim to make that tracing nearly impossible.

The Technologies That Power Privacy Coins

Privacy coins use advanced cryptographic tools to shield user information. The exact methods differ from coin to coin:

- Ring Signatures — Used by Monero, they group the sender’s signature with others, so it’s unclear who initiated the transaction.

- Stealth Addresses — These generate a unique one-time address for each transaction, hiding the recipient.

- Zero-Knowledge Proofs — Zcash’s approach allows the network to confirm a transaction’s validity without showing the sender, receiver, or amount.

These methods can be combined, making blockchain analysis far less effective.

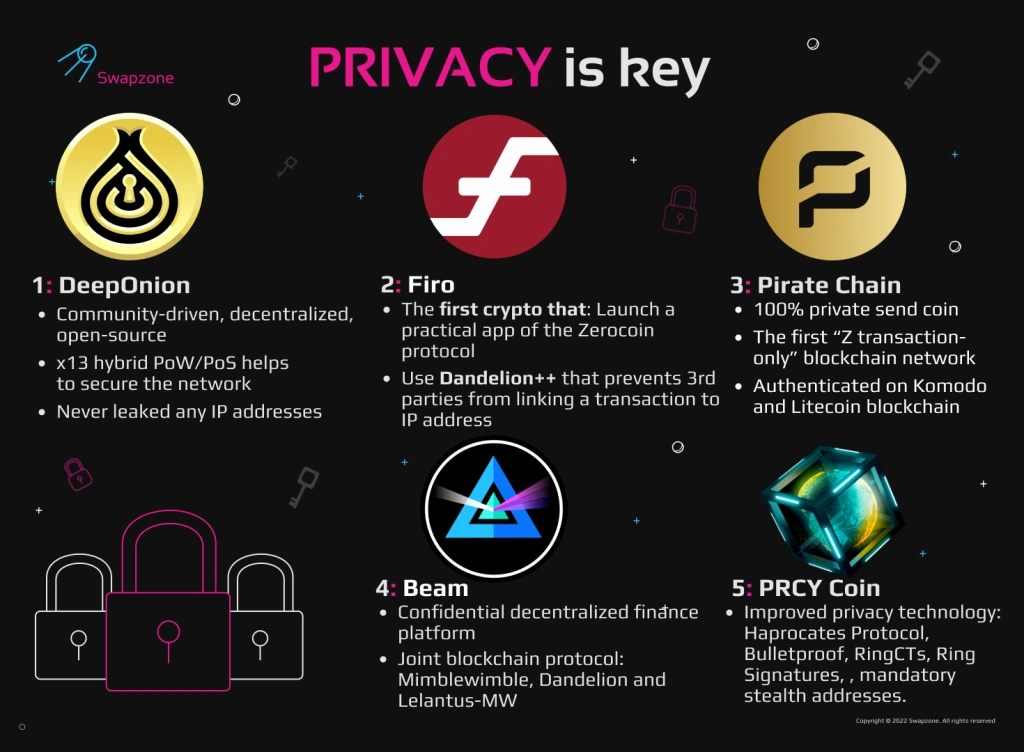

Popular Privacy Coins and What Sets Them Apart

Credit from Swapzone

Monero (XMR) is fully private by default, meaning every transaction uses ring signatures and stealth addresses automatically.

Zcash (ZEC) gives users a choice between transparent and shielded transactions, using zero-knowledge proofs for privacy.

Dash (DASH) is primarily a fast payment coin, but offers “PrivateSend” — a mixing service that obscures origins of transactions.

Although Monero is the most privacy-focused, Zcash’s flexibility appeals to users who want control over when to use anonymity.

Use Cases That Show Their Value

Privacy coins are not just for those with something to hide — they have legitimate, everyday applications.

A small business might use them to prevent competitors from seeing supplier payment amounts. An activist working under restrictive government oversight might rely on them to receive safe, untraceable donations. Even regular consumers may prefer them to keep personal spending habits private from advertisers or data brokers.

How They Work — A Simple Analogy

Think of a blockchain like a glass box where every payment is visible to the world. You can see who’s paying whom and exactly how much. Privacy coins replace the glass with opaque walls.

If you send Monero, your payment is mixed with many others, making the source unclear. Zcash can hide all details yet still prove the payment is valid. Dash can mix transactions so the original source is untraceable. To outside observers, the flow of funds becomes a puzzle without enough pieces.

Risks and Limitations Every Beginner Should Know

While privacy coins offer strong confidentiality, they also come with challenges:

Regulatory scrutiny is the most prominent. Countries like Japan and South Korea have banned licensed exchanges from listing them, citing anti-money laundering concerns. In Europe, some major platforms have delisted Monero and Zcash for similar reasons.

Public perception can also be a hurdle. Even though most privacy coin transactions are legal, the association with illicit use has created stigma. This can affect liquidity and exchange availability.

Technical complexity is another factor. Setting up wallets and enabling privacy features can be more involved than using standard cryptocurrencies. Zcash’s shielded transactions, for example, require specific wallet compatibility and more computing resources.

Steps to Start Using Privacy Coins Safely

If you decide to explore privacy coins:

- Check local laws — Regulations vary widely by country.

- Choose a reputable exchange — Binance and Kraken list some privacy coins in certain regions.

- Select the right wallet — Monero’s official GUI wallet, ZecWallet for Zcash, or compatible hardware wallets like Ledger are common options.

- Enable privacy features — In Zcash, for instance, transactions default to public unless shielded mode is used.

Security is as important as privacy. Using a hardware wallet and, if possible, a VPN can help safeguard both your funds and your identity.

The Road Ahead for Privacy Coins

The debate over privacy coins is far from settled. Regulators aim to curb illicit finance, while developers push to protect user rights to confidentiality. Some projects are experimenting with selective disclosure — a feature allowing users to share transaction details with trusted authorities when necessary.

Market demand for privacy will play a role too. If the trend toward increased surveillance continues, more individuals and organizations may see the appeal of privacy-focused digital currencies.

Conclusion: Privacy Coins for Beginners

Credit from StealthEX

For those new to cryptocurrency, privacy coins for beginners offer a fascinating blend of technology, philosophy, and utility. They are not a replacement for mainstream cryptocurrencies but an alternative for users who value discretion.

By understanding how they work, where they’re accepted, and the legal landscape around them, investors can make informed decisions. In a world where digital footprints are increasingly permanent, privacy coins provide an option for those who believe financial confidentiality should remain possible in the age of blockchain.