Top 10 Regulatory Trends : In the space of a decade, crypto has shifted from a fringe experiment to a trillion-dollar industry at the heart of global finance. But with that growth comes scrutiny. In 2025, governments and regulators are no longer asking if crypto should be regulated—they’re deciding how.

The year marks a decisive point. Stablecoins are on the radar of central banks, decentralized finance is no longer left unchecked, and frameworks like the EU’s MiCA regulation are setting new precedents. These top 10 regulatory trends show how the rules of the game are changing—and what that means for investors, businesses, and users.

1. Global Coordination Gains Momentum

Source: Daily Sabah

The crypto market may be borderless, but regulation has always been fragmented. In 2025, the IMF and Financial Stability Board (FSB) are pushing harder than ever for global alignment. The aim is to harmonize rules on stablecoins, AML enforcement, and systemic risk.

While regional differences remain, especially between the U.S., Europe, and Asia, the direction is clear: international cooperation is no longer optional if crypto is to mature.

2. Top 10 Regulatory Trends : U.S. Regulation Moves Toward Clarity

Source: Shelly Palmer

The United States has long been accused of “regulating by enforcement.” That approach is shifting in 2025, with Congress actively debating bills like the Digital Asset Market Structure Act. Executive guidance is also shaping how agencies approach digital assets.

The rivalry between the SEC and CFTC hasn’t fully resolved, but progress toward a unified framework is underway. For U.S. markets, clearer oversight could unlock deeper institutional participation.

3. Top 10 Regulatory Trends : MiCA Sets the Tone for Europe

The European Union has taken a bold step with the rollout of the Markets in Crypto-Assets Regulation (MiCA). The framework introduces licensing requirements, stricter consumer protections, and standardized rules across member states.

For the EU, this provides legal certainty. For the world, MiCA acts as a reference point. Countries in Asia, Africa, and the Americas are watching closely to see how the rollout affects adoption, compliance costs, and innovation.

4. Stablecoin Oversight Tightens, CBDCs Rise

Source: Vegavid

Stablecoins—once treated as niche—are now central to financial debate. Regulators demand full reserve backing, independent audits, and transparent disclosures. The concern is systemic risk, given stablecoins’ growing role in payments and trading.

Meanwhile, central banks are accelerating CBDC projects. From China’s digital yuan to the EU’s digital euro, these state-backed currencies are entering live trials. How they coexist with—or compete against—private stablecoins remains one of 2025’s defining questions.

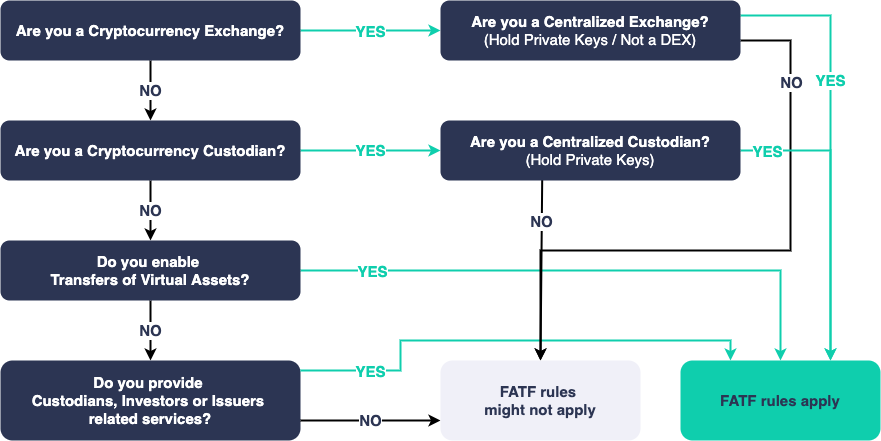

5. AML and the Travel Rule Go Global

Source: KYC Chain

The fight against money laundering is reshaping the crypto sector. The FATF Travel Rule—which requires detailed information on crypto transfers—is now being implemented across more countries.

Exchanges face heavier compliance obligations, while DeFi platforms are under pressure to explore identity checks without undermining decentralization. The result may be a reshaping of the industry, as smaller firms struggle to adapt and larger players strengthen their dominance.

6. Top 10 Regulatory Trends : DeFi Faces Its Regulatory Test

Source: Rapid Innovation

Decentralized finance is no longer flying under the radar. In 2025, regulators are asking how DeFi platforms can comply with KYC, AML, and audit requirements. Some regions are proposing mandatory code audits, while others target the developers and governance structures behind protocols.

The question remains: can DeFi remain truly decentralized while being pulled into regulatory frameworks? Experiments with “responsible DeFi” initiatives are underway, but the balance is fragile.

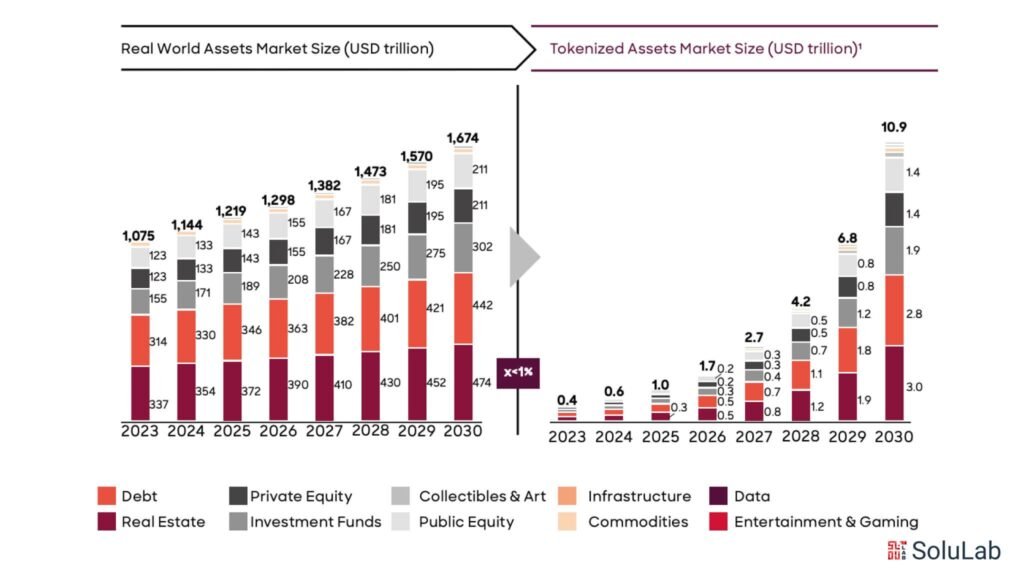

7. Top 10 Regulatory Trends: NFTs and Tokenization in the Spotlight

Source: Solulab

NFTs are evolving beyond digital art into instruments tied to finance and ownership. Regulators are examining whether certain NFTs should be treated as securities, especially when linked to revenue or profit-sharing.

At the same time, the tokenization of real-world assets (RWAs) such as real estate, commodities, and bonds is accelerating. This forces regulators to modernize traditional securities laws while also addressing copyright, tax, and consumer protection concerns for digital assets.

8. Taxation Rules Become Unavoidable

Source: Action Law

Gone are the days when crypto taxes could be overlooked. In 2025, new rules across the U.S., UK, and EU are imposing stricter tax reporting obligations for both individuals and institutions.

Exchanges are being required to integrate reporting tools directly into their platforms, making compliance easier for users but leaving little room for evasion. International cooperation is expanding, meaning tax authorities now share crypto-related data across borders.

9. Security and Consumer Protection Take Priority

Source: Linkedin

Billions lost to hacks and fraud have made cybersecurity a regulatory priority. Licensed exchanges must now meet stricter standards for insurance, audits, and user compensation.

Beyond hacks, consumer protection is broadening: clearer disclosures, mandatory risk warnings, and stronger fraud prevention programs are being mandated. Regulatory sandboxes are still offered, but the expectation is that even experimental projects must not put users at risk.

10. ESG Standards Shape the Future of Mining

Source: The Conversation

Environmental, Social, and Governance (ESG) concerns are reshaping the regulatory agenda. The EU is leading efforts to enforce sustainability reporting for mining operations, while regions like North America are offering incentives for renewable-powered crypto mining.

For investors, ESG has become a critical filter. Green projects are attracting more institutional capital, while proof-of-work chains face increasing pressure to demonstrate progress on emissions.

Conclusion

The top 10 regulatory trends in crypto for 2025 paint a picture of a sector entering its regulated adulthood. From MiCA in Europe to stablecoin laws, DeFi compliance, and ESG mandates, the rules being written today will shape how digital assets integrate into global finance tomorrow.

The trade-off is clear: greater oversight may limit some freedoms but will also bring legitimacy, institutional trust, and long-term stability. For crypto to thrive in 2025 and beyond, adapting to this new regulatory environment isn’t just wise—it’s inevitable.