Top 10 Crypto-Friendly Countries : The global landscape for digital assets is evolving rapidly, and by 2025, choosing the right jurisdiction has become a strategic decision for crypto traders, entrepreneurs, and even governments. The phrase crypto-friendly countries doesn’t simply mean low taxes anymore. Instead, it covers a broad mix of factors: regulatory clarity, supportive tax structures, banking access, community adoption, and political stability.

While some countries aim to attract global talent through zero capital gains tax or digital nomad visas, others focus on building institutional trust and advanced ecosystems. This list of the Top 10 Crypto-Friendly Countries and Jurisdictions in 2025 highlights where innovation, governance, and lifestyle converge to create opportunities for crypto investors and professionals worldwide.

Switzerland: The Original Crypto Safe Haven – Top 10 Crypto-Friendly Countries

Source: CCN

Switzerland remains the benchmark for crypto-friendliness, combining robust legal clarity with financial sophistication. The country’s Distributed Ledger Technology (DLT) Act provides a comprehensive legal framework, while the Swiss Financial Market Supervisory Authority (FINMA) has earned global respect for its transparent regulatory practices.

Zug, famously known as “Crypto Valley,” continues to house a dense concentration of blockchain startups, major players like Ethereum’s foundation, and specialized banks such as Sygnum and SEBA. For individuals, Switzerland’s zero capital gains tax on personal crypto holdings makes it one of the most financially rewarding jurisdictions for long-term investors. Beyond taxation, the integration of CBDCs and green mining initiatives reinforces Switzerland’s commitment to combining innovation with sustainability.

Singapore: Asia’s Digital Finance Epicenter – Top 10 Crypto-Friendly Countries

Source: Yahoo Finance

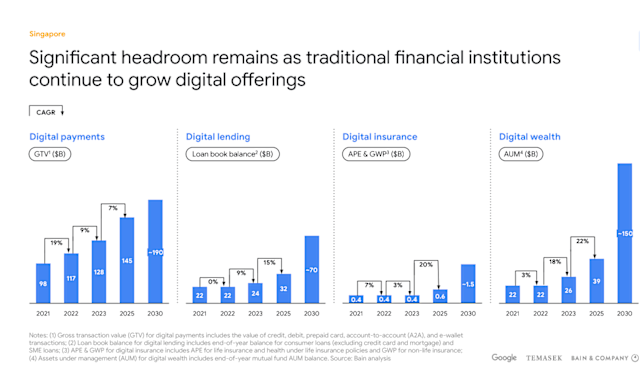

Singapore has cultivated an environment that blends strict oversight with global innovation appeal. The Monetary Authority of Singapore (MAS) introduced one of the clearest licensing systems for crypto exchanges and service providers, along with detailed stablecoin regulations. This predictability reduces risk for investors and entrepreneurs.

The absence of capital gains tax provides additional incentive for crypto traders, while the corporate tax system remains competitive for businesses. Singapore’s reputation as a fintech powerhouse means startups enjoy access to global talent, institutional investors, and government-backed research grants. Its geographic position as Asia’s gateway also makes it ideal for companies looking to expand across the region, reinforcing its place among the top crypto-friendly countries in 2025.

Germany: Regulation With Investor Protection

Germany exemplifies how regulation can coexist with adoption. Under BaFin’s supervision and in line with the EU’s MiCA regulations, Germany offers clear, enforceable rules for crypto companies. For individuals, the tax system rewards patience: crypto held for more than one year is tax-free, and smaller transactions under €600 also escape taxation.

The country has also embraced tokenized securities and real-world asset (RWA) projects, linking blockchain to its already-strong financial sector. While some observers note that Germany’s crypto exchange ecosystem is not as vibrant as in Switzerland or Singapore, its emphasis on consumer protection and long-term adoption continues to attract cautious investors and financial institutions.

Portugal: Where Lifestyle Meets Tax Benefits

Source: Exolix

Portugal has become the poster child for digital nomads seeking both sunshine and crypto benefits. Crypto gains on holdings longer than 365 days are exempt from tax, while Lisbon has become one of Europe’s liveliest hubs for blockchain events, startups, and conferences.

