Over the past few years, decentralized finance has evolved from a niche blockchain experiment into an influential segment of the global financial landscape. In 2025, the Top 10 DeFi Projects are not just surviving — they’re expanding into new use cases, integrating real-world assets, and competing for both retail and institutional adoption.

These platforms represent the core pillars of DeFi: decentralized exchanges, lending protocols, staking solutions, and yield aggregators. While each operates differently, they share a commitment to open access, transparent governance, and innovation in financial services.

Uniswap (UNI)

Source: CoinCentral

Uniswap’s role as a pioneer in the automated market maker (AMM) model is well established. It continues to dominate the decentralized exchange space with deep liquidity and an expanding cross-chain presence.

The upcoming Uniswap v4 introduces features like “hooks” for customized trading logic and reduced gas costs, which could redefine user experience on the platform. Even with rising competition, its brand recognition and developer ecosystem keep it at the forefront.

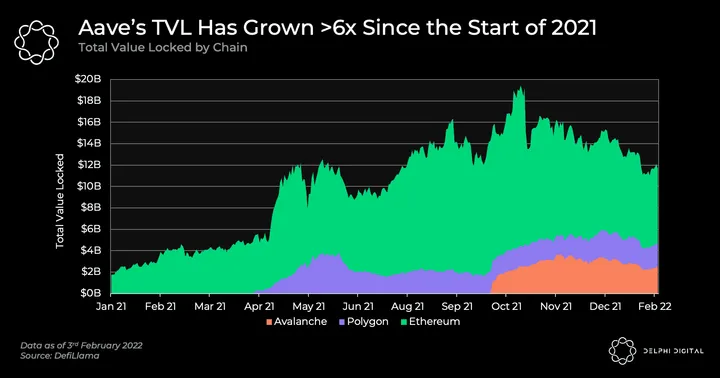

Top 10 DeFi Projects : Aave (AAVE)

Source: delphidigital

Aave has become synonymous with decentralized lending. Its protocol allows users to earn interest on deposits and borrow assets without intermediaries, using a transparent interest rate model that responds to market demand.

The addition of flash loans — a feature unique to DeFi — has fueled countless arbitrage and liquidation strategies. Multi-chain deployment ensures Aave remains accessible to a wide audience, though it faces the challenge of scaling responsibly in a shifting regulatory climate.

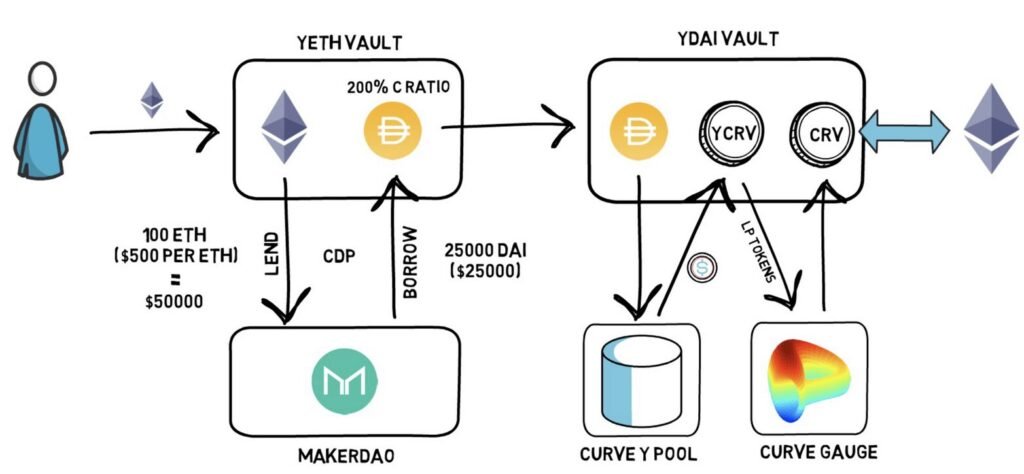

MakerDAO (DAI)

Source: 101BlockChain

MakerDAO underpins one of the most important stablecoins in DeFi, DAI. Pegged to the US dollar and governed by MKR token holders, DAI offers stability in a sector often marked by volatility.

Its integration across lending markets, payment platforms, and DeFi apps has cemented its status as a utility cornerstone. Yet, as global scrutiny on stablecoins intensifies, MakerDAO will need to navigate compliance while protecting decentralization.

Top 10 DeFi Projects : Curve Finance (CRV)

Curve specializes in low-slippage swaps for assets with similar value, such as stablecoins and wrapped tokens. This design has made it indispensable for stablecoin liquidity and yield farming strategies.

Its DAO-driven governance model and partnerships with other DeFi protocols reinforce its influence, but as AMM competition grows, Curve must innovate to sustain its market edge.

Top 10 DeFi Projects : Lido Finance (LDO)

Source: Coinsutra

Lido is the leader in liquid staking, offering users the ability to stake Ethereum and other proof-of-stake assets while retaining liquidity through derivative tokens like stETH.

This dual utility — earning staking rewards while using staked assets elsewhere — has made Lido a cornerstone of DeFi’s yield economy. However, its scale has sparked debates about validator centralization, a topic likely to remain in focus.

Top 10 DeFi Projects : Synthetix (SNX)

Source: Xspring Digital

Synthetix brings derivatives to DeFi through synthetic assets that track the value of traditional instruments like currencies, commodities, and indices. This opens on-chain access to global markets without custodial risks.

Recent integrations with perpetual trading platforms have expanded liquidity and trading volume, keeping Synthetix relevant in a growing derivatives market.

Top 10 DeFi Projects : Balancer (BAL)

Source: Boxmining

Balancer offers a flexible AMM design that allows multiple tokens and custom weighting in liquidity pools. This makes it particularly attractive for index-like portfolio structures and dynamic market strategies.

Its compatibility with other DeFi protocols enhances utility, although the complexity of its pools means it primarily appeals to more experienced DeFi participants.

Compound (COMP)

Compound set the template for algorithmic money markets, with its interest rate model adjusting in real time based on supply and demand. The platform remains a trusted option for lending and borrowing in the Ethereum ecosystem.

Its governance token, COMP, enables community-driven decision-making, and the protocol continues to prioritize security and predictability in a rapidly evolving space.

Yearn Finance (YFI)

Source: Cryptonary

Yearn Finance automates the hunt for yield through its Vaults, which deploy user deposits across multiple protocols according to predefined strategies. It is designed for users who want exposure to DeFi returns without active management.

While yield levels have narrowed, Yearn’s active governance and constant strategy development keep it competitive.

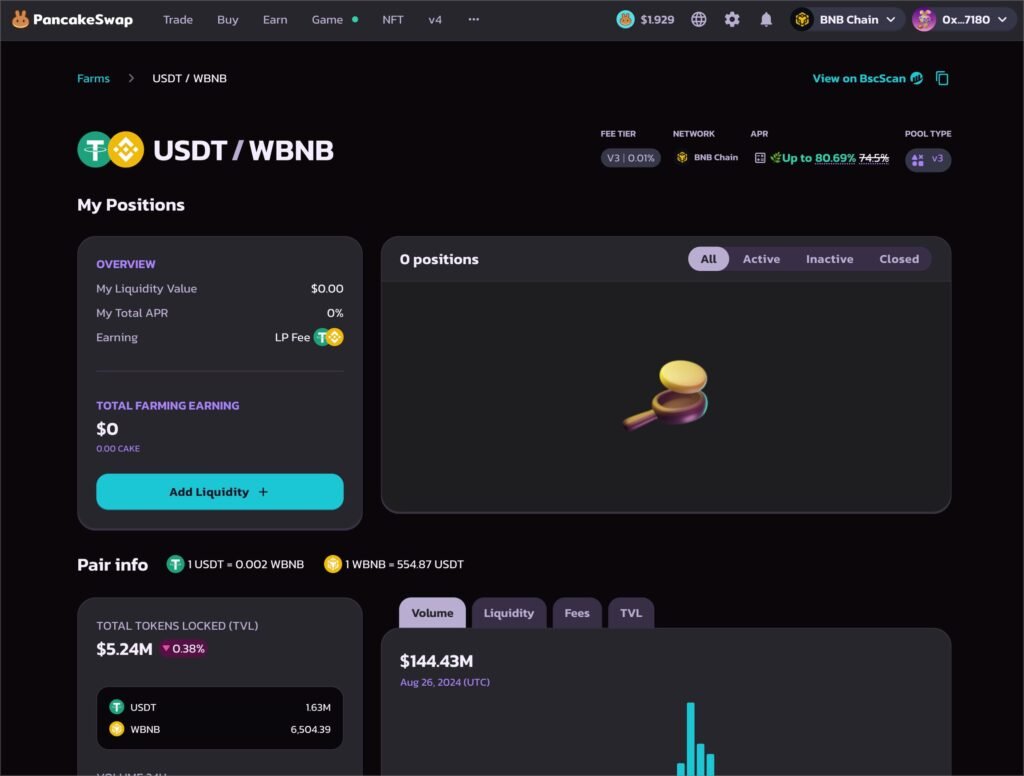

PancakeSwap (CAKE)

Source: Pancakeswaps

As Binance Smart Chain’s most popular DEX, PancakeSwap offers low-cost trading, liquidity farming, and NFT features. Its appeal lies in accessibility — low fees make it an easy entry point for retail users.

Although similar in concept to Ethereum-based DEXs, PancakeSwap’s rapid feature rollout and active community give it staying power in a fast-moving market.

At-a-Glance: Top 10 DeFi Projects in 2025

| Project | Launch Year | Main Function | TVL (Latest) | Governance Token | Chain Support | Standout Feature |

|---|---|---|---|---|---|---|

| Uniswap | 2018 | AMM DEX | High | UNI | Multi-chain | Deep liquidity |

| Aave | 2020 | Lending/Borrowing | High | AAVE | Multi-chain | Flash loans |

| MakerDAO | 2017 | Stablecoin | High | MKR | Ethereum-based | Decentralized peg |

| Curve Finance | 2020 | Stable swaps | High | CRV | Multi-chain | Low slippage |

| Lido Finance | 2020 | Liquid staking | High | LDO | Multi-chain | stETH liquidity |

| Synthetix | 2018 | Synthetic assets | Medium | SNX | Ethereum & L2 | On-chain derivatives |

| Balancer | 2020 | Multi-token AMM | Medium | BAL | Multi-chain | Flexible pools |

| Compound | 2018 | Lending/Borrowing | Medium | COMP | Ethereum-based | Dynamic rates |

| Yearn Finance | 2020 | Yield aggregator | Medium | YFI | Multi-chain | Automated yield |

| PancakeSwap | 2020 | DEX + farming | High | CAKE | BSC | Low trading fees |

What’s Driving DeFi in 2025

- Cross-chain integration is becoming a must-have, with top platforms operating on multiple blockchains.

- Real-world asset tokenization is bringing bonds, real estate, and commodities into DeFi portfolios.

- Liquid staking growth is reshaping yield strategies across ecosystems.

- Protocol-level security upgrades are raising trust levels for institutional adoption.

- Stablecoin policy shifts are pushing projects toward compliance-ready frameworks.

Conclusion

The Top 10 DeFi Projects of 2025 show that decentralized finance is maturing into a sophisticated, multi-layered ecosystem. These platforms are defining how blockchain can support lending, trading, and wealth generation at a global scale.

As adoption expands, the real challenge will be balancing growth, security, and decentralization — a balance that will determine which of today’s leaders remain relevant in the years to come.