In the trading world, it’s easy to get caught up in the hype of tools that promise to simplify everything. That’s why today, we’re going to have a straightforward and honest conversation about what trading signals are, and more specifically, what you can realistically expect from Prorex trading signals. Let’s be clear from the start: no tool, no matter how advanced, can predict the future with 100% certainty. The purpose of this article is not to sell you a dream of guaranteed profits, but to provide a transparent look at how these signals can function as a valuable assistant in your analytical process, provided you approach them with the right mindset and a clear understanding of their role.

Content

What Prorex Trading Signals Realistically Offer

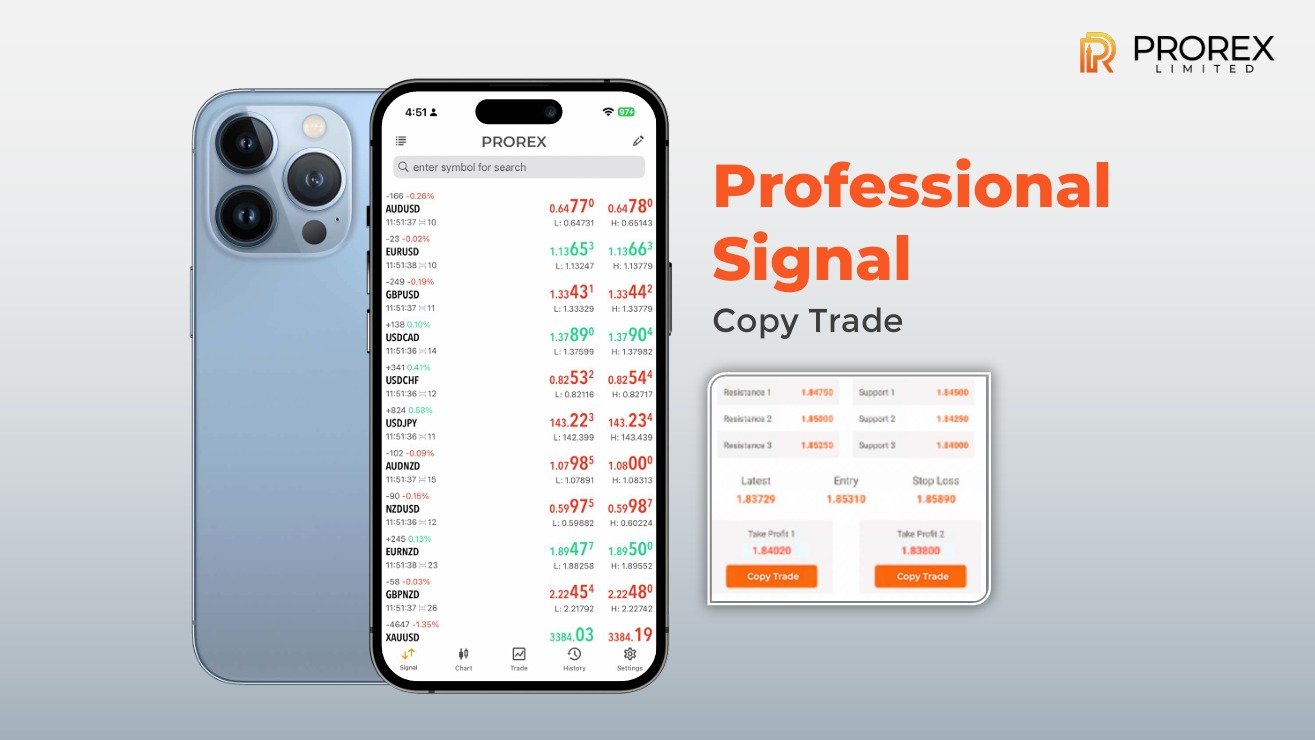

So, what are you actually getting when you use Prorex trading signals? It’s important to understand them as data-driven suggestions, not as infallible commands. These prorex signals are generated by algorithms on the Prorex trading platform that constantly analyze market data for recognizable patterns and trends. The value here is in their ability to flag potential opportunities that you, as a human trader, might not have the time to search for across dozens of assets. Think of them as a highlighting tool that says, “This is a situation that might be worth your attention.” The signal brings a potential trade to your desk; it doesn’t and shouldn’t make the final decision for you.

The Trader’s Responsibility When Using Prorex Forex Signals

This brings us to the most critical point: the trader is always in control. Using Prorex forex signals effectively requires a partnership between the technology and your own judgment. A responsible approach to prorex online trading means never blindly following any alert. When a signal appears, your job is to perform your own due diligence. Does this trade fit your personal strategy and risk tolerance? What does your own analysis of the chart tell you? A wise prorex investment is one where the signal serves as a point of confirmation or discovery, not as a replacement for your own thinking. Ultimately, you are the one managing your capital, and that responsibility remains paramount.

