When people first hear about Prorex Pamm Trader, they often have a long list of questions. Is it different from copy trading? How does a PAMM account actually work? Can it really help everyday investors participate in forex without being glued to a trading screen? To make sense of these questions, let’s take a closer look at how Prorex Limited has built its PAMM system and why it has become an attractive option for both new and seasoned investors.

What Exactly Is Prorex Pamm Trader?

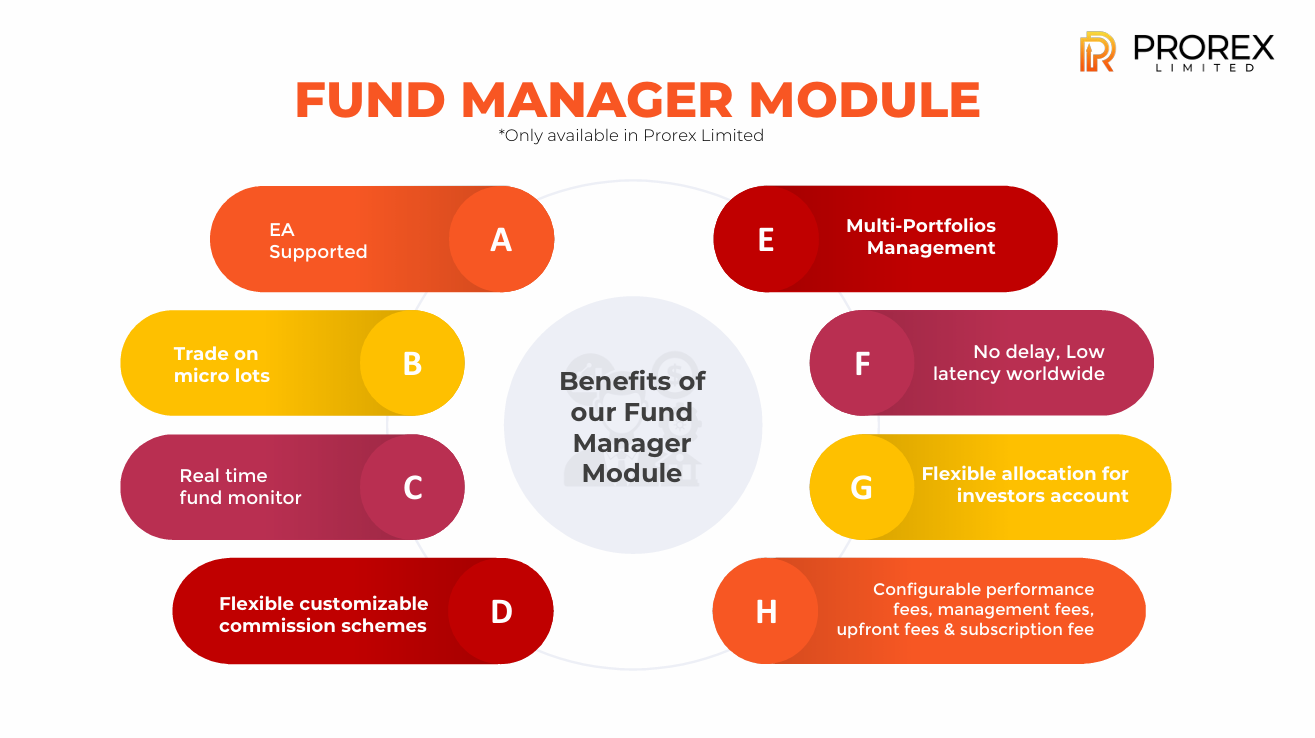

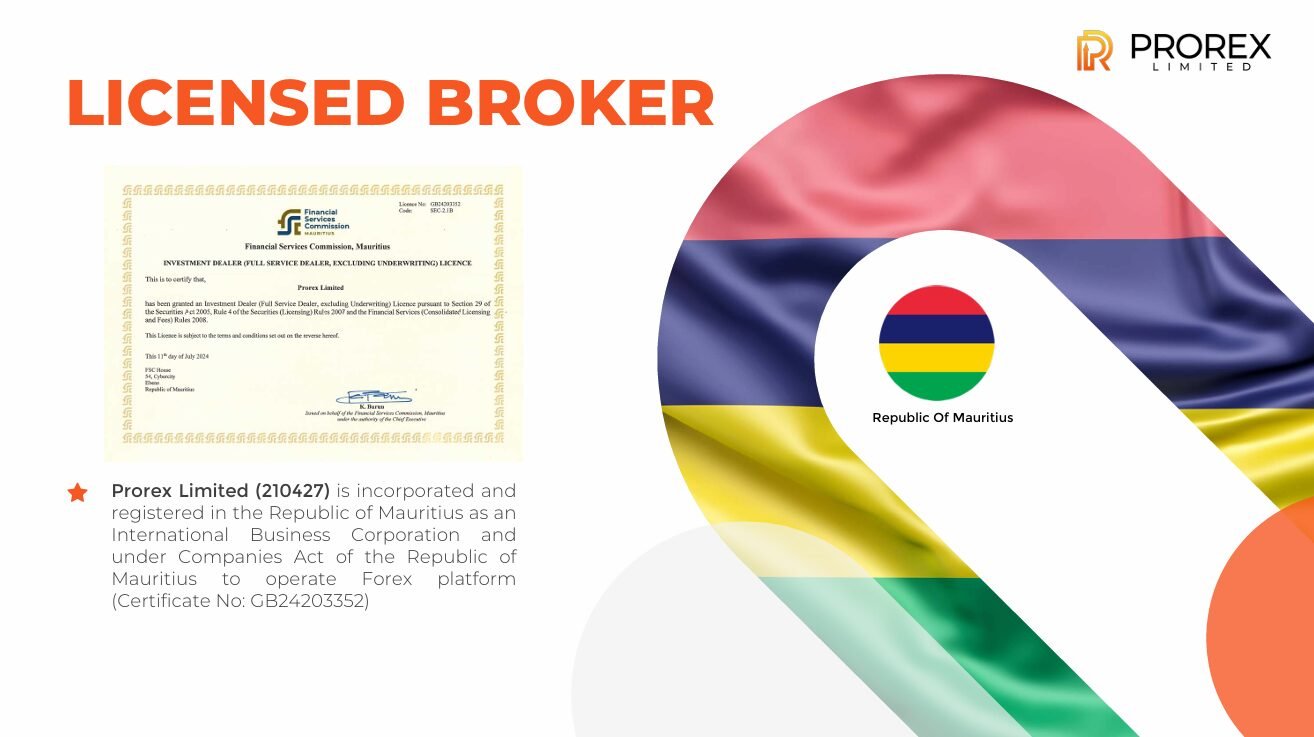

The term PAMM stands for Percentage Allocation Management Module. In the simplest terms, it allows investors to allocate funds to experienced strategy providers who trade on their behalf. With Prorex Pamm Trader, the process is structured within a licensed and regulated environment under the Financial Services Commission in Mauritius. Investors’ funds are pooled together, and profits or losses are distributed proportionally based on individual contributions.

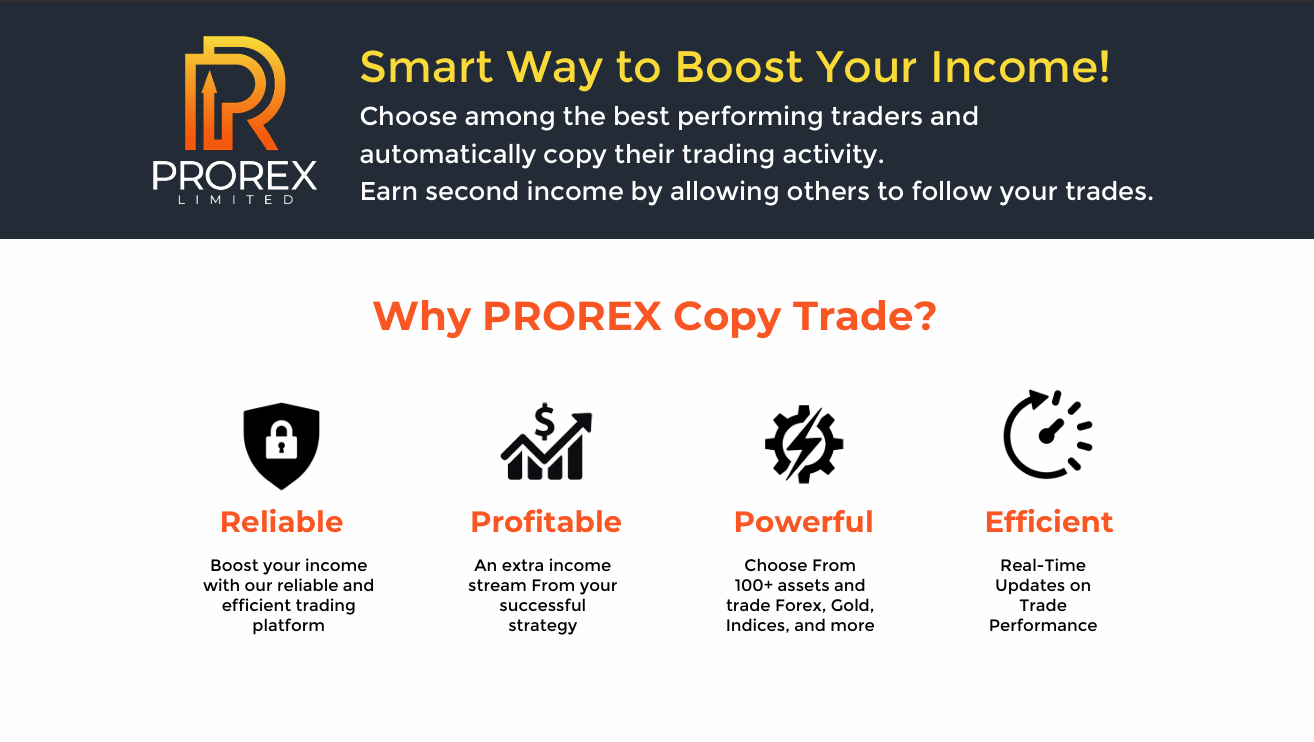

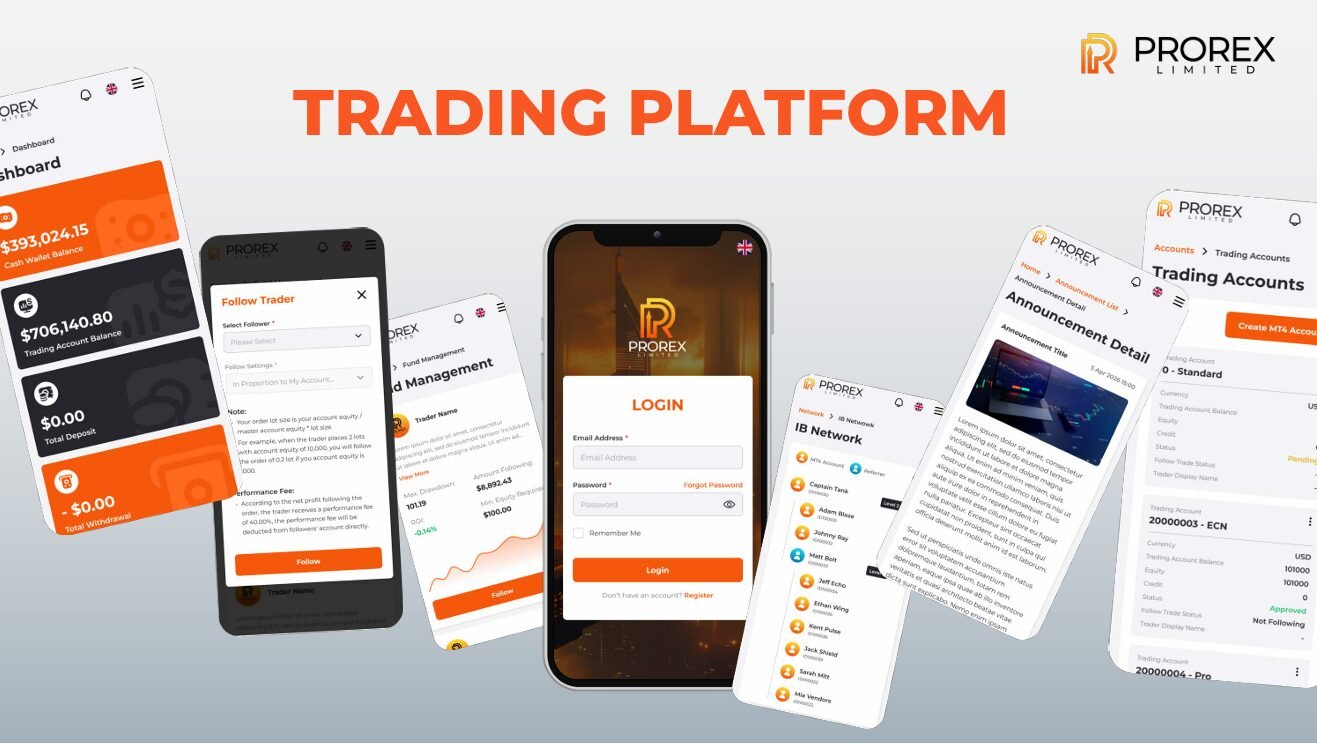

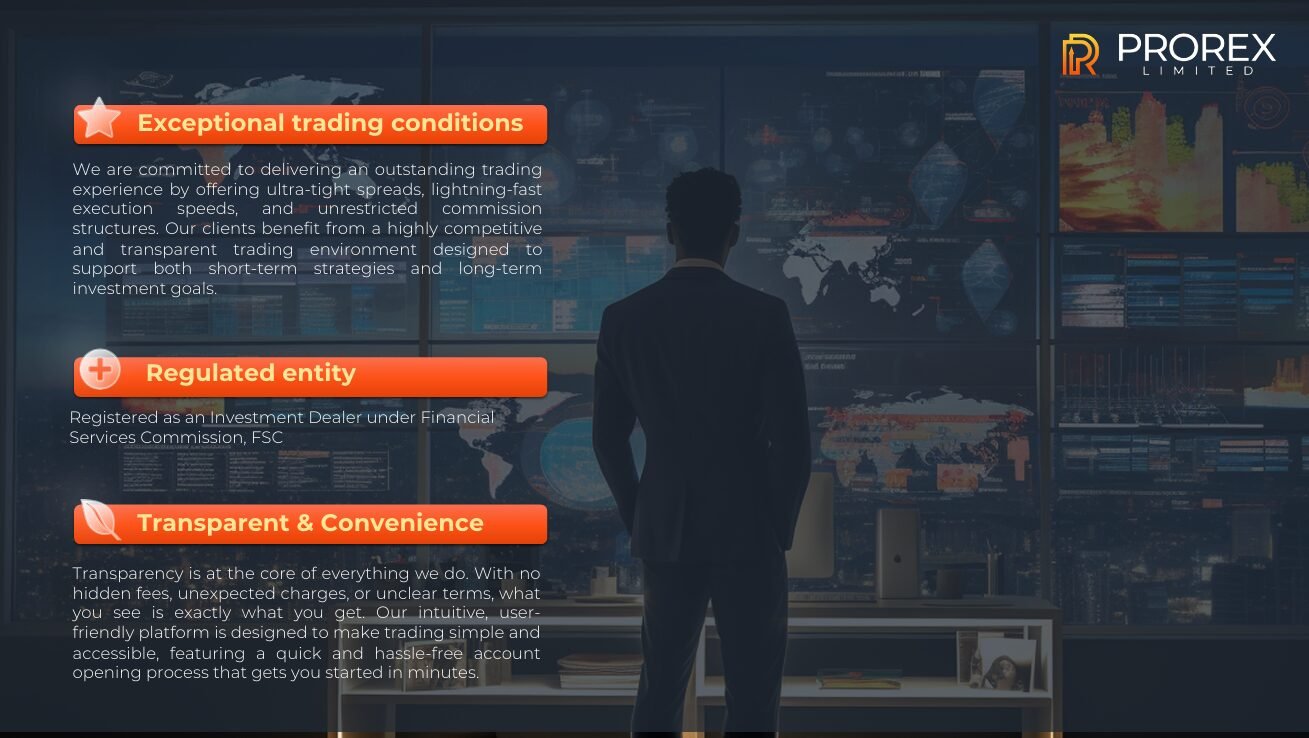

What sets Prorex apart is its commitment to transparency. Performance fees, management charges, or subscription costs are outlined clearly, so investors know what to expect. Paired with ultra-low spreads, fast execution, and access to MetaTrader 5, the model creates a balance between accessibility and professional-level tools.

How Does Prorex Pamm Trader Differ from Copy Trading?

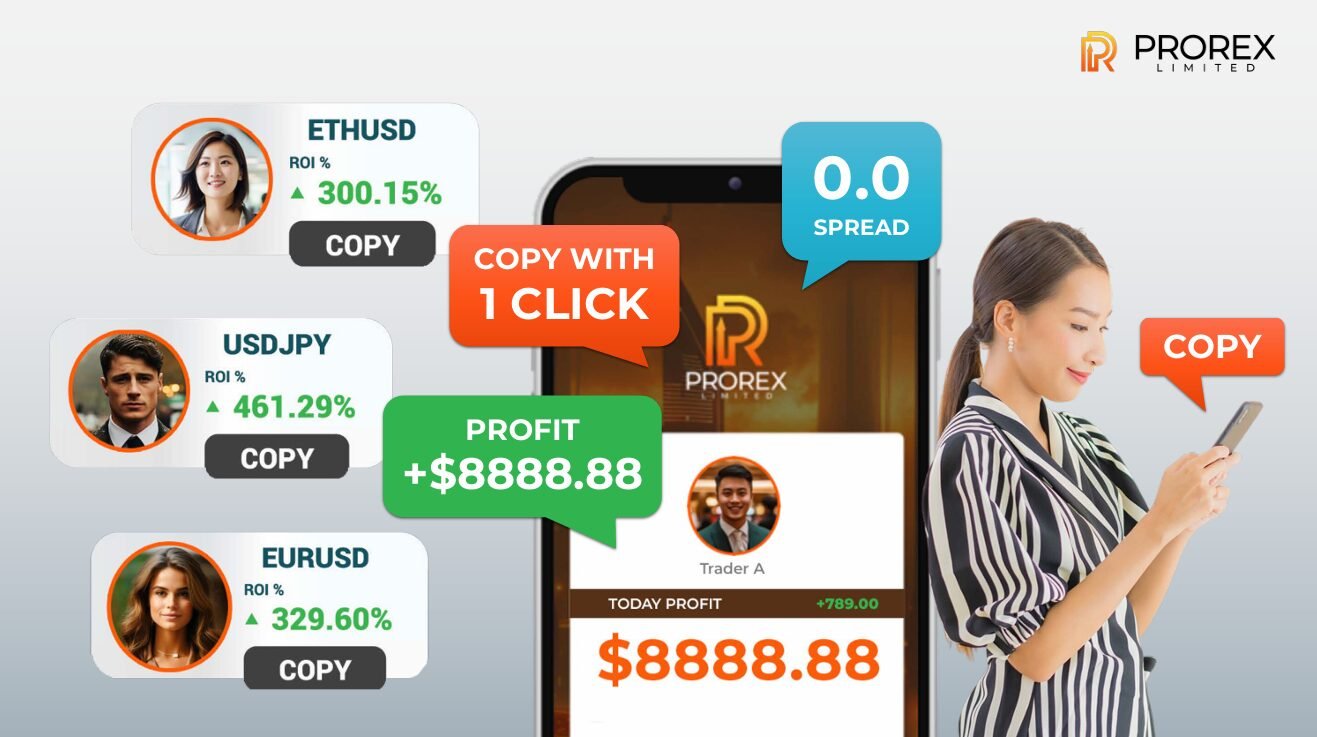

This is a common question, and the distinction is important. Copy trading involves mirroring the trades of another trader one-to-one in real time. PAMM accounts, on the other hand, pool investments and distribute results proportionally. With Prorex Pamm Trader, this means you are not simply copying trades but participating in a system that emphasizes structured portfolio management.

The advantage here is flexibility. Investors can choose managers based on their past performance, preferred strategies, and fee structures. At the same time, managers benefit by growing their audience and publishing their strategies on Prorex’s platform. Both groups interact within a transparent framework, supported by MT5’s features like expert advisor (EA) compatibility and customizable allocation methods.

What Are the Risks and Benefits?

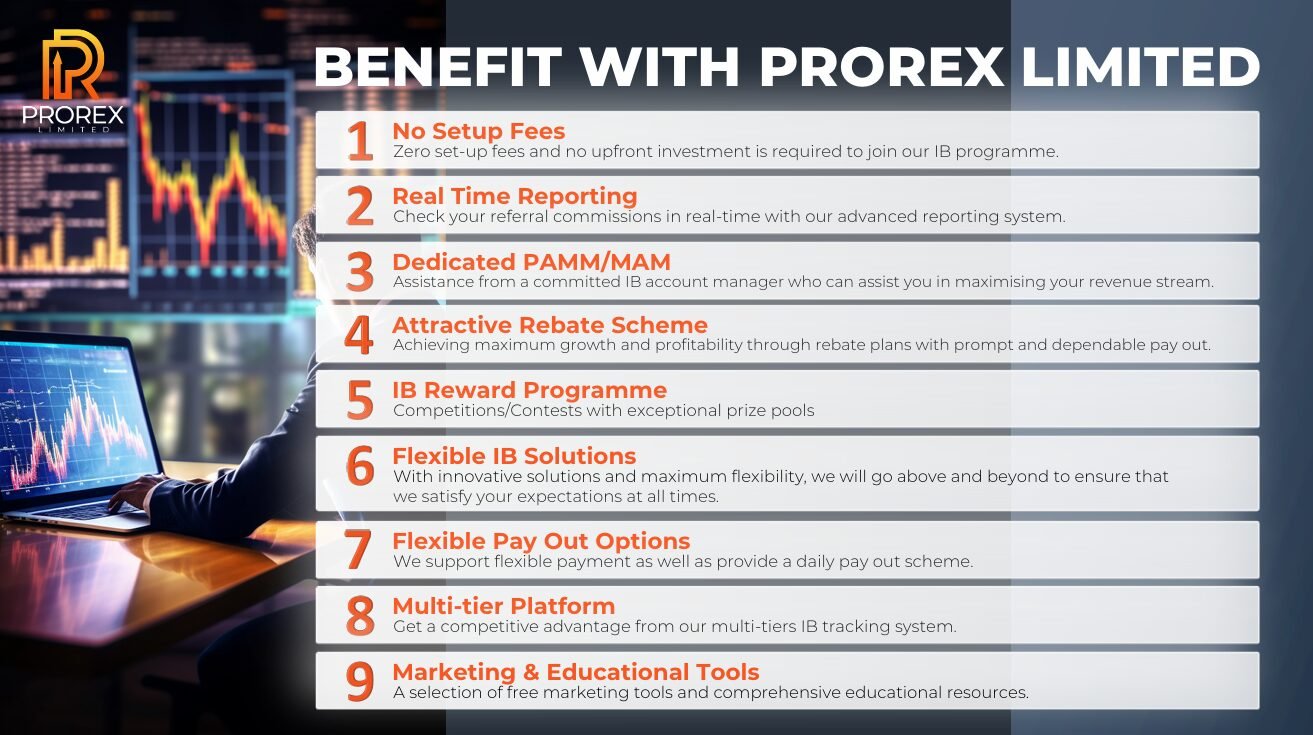

No knowledge hub would be complete without addressing the realities of risk. Like any form of trading, PAMM accounts are not risk-free. Market volatility and the skill of the chosen manager will directly influence results. However, Prorex Pamm Trader helps investors make more informed decisions by providing real-time reporting, performance history, and a wide variety of strategies to compare.

The benefits are equally clear: diversification, access to professional strategies, potential passive income, and the removal of emotional trading pressures. For those without time to track markets constantly, this creates a more sustainable way to participate in forex and CFD trading while still having visibility and control over allocations.

Conclusion: Why Prorex Pamm Trader Belongs in Today’s Investing Toolkit

In the crowded landscape of forex brokers, knowledge is power. By answering the most common questions, it becomes clear that Prorex Pamm Trader is more than a buzzword—it is a structured, transparent, and technology-driven approach to portfolio management. For investors seeking a balance of professional guidance and personal control, Prorex offers a platform where informed choices can lead to meaningful opportunities.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia