Top 10 crypto scams : Cryptocurrency has entered a new era in 2025. With Bitcoin crossing the $100,000 mark and more institutional adoption than ever before, the digital asset market feels like it’s finally found its place in mainstream finance. But with record highs in market capitalization comes a darker parallel reality: the rise of more sophisticated scams. Fraudsters have always followed the money, and in the borderless, anonymous world of crypto, the opportunities for exploitation are endless.

What’s especially alarming in 2025 is how polished and convincing scams have become. We’re no longer just talking about poorly written phishing emails. Criminals are now deploying AI-powered deepfakes of public figures, sophisticated rug-pull schemes disguised as community projects, and fake trading platforms that look every bit as professional as legitimate exchanges. Whether you’re a day trader, a long-term HODLer, or a complete beginner, these scams can—and do—trap anyone who’s not prepared.

Below, we break down the top 10 crypto scams dominating the space in 2025, explore how they work, and offer practical steps you can take to protect your assets.

Top 10 crypto scams : Phishing Attacks

Source: Graphus

Phishing remains one of the most damaging and persistent threats in crypto. The concept is simple: trick the victim into revealing private credentials—be it login details, recovery phrases, or private keys—by pretending to be a trusted source. But while the idea is old, the execution in 2025 is chillingly advanced. AI now makes it easy to clone entire websites, replicate brand language perfectly, and even generate realistic chat support interactions that appear genuine.

A notable example was the phishing wave that followed the Ledger hardware wallet data breach in 2020. Scammers sent convincing emails directing victims to a “support” site that was, in reality, a trap designed to capture seed phrases. Fast forward to today, and these attacks are more targeted, often arriving through social media DMs, fake browser extensions, or even compromised ad placements in search results.

Prevention: Always type URLs manually rather than clicking links, bookmark official login pages, and use hardware-based 2FA devices like YubiKeys rather than SMS-based codes.

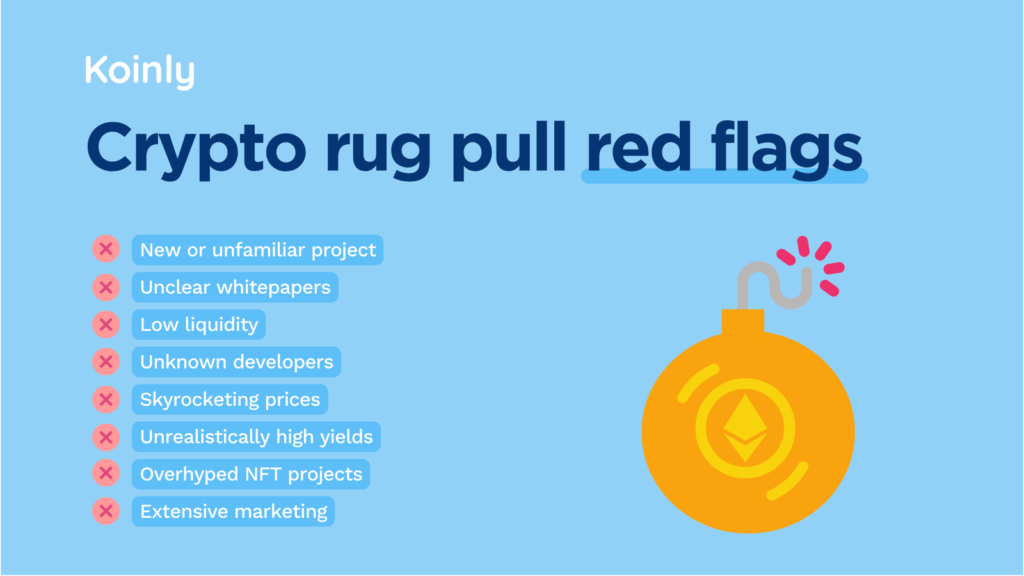

Top 10 crypto scams : Rug Pulls

Source: Koinly

Rug pulls are the crypto version of the exit scam. A project launches, creates hype, and encourages liquidity or token purchases—only for the developers to disappear overnight with the funds. While rug pulls have been a feature of the crypto landscape for years, 2025 has seen them evolve into more sophisticated forms. Many are now tied to meme coins or short-lived DeFi projects, using viral marketing and influencer endorsements to gain credibility quickly.

One major 2025 example was Meteora Token, which went viral on social media before its anonymous creators removed $6 million in liquidity and vanished. With no real project development or locked liquidity, it was a textbook rug pull.

Prevention: Check liquidity lock status on blockchain explorers, confirm the development team’s track record and transparency, and look for reputable smart contract audits before investing.

Top 10 crypto scams : Ponzi Schemes

Source: FinaHukuk

Ponzi schemes are as old as investing itself, but the blockchain has given them a new lease of life. In a crypto Ponzi scheme, early investors are paid returns using the funds of newer investors. These scams often present themselves as “investment platforms” or “automated trading systems” that supposedly generate consistent, high returns regardless of market volatility—a huge red flag.

A disturbing trend in 2025 is the combination of Ponzi structures with romance scams, creating so-called “pig butchering” schemes. Here, scammers build long-term online relationships before persuading their victims to invest in a “sure thing” that’s actually just a fraudulent platform. Losses from these hybrid scams have already topped billions globally this year.

Prevention: Be wary of any investment promising fixed daily or monthly returns, especially in volatile markets. Verify the business model and licensing through financial authorities, and never invest money you can’t afford to lose.

Fake ICOs and Token Launches

Source: CoinTelegraph

Initial Coin Offerings (ICOs) may not dominate headlines like they did during the 2017–2018 boom, but they’re back—reborn in 2025 with AI-generated polish. Fake token launches now come with professional websites, convincing roadmaps, and even fake “team member” profiles on LinkedIn. Scammers will often pay for sponsored articles or influencer coverage to lend legitimacy to their projects.

One telltale sign is the absence of a working product or prototype. These scams rely heavily on hype, FOMO, and exclusivity—offering limited “whitelist” opportunities or using countdown timers to push quick decisions.

Prevention: Cross-verify founder identities, check for working demos or prototypes, and look for partnerships with established blockchain organizations. If a project has no independent audit, treat it as high risk.

Top 10 crypto scams : Pump-and-Dump Schemes

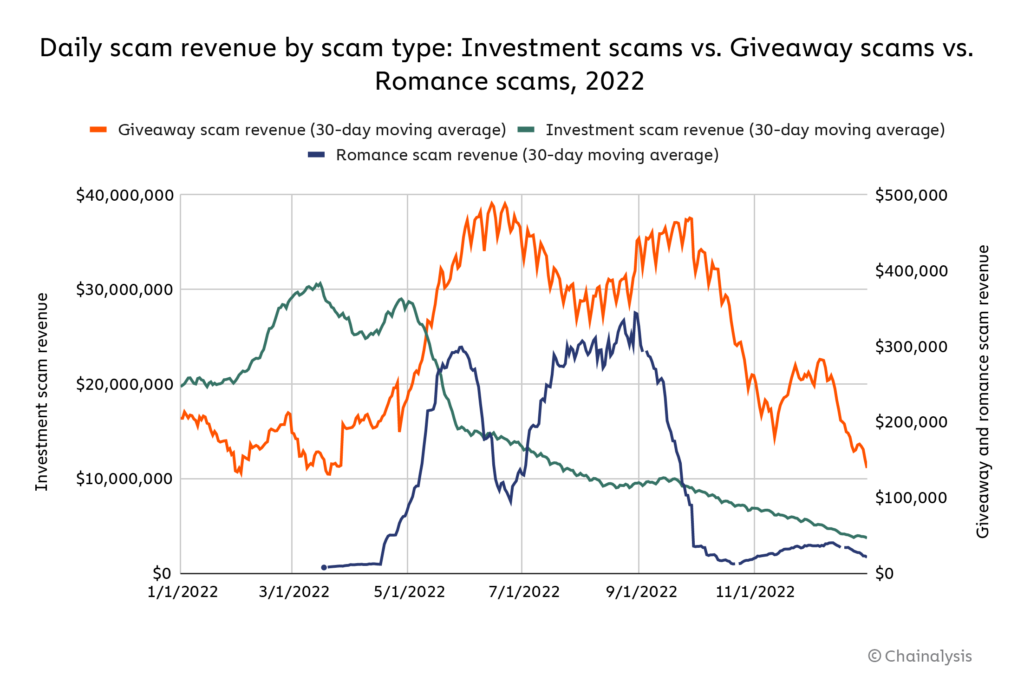

Pump-and-dump scams have been part of penny stock trading for decades, and in crypto, they’re even easier to pull off due to low liquidity in many tokens. Here’s how it works: a group of insiders coordinates to buy large quantities of a coin, driving up its price. Social media hype follows, drawing in unsuspecting buyers. Once the price peaks, the insiders sell off, leaving latecomers with heavy losses.

In 2025, analytics firm Chainalysis reported that nearly 99% of tokens launched on Pump.fun, a Solana-based platform, were linked to fraudulent activity. Many of these tokens saw meteoric rises followed by crashes within hours.

Prevention: Avoid investing in tokens experiencing sudden, unexplained price surges, especially if the only “news” is social media chatter. Research the token’s trading history and liquidity before buying in.

Romance Scams

Source: Chainanalysis

Romance scams target more than just the heart—they aim for the wallet too. In the crypto variant, scammers meet potential victims through dating apps or social media, cultivate a relationship over weeks or months, and then introduce a “shared investment” opportunity.

In early 2025, a Maryland woman lost $2.5 million after a months-long online relationship ended with her transferring funds to a fake trading platform. By the time she realized she’d been scammed, the platform and her “partner” had disappeared.

Prevention: Keep personal relationships and financial decisions completely separate. Be suspicious of anyone who suggests secrecy around an investment or pushes you toward platforms you can’t verify independently.

Fake Celebrity Endorsements

Source: FMA

Deepfake technology has made fake celebrity endorsements frighteningly convincing. In these scams, AI-generated videos or voice clips feature high-profile figures “recommending” a coin or a giveaway. Elon Musk remains the most frequently impersonated figure, but 2025 has also seen fake endorsements from well-known finance influencers and even politicians.

Prevention: Always confirm promotions via the celebrity’s verified social media or official website. No legitimate public figure will ever ask for direct wallet transfers or promise guaranteed returns.

Social Media Impersonation and Giveaways

Scammers have mastered the art of blending in on platforms like Twitter (X), Discord, and Telegram. They impersonate influencers, exchanges, or even wallet providers, offering giveaways with a simple condition: send them a small amount of crypto, and they’ll send back more. Of course, the return never happens.

Others pose as “support staff” in community channels, claiming they can fix wallet or transaction issues—but their real aim is to extract your private keys.

Prevention: Remember that legitimate giveaways never require you to send money first. If you need support, only contact teams through official, verified channels.

Blackmail and Sextortion

Source: excellence it

These scams play on fear rather than greed. Scammers send threatening emails claiming to have hacked your webcam or stolen personal data, and demand crypto payment to prevent the release of compromising material. In most cases, they have nothing, but the threat is enough to make some victims pay.

Prevention: Do not respond to such messages. Update your passwords, enable security software, and report the incident to authorities.

Fake Tech Support

Source: Kaspersky

Fake tech support scams are a growing threat in 2025. Fraudsters set up websites with domain names similar to legitimate wallet or exchange support pages, often boosted by paid ads to appear at the top of search results. Victims call the listed numbers or fill out “support forms,” unknowingly handing over sensitive wallet data or granting remote access to their computers.

Prevention: Always access support through direct links from the official app or hardware wallet documentation. No legitimate support team will ever ask for your private keys or seed phrase.

Quick Reference Table — Top 10 Crypto Scams in 2025

| Scam Type | Method | 2025 Example | Prevention |

|---|---|---|---|

| Phishing | Fake logins/links | Ledger breach phishing | Use hardware 2FA, manual URLs |

| Rug Pull | Remove liquidity after hype | Meteora Token scam | Check liquidity lock & audits |

| Ponzi | Pay old investors with new | Romance-linked Ponzi | Avoid guaranteed returns |

| Fake ICO | Fake project fundraising | AI-generated ICOs | Verify founders & prototypes |

| Pump-and-Dump | Price pump then dump | Pump.fun tokens fraud | Avoid hype buying |

| Romance Scam | Emotional manipulation | Maryland Tinder case | Keep finance separate |

| Fake Celebrity | Deepfake promotions | Musk AI giveaways | Confirm via official accounts |

| Social Media Impersonation | Fake giveaways/support | Discord wallet drains | No upfront crypto |

| Blackmail/Sextortion | Threats for payment | Webcam hack scam | Ignore & secure devices |

| Fake Tech Support | Fake help lines/sites | Ledger fake numbers | Use official support only |

Final Thoughts

The top 10 crypto scams of 2025 reveal a simple truth: as the market matures, fraudsters will only get better at exploiting it. They’ll adapt, innovate, and use every tool available—including AI—to make their schemes more believable. The only real defense is awareness and vigilance. Never rush into an investment, always verify before you trust, and remember that in crypto, skepticism isn’t just wise—it’s essential for survival.