IDR 2025: A Currency Between Calm and Concern

The Rupiah Forecast 2025 reflects a currency walking a fine line — buoyed by solid domestic performance, yet shadowed by external pressures that could shift at any moment. Indonesia’s economic fundamentals remain mostly intact: GDP is expanding steadily, inflation is under control, and Bank Indonesia continues to act prudently. But none of this exists in a vacuum. With high interest rates in advanced economies and capital flows fluctuating almost weekly, the Indonesian Rupiah is being asked to hold its ground in an unpredictable global setting. What happens next depends on a series of moving parts — some domestic, many global.

Global Interest Rates: The Dollar Remains a Drag

Source: Coincodex

One of the most persistent headwinds for the IDR remains the U.S. dollar. Despite broad hopes of monetary easing, the Fed has maintained a relatively firm stance amid lingering inflation in the U.S. This has prevented capital from flowing freely into emerging markets. In fact, the Rupiah forecast 2025 continues to be shaped by this imbalance: as long as global money favors the dollar, the IDR faces an uphill climb. For Indonesia, this dynamic makes it harder to attract speculative capital, even when fundamentals are sound. The IDR isn’t weak — it’s just swimming against a global current.

Trade Wind Shift: Commodities Won’t Carry All the Weight

For years, Indonesia’s trade surplus has offered reliable support for the Rupiah. But in 2025, that support looks slightly less dependable. Exports like coal, nickel, and palm oil are facing fluctuating demand, especially as China’s recovery shows uneven momentum. Commodity prices themselves have become harder to predict, shaped by geopolitical shifts and weather disruptions. While Indonesia still earns from these sectors, the margin is narrowing. If the surplus fades too quickly, the IDR outlook may become increasingly tied to volatile capital flows rather than stable trade receipts — a shift that could raise downside risks.

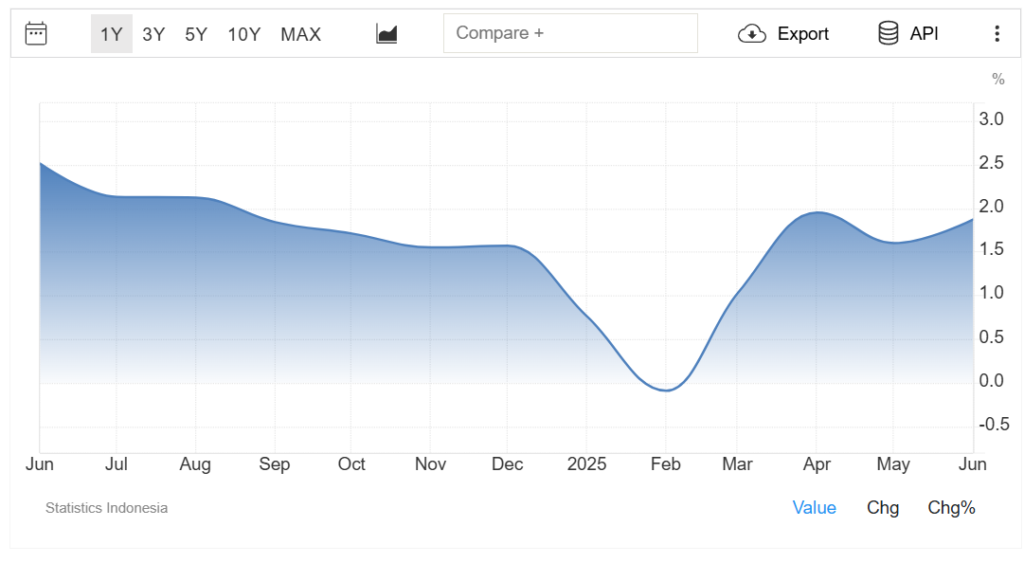

Domestic Resilience: Growth Still Has a Backbone

Source: TradingEconomics

On the home front, Indonesia’s economic engine continues to turn steadily. With government investment, digital infrastructure, and household consumption driving expansion, GDP growth is forecast to remain near 5%. Bank Indonesia’s inflation control has also helped restore trust in policy direction. Still, nothing is guaranteed. If energy or food prices spike unexpectedly, or if fiscal stimulus pressures the budget, investors may grow cautious. The Rupiah forecast is tightly linked to this confidence. As long as the domestic story stays clear and consistent, the IDR can hold — but slippage in communication or delivery could have a rapid impact.

Central Bank Policy: Rupiah Forecast 2025- The Balancing Game Continues

Soource: Sah! News

Bank Indonesia has earned a reputation for being pragmatic. It has managed inflation without panicking and offered currency support without alarming markets. In 2025, that steady tone remains essential. The central bank must balance between keeping the IDR attractive and not stifling growth. While it is expected to remain patient, global developments could force quicker decisions — especially if the Fed eases or global growth sharply slows. The Rupiah forecast 2025 depends as much on Bank Indonesia’s clarity as on its rate policy. Markets don’t need perfection — just predictability.

Capital Markets: Rupiah Forecast 2025- Inflows Are Cautious, Not Committed

Source: ANTARANEWS

Indonesia remains on the radar for investors, but appetite in 2025 is cautious. Foreign direct investment continues to flow into long-term projects, but short-term capital has been more volatile. Shifting expectations about interest rates, regional risk, and currency strength all factor into investor decisions. For the IDR, that means performance is increasingly shaped by perception rather than data alone. A hawkish Fed comment, a regional scare, or a domestic policy shift can all spark reactions — even if nothing fundamentally changes. The IDR’s stability this year will be earned not just through numbers, but through narrative control.

Rupiah Forecast 2025 : Regionally Strong — But Still Grouped with the Vulnerable

In the emerging market currencies outlook 2025, the Indonesian Rupiah is not the weakest player — far from it. Compared to other currencies under pressure, such as the Argentine peso or Turkish lira, the IDR benefits from policy credibility, a contained fiscal deficit, and a manageable debt profile. Still, it is not fully immune. Global investors tend to treat emerging markets as a group when risk appetite wanes. That means even the stronger currencies, like the Rupiah, get pulled into selloffs during flight-to-safety periods. For the IDR, strength is relative — and somewhat conditional.

Conclusion: Reading the Signals, Not Just the Stats

The Rupiah Forecast 2025 is less about big, sudden movements — and more about subtle shifts in confidence, narrative, and positioning. The currency’s performance will depend on how well Indonesia manages the perception game: can it stay credible, stable, and consistent in an unpredictable world? While the macro picture remains solid, risks — both external and internal — are real. For traders, investors, and policymakers alike, the message is clear: this is a year to interpret trends carefully, act gradually, and avoid chasing false signals. Stability is possible — but it must be earned, not assumed.