Top 10 Crypto Security Breaches: The year 2025 has once again highlighted the delicate balance between blockchain innovation and the persistent threats that shadow it. While the crypto ecosystem has matured in terms of adoption, regulation, and institutional involvement, crypto security breaches remain a recurring theme—sometimes even outpacing previous years in scale and complexity. Chainalysis reports that losses from hacks have already exceeded $2.17 billion by mid-year, with a single incident accounting for nearly three-quarters of that amount.

What makes these breaches alarming is not only the money lost but the new patterns of attack. From highly technical DeFi exploits to old-fashioned phishing scams and even physical coercion, attackers are proving that vulnerabilities exist across every layer of the industry. Documenting these incidents, and the lessons they bring, is critical to strengthening resilience in a space that aspires to become a cornerstone of global finance.

1. Bybit Exchange Hack – Top 10 Crypto Security Breaches : A Historic $1.5 Billion Loss

Source: Cointelegraph

The Bybit hack has already earned a place in history as the single largest theft in the crypto industry to date. Attackers managed to compromise a wallet system and siphon out an astonishing $1.5 billion before the platform could respond. While investigations are still ongoing, preliminary reports point to a sophisticated mix of compromised private keys and exploitation of custodial vulnerabilities.

The aftermath of this hack sent shockwaves through the industry, triggering mass withdrawals from centralized exchanges as users questioned how even the most established platforms could lose such an amount. The lesson is painful but clear: exchanges must adopt far more robust custody models, with multi-signature protocols, distributed cold storage, and real-time anomaly detection that can halt suspicious withdrawals within seconds. Trust, once lost at this scale, is far harder to rebuild.

2. FixedFloat Exploit – $26.1 Million Vanished from Liquidity Pools

FixedFloat, a hybrid swap platform that operates at the intersection of centralized and decentralized systems, suffered a devastating exploit worth $26.1 million. The attackers exploited vulnerabilities within automated liquidity pools and smart contract logic, draining funds before security measures could react.

This breach underscores the risks associated with automated systems that handle significant capital without ongoing supervision. It highlights that one-off audits are not enough. DeFi protocols must introduce constant stress-testing, deploy monitoring systems that detect irregular contract behavior, and adopt circuit-breaker mechanisms that can freeze liquidity pools in the event of a suspicious drain. Without such protections, every liquidity pool is a ticking time bomb.

3. Gamma Strategies Breach – $3.4 Million Lost in DeFi Vaults

Source: The Block

Gamma Strategies, a lesser-known DeFi project focused on liquidity management, faced a $3.4 million breach when attackers exploited vulnerabilities within its vault system. Though relatively small compared to headline-grabbing billion-dollar heists, this incident is a reminder that even specialized protocols managing niche financial strategies are prime targets for attackers.

The lesson here is about scope: security must be universal. Major protocols often receive extensive audits, but smaller or more specialized projects are no less important. Every vault, lending service, or automated strategy is effectively an open invitation for hackers if protections aren’t comprehensive. As DeFi diversifies, attackers will continue to target projects that underestimate their visibility.

4. Wrench Attacks – When Physical Threats Bypass Digital Defenses

Source: Fortune Crypto

2025 has seen a disturbing increase in so-called “wrench attacks”, where individuals are physically coerced into handing over private keys, recovery phrases, or direct access to wallets. These attacks highlight that the threat landscape is no longer confined to code. As crypto wealth grows, so too does the risk of real-world targeting.

Unlike technical breaches, wrench attacks demand a different kind of response. Secure custody providers must incorporate features such as emergency kill-switches, delayed withdrawals, and decoy wallets. At the same time, individuals must be educated about physical security, discretion, and safe practices for storing recovery information. It is a sobering reminder that crypto’s promise of “being your own bank” also comes with personal risks.

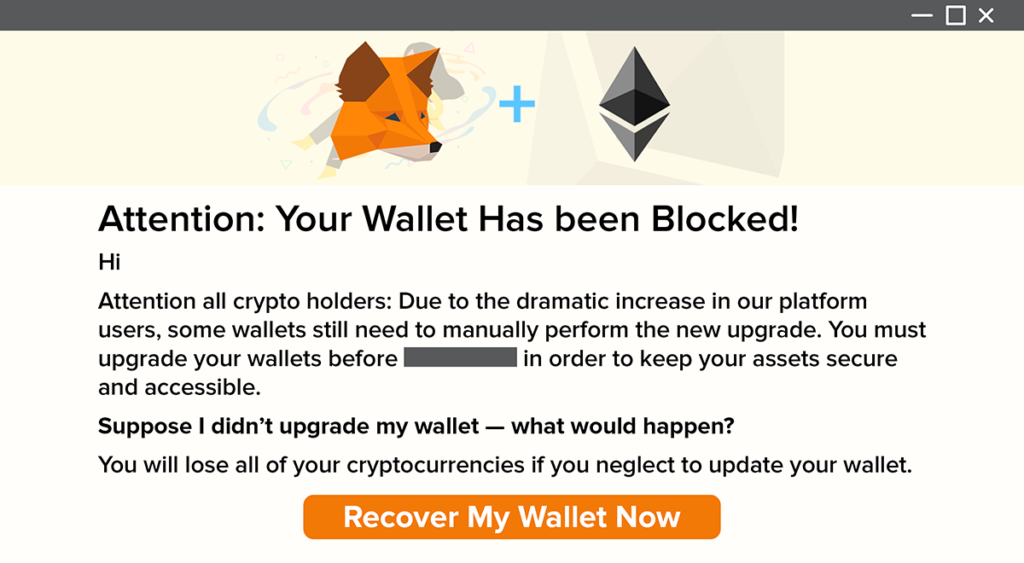

5. Wallet Phishing Epidemics – AI-Driven Social Engineering

Source: FTC

Phishing may be the oldest trick in the cybercriminal handbook, but 2025 has proven that it is evolving at alarming speed. Hackers are now using artificial intelligence to create highly convincing phishing campaigns that mimic trusted wallet providers, exchanges, or even friends and colleagues. According to industry reports, more than 23% of this year’s breaches are directly linked to wallet compromise via phishing.

The lesson here goes beyond technical defenses. Education and awareness are critical. Hardware wallets, user-friendly anti-phishing tools, and browser-level scam detection are necessary safeguards. More importantly, users must be consistently trained to question links, verify domains, and understand that human psychology remains the softest target for attackers.

6. Cross-Chain Bridge Exploits – The Achilles’ Heel of DeFi

Source: 1 inch

Cross-chain bridges remain among the most vulnerable components in the crypto ecosystem. In 2025, multiple incidents of bridge exploits resulted in significant losses, echoing the infamous Wormhole hack of 2022. These attacks exploit weak consensus mechanisms, validator collusion, or poorly secured cross-chain contracts.

The repeated failures of bridges illustrate a structural flaw in the pursuit of interoperability. Until industry-wide standards and cross-chain security frameworks are developed, bridges will continue to act as open invitations to hackers. The push for scalability and multi-chain integration must be balanced with an uncompromising commitment to security protocols that are uniform across ecosystems.

7. Insider Threats – Top 10 Crypto Security Breaches : Breaches from Within

Source: Helpnetsecurity

While most attention focuses on external hackers, 2025 has seen an uptick in breaches caused by insiders—employees or contractors misusing privileged access. These cases are often the hardest to detect because they involve trusted personnel bypassing or disabling safeguards.

The lesson is governance. Platforms must implement role-based access controls, monitor every privileged action, and rotate staff permissions regularly. Independent third-party audits are also essential to ensure that insiders cannot conceal malicious behavior. No amount of firewalls or encryption can protect a platform if its weakest link lies within its own team.

8. Sophisticated Laundering Mechanisms – $900 Million Washed Clean

Hackers in 2025 are not just stealing funds—they are also finding increasingly complex ways to launder them. Reports estimate that nearly $900 million has been successfully laundered through a combination of exchanges, mixers, and decentralized platforms this year alone. These criminals use rapid cross-chain transfers, privacy coins, and decentralized services to obfuscate trails before regulators can respond.

The lesson here is about scale. Anti-money laundering (AML) measures can no longer remain siloed within single jurisdictions. Regulators, exchanges, and blockchain analytics firms must cooperate internationally, using AI-driven monitoring tools to flag suspicious patterns in real time. Without global coordination, stolen funds will continue to slip through fragmented oversight.

9. Lazarus Group – Nation-State Hacking Continues

The North Korean-linked Lazarus Group continues to dominate headlines in 2025, orchestrating sophisticated attacks against both centralized exchanges and DeFi platforms. These state-sponsored operations involve advanced malware, social engineering, and coordinated laundering operations that rival any corporate cybersecurity team.

The persistence of nation-state hacking shows that crypto is now a geopolitical battlefield. Defending against such actors requires intelligence sharing across borders, greater collaboration between private firms and governments, and an understanding that no single exchange or protocol can withstand these threats alone.

10. Long-Tail Small-Scale Hacks – Death by a Thousand Cuts

While billion-dollar hacks dominate news cycles, dozens of smaller breaches—often under $5 million each—collectively represent hundreds of millions in losses. These “long-tail” incidents usually target smaller startups, emerging protocols, or lightly secured wallet applications.

The lesson here is universal: no project is too small to warrant serious security investment. Startups must prioritize security from day one, rather than waiting until they scale. For users, it means exercising caution when engaging with lesser-known apps, even if they promise innovative features or higher yields.

Key Lessons from 2025 – Top 10 Crypto Security Breaches

The overarching lessons of 2025’s security breaches are that crypto security is both a technical and a human challenge. Centralized exchanges need continuous audits and stronger custody solutions. DeFi projects must employ layered security, bug bounties, and insurance protections. Wallets must prioritize phishing resistance and accessible cold storage. Most importantly, regulators, developers, and users must work together in building an ecosystem where security is non-negotiable.

Conclusion – Top 10 Crypto Security Breaches

The Top 10 Crypto Security Breaches of 2025 reveal a troubling but essential truth: the greater the adoption of crypto, the higher the stakes for its security. Billions have been lost this year through exchange breaches, DeFi exploits, phishing epidemics, and even physical threats. Yet each loss is also a lesson.

If the industry embraces these lessons—by adopting stronger standards, educating users, and fostering global cooperation—2025 could ultimately be remembered not just as a year of historic breaches, but as the turning point where security became the foundation of crypto’s next chapter.