Top 10 Smart Contract : Ethereum has long been synonymous with smart contracts, serving as the backbone for decentralized finance, NFT marketplaces, and thousands of dApps. Yet, by 2025, Ethereum’s dominance is no longer absolute. Scalability bottlenecks, high gas fees, and persistent debates about network efficiency have left room for ambitious competitors. From high-throughput blockchains like Solana to eco-conscious solutions like Algorand, new players are offering faster, cheaper, and more specialized alternatives.

The smart contract industry has matured into a multi-billion-dollar sector, powering everything from cross-border payments to government-backed digital identities. As blockchain enters mainstream enterprise and consumer applications, developers and investors are asking a critical question: which platforms will shape the next decade of Web3? This article explores the top 10 smart contract platforms competing with Ethereum in 2025, analyzing their strengths, weaknesses, and areas of innovation.

Understanding Smart Contract Platforms

A smart contract platform is more than just a blockchain—it’s an entire ecosystem where developers build, deploy, and execute automated agreements without relying on intermediaries. These platforms handle transaction verification, guarantee immutability, and create trustless environments that make decentralized systems possible.

Ethereum set the standard, but its challenges have made room for innovation. Some platforms aim to solve Ethereum’s congestion by boosting speed and scalability, while others focus on niche applications like enterprise solutions, cross-chain communication, or sustainability. This diversity reflects the reality of 2025: there is no single “Ethereum killer,” but rather a multi-chain future where different platforms excel in different use cases.

Evaluation Factors for Ethereum Competitors

When comparing platforms, several factors stand out:

- Security: Platforms must defend against hacks and vulnerabilities.

- Scalability: High transaction throughput without sacrificing decentralization.

- Transaction Costs: Affordable gas fees for mass adoption.

- Ecosystem Support: Active communities, developer tools, and SDKs.

- Consensus Models: From Proof of Stake to hybrid systems shaping efficiency.

- Governance and Flexibility: On-chain voting, upgradeability, and adaptability.

Ethereum remains the baseline, but these criteria highlight where other blockchains are competing aggressively.

Top 10 Smart Contract Platforms Competing With Ethereum in 2025

1. Polkadot

Polkadot offers a unique parachain framework that connects multiple blockchains into one interoperable ecosystem. This design allows dApps and tokens to move across chains seamlessly, addressing one of Ethereum’s biggest limitations—fragmentation. Using Nominated Proof of Stake, Polkadot achieves scalability while maintaining security. Its growing ecosystem includes parachains focused on DeFi, gaming, and cross-chain bridges. The challenge lies in building a developer community as large as Ethereum’s, but its multi-chain architecture makes it one of the most ambitious Ethereum competitors.

2. Hyperledger

Source: Educuba

Hyperledger, led by the Linux Foundation, represents the enterprise face of blockchain. Unlike public, permissionless networks, Hyperledger focuses on permissioned frameworks tailored for industries that demand high security and privacy. Banks, hospitals, and supply chain giants use Hyperledger to customize blockchain solutions without exposing sensitive data to the public. Its modular architecture and flexible consensus mechanisms give businesses full control. While Hyperledger doesn’t compete in DeFi or NFTs, it dominates where compliance, regulation, and scalability are critical.

3. Cardano

Source: CoinTruck News

Cardano takes a scientifically rigorous approach to blockchain design. Built on peer-reviewed research and formal verification, it offers unmatched confidence in security and sustainability. Its Ouroboros PoS protocol is energy-efficient, making it appealing in a world increasingly focused on green technology. Although Cardano has been criticized for slow adoption, its partnerships with governments and educational institutions reflect its long-term vision. It is positioning itself not as a speculative playground but as a foundation for critical societal infrastructure.

4. Solana

Source: Cryptopotato

Solana is the performance-driven alternative to Ethereum, boasting transaction speeds of up to 65,000 TPS. Its hybrid Proof of History and Proof of Stake system has enabled it to attract developers of high-frequency applications like Web3 gaming and DeFi trading. Low fees make it accessible to retail users, and its NFT ecosystem has exploded in recent years. However, Solana has faced criticism for occasional network outages, raising questions about reliability. Despite this, its relentless focus on speed and scale ensures it remains one of the most closely watched Ethereum challengers.

