Navigating the world of online trading requires a level-headed perspective. It’s easy to get caught up in promises of quick returns, but the reality is that success is built on careful strategy, risk management, and, crucially, the right tools. The purpose of this article is to provide a straightforward examination of one such tool: the Prorex trading platform. Our goal is not to sell you on it, but to lay out the facts as clearly as possible so you can make an informed decision that aligns with your personal trading philosophy.

Content

A Straightforward Look at the Prorex Trading Platform

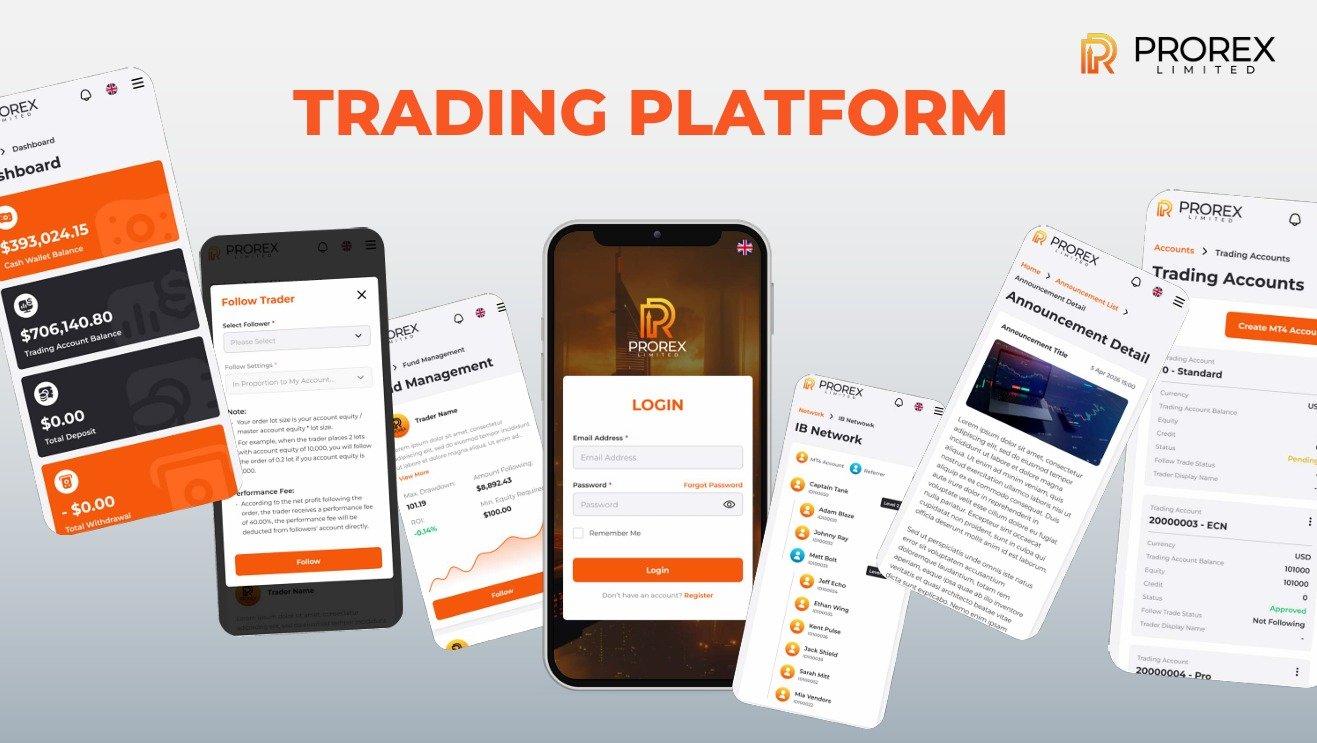

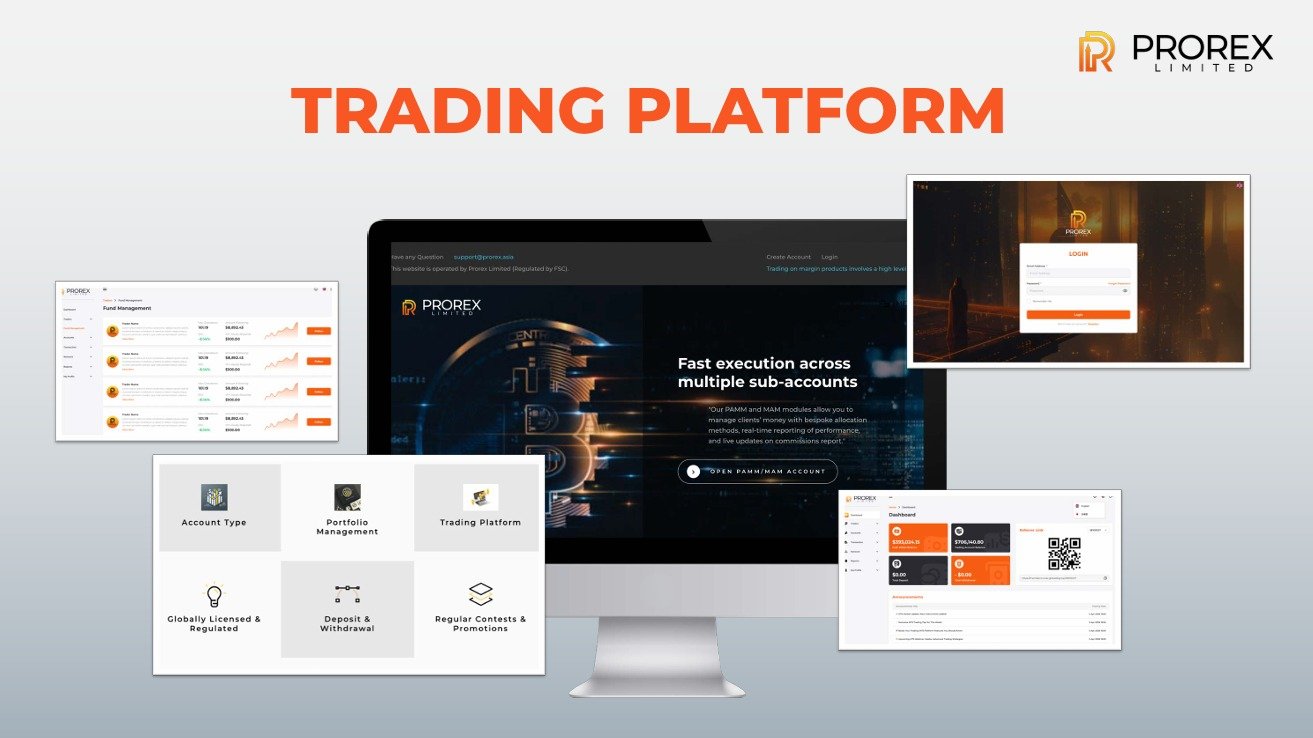

When you evaluate any trading platform, the first thing to assess is its usability and the tools it provides. The Prorex platform offers a suite of standard analytical instruments. Including charting packages and technical indicators, which are fundamental for any prorex online trading. The design appears to prioritize a clean layout, which can be helpful in reducing confusion when you’re analyzing market data. It is important to remember that these are tools for analysis, not guarantees of any particular outcome. Their effectiveness is entirely dependent on the skill and knowledge of the trader using them for their prorex investment strategy.