The government’s Digital Transitional Action Plan signals a proactive approach to technological innovation, with blockchain set to play a role in both the public and private sectors. Although dedicated crypto banking infrastructure remains limited, the country’s low living costs, community culture, and open attitude toward expatriates make it a magnet for entrepreneurs looking to balance work with lifestyle.

El Salvador: The Bitcoin Pioneer

Source: Bein

El Salvador remains unique as the first nation to adopt Bitcoin as legal tender. Its experiment continues into 2025 with Bitcoin Bonds, tax exemptions for Bitcoin-related income, and a residency-by-investment program aimed at global entrepreneurs.

The government has also promoted geothermal-powered Bitcoin mining, emphasizing sustainability alongside innovation. For investors, the appeal lies in zero taxation on Bitcoin income and the opportunity to be part of a nation writing economic history with digital assets. Despite skepticism from international institutions, El Salvador has firmly positioned itself as a global case study in crypto-driven policy.

United States: Scale and Complexity in One Market

Source: CoinDesk

The United States is a paradox for crypto. On one hand, it suffers from regulatory fragmentation, with agencies like the SEC, CFTC, and state regulators often overlapping or clashing. On the other, it remains the largest and most liquid crypto market in the world.

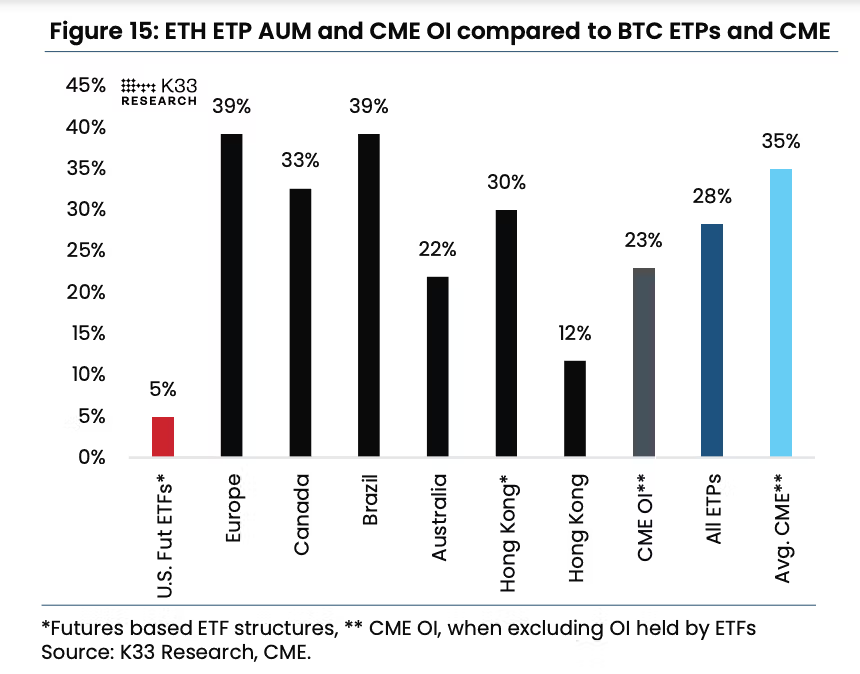

The approval of Bitcoin and Ethereum ETFs has opened the door to institutional adoption on an unprecedented scale. Players such as BlackRock and Fidelity now offer digital asset exposure to mainstream investors. Although tax policies can be complex—distinguishing between short-term and long-term gains—the U.S. continues to lead in mining capacity, startup ecosystems, and investor adoption, making it impossible to overlook.

United Arab Emirates: Dubai’s Crypto Revolution

Source: Tulpartax

The UAE has successfully transformed itself into a global magnet for crypto entrepreneurs. The establishment of VARA in Dubai and ADGM in Abu Dhabi has created clarity around regulation, while free zones provide corporate tax exemptions.

Traders and businesses alike benefit from tax-free crypto transactions, while the country has attracted major exchanges including Binance and Bybit. Local banks like Emirates NBD have started offering crypto-related services, further strengthening its ecosystem. Dubai’s strategic global connectivity—situated between Asia, Europe, and Africa—makes it one of the fastest-growing crypto hubs in 2025.

Estonia: Blockchain in the DNA

Source: The Coin Republic

Estonia’s global reputation as a digital-first nation makes it a natural fit for blockchain innovation. The government offers a flat 20% tax rate, while crypto-friendly banks such as LHV provide smoother access to financial services.

The licensing regime for Virtual Asset Service Providers (VASPs) has become stricter, requiring higher capital reserves, but this has improved the overall quality and trustworthiness of the sector. Estonia continues to invest in blockchain education and workforce training, ensuring long-term sustainability for startups choosing to base themselves there.

Malta: Europe’s Blockchain Island

Malta’s branding as the “Blockchain Island” reflects its early embrace of crypto regulation. While its ecosystem may be smaller than Switzerland or Germany, Malta still provides no capital gains tax on crypto and a flexible corporate tax framework that appeals to entrepreneurs.

Global exchanges such as Binance and OKX once chose Malta as their operational base, and the government continues to encourage blockchain adoption through public and private initiatives. For those seeking an EU-based jurisdiction with a flexible but clear regulatory stance, Malta remains a contender in 2025.

Australia: Expanding Its Asia-Pacific Presence

Source: decrypt

Australia closes the list with a pragmatic approach to regulation and taxation. Its capital gains tax framework applies to crypto, but transactions under AUD 10,000 are exempt, allowing day-to-day use of digital assets.

Major banks, including NAB and ING, support crypto integration, and blockchain is spreading into industries like healthcare, logistics, and supply chains. With thriving communities in Sydney and Melbourne, Australia is cementing its position as a regional hub in the Asia-Pacific.

Comparison Table: Top 10 Crypto-Friendly Countries

| Country | Tax Treatment on Crypto | Regulatory Clarity | Banking Support | Adoption Level | Key Strength |

|---|---|---|---|---|---|

| Switzerland | No capital gains tax | Strong (FINMA, DLT) | Sygnum, SEBA, etc. | High | Stability + CBDCs |

| Singapore | No capital gains tax | Clear (MAS) | Growing support | High | Asia fintech hub |

| Germany | Tax-free after 1 year | Strong (BaFin, MiCA) | Licensed banks | Medium-High | RWAs + investor protection |

| Portugal | Tax-free >365 days | Flexible (EU-aligned) | Limited banks | Medium | Lifestyle + nomad hub |

| El Salvador | Zero Bitcoin tax | Bold, pioneering | National wallet | Growing | Bitcoin as legal tender |

| United States | Complex (short/long-term) | Mixed (SEC, CFTC) | Strong institutional | Very High | Liquidity + ETFs |

| UAE | Tax-free | VARA, ADGM clarity | Emirates NBD, etc. | High | Global hub + free zones |

| Estonia | Flat 20% tax | Strict VASP rules | LHV, TBB | Medium | Digital-first infrastructure |

| Malta | No capital gains tax | “Blockchain Island” | Limited but growing | Medium | EU access + flexibility |

| Australia | Exempt < AUD 10k | Clear VASP rules | NAB, ING, St. George | Medium-High | Asia-Pacific reach |

Conclusion – Top 10 Crypto-Friendly Countries

The Top 10 Crypto-Friendly Countries in 2025 reflect a competitive global landscape where governments compete to attract innovation, capital, and talent. Switzerland, Singapore, and Germany offer maturity and reliability. El Salvador and the UAE push bold new approaches, while Portugal and Malta appeal to digital nomads and startups. Emerging players like Hong Kong, Kazakhstan, and Panama are also gaining momentum.

For investors, entrepreneurs, and traders, the choice of jurisdiction depends on whether the priority is tax savings, regulatory clarity, lifestyle, or market access. What’s clear is that crypto-friendly countries are no longer niche—they’re at the center of the digital economy shaping our global future.