When people first hear about Prorex AI Trading, curiosity often comes with questions. Can artificial intelligence really improve trading results? How does it fit into everyday investing strategies? And most importantly, how can traders balance automation with trust and transparency?

As a regulated international AI trading platform, Prorex Limited has developed tools such as portfolio management, copy trading, and PAMM modules to address these concerns. In this knowledge hub, we’ll explore the most frequently asked questions about Prorex and how its approach reshapes the way both beginners and professionals engage with global markets.

What Makes Prorex AI Trading Different From Traditional Platforms?

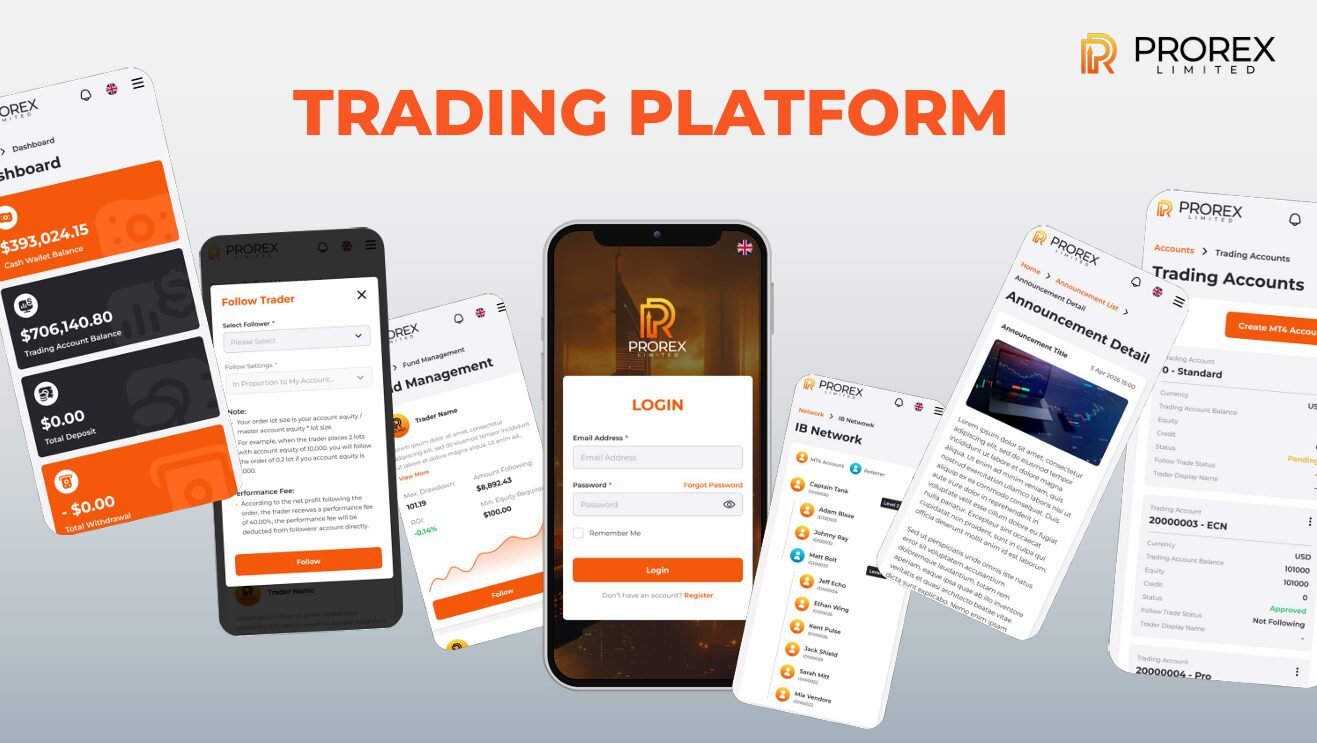

A common question is what separates Prorex from other trading platforms available today. Unlike traditional systems that rely heavily on manual decision-making, Prorex AI Trading incorporates automation through MetaTrader 5, offering access to advanced charting, multi-asset support, and customizable Prorex indicators.

This allows traders to use AI trading strategies that adapt in real time, filtering out noise and reducing the emotional bias that often leads to inconsistent results. The automated trading system is not about replacing human judgment but about enhancing it—giving traders more confidence and precision in markets ranging from forex to commodities and even crypto AI trading.

How Does Prorex Portfolio Management Help Investors Diversify?

