Top 10 Crypto Derivatives : In 2025, crypto derivatives have matured from a niche market into one of the most important sectors of digital asset trading. Futures contracts, perpetual swaps, and options now account for billions of dollars in daily trading volume, often exceeding spot markets. Traders rely on these instruments for multiple reasons — hedging against volatility, speculating on price movements, and building structured trading strategies. Institutions, once cautious, have increasingly entered the derivatives space, drawn by improved compliance frameworks and deeper liquidity.

The top 10 crypto derivatives platforms represent this evolution. Each exchange has carved out its niche, whether by focusing on liquidity at scale, retail accessibility, institutional-grade trust, or innovative features like copy trading and gamification. The differences between these platforms highlight how diverse trader needs have become — and how competitive the exchange landscape is in 2025.

1. Binance Futures: The Uncontested Giant

Source: The Block

Binance Futures continues to dominate the crypto derivatives landscape in 2025. With daily derivatives trading volumes often surpassing $50 billion, it offers unmatched liquidity across a vast range of futures and perpetual contracts. This scale is more than just a vanity metric — it ensures that traders experience tight spreads, fast order execution, and lower slippage, all of which are critical when dealing with high-leverage positions.

Beyond liquidity, Binance Futures provides a comprehensive set of trading tools. Traders can access cross-margin and isolated margin options, advanced order types like stop-limits and trailing stops, and hedge their risk with wide market coverage across Bitcoin, Ethereum, and hundreds of altcoins. The SAFU insurance fund also provides peace of mind by protecting users in the event of market disruptions or exchange issues. However, regulatory challenges remain a recurring theme, with restrictions in certain regions limiting access to the platform. Despite these hurdles, Binance Futures remains the benchmark for scale and reliability in derivatives trading.

2. Bybit: Balancing Accessibility and Power

Source: CoinBureau

Bybit has established itself as one of the top crypto futures platforms by striking a rare balance between accessibility for beginners and advanced tools for professionals. Known for its smooth user interface, Bybit attracts traders who want an intuitive yet powerful experience. It has grown rapidly since its launch, consistently ranking among the top exchanges by derivatives trading volume and open interest.

One of Bybit’s standout innovations is its introduction of USDC-settled contracts, giving traders a stable and predictable collateral option. This feature, combined with its wide selection of perpetual futures, makes Bybit particularly appealing to those looking to avoid volatility in margin collateral. Bybit has also leaned heavily into copy trading, allowing retail users to follow experienced traders, a trend that has boosted community engagement and attracted a younger, mobile-first demographic. On the flip side, access in some regions is restricted due to regulatory pressures, but for those who can use it, Bybit represents a strong blend of user-friendliness and professional-grade performance.

3. OKX: The CeFi–DeFi Bridge

OKX has made its name not just as a centralized exchange but as a platform that bridges the worlds of CeFi and DeFi. Its derivatives markets are extensive, covering futures, perpetual swaps, and options. What sets OKX apart is the integration of risk management tools designed for sophisticated traders, such as portfolio margining and customizable leverage.

In 2025, OKX has also expanded its hybrid ecosystem, allowing traders to move seamlessly between centralized derivatives products and decentralized finance opportunities. This makes it particularly appealing to traders who want exposure not only to traditional futures markets but also to yield-generating opportunities. While it offers fewer total markets than competitors like Gate.io or MEXC, its ecosystem-driven model has won it a loyal following among professionals who value flexibility and innovation. OKX continues to solidify its place as a multi-layered trading hub that connects traditional trading with DeFi experimentation.

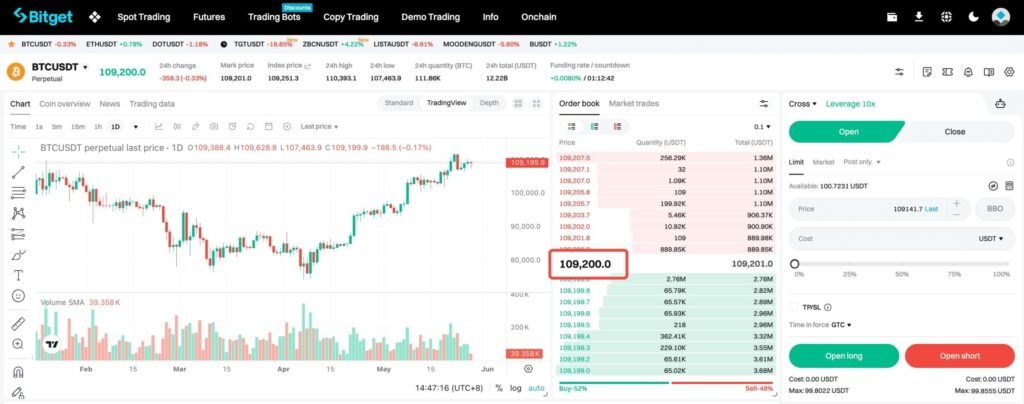

4. Bitget: Social Trading at the Core

Source: Bitget

Bitget has risen rapidly in 2025 by positioning itself as the copy trading leader in crypto derivatives. While many exchanges now offer social trading features, Bitget has fully embraced it, making it the cornerstone of its ecosystem. This model appeals strongly to beginners who may lack the expertise to design their own strategies but still want to participate in leveraged futures trading.

The platform supports a large number of perpetual and futures contracts while also providing insurance funds designed to protect traders during market volatility. This added safety net, combined with its strong community-driven features, has fueled exponential growth in its user base. Bitget’s challenge lies in navigating increasing regulatory scrutiny as it expands into new markets, but its momentum and retail adoption suggest it will remain one of the most talked-about exchanges in 2025.

5. Gate.io: Variety Above All

Source: Cointelegraph

Gate.io has maintained its position as one of the most versatile platforms in the industry. With more than 600 derivatives markets, it offers unparalleled breadth, covering not only major cryptocurrencies but also a wide range of mid-cap and niche altcoins. This makes it the go-to choice for traders who want exposure beyond Bitcoin and Ethereum.

Its strong presence in Asia has fueled liquidity across altcoin futures, allowing traders to execute orders efficiently in markets that are often illiquid elsewhere. The platform can feel overwhelming to new users due to its vast array of tools and trading pairs, but experienced traders see this as a strength rather than a drawback. In 2025, Gate.io’s combination of coverage, liquidity, and established history makes it a cornerstone exchange for altcoin derivatives enthusiasts.

6. KuCoin Futures: The Altcoin Specialist

Source: Kucoin

KuCoin, often dubbed the “People’s Exchange,” has continued to focus on altcoin access in its futures platform. For traders seeking opportunities in smaller market contracts, KuCoin remains one of the most reliable places to find them. Its Futures Brawl gamified trading mode adds a unique flavor, appealing to retail traders who enjoy an interactive experience.

In addition, KuCoin Token (KCS) provides fee discounts, making trading more cost-effective for loyal users. Its futures offerings cover a broad range of altcoins, which gives it a niche advantage in serving communities that want speculative exposure beyond the majors. That said, KuCoin’s global expansion is tempered by regulatory uncertainties, particularly in Western markets. Still, in 2025, it remains a key platform for traders who prioritize variety and community-driven trading culture.

7. Kraken Futures: The Institutional Standard

Kraken Futures stands out as one of the most regulation-compliant and security-first platforms in the derivatives space. Unlike some of its Asian competitors, Kraken has built its reputation around transparency and institutional trust. While its range of contracts is smaller — mainly covering Bitcoin, Ethereum, and a select few other assets — its emphasis on compliance and user protection makes it the preferred choice for conservative traders and funds.

Kraken’s strict adherence to regulatory frameworks has allowed it to grow in institutional adoption, particularly in Europe and North America. Its lower market breadth is a limitation compared to exchanges like Binance or OKX, but for those who prioritize trust and reliability over sheer variety, Kraken remains one of the most respected names in the space.

8. BingX: Retail-Friendly Growth

Source: CoinBureau

BingX has been steadily growing into a strong competitor, particularly in Southeast Asia and emerging markets. Its emphasis on demo trading features allows beginners to practice without risk, while its copy trading functions provide an easy on-ramp to leveraged trading.

At the same time, BingX offers professional-grade tools for advanced users, striking a balance that appeals to both newcomers and seasoned traders. Its liquidity is still building compared to top-tier platforms, but its expansion and user-centric features make it a compelling platform in 2025. BingX’s ability to balance retail accessibility with pro-level infrastructure will be key to its continued success.

9. Deribit: Options Expertise – Top 10 Crypto Derivatives

Source: Dinsights

Deribit has long held its crown as the undisputed leader in crypto options trading, and in 2025 that remains unchanged. Its dominance in Bitcoin and Ethereum options makes it the go-to platform for institutions and professional traders who want exposure to volatility products and advanced hedging strategies.

The exchange does not attempt to compete with others in terms of the number of futures or perpetual pairs — instead, it has doubled down on being the global leader in options. For traders seeking sophisticated tools, Deribit is unmatched, though those looking for wide-ranging futures markets may need to supplement their activity elsewhere.

10. MEXC Futures: Fee Disruptor – Top 10 Crypto Derivatives

MEXC Futures has quickly gained recognition by aggressively pursuing a zero or ultra-low fee model. This strategy has allowed it to attract high-frequency traders and retail users looking to minimize costs. With more than 700 markets available, MEXC offers extensive futures coverage that rivals even Gate.io in breadth.

Its growth trajectory in 2025 highlights how disruptive pricing can reshape competition in the derivatives industry. However, questions remain about the sustainability of a zero-fee approach in the long term. For now, though, MEXC has established itself as a major challenger to more established names, particularly among retail traders who prioritize affordability and variety.

Trends Defining Derivatives in 2025 – Top 10 Crypto Derivatives

Across these top 10 crypto derivatives platforms, several trends stand out. Institutional adoption is accelerating, bringing stricter regulatory oversight and higher compliance standards. Asian exchanges continue to dominate in terms of retail volume and market diversity, while Western platforms focus on trust and transparency. Meanwhile, social and copy trading have redefined how new traders engage with futures, and the rise of zero-fee models has forced competitors to rethink their pricing strategies.

Conclusion: Top 10 Crypto Derivatives

The top 10 crypto derivatives platforms in 2025 highlight just how diverse the trading ecosystem has become. Binance maintains its dominance in liquidity, Bybit excels in accessibility, and Bitget has become synonymous with copy trading. Deribit continues to own the options space, while Kraken attracts institutions through trust and compliance.

Each platform serves a different trader profile, from beginners seeking social tools to institutions demanding transparency. As the derivatives market evolves, the key for traders will be aligning their strategies with the platform that best fits their needs — all while keeping risk management and independent research front and center.