The world of online trading is filled with promises of quick wins and complex strategies. Let’s cut through the noise. Success in this field isn’t about finding a secret formula; it’s about having clear information, managing your expectations, and making decisions based on facts. The purpose of this article is to provide a straightforward examination of what a Prorex investment entails. We won’t focus on hype, but on the practical realities of using this service, so you can determine if it’s the right tool for your personal trading plan.

Content

- 1. Understanding the Realities of a Prorex Investment’s Tools and Costs

- 2. The Mechanics of a Prorex Investment: Managing Your Capital and Expectations

- 3. Your Responsibility: Verification, Regulation, and Seeing Past the Hype

- 4. Making an Informed Decision: Is This the Right Tool for Your Strategy?

Understanding the Realities of a Prorex Investment’s Tools and Costs

Any broker provides a set of tools, and it’s essential to understand them for what they are. The prorex trading platform is your connection to the market—its reliability is important, but it doesn’t trade for you. You may also encounter features like prorex trading signals. It’s crucial to approach these prorex signals with a healthy dose of realism. They are automated suggestions based on analysis, not guarantees of future performance. The prorex trading signals accuracy can and will vary with market conditions. Traders on the Prorex platform pay a transparent spread, the standard transaction cost in online forex trading. Being aware of these costs and the limitations of your tools is the first step toward responsible trading.

The Mechanics of a Prorex Investment: Managing Your Capital and Expectations

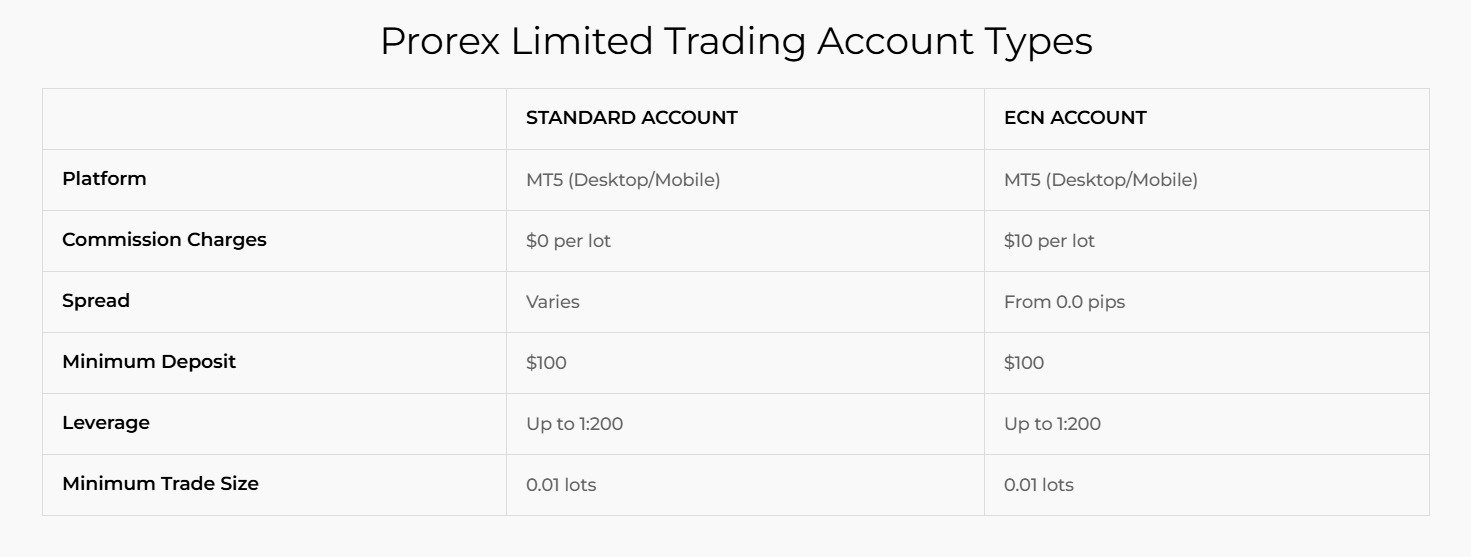

So, how does a Prorex investment work on a practical level? It begins when you open a prorex account and choose from the available Prorex account types. Each type will likely offer different conditions, so it’s your responsibility to read and understand which one aligns with your capital and experience. The prorex minimum deposit is the initial capital you are putting at risk. Before committing, you should also have a clear understanding of the Prorex deposit and withdrawal procedures. Look into the stated processing times and available methods to ensure they align with your expectations for accessing your funds. A smooth process is important, but knowing the terms upfront prevents future frustration.

Your Responsibility: Verification, Regulation, and Seeing Past the Hype

This is the most critical part of your evaluation. Before choosing any broker, traders should first verify whether Prorex is regulated. The Prorex regulation status demonstrates the broker’s commitment to maintaining strict operational standards. Do not take any broker’s claims at face value. It is your due diligence to perform a Prorex license verification directly on the official regulator’s website. This simple check is non-negotiable for safeguarding your funds. You might also be offered a Prorex trading bonus. Remember that these are marketing incentives that almost always come with terms and conditions, such as required trading volumes, that you must understand before accepting.

Making an Informed Decision: Is This the Right Tool for Your Strategy?

No single broker is the perfect fit for everyone. The best forex trading platforms 2025 are those that are transparent about their costs, operate under a verifiable regulatory framework, and provide stable tools. Your decision to open a pprorex trading account for prorex forex trading should come after careful consideration. Assess whether its platform, account structures, and, most importantly, its regulatory standing align with your personal risk tolerance and trading strategy. A well-informed decision is your most powerful asset in the market.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia