In the world of online trading, new terms and systems often raise questions for both beginners and experienced investors. One that frequently comes up is Prorex Pamm, a model designed to make managed accounts more transparent and flexible. To better understand how it works and why it matters in 2025, here are answers to some of the most common questions traders and investors ask.

What Is Prorex PAMM and How Does It Work?

At its core, Prorex Pamm trading is a system where investors allocate their funds to skilled managers while retaining full visibility over performance. The model is based on Percentage Allocation Management Module, which distributes profits and losses proportionally among participants.

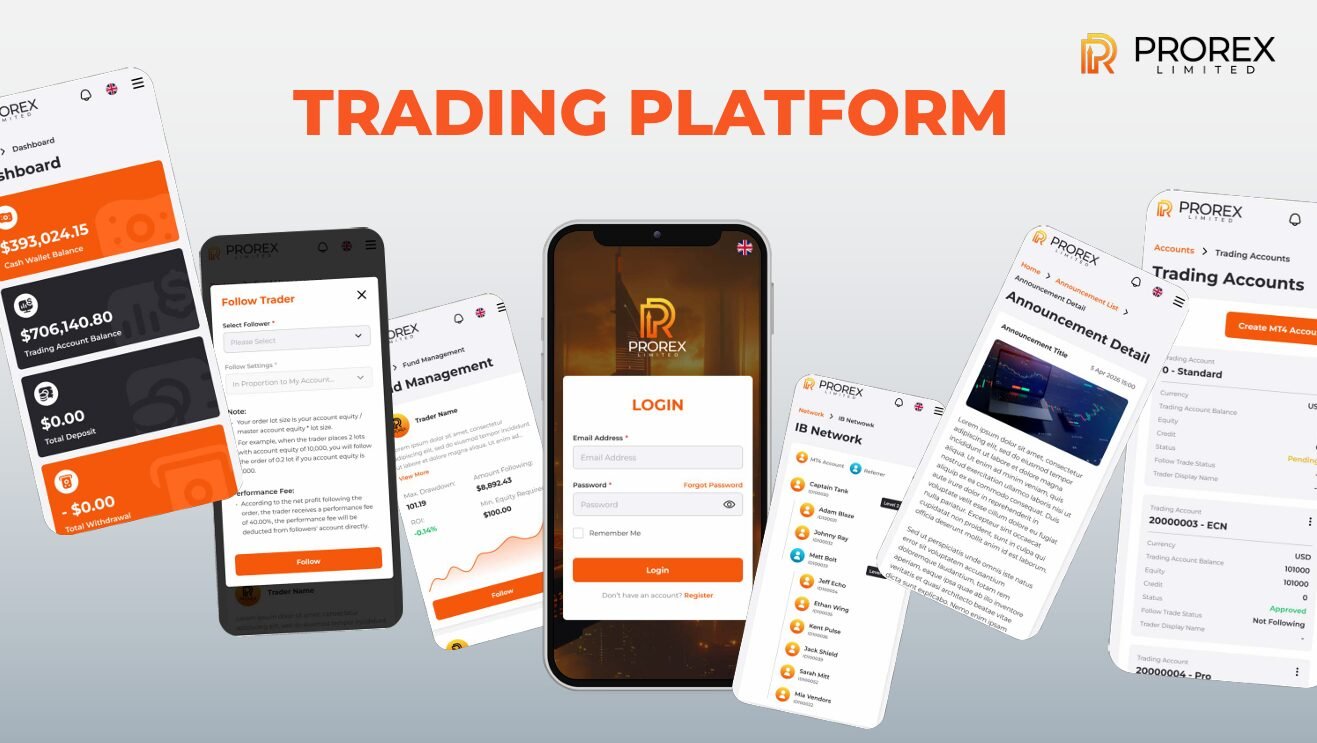

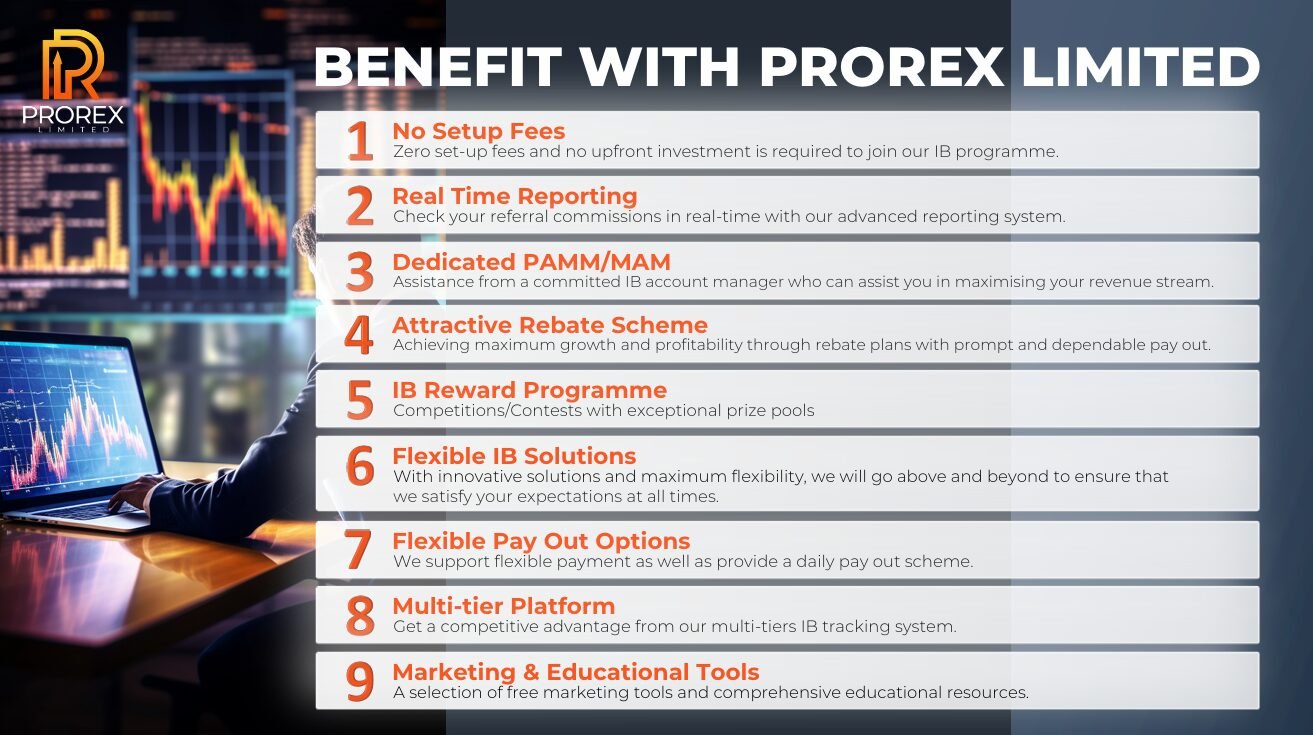

The advantage lies in the balance between trust and oversight. Investors can see how their funds are being managed in real time, while managers benefit from tools such as Prorex AI trading, Expert Advisors (EA), and Prorex indicators. Low-latency execution and Prorex low spread conditions further enhance the trading experience, creating an environment that feels both professional and accessible.

How Does Prorex PAMM Differ from Copy Trading?

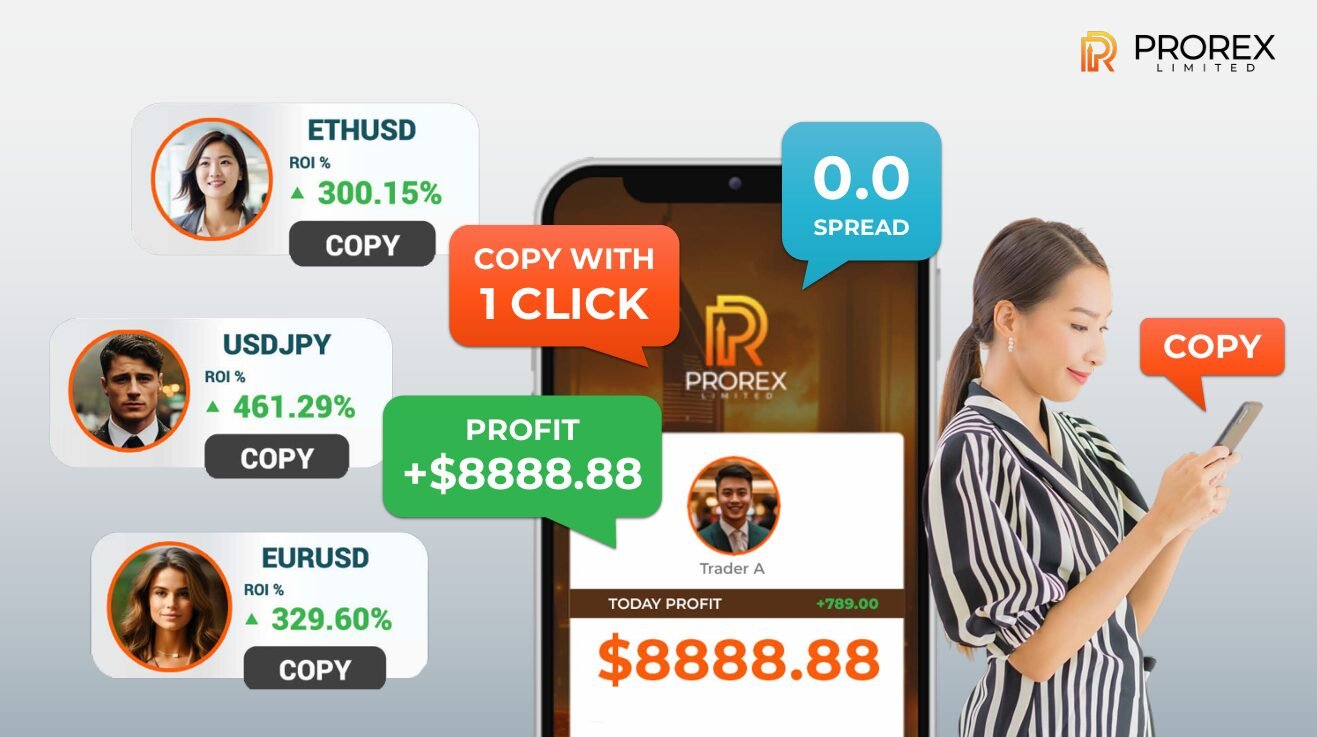

A common question is whether PAMM and copy trading are the same. While both connect investors with traders, the approach is different. Prorex copy trading allows individuals to follow specific strategies by mirroring trades in real time. Users can browse through strategies, check historical results, and choose the ones that match their financial goals.

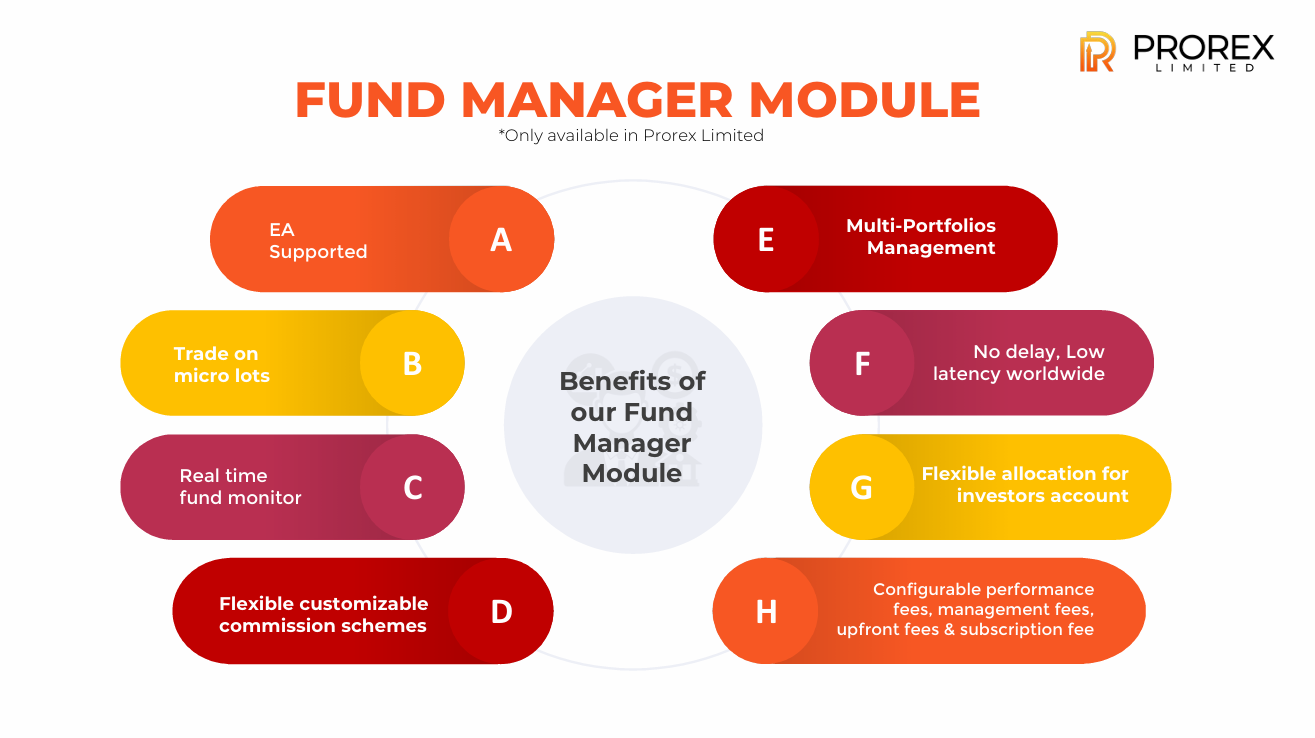

Meanwhile, the Prorex PAMM system offers more structured portfolio management. Here, managers can oversee multiple accounts through the multi account manager (MAM) module, set performance fees, and even adjust trading conditions. Together, the two features complement one another: copy trading supports convenience, while PAMM focuses on long-term structured allocation. Incentives such as Prorex free credit and Prorex free bonus help new participants get started with lower barriers to entry.

Why Choose a Prorex PAMM Account in 2025?

Another frequent inquiry is why PAMM still matters in a market full of automation and independent trading platforms. The answer lies in adaptability. A Prorex PAMM account gives investors the option to diversify, track results instantly, and customize allocations without losing autonomy.

For fund managers, the system offers scalability through features like configurable commission schemes and global reach with real-time reporting. These elements are why Prorex continues to be mentioned among contenders for the best PAMM broker 2025. By combining human expertise with advanced digital tools, the platform delivers a blend of structure and flexibility that is well-suited to today’s trading environment.

Conclusion: Turning Questions into Confidence

For many, the decision to invest or trade comes with uncertainties, but knowledge often turns hesitation into confidence. By looking at the Prorex Pamm system through common questions, it becomes clear that its strengths lie in transparency, adaptability, and accessibility. Whether through structured PAMM accounts, dynamic copy trading, or scalable MAM tools, Prorex demonstrates how managed trading can evolve into a reliable and human-centered experience.

Register PROREX member NOW! Click HERE

【 Prorex Limited 】

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia