The cryptocurrency market in 2025 is showing signs of maturity. Speculative hype is giving way to innovations with practical applications, while institutions are playing a larger role in shaping the ecosystem. Regulatory clarity is improving, technology is advancing, and blockchain is finding its place alongside traditional finance. Here’s a breakdown of the top 10 crypto trends shaping the year — along with a quick-reference table summarizing their impact.

Quick Overview Table: Top 10 Crypto Trends 2025

| Trend | Adoption Level | Key Drivers | Potential Risks |

|---|---|---|---|

| Regulatory Evolution | High | MiCA in EU, U.S./Asia policy updates | Over-regulation may slow small startups |

| Institutional Adoption | High | ETFs, corporate treasuries, bank integration | Tighter link to traditional market volatility |

| DeFi–TradFi Convergence | Medium–High | Tokenized bonds, institutional DeFi | Compliance challenges |

| RWA Tokenization | Medium–High | Fractional ownership, liquidity | Valuation and legal enforcement issues |

| AI–Blockchain Integration | Medium | Decentralized AI markets, AI trading | Data privacy and ethics concerns |

| Bitcoin Post-Halving Era | High | Scarcity narrative, corporate reserves | Price volatility |

| Ethereum Scaling | High | Layer 2 networks, staking yields | Competition from newer blockchains |

| NFT Utility Shift | Medium | Gaming, loyalty programs, identity | Market fatigue |

| Memecoin Evolution | Medium | Social media influence, gamified investing | Extreme volatility |

| Cross-Chain Interoperability | High | LayerZero, Wormhole, Cosmos | Security of bridging protocols |

1. Regulatory Evolution Gains Momentum

Source: idnow

Regulatory clarity is one of 2025’s defining shifts. The European Union’s MiCA framework is setting the pace for global policy, while the U.S., Japan, and Singapore refine their own rules. Clearer KYC and AML requirements are standardizing entry points for investors. For institutions, this means confidence; for smaller projects, it raises compliance costs but improves overall credibility in the market.

2. Institutional Adoption Becomes Mainstream

This year, crypto has moved beyond hedge funds into the portfolios of pension funds, insurers, and major corporations. ETFs for Bitcoin and Ethereum have opened the door for large-scale participation. Banks and asset managers are integrating crypto desks into traditional services, boosting liquidity while also syncing crypto more closely to broader market movements.

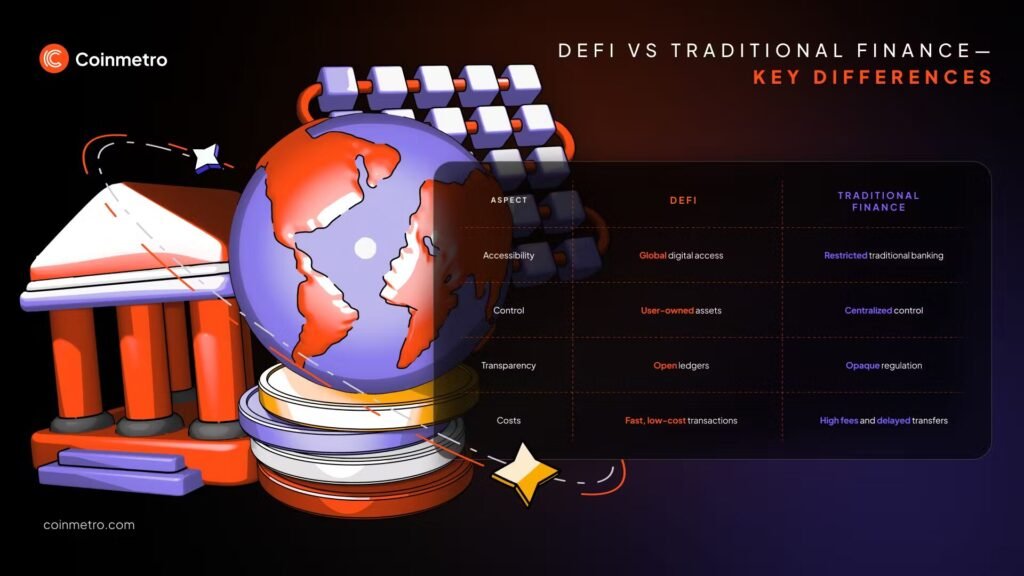

3. DeFi and Traditional Finance Start to Blend

Source: CoinMetro

The gap between DeFi and legacy finance is narrowing. Tokenized government bonds and on-chain equities are attracting regulated institutional players. Retail users benefit from faster settlement and global access, while cross-chain DeFi solutions make navigating multiple blockchains effortless.

4. Real-World Asset Tokenization Expands

Source: WeAlwin

Fractional ownership of real estate, commodities, fine art, and carbon credits is no longer a niche concept. In 2025, RWA tokenization is being adopted by both startups and corporations seeking liquidity and efficiency. The ability to trade high-value assets 24/7 is reshaping investment models.

5. AI–Blockchain Integration Takes Shape

Source: Coinmetro

AI-powered trading bots, fraud detection, and decentralized AI marketplaces are emerging as a significant crypto trend. Blockchain ensures data integrity, while AI enhances decision-making. Tokenized AI models are also appearing, sparking discussions about intellectual property rights and ethical oversight.

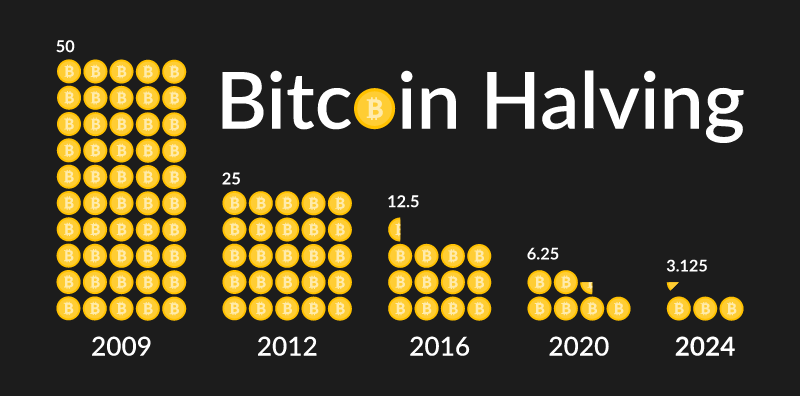

6. Bitcoin’s Institutional Phase Post-Halving

Source: axi

With the April 2024 halving reducing Bitcoin’s block rewards, scarcity narratives have strengthened. Corporations are adding BTC to their reserves, and Bitcoin Layer 2 solutions like the Lightning Network are expanding use cases beyond store-of-value. Institutions are leaning toward long-term holding strategies, adding stability to market flows.

7. Top 10 Crypto Trends: Ethereum Scaling and Ecosystem Growth

Source: X

Ethereum’s stronghold on DeFi and NFTs continues, but its growth is now largely driven by Layer 2 networks like Arbitrum, Optimism, and Base. These scaling solutions make transactions cheaper and faster, while increased staking participation provides attractive yields for long-term holders.

8. Top 10 Crypto Trends : NFTs Move Beyond Collectibles

Source: Cryptodnes

NFTs are evolving into functional assets — acting as access passes, loyalty rewards, in-game assets, and verified identities. Big brands are experimenting with NFT-driven customer engagement, while integration with RWA tokenization adds tangible value to digital ownership.

9. Top 10 Crypto Trends : Memecoins Mature (Slightly)

Source: Altorise

While memecoins still rely heavily on viral momentum, 2025 is seeing experiments with genuine utility — from gaming integration to charitable fundraising. They remain speculative and volatile, but community-driven development is helping some projects build staying power.

10. Top 10 Crypto Trends : Cross-Chain Interoperability Becomes Essential

Source: Helalabs

Multi-chain wallets, seamless swaps, and interoperability protocols like LayerZero, Wormhole, and Cosmos are dissolving the barriers between blockchains. This enhances liquidity, broadens user choice, and creates a more connected Web3 ecosystem.

Conclusion – Top 10 Crypto Trends

The top 10 crypto trends of 2025 signal a market in transition — more regulated, more integrated with traditional finance, and increasingly focused on real-world utility. As institutional players deepen their involvement and technologies like AI and cross-chain solutions mature, crypto is stepping further into the global financial mainstream. The coming years will test whether these advancements can maintain the decentralization and innovation that made blockchain unique in the first place.