Key Factors to Assess in a Trading Platform

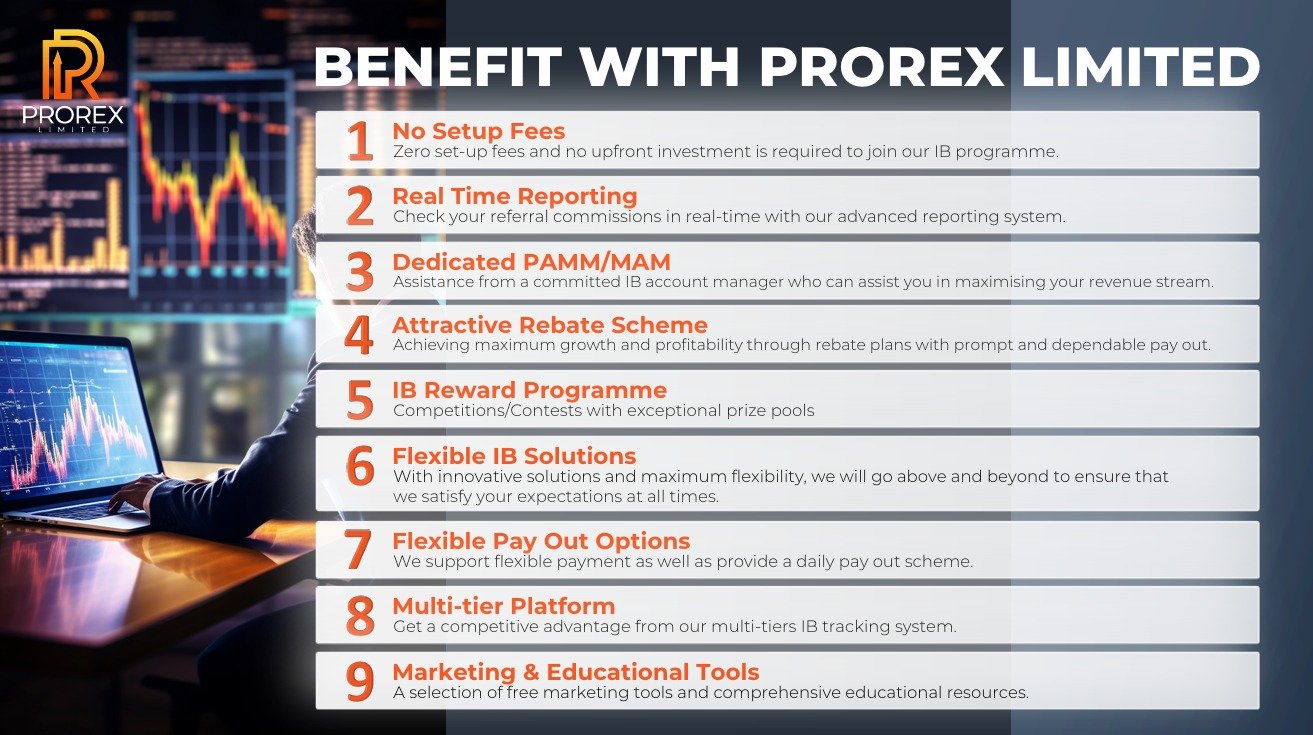

A trustworthy tool needs to exist within a trustworthy environment. When you’re considering a platform, transparency in its operations is key. For example, it’s essential to understand the prorex spread, as this is a direct and clear cost of doing business in the markets. Furthermore, one of the first things any prudent trader should verify is the broker’s prorex regulation status; this is your assurance of operating within a framework of accountability and security. Choosing the right prorex account is also about clarity—finding one whose features and costs align with your goals. And while a prorex trading bonus can seem attractive, it’s vital to read the terms and conditions to understand exactly what is being offered. A reputable platform will be upfront about all these details.

Making an Informed Decision About Your Trading Tools

To conclude, Prorex trading signals are a legitimate and potentially very useful tool for the informed trader. They are designed to support your analytical efforts, save you time, and broaden your view of the market. They are not, however, a substitute for discipline, strategy, and sound risk management. As you assess the landscape of the Best forex signal providers 2025, the most reliable partners will be those who are transparent about what their tools can and cannot do. By choosing your tools wisely and understanding your role in using them, you place yourself in the strongest possible position to navigate the markets responsibly.

Register PROREX member NOW! Click HERE

Official Website:Prorex Limited

General Support and Inquiries:Support@Prorex.Asia

Finance Inquiries:Finance@Prorex.Asia