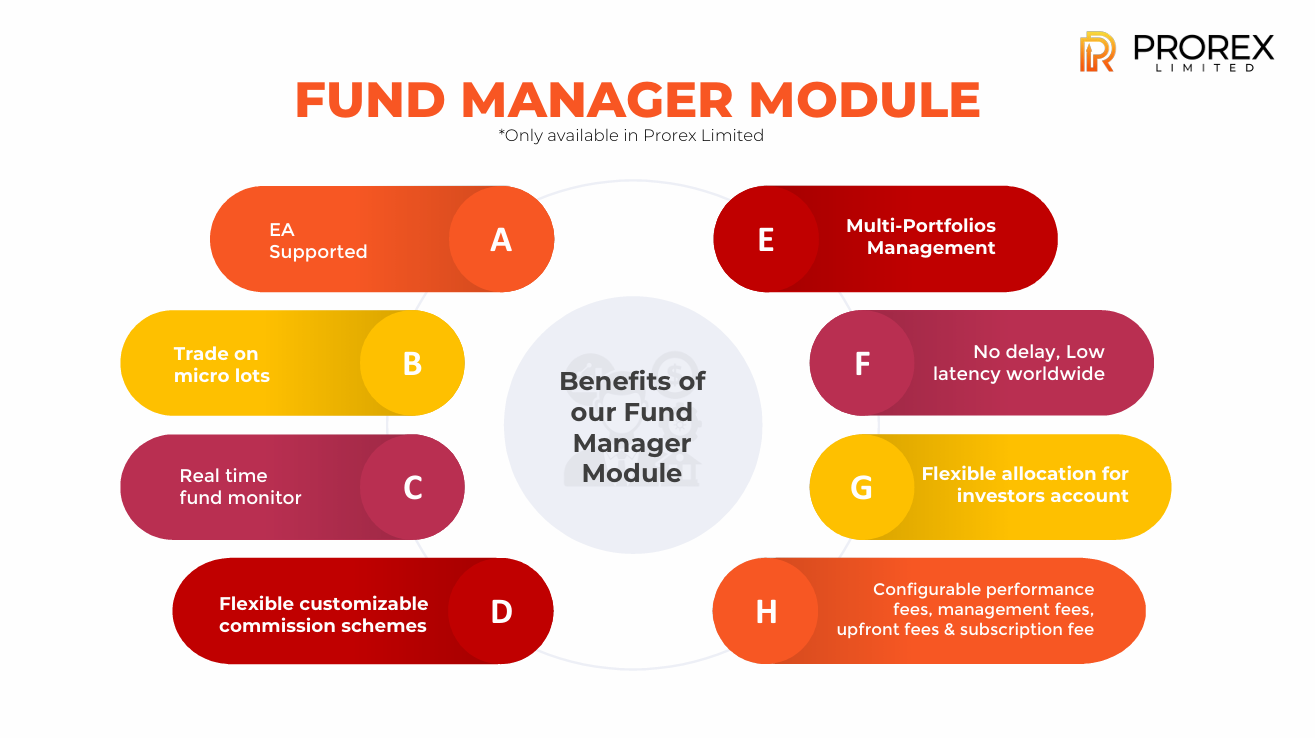

Another frequent query involves diversification, as many investors want exposure to different markets but lack the expertise or time to manage them. With Prorex portfolio management, users can benefit from professional oversight through the Prorex PAMM trader and Multi-Account Manager modules.

The Prorex fund manager module gives professionals tools to manage multiple accounts with flexibility, real-time reporting, and customizable performance fees. For investors, this means access to a broader range of strategies without the complexity of direct trading. Even smaller participants can enter thanks to micro-lot trading, EA support, and incentives such as Prorex free credit or a prorex free bonus.

By lowering barriers to entry, Prorex turns diversification into a practical reality instead of an abstract goal.

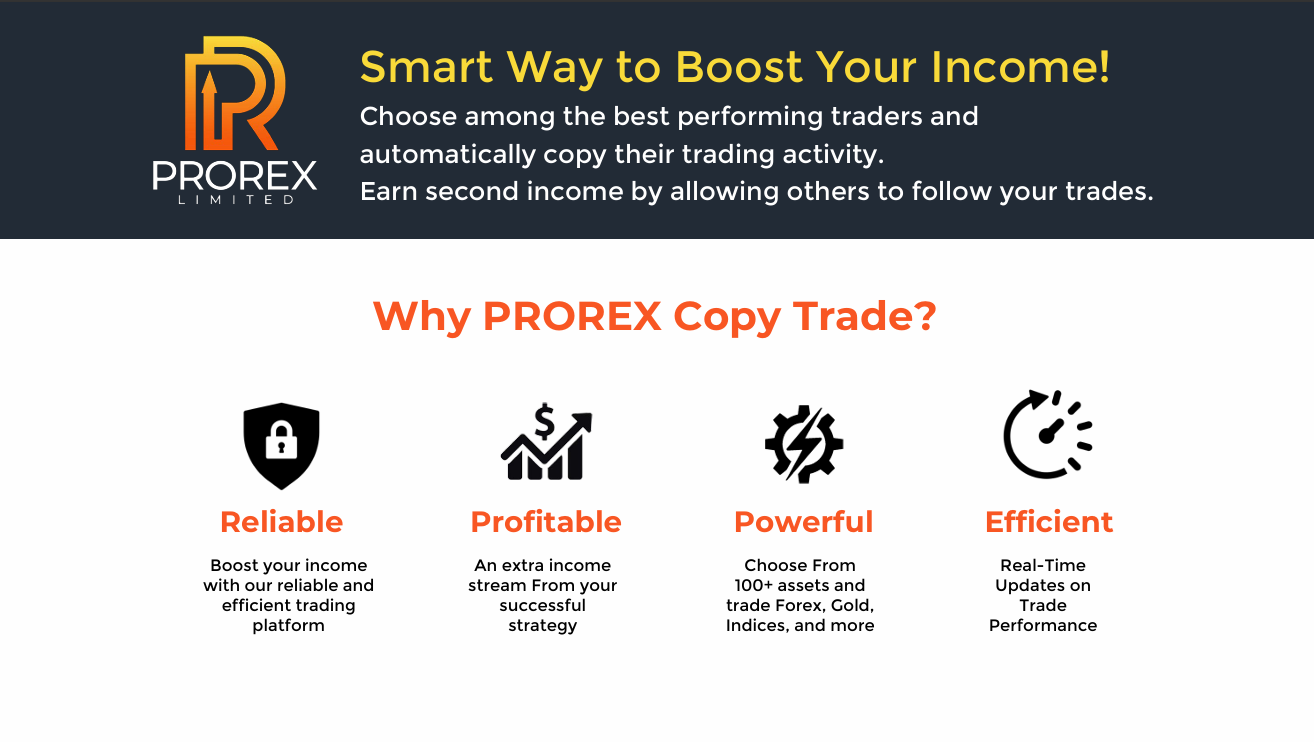

Can Copy Trading Really Be Reliable and Educational?

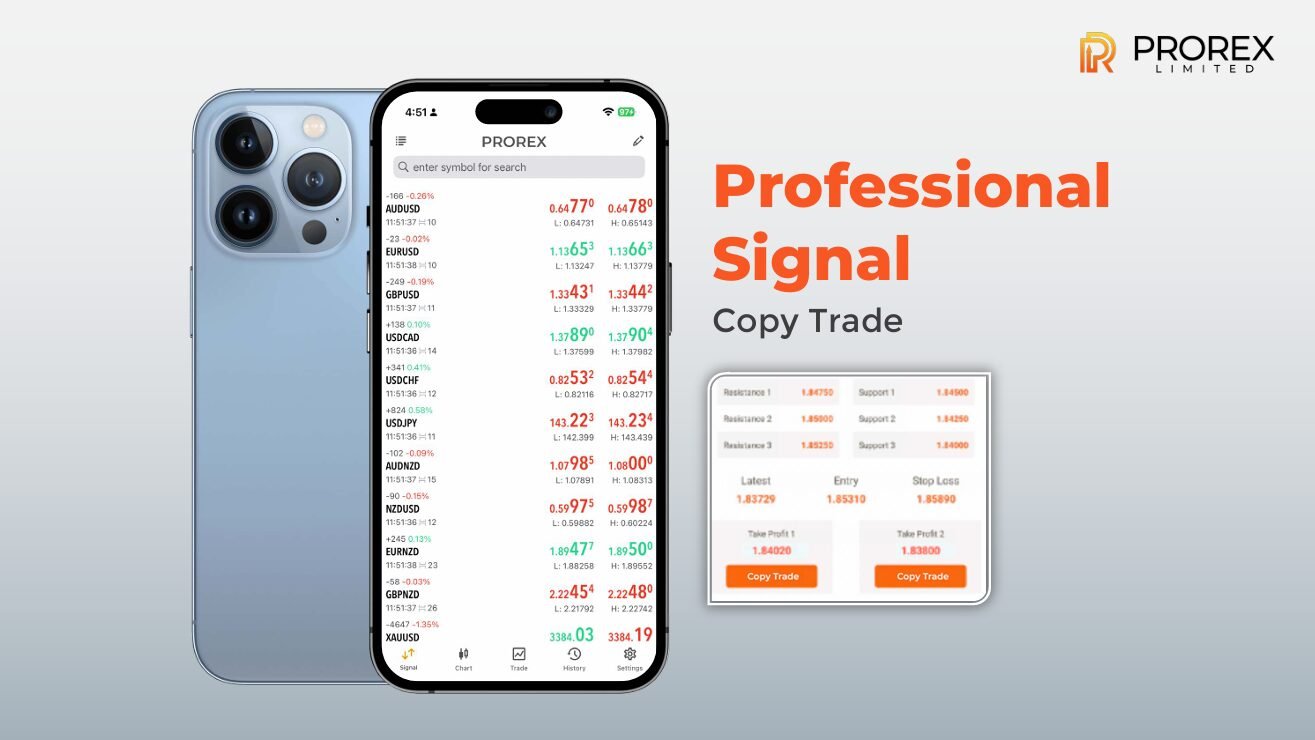

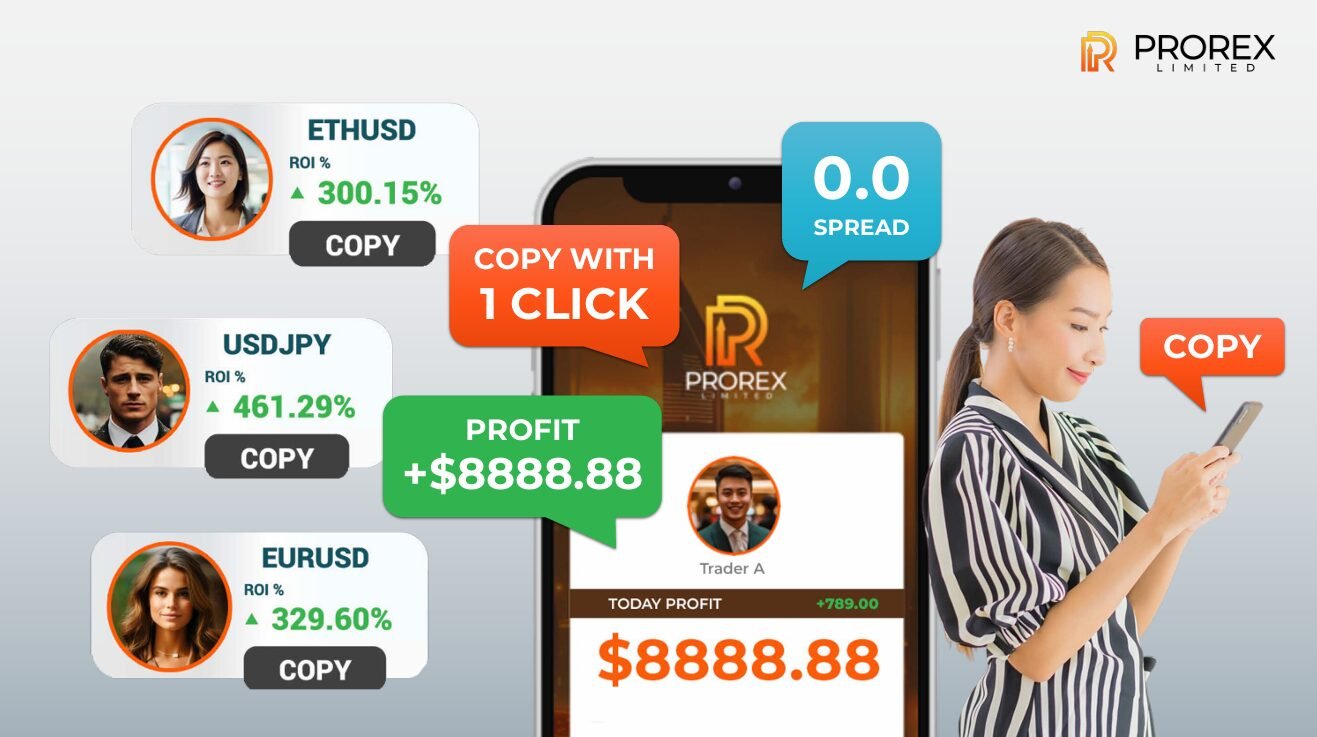

One of the most debated topics is whether copy trading is sustainable. Critics often wonder if simply following another trader’s moves is risky or ineffective. Prorex answers this with a transparent and structured Prorex copy trading model.

Here, users can review hundreds of strategies, compare historical performance, and follow traders that align with their own risk preferences. At the same time, experienced traders can participate in the Prorex revenue share program. Earning additional income by allowing others to replicate their trades.

This creates a two-way ecosystem where beginners gain exposure to professional decision-making while providers grow their network. With features like prorex low spread, regulated oversight under a Mauritius forex broker license, and real-time reporting. Prorex adds accountability and education to what is often seen as a shortcut.

Conclusion: Why Prorex AI Trading Stands Out in 2025

The questions surrounding AI-driven investing are valid. But the answers point to how platforms like Prorex AI Trading are shaping the industry. By offering automation without removing human control, portfolio management that encourages diversification, and copy trading that doubles as a learning tool. Prorex Limited highlights the practical benefits of AI trading.

As more traders seek the best AI trading platforms 2025. Prorex stands as an example of how technology and transparency can work together. Instead of replacing the human element, its approach supports investors with smarter, more accessible solutions for today’s fast-moving markets.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia