Top 10 Cross-Border Remittance : The story of cross-border remittance is ultimately the story of global migration. Every year, millions of workers leave their home countries in search of better opportunities, and in doing so, they send money back to support families and communities. These remittance flows now represent hundreds of billions of dollars annually, serving as critical lifelines for countries in Asia, Africa, and Latin America. Yet, the systems that handle these transfers have historically been slow, costly, and opaque. A worker in Europe sending money to the Philippines, for instance, might wait several days while paying fees that eat into already modest wages.

In 2025, a different picture is emerging. Blockchain networks, stablecoins, and crypto-powered remittance solutions are rewriting the rules of international money transfers. They promise near-instant settlement, lower costs, and increased transparency. More importantly, they open doors for the unbanked, enabling millions to send and receive money with just a mobile phone. This article explores the top 10 cross-border remittance crypto solutions in 2025, highlighting the platforms and technologies driving this transformation.

Key Factors Driving Crypto Remittance in 2025 – Top 10 Cross-Border Remittance

Several forces explain why crypto remittance has moved from a fringe idea to a mainstream reality. The most obvious factor is cost: blockchain reduces fees by eliminating intermediaries. Instead of paying 6–8% in traditional systems, users often pay less than 1% with crypto solutions. For families relying on remittances for survival, this difference is life-changing.

Speed is another driver. Traditional transfers might take three to five business days, while blockchain transactions often settle in minutes. Financial inclusion also plays a central role, as nearly 1.4 billion people worldwide remain unbanked. With mobile-first crypto wallets, these populations can now send and receive remittances without needing a bank account.

Finally, stablecoins and CBDCs are addressing one of crypto’s long-standing challenges: volatility. By pegging value to national currencies, they provide the stability required for reliable transfers. Combined with regulatory progress and growing partnerships between fintechs and banks, the adoption curve has steepened dramatically in 2025.

Top 10 Cross-Border Remittance – Methodology for Selection

This list of the top 10 cross-border remittance crypto solutions in 2025 was curated with clear evaluation criteria. Transaction speed and scalability were prioritized, since delays are unacceptable in remittance contexts. Cost-effectiveness was another major factor, measured by average fees across common corridors.

Global reach and regional penetration were considered—some platforms thrive in specific regions like Africa or Southeast Asia, while others target institutional corridors. Regulatory compliance and licensing also played a role, as remittance is highly regulated worldwide. Finally, user experience mattered: platforms that integrate fiat on/off ramps, mobile-first access, and user-friendly apps ranked higher.

Top 10 Cross-Border Remittance Crypto Solutions in 2025

Source: Decrypt

Ripple has become one of the most established names in institutional remittance. Its On-Demand Liquidity (ODL) system allows banks and payment providers to use XRP as a bridge asset, eliminating the need for pre-funded accounts. This not only speeds up transfers but also frees liquidity for institutions. By 2025, Ripple has secured corridors across Asia-Pacific, the Middle East, and Latin America. Banks and regulators increasingly recognize Ripple as a core infrastructure layer for modern payments, showing how blockchain can complement—not just disrupt—legacy finance.

2. Stellar (XLM & MoneyGram Access)

Source: Board Game Geek

Stellar remains at the forefront of consumer-oriented remittance. Its open-source blockchain is optimized for low-cost, high-volume transfers, making it an ideal network for everyday use. The Stellar–MoneyGram partnership bridges digital and fiat worlds, allowing users to deposit and withdraw cash in physical locations. This model is vital in regions where digital banking penetration remains low. In Africa, Southeast Asia, and Latin America, Stellar is powering remittances that reach people who previously relied on costly money transfer operators.

3. Circle (USDC Stablecoin Transfers)

Source: Bankless times

Circle’s USDC has grown into one of the most trusted stablecoins for international transfers. Pegged to the U.S. dollar and backed by transparent reserves, USDC provides stability without sacrificing blockchain speed. In 2025, partnerships with Visa, Stripe, and fintech platforms have expanded USDC into mainstream financial systems. Migrant workers, freelancers, and small businesses increasingly rely on USDC for cross-border transfers, benefiting from its low volatility and wide accessibility.

4. Tether (USDT in Emerging Markets)

Despite ongoing debates around transparency, Tether’s USDT remains the world’s most used stablecoin, particularly in emerging markets. For users in countries with volatile currencies—such as Argentina, Turkey, or Nigeria—USDT serves as a digital dollar that preserves value. Its wide availability across exchanges and wallets makes it highly practical for remittance. By 2025, USDT continues to dominate in regions where demand for dollar stability is strongest, even as regulators scrutinize its operations.

5. Lightning Network (Bitcoin Layer 2)

Source: Tastycrypto

Bitcoin is still the most recognizable cryptocurrency globally, but its original blockchain was not designed for fast, low-cost transfers. The Lightning Network, built as a layer-two solution, solves this by enabling near-instant micro-transactions. In remittance, Lightning is proving especially useful for small transfers, such as $20–$50 payments, where traditional fees would be prohibitive. Fintech startups in Latin America, Africa, and Southeast Asia are building remittance services on Lightning, making Bitcoin not just a store of value but a practical payment rail.

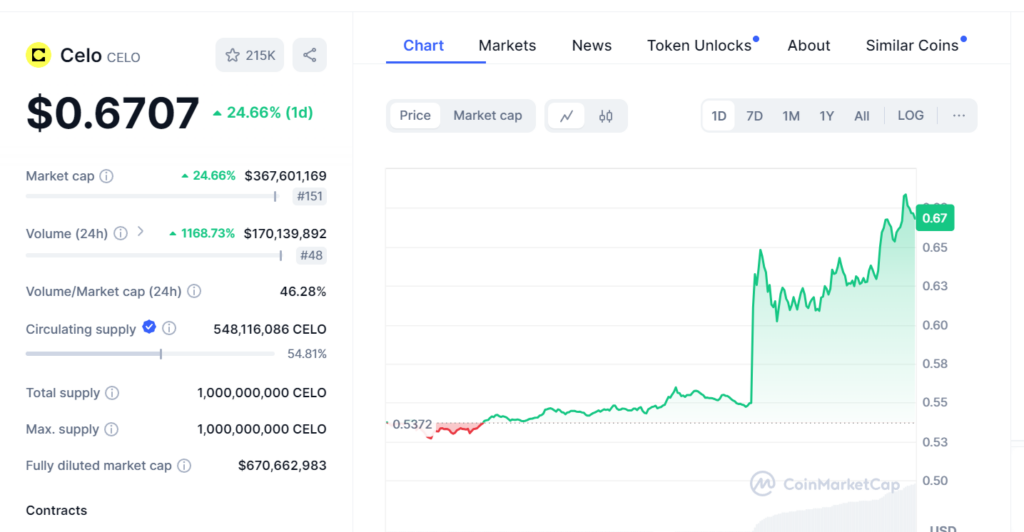

6. Celo (Mobile-First Blockchain for Remittance)

Source: The Coin Republic

Celo stands out for its mobile-first approach. With billions of people worldwide relying on mobile phones rather than bank accounts, Celo has designed a blockchain that integrates directly with mobile ecosystems. Its stablecoins, including local-currency-pegged options, reduce volatility risks. In 2025, Celo is particularly impactful in Africa, where mobile money systems are dominant. By focusing on usability and inclusivity, Celo ensures crypto remittance is accessible to those who need it most.

7. Airwallex (Business and SME Remittance)

Source: Airwallex

Airwallex addresses a different but equally important side of remittance: business transfers. SMEs and global e-commerce sellers often face high costs and delays in cross-border payments. By integrating blockchain technology, Airwallex streamlines these transactions, offering multi-currency wallets and faster settlements. In 2025, Airwallex is a key player for businesses that need efficient international payment infrastructure, showing how blockchain is not just for consumer remittance but also for global trade.

8. Worldcoin & AI-Optimized Remittance

Worldcoin, alongside emerging AI-powered remittance startups, represents the experimental edge of this space. By combining blockchain with artificial intelligence, these platforms optimize routing, predict fees, and minimize settlement delays. Imagine sending money abroad and having AI instantly calculate the cheapest and fastest network path—that’s the promise here. While still early-stage, such systems highlight the growing role of AI in shaping the efficiency of global remittance.

9. Zenus Bank (Blockchain-Integrated Banking)

Source: GFTS

Zenus Bank bridges traditional banking with blockchain remittance. By offering U.S. bank accounts to clients globally, it provides stability and credibility while integrating crypto payment rails. In practice, this means individuals and businesses can use Zenus as a gateway into the U.S. financial system while enjoying the benefits of faster, cheaper crypto transfers. This hybrid model may become increasingly common as regulators encourage cooperation between fintechs and banks.

10. BOSS Money (Africa-Focused Remittance Innovation)

Source: Boss Money

Africa is home to some of the most expensive remittance corridors in the world, making innovation critical. BOSS Money is expanding access by leveraging blockchain rails while maintaining local partnerships for last-mile delivery. By integrating with fintech startups and ensuring people can cash in and out easily, BOSS Money reduces costs while improving accessibility. In 2025, it represents how crypto can be tailored to meet regional challenges, particularly in underserved communities.

Comparative Table: Top 10 Cross-Border Remittance Solutions

| Solution | Speed | Avg. Cost | Regional Strengths | Best For |

|---|---|---|---|---|

| Ripple (XRP) | Seconds | <1% | Asia-Pacific, MENA | Banks, financial institutions |

| Stellar (XLM) | Seconds | <1% | Africa, Latin America | Retail & cash-to-crypto users |

| Circle (USDC) | Minutes | <1% | Global | Stablecoin transfers |

| Tether (USDT) | Minutes | <1% | Emerging markets | Dollar stability, everyday users |

| Lightning (BTC) | Seconds | Negligible | Latin America, SEA | Micro-remittances |

| Celo | Seconds | <1% | Africa, mobile-first | Financial inclusion |

| Airwallex | Hours | Low fees | Global (SME focus) | Business remittance |

| Worldcoin/AI | Varies | Dynamic | Global experimental | AI-optimized transfers |

| Zenus Bank | Hours–1 day | Low fees | U.S.–Global corridors | Hybrid banking/crypto access |

| BOSS Money | Minutes | <2% | Africa | Regional cash-out access |

Challenges & Risks Ahead – Top 10 Cross-Border Remittance

Even with these advances, challenges remain. Regulations differ widely across jurisdictions, creating uncertainty for platforms. Stablecoins face scrutiny, especially from governments wary of dollarization. Cybersecurity threats—from phishing to smart contract vulnerabilities—pose risks to users. And infrastructure gaps, including limited internet access in rural areas, restrict adoption in some regions. These issues need addressing before crypto remittance can reach full maturity.

Future Outlook (2025–2030)

Looking ahead, the future of remittance may be shaped by CBDC integration, which could merge state-backed currencies with blockchain rails. Multi-chain interoperability is another frontier, enabling seamless transfers across different blockchains. Artificial intelligence will likely play a greater role in optimizing cost and speed. And as partnerships between traditional banks, fintechs, and blockchain firms deepen, the distinction between “crypto remittance” and “traditional remittance” may gradually disappear.

Conclusion

The top 10 cross-border remittance crypto solutions in 2025 demonstrate how blockchain is reshaping the movement of money globally. From Ripple and Stellar’s institutional and retail corridors to Circle and Tether’s stablecoin dominance, these platforms represent a turning point for the industry. With AI-driven optimization, mobile-first inclusion, and growing bank–fintech partnerships, 2025 may well be remembered as the year crypto remittance became mainstream.