Understanding Your Financials: Accounts, Costs, and Add-ons

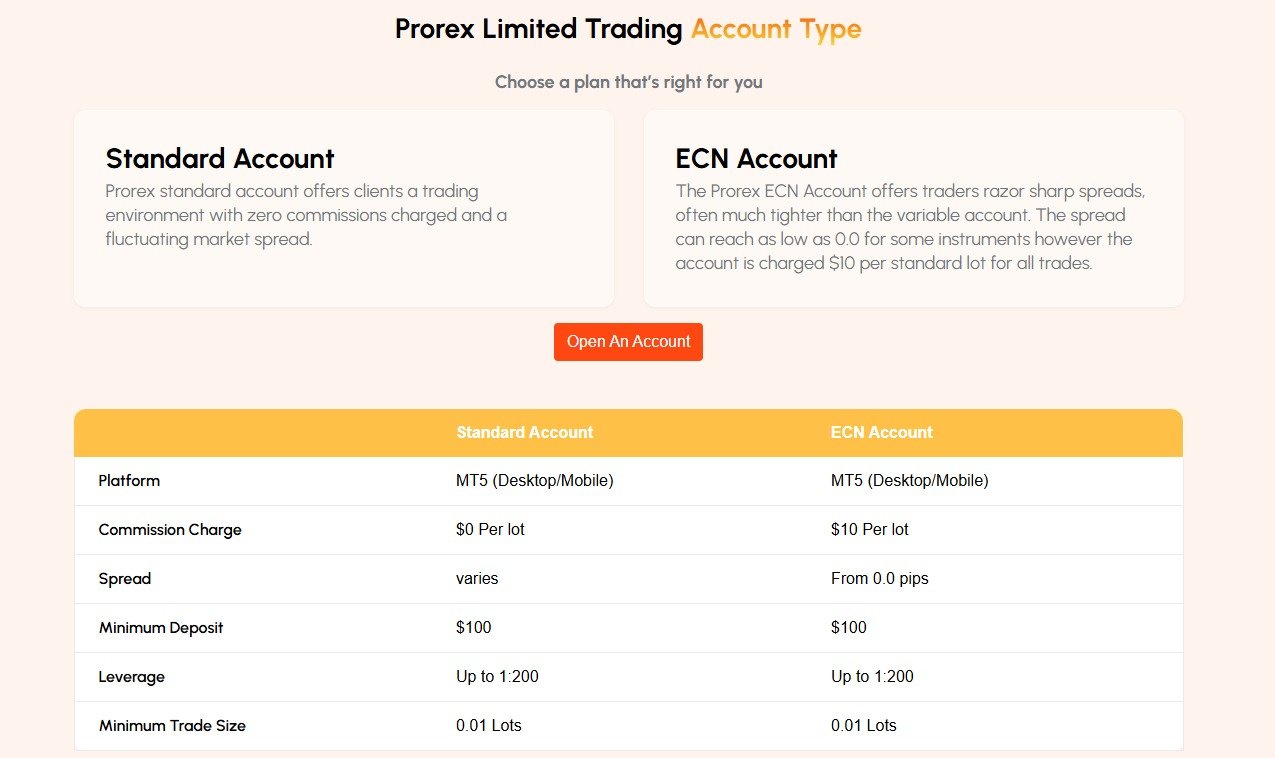

Opening a prorex trading account involves a clear financial commitment. The prorex minimum deposit is the initial capital you need to get started, and it’s essential to trade only with funds you are prepared to risk. When executing trades, a key cost to be aware of is the prorex spread—the difference between the buy and sell price, which is how brokers typically make their money. Some platforms may offer a prorex trading bonus, but it’s critical to read the terms and conditions associated with it, as they often come with specific trading volume requirements. Similarly, while prorex trading signals or prorex signals are available, they should be viewed as supplementary data points for your own research, not as direct financial advice for your prorex account.

The Critical Role of Oversight on the Prorex Trading Platform

No component of a trading platform is more important than its regulatory status. It’s the baseline for trust and security. Prorex regulation signifies that the platform operates under the supervision of a financial authority, which sets rules for client fund protection and fair business practices. This is not a “feature” but a fundamental requirement for any legitimate brokerage. Verifying a platform’s regulatory compliance should be the first step for anyone considering prorex forex trading. This oversight provides a necessary layer of protection and recourse for you as a client.

Making an Informed Decision for Your Trading Journey

In the end, no platform can trade for you. The decision to use the Prorex trading platform—or any other—comes down to your individual needs, trading style, and due diligence. By understanding its tools, the associated costs, and its regulatory framework, you are in a much better position to determine if it’s the right fit for your objectives. A successful trading journey is built on a foundation of education and realistic expectations, and choosing your platform is a significant part of that foundational work.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia