TOP 10 Risks and Threats : By 2025, the crypto sector has matured into a trillion-dollar ecosystem. Yet with greater visibility comes greater risk. Governments, hackers, and financial institutions are all paying closer attention — and their actions will shape the industry’s survival.

The following TOP 10 Risks and Threats outline the dangers looming over digital assets this year, touching on regulation, cybersecurity, environmental challenges, and public trust.

1. Intensifying Regulatory Crackdowns

Governments are no longer watching from the sidelines. In 2025, more countries have rolled out targeted crypto laws, ranging from strict licensing to transaction limits. While regulation provides clarity, it also threatens innovation by restricting certain activities.

Investors and businesses must remain adaptable — especially in regions where legal frameworks are shifting rapidly.

2. AML and KYC Enforcement

Source: Flagright

Crypto exchanges and DeFi platforms are under closer surveillance for compliance failures. Regulators are prioritizing Anti-Money Laundering (AML) and Know Your Customer (KYC) enforcement, with heavy penalties for violators.

This means exchanges without robust compliance systems risk closure, damaging both liquidity and user trust.

3. Cyberattacks on Exchanges and Wallets

Source: Bloxbytes

Hackers continue to innovate. AI-powered attacks, phishing, and ransomware are increasingly common, while DeFi exploits remain a costly problem. Billions have already been drained from platforms through vulnerabilities in 2024–2025.

No matter how advanced defenses become, the cat-and-mouse game between exchanges and cybercriminals is far from over.

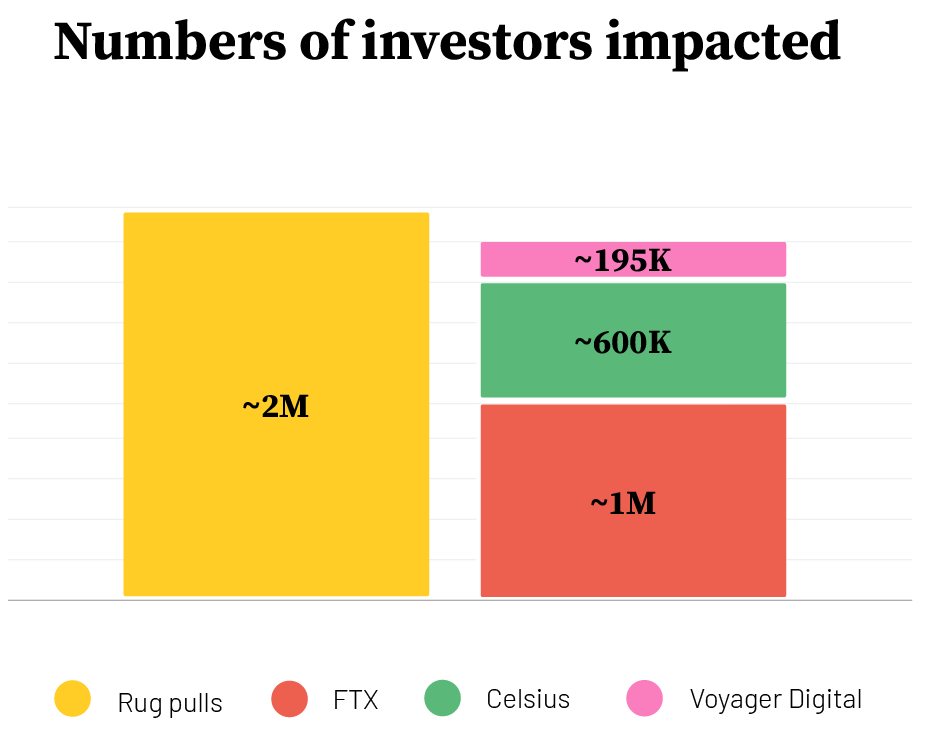

4. Rising Scams and Rug Pulls

Source: SOLIDUS LABS

Fraudulent projects have become more polished, making it harder for average investors to spot the red flags. Pump-and-dump schemes, fake NFTs, and rug pulls still dominate headlines.

The crypto community faces an urgent need for better investor education and independent audits to restore confidence.

5. Stablecoin Fragility and Crash Risks

Source: boldergroup

Stablecoins are the backbone of DeFi — but their stability is not guaranteed. Questions about reserve transparency continue to shadow fiat-backed stablecoins, while algorithmic stablecoins remain vulnerable to sharp market moves.

A sudden stablecoin collapse could destabilize lending pools, DEX trading, and the wider crypto ecosystem.

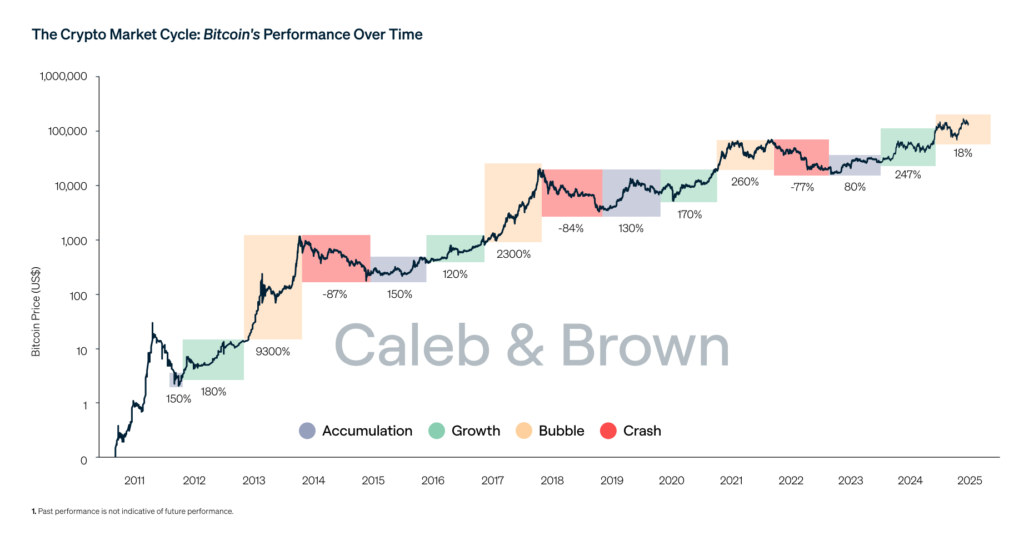

6. Volatility and Liquidity Shocks

Source: Caleb and Brown

Crypto remains highly volatile. Sudden whale trades, macroeconomic news, and central bank decisions can spark unpredictable swings. Smaller tokens are especially at risk of liquidity crises when markets turn bearish.

Investors holding leveraged positions face the greatest danger — as cascading liquidations can amplify market crashes.

7. Smart Contract Weaknesses

Source: Solulab

The engine of DeFi is also its Achilles heel. Bugs, poor coding practices, and inadequate audits have caused multi-million-dollar losses.

Even audited contracts have been exploited in 2025, raising questions about the industry’s reliance on untested code. Until stronger security frameworks are in place, smart contracts remain a high-risk area.

8. TOP 10 Risks and Threats : Global Legal Inconsistencies

Source: cellbunq

Crypto’s borderless nature collides with fragmented national laws. Exchanges that operate internationally face constant legal uncertainty, with some countries embracing crypto while others impose strict bans.

For investors, this means the rules of engagement may change overnight — sometimes without warning.

9. TOP 10 Risks and Threats : Environmental Scrutiny and ESG Demands

Sustainability is no longer optional. Proof-of-Work mining faces mounting criticism for its carbon footprint, while ESG-focused investors demand greener alternatives.

This pressure could push more projects toward Proof-of-Stake or hybrid models. Those unable to adapt may lose institutional backing.

10.TOP 10 Risks and Threats: Reputational Damage and Trust Deficit

Crypto’s credibility suffers each time an exchange collapses or a scam dominates the news cycle. Public trust is fragile — and without transparent governance, adoption could stall.

The industry’s long-term health depends on projects that prioritize ethics, security, and communication.

Quick Reference Table: TOP 10 Risks and Threats to Crypto in 2025

| Risk Category | Example | Potential Impact |

|---|---|---|

| Regulatory Crackdowns | MiCA in Europe, U.S. SEC actions | Legal uncertainty, project shutdowns |

| AML/KYC Non-Compliance | Unlicensed exchanges | Fines, license revocations, loss of trust |

| Cybersecurity Threats | DeFi protocol hacks, phishing | Billions lost, shaken investor confidence |

| Scams and Rug Pulls | Pump-and-dumps, fake NFT projects | Retail investors losing funds |

| Stablecoin Risks | USDT/USDC scrutiny, algorithmic failures | Market instability, liquidity crashes |

| Market Volatility | Whale trades, leveraged liquidations | Rapid sell-offs, panic-driven downturns |

| Smart Contract Vulnerabilities | Unpatched DeFi exploits | Protocol drains, user losses |

| Cross-Border Legal Issues | Differing regulations in Asia vs. EU | Compliance costs, restricted access |

| Environmental/ESG Pressures | Bitcoin mining debates | Institutional divestment, policy bans |

| Reputational Risks | Exchange collapse scandals | Declining adoption, erosion of public trust |

Conclusion : TOP 10 Risks and Threats

The TOP 10 Risks and Threats in 2025 illustrate how the crypto market is evolving in complexity. The dangers are no longer isolated events — they overlap across regulation, technology, and public perception.

Investors, businesses, and regulators alike must recognize that the future of digital assets depends not just on innovation, but on building resilience. Only by addressing these risks can the crypto industry maintain its growth trajectory while avoiding self-inflicted setbacks.