The cryptocurrency landscape in 2025 is not just about trading Bitcoin or Ethereum — it’s about entire nations positioning themselves as leaders in a new era of financial innovation. The top 10 crypto countries this year are those that have embraced blockchain as part of their economic DNA, weaving it into their financial infrastructure, regulatory frameworks, and innovation ecosystems. These nations have moved beyond treating crypto as a speculative fad; instead, they see it as a strategic asset capable of attracting investment, talent, and global influence.

This transformation did not happen overnight. The industry weathered some of its darkest days during the 2021–2022 downturn, when market sentiment collapsed after high-profile failures such as Terra-Luna and FTX. Investor confidence was shaken, and regulatory agencies worldwide began tightening oversight. But by 2023, signs of recovery emerged: Bitcoin regained momentum, institutional players returned, and global market capitalization surged from under $1 trillion to over $1.5 trillion by the year’s end. In 2024, the SEC’s approval of the first U.S. Bitcoin ETFs, the scheduled Bitcoin halving, and renewed investor interest in the wake of political changes in the United States all contributed to a fresh wave of enthusiasm.

In this competitive environment, certain countries have set themselves apart, crafting the conditions for sustainable blockchain growth. Let’s explore the ten nations that have taken the lead in crypto adoption, regulation, and innovation in 2025.

Switzerland: Crypto Valley’s Global Influence

Switzerland remains the gold standard for crypto-friendly regulation, thanks in large part to its famed “Crypto Valley” in the canton of Zug. This region has become home to hundreds of blockchain startups, global exchanges, and token projects. The Swiss Financial Market Supervisory Authority (FINMA) offers one of the clearest and most predictable regulatory environments for digital assets in the world, with well-defined rules for ICOs, token classifications, and licensing requirements. Beyond regulation, Switzerland’s tax policies — especially favorable treatment for long-term investors — make it an attractive base for both individuals and corporations. The country’s banking sector, traditionally conservative, has also opened its doors to crypto firms, creating a rare synergy between old-world finance and cutting-edge blockchain technology.

Singapore: Southeast Asia’s Blockchain Leader

Source: CoinGeek

Singapore has carefully built its reputation as a top-tier crypto jurisdiction, balancing regulatory oversight with innovation-friendly policies. The Monetary Authority of Singapore (MAS) oversees the Payment Services Act, which gives crypto businesses a clear and stable framework for operation. This regulatory certainty is paired with an investor-friendly tax regime — there is no capital gains tax on cryptocurrency transactions — making Singapore especially attractive to both traders and institutional investors. The city-state has also invested heavily in talent development, with institutions like the National University of Singapore (NUS) and Singapore Management University (SMU) offering specialized blockchain programs. Events like Singapore Blockchain Week foster collaboration between startups, multinational corporations, and regulators, reinforcing its status as the fintech hub of Southeast Asia.

United Arab Emirates: Blockchain Hubs in Dubai & Abu Dhabi

Source: Filings

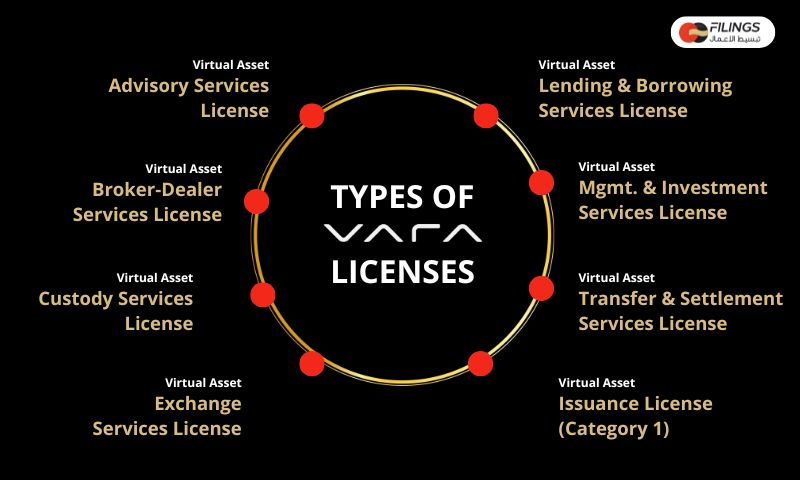

The UAE’s rapid ascent in the crypto world has been nothing short of remarkable. Dubai’s Virtual Assets Regulatory Authority (VARA) has established one of the most comprehensive and business-friendly digital asset frameworks globally, while Abu Dhabi Global Market (ADGM) offers its own tailored regulatory ecosystem for crypto and fintech. The country’s free economic zones provide unparalleled operational benefits, including zero personal income tax and full foreign ownership of businesses. Beyond financial incentives, the UAE is actively cultivating blockchain expertise, with universities offering dedicated courses and the government hosting major industry events like the Future Blockchain Summit. The result is a forward-looking market that draws both entrepreneurs seeking a launchpad and established firms looking to expand their reach.

Hong Kong: Rebuilding Its Position in Crypto Finance

Source: Investopedia

Hong Kong has experienced a transformation in its approach to crypto regulation. After years of cautious oversight, the city has emerged with a renewed strategy to position itself as a major digital asset hub. The Securities and Futures Commission (SFC) now provides clear licensing rules for exchanges and virtual asset service providers, ensuring compliance while encouraging innovation. Government-backed projects, such as the Project Ensemble Sandbox, are testing the tokenization of real-world assets, signaling a broader institutional embrace of blockchain. Its position as a bridge between mainland China’s vast markets and global finance gives Hong Kong a strategic advantage, attracting companies looking to tap into both spheres.

Canada: Combining Innovation and Legal Clarity

Source: Cision

Canada was an early pioneer in the crypto space, becoming the first country to approve a Bitcoin ETF, which opened the door for mainstream, regulated investment in digital assets. The Canadian Securities Administrators (CSA) developed a comprehensive framework for crypto operations early on, providing businesses with clarity and reducing legal uncertainties. Major banks, including the Royal Bank of Canada (RBC) and Scotiabank, have also taken steps to integrate digital asset services, an important sign of institutional acceptance. While crypto is subject to standard taxation, the stability of Canada’s financial system, combined with its openness to blockchain innovation, continues to make it a preferred location for companies seeking long-term growth.

United States: The World’s Largest Crypto Market

The United States is an undeniable powerhouse in the crypto industry, boasting the largest concentration of blockchain startups, exchanges, and venture capital funding. However, the regulatory landscape remains complex, with oversight shared between the Securities and Exchange Commission (SEC) and the Commodity Futures Trading Commission (CFTC). Despite these challenges, state-level initiatives have created significant opportunities. Wyoming has passed landmark pro-crypto laws, Texas has become a global leader in Bitcoin mining, and New York remains a major hub for institutional investment in digital assets. The scale, talent pool, and financial influence of the U.S. ensure that it will remain a central force in the crypto economy for years to come.

Cayman Islands: Offshore Finance Meets Blockchain

The Cayman Islands has leveraged its reputation as a leading offshore financial center to become a prime jurisdiction for crypto operations. Its Virtual Asset Service Providers (VASP) Act sets clear rules for licensing and AML compliance, while maintaining a zero-direct-tax environment for crypto transactions. This combination of regulatory structure and tax efficiency has attracted hedge funds, token issuers, and major exchanges seeking both flexibility and global reach. The islands’ established legal framework and deep financial expertise make them particularly appealing for large-scale blockchain investment operations.

Bermuda: Nimble Regulation, Strong Oversight

Source: Linkedin

Bermuda has distinguished itself as a proactive regulator in the digital asset space. Its Digital Asset Business Act (DABA) provides a comprehensive framework for licensing, compliance, and operational oversight, giving businesses both clarity and confidence. The Bermuda Monetary Authority takes an active role in engaging with crypto companies, ensuring that regulations evolve alongside technological advances. The island’s tax benefits — including no capital gains tax — combined with educational programs in blockchain at Bermuda College, create a fertile environment for startups and established firms alike.

Australia: Top 10 Crypto Countries – Asia-Pacific’s Balanced Approach

Source: Asic

Australia offers one of the most balanced crypto environments in the Asia-Pacific region. The Australian Securities and Investments Commission (ASIC) oversees licensing and compliance, while a regulatory sandbox allows startups to test their products before full regulatory requirements apply. This dual approach ensures consumer protection without stifling innovation. Government collaborations with blockchain companies, along with fair and clearly defined tax rules for active traders, have strengthened Australia’s position as a regional leader in digital asset adoption.

Panama: Top 10 Crypto Countries – Zero Tax Advantage for Crypto Traders

Panama’s greatest draw is its favorable tax regime — there is no capital gains tax on cryptocurrency, making it an ideal jurisdiction for high-volume traders and long-term investors. While the country’s AML regulations are still developing, its strategic location between North and South America positions it as a natural hub for international crypto business. The government has shown increasing interest in developing a stronger fintech sector, and as its regulatory clarity improves, Panama’s appeal to global crypto entrepreneurs is expected to grow significantly.

Comparison Table: Top 10 Crypto Countries 2025

| Country | Regulatory Clarity | Crypto Tax Policy | Key Strengths |

|---|---|---|---|

| Switzerland | High | Low/Investor-Friendly | Crypto Valley hub, strong banking |

| Singapore | High | No capital gains tax | Education, fintech events |

| UAE | High | Zero personal income tax | Free zones, blockchain education |

| Hong Kong | Medium-High | Standard rates | Gateway to China, tokenization projects |

| Canada | High | Moderate taxes | First Bitcoin ETF, bank integration |

| United States | Medium | Varies by state | Largest market, VC funding |

| Cayman Islands | High | No direct taxes | Offshore finance hub |

| Bermuda | High | No capital gains tax | Proactive regulator, education |

| Australia | High | Progressive tax rules | Regulatory sandbox, gov partnerships |

| Panama | Medium | No capital gains tax | Strategic trade location |

Conclusion: Top 10 Crypto Countries – The Global Race for Crypto Leadership

From Switzerland’s precision-crafted “Crypto Valley” to Panama’s tax-free trading environment, the top 10 crypto countries in 2025 have demonstrated that strategic policy-making, regulatory clarity, and targeted investment in talent can transform entire national economies. While each country has its own unique strengths, they share common principles: fostering innovation, attracting global capital, and building robust ecosystems where blockchain can thrive. As competition intensifies, more nations will adopt similar strategies, shaping the next chapter in the global digital finance revolution.