What Are Stablecoins?

In the ever-volatile world of cryptocurrency, the term stablecoins for beginners often emerges as a calming contrast. Unlike Bitcoin or Ethereum—whose prices can swing wildly—stablecoins are pegged to something more predictable, such as the US dollar or gold. This built-in stability has made them an entry point for many newcomers seeking to understand crypto without risking dramatic losses.

But what really makes a stablecoin “stable”? And can it be trusted as much as traditional cash? The answers lie in understanding the mechanics, use cases, and underlying assets behind these digital tokens.

Why Stability Matters in Crypto

Cryptocurrencies are praised for decentralization and innovation, but they’re also criticized for their unpredictable price swings. This is where stablecoins carve out their niche.

Picture this: you’re a freelancer in the Philippines working with a US client. Traditional wire transfers can be slow and expensive. Crypto seems like a faster option—but what if your payment in Ethereum drops 12% overnight? That’s a real issue. Stablecoins such as USDC or USDT offer a smoother alternative by preserving value while still taking advantage of blockchain speed and accessibility.

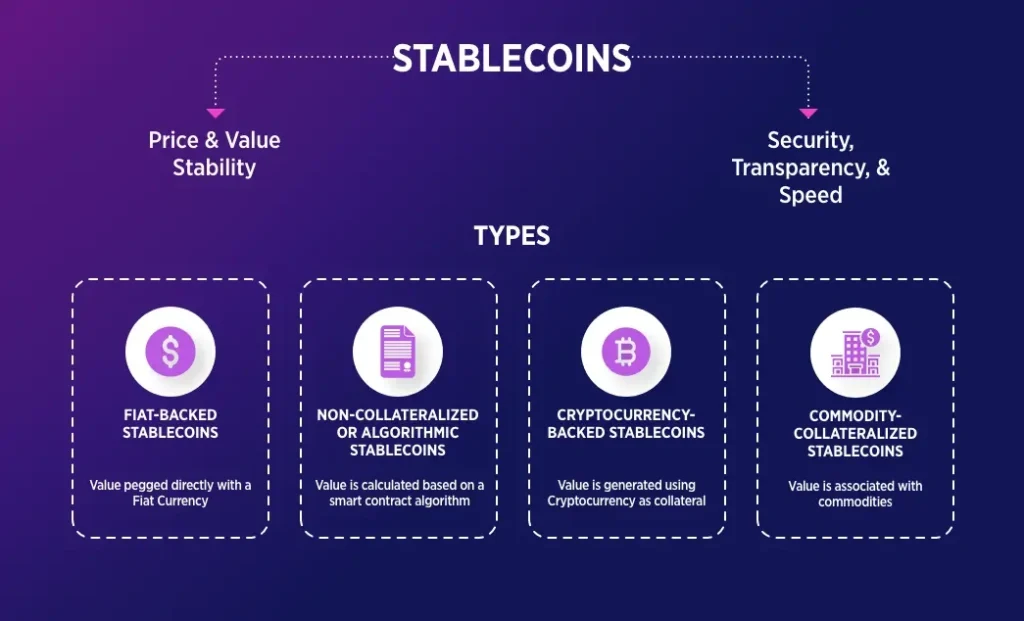

Types of Stablecoins for Beginners to Know

Credit from Bitcompare

Stablecoins aren’t all created the same. They vary based on what backs them—or whether they’re backed at all. Here are four key types of stablecoins that beginners should understand:

1. Fiat-Backed Stablecoins

These stablecoins are supported by reserves of traditional currencies like USD, EUR, or GBP, held by a centralized entity (often a regulated financial institution). Their stability comes from being directly tied to real-world money.

- Example: USDC (USD Coin), USDT (Tether)

2. Cryptocurrency-Backed Stablecoins

Instead of fiat, these are backed by other cryptocurrencies—typically over-collateralized to account for volatility. They often rely on smart contracts and decentralized governance systems.

- Example: DAI (issued by MakerDAO)

3. Non-Collateralized or Algorithmic Stablecoins

These stablecoins don’t rely on external assets at all. Instead, they use algorithmic mechanisms—smart contracts that adjust supply and demand automatically to maintain a target price. While innovative, they are more experimental and can be riskier.

- Example: Frax (partially algorithmic), TerraUSD (UST) — now defunct

4. Commodity-Backed Stablecoins

These are backed by physical assets like gold, oil, or other commodities. They provide price stability tied to tangible resources and may appeal to those seeking a hedge against fiat inflation.

- Example: PAX Gold (PAXG), which is backed by real gold reserves

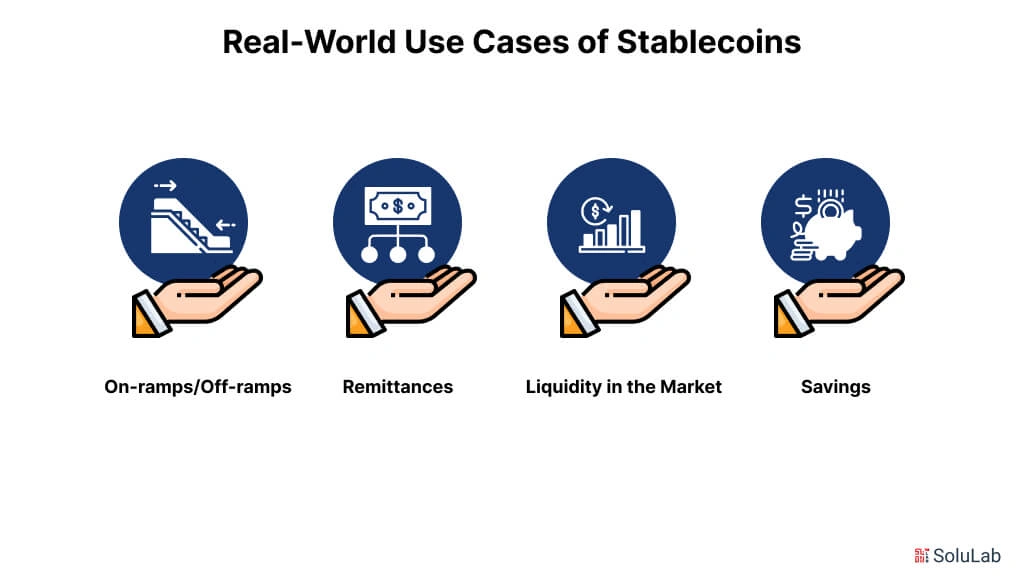

How Stablecoins Are Used in the Real World

Credit from SoluLab

Stablecoins aren’t just theoretical assets—they’re used in ways that intersect with everyday life:

- Cross-border payments: Lower fees and faster settlement than traditional bank transfers.

- Crypto trading: Traders often park their gains in stablecoins to avoid volatility without cashing out.

- DeFi participation: Many decentralized finance platforms rely on stablecoins for lending, borrowing, and staking.

- Everyday purchases: In some inflation-prone countries, people prefer stablecoins over their local currencies.

A real-world example? In Venezuela, stablecoins are increasingly used to store value as hyperinflation erodes the bolívar. The same is happening in parts of Lebanon and Nigeria.

Risks and Controversies Around Stablecoins

While the concept is simple, not all stablecoins are created equal. For beginners, here are key concerns:

- Reserve Transparency: Are the reserves real and regularly audited?

- Regulatory Uncertainty: Some governments question whether stablecoins are a threat to national monetary systems.

- Redemption Risk: Can users always redeem 1:1 for the pegged asset?

- Smart Contract Bugs (for algorithmic types): Vulnerabilities in code can lead to loss of funds.

Take Tether (USDT) for example—its transparency about reserves has faced legal and public scrutiny. Though it remains widely used, caution is advised.

Stablecoins for Beginners: Choosing the Right One

Not all stablecoins serve the same purpose, and beginners need to align their choice with their goals. A quick breakdown:

| Purpose | Recommended Stablecoin |

|---|---|

| Trading | USDC, USDT |

| DeFi | DAI, FRAX |

| Long-Term Stability | USDC |

| High-Risk Experimentation | Algorithmic coins like Frax or new entrants |

Always double-check that the stablecoin is supported by the wallet or exchange you use and that it’s backed by transparent protocols.

How to Get Started with Stablecoins

Here’s a simplified path for any newcomer:

- Create a wallet: Use beginner-friendly wallets like MetaMask or Coinbase Wallet.

- Pick an exchange: Binance, Kraken, and Coinbase are common starting points.

- Buy with fiat: Most stablecoins can be purchased directly with your local currency.

- Practice transactions: Try transferring a small amount to test out sending/receiving.

- Stay informed: Follow developments around stablecoin regulation and innovation.

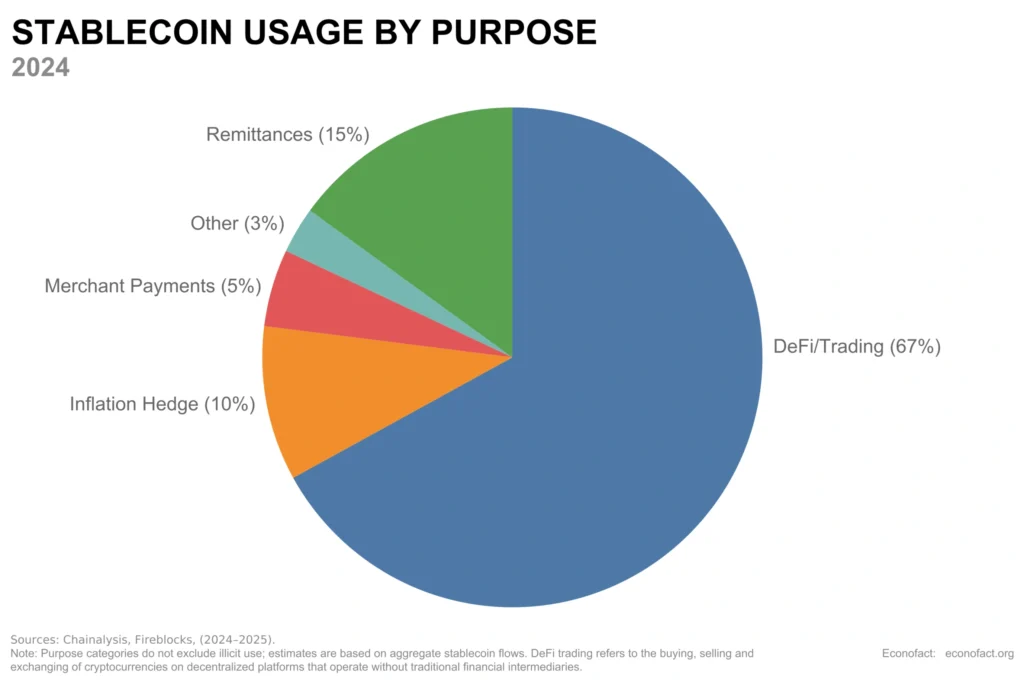

Looking Ahead: The Future of Stability in Crypto

Credit from Econofact

Stablecoins are increasingly being eyed by central banks and governments. The rise of CBDCs (Central Bank Digital Currencies)—like China’s digital yuan—suggests that the concept of a “digital dollar” or “digital euro” could become a mainstream reality.

At the same time, global discussions on regulating stablecoins have picked up speed. In the US, legislation aims to enforce reserve transparency and limit algorithmic models. For beginners, this means the landscape is evolving—but not without oversight.

Conclusion: Why Stablecoins for Beginners Matter Now More Than Ever

In 2025, as cryptocurrency continues to mature, stablecoins for beginners offer a crucial bridge between the traditional and the new. They serve as a digital anchor in a sea of volatility, and for those just beginning their crypto journey, they provide both a learning path and a layer of financial protection.

Understanding stablecoins isn’t just about knowing how they work—it’s about recognizing their real-world role in shaping a more accessible and flexible financial system.