Before you place a single trade, the most important decision you’ll make is choosing your foundational tool: your trading account. Let’s talk openly about what selecting a Prorex trading account involves. This isn’t about finding a shortcut to wealth; it’s about understanding the environment you’ll be trading in. The goal of this guide is to give you a clear, unvarnished look at the options available for prorex online trading, so you can make a choice that you understand completely and that genuinely aligns with your financial situation and goals here in Malaysia.

Content

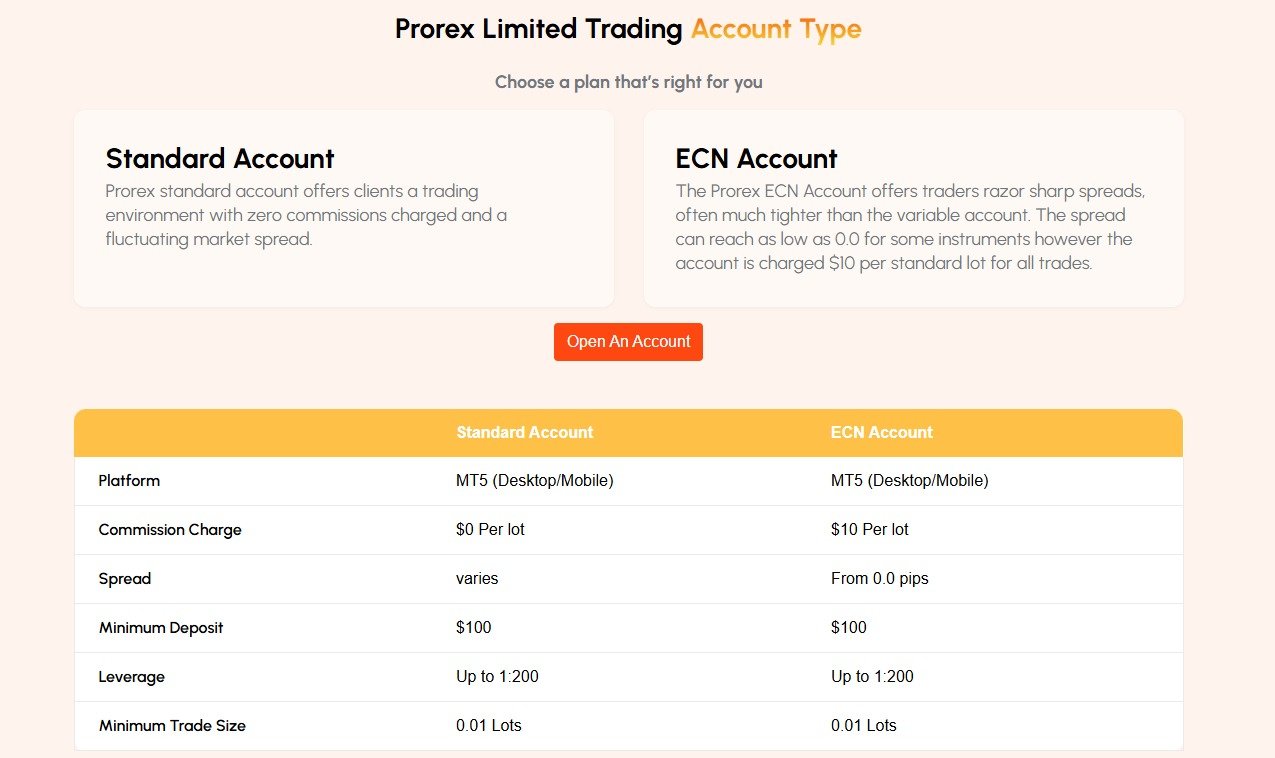

A Clear Look: Prorex Trading Account Types Comparison

Let’s cut through the jargon with a straightforward Prorex account types comparison. Brokers typically offer different account tiers, and it’s important to know what you’re signing up for. The Prorex account for beginners, often called a ‘Standard’ account, usually has simpler Prorex trading fees where the cost is built into the spread. This is direct and easy to track. For more frequent traders, a Prorex account for day trading (like an ECN account) will have much lower spreads but a fixed commission per trade. Neither is inherently “better,” but one will be more cost-effective for you depending on how often you plan to trade. It’s a simple matter of matching the fee structure to your activity level.

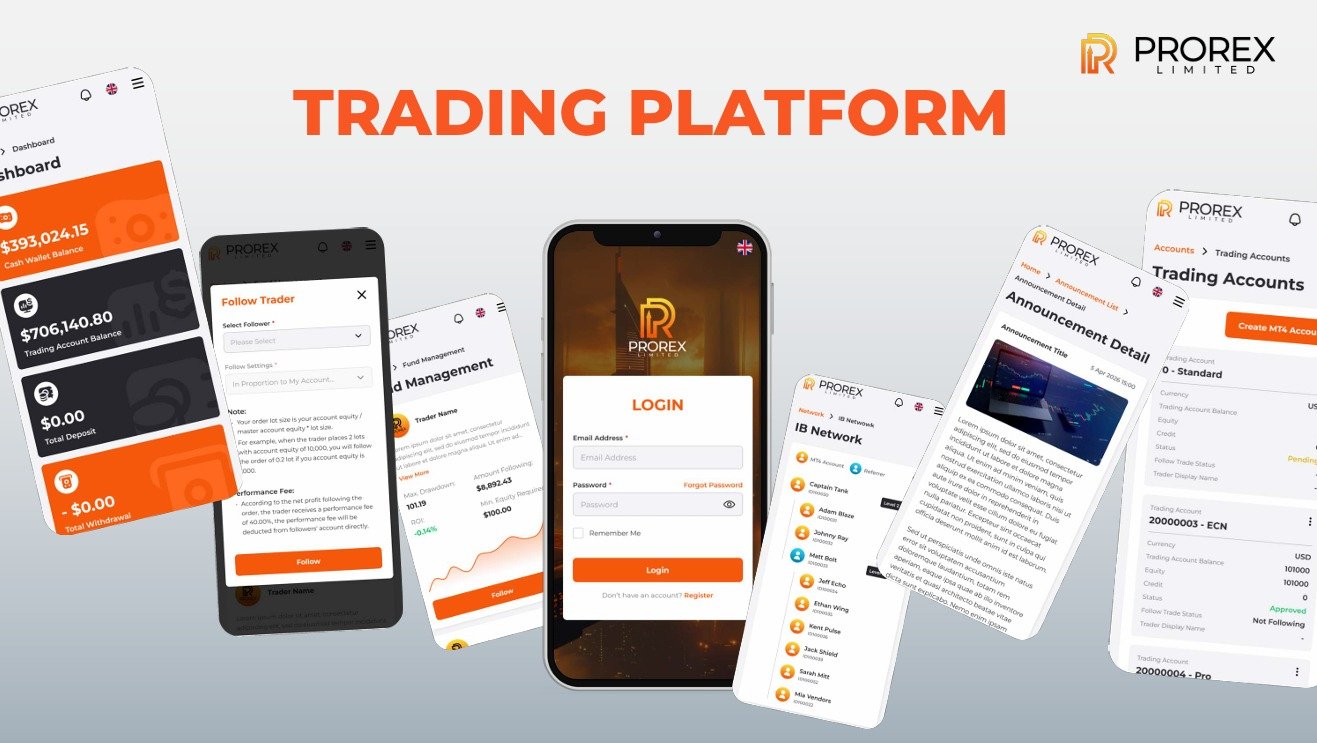

Understanding Your Tools: The Prorex Trading Platform

Your main workspace will be the prorex trading platform. This is the software you’ll use to analyse markets and manage your prorex investment. Most platforms, like the popular MT4 or MT5, are robust, but it’s crucial you feel comfortable with the one you choose. Before committing any real funds, I strongly advise spending time on a demo prorex account. Get a feel for the layout, practice placing trades, and learn where the key functions are. A platform should feel like a reliable tool, not a confusing puzzle. Your comfort and competence with the platform are non-negotiable for responsible trading.

A Realistic View on Bonuses and Leverage

You will encounter offers like a prorex trading bonus and access to high leverage. Let’s be transparent about these. A bonus can be a helpful boost to your initial capital, but it always comes with terms and conditions, usually requiring you to trade a certain volume. Always read and understand these terms before accepting. Similarly, while a high leverage Prorex account allows you to control larger positions, it must be handled with extreme caution. Leverage magnifies both your potential profits and your potential losses equally. It is a tool for experienced traders and should be used with a clear understanding of the significant risks involved.

An Honest Answer: Is Prorex a Good Broker for Beginners?

So, let’s tackle the main question: Is Prorex a good broker for beginners? A suitable broker for someone starting out is one that prioritizes education, provides transparent information, and offers a safe environment to learn. The process of getting started with Prorex should feel clear and supported. Look for evidence of comprehensive educational materials and easily accessible customer service. Ultimately, the best broker for you is one that empowers you to trade responsibly. The final step in making an informed choice about a Prorex trading account is to ensure it provides the transparent tools and support you need for a steady, well-considered start.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia