Cryptocurrencies may seem driven by speculation and hype, but under the surface, every serious blockchain project relies on a carefully structured economic system. That system is known as tokenomics.

For beginners, understanding tokenomics is essential because it offers insights into how a cryptocurrency token is created, distributed, used, and potentially gains or loses value over time. Whether you’re buying tokens, building a decentralized app, or simply learning about Web3, knowing the basics of tokenomics helps you look beyond short-term price swings.

Tokenomics for Beginners: What Exactly Is Tokenomics?

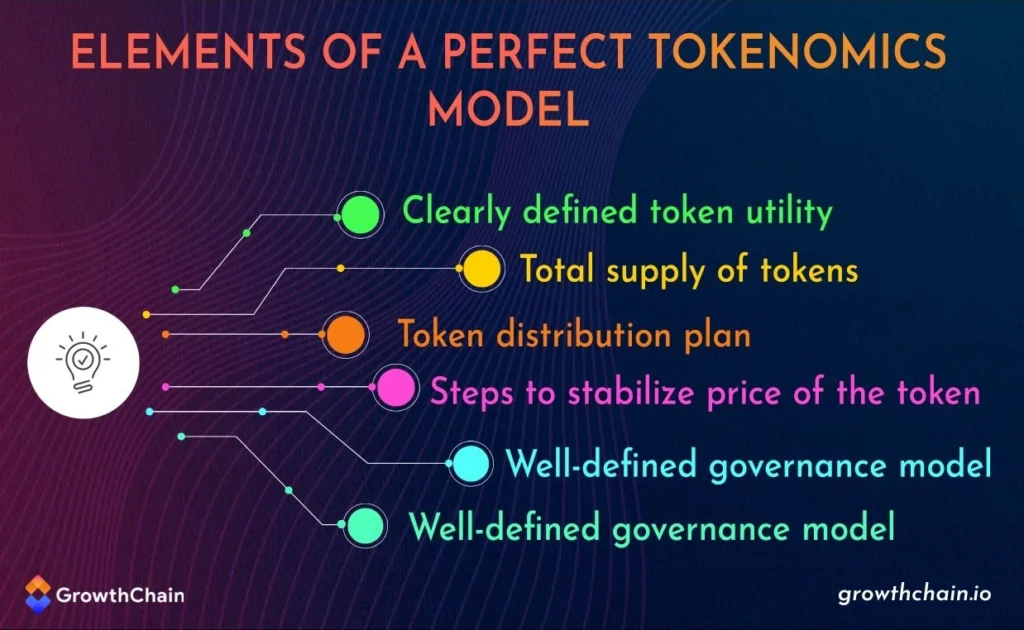

Credit from GrowthChain

Tokenomics is a set of design choices that define how a crypto token functions within its ecosystem. It governs everything from how many tokens will ever exist to who gets them, how they’re used, and what motivates people to keep using them.

Well-designed tokenomics helps ensure that a crypto project:

- Attracts and retains users

- Encourages long-term holders

- Balances supply and demand

- Remains secure and decentralized

Projects with poor tokenomics, on the other hand, often experience inflated supply, rapid value drops, and weak user engagement—even if the technology behind them is sound.

Supply Dynamics: Scarcity and Inflation

One of the first questions investors ask about a token is: How many are there?

Token supply comes in several forms, and each has a different impact on price and long-term value:

| Type of Supply | What It Means | Example |

|---|---|---|

| Total Supply | Maximum number of tokens ever created | Bitcoin: 21 million (fixed) |

| Circulating Supply | Tokens currently available in the market | Ethereum: ~120 million (2025 est.) |

| Max Supply | Upper limit (if any) of token creation | Binance Coin: 200 million max, but reducing through burns |

Bitcoin’s fixed supply model is widely praised for its built-in scarcity. Ethereum, in contrast, has no hard cap but introduces supply control through fee burning, introduced via the EIP-1559 upgrade.

Both approaches can support long-term value, but they require careful balance between token creation and usage.

Distribution: Who Holds the Tokens—and Why It Matters

Credit from Medium

How tokens are distributed during a project’s early stages tells a lot about its fairness and future. If too many tokens are in the hands of a few insiders, the project becomes vulnerable to price manipulation or sudden sell-offs.

Most crypto projects divide token allocations across several key groups:

- Founders and team members

- Early investors or venture capital

- Community rewards and development funds

- Public sales or token launches

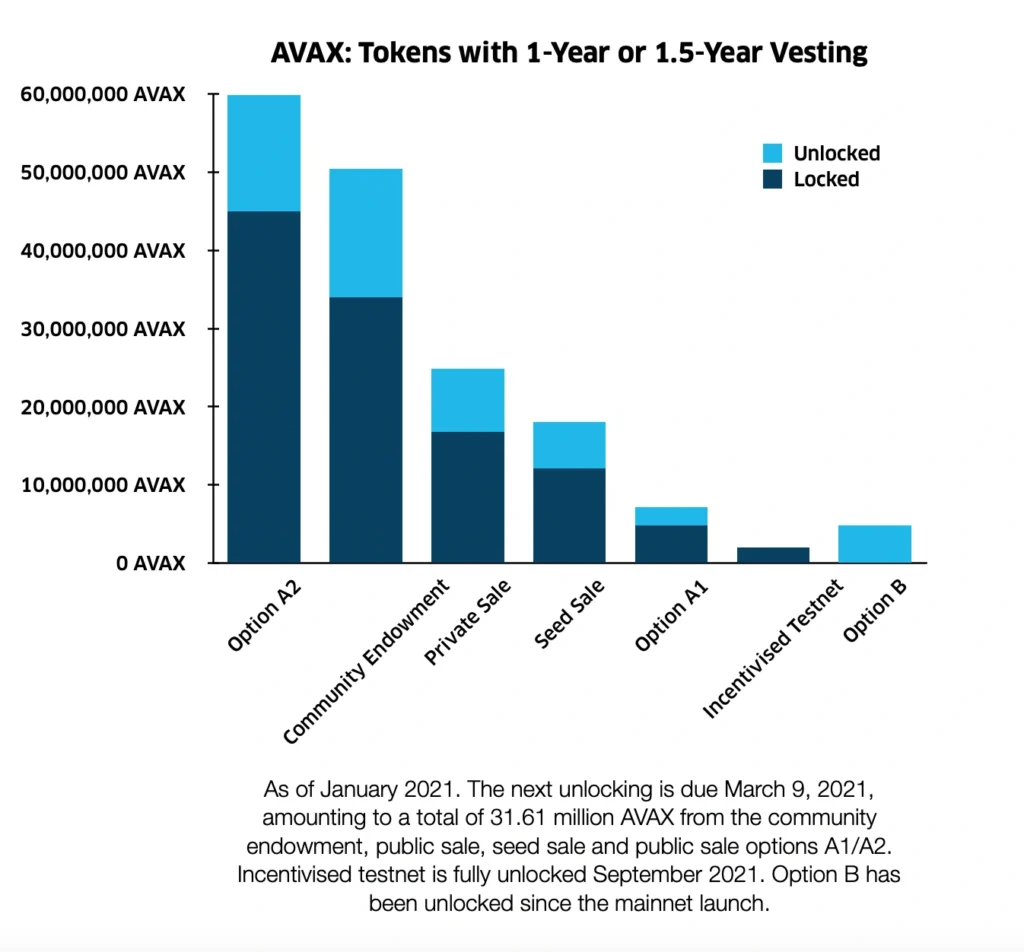

Often, these allocations are locked or vested over several years to prevent early dumping. For example, Avalanche (AVAX) implements multi-year vesting for team and foundation tokens to align incentives over the long term.

When reviewing a token, beginners should check if token holders are locked in for the journey—or free to exit at any time.

Utility: The Heart of Token Value

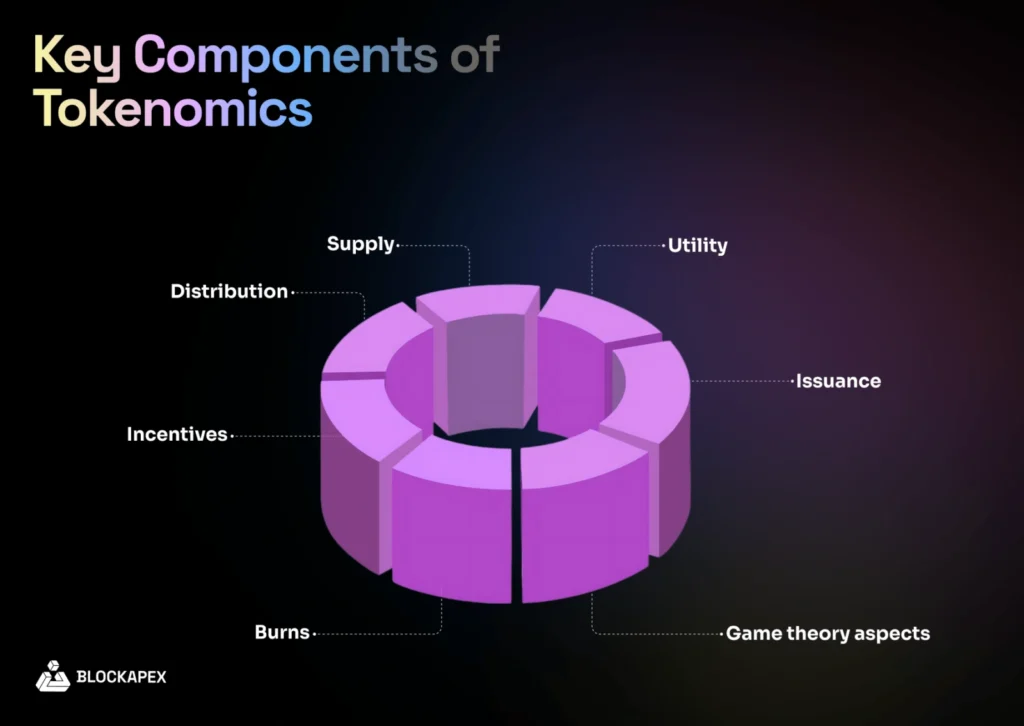

Credit from BlockApex

A token needs more than scarcity to hold value. It needs utility—a reason for people to use it.

Some tokens act like fuel. For example, Ethereum’s ETH is used to pay gas fees when executing smart contracts. Others function more like access keys: Filecoin (FIL) is required to store files on its decentralized network.

Tokens may also grant governance rights, letting holders vote on project upgrades, funding proposals, or fee changes. Uniswap’s UNI token is a good example of a governance token that has no transactional use but carries voting power within the protocol.

Staking is another key utility, especially in proof-of-stake blockchains like Cardano or Solana. Token holders lock their assets to support the network’s operations in exchange for rewards.

A token without practical use may experience hype-driven growth, but its long-term prospects are uncertain.

Incentives: Motivating Participation and Loyalty

Tokenomics also includes incentives designed to reward users and encourage positive behavior in the network. These can take many forms, but all aim to keep people invested—both literally and emotionally.

Staking rewards are perhaps the most common. When you stake your tokens, you’re helping to validate transactions or secure the network. In return, you earn more tokens.

Other forms of incentives include:

- Liquidity rewards for users who provide tokens to decentralized exchanges

- Airdrops that distribute tokens for free to certain wallet holders

- Usage-based rewards, often found in GameFi or Web3 social apps

Incentives need to be balanced. If a project gives away too many tokens too quickly, it may cause inflation and price drops. But if rewards are too small, user interest may fade.

Burning Tokens: A Strategy to Manage Supply

Token burning involves permanently removing tokens from circulation. This reduces supply and may help support price, especially in systems where new tokens are constantly minted.

The most prominent example is Binance Coin (BNB), which undergoes quarterly burns based on exchange revenue. Ethereum’s ongoing fee-burning mechanism has also significantly reduced its net inflation rate.

While burning can create a deflationary effect, it’s not inherently good or bad—it depends on how it’s used and whether demand keeps up with supply reductions.

Tokenomics for Beginners: Security and Governance Models

Another part of tokenomics that often flies under the radar is the system’s consensus mechanism and governance model.

Consensus mechanisms determine how new tokens are created and how transactions are verified. Proof of Work (PoW), as used by Bitcoin, relies on miners solving complex puzzles. Proof of Stake (PoS), used by Ethereum post-2022, allows token holders to validate transactions based on how many tokens they hold and stake.

Governance, on the other hand, shapes how decisions are made. In some projects, like MakerDAO or Aave, token holders vote on everything from interest rates to code updates. A decentralized governance structure can give users a meaningful role in shaping a project’s future, but it only works if voting is fair, transparent, and accessible.

Comparing Tokenomics in Real Crypto Projects

Different crypto projects apply tokenomics based on their goals and community structure. Below is a comparison of four well-known tokens:

| Project | Total Supply | Token Use | Notable Mechanism |

|---|---|---|---|

| Bitcoin | 21 million | Peer-to-peer money | Halving every 4 years reduces new supply |

| Ethereum | No fixed cap | Transaction fees, staking | Burns part of gas fees to reduce inflation |

| Solana | ~560 million | Smart contract platform, staking | High throughput PoS system |

| Uniswap | 1 billion UNI | Governance voting | Community treasury and gradual vesting |

Each token’s economic design reflects its ecosystem’s values—whether scarcity, utility, or community governance.

What to Look for When Evaluating Tokenomics

When you’re researching a crypto project, its tokenomics should be one of your first checkpoints. Here are some guiding questions to consider:

- Is the total supply fixed or unlimited?

- How are tokens being distributed, and is there a vesting schedule?

- What can users actually do with the token?

- Are there incentives that drive ongoing participation?

- How are decisions made in the ecosystem? Who holds voting power?

If the token has little utility, uneven distribution, and weak incentives, it may not be sustainable—regardless of how well it’s marketed.

Final Thoughts: Why Tokenomics Is the Foundation of Crypto Projects

Tokenomics isn’t about technical jargon or complex graphs. At its core, it’s about understanding how crypto tokens are designed to function—and why people might value them.

For beginners, learning tokenomics offers a smarter way to approach investing, building, or even just participating in a crypto ecosystem. It helps filter out short-term hype and highlights the systems that have a chance of lasting.

In an industry where new tokens appear every day, only a few are built on solid economic ground. Tokenomics gives you the tools to tell the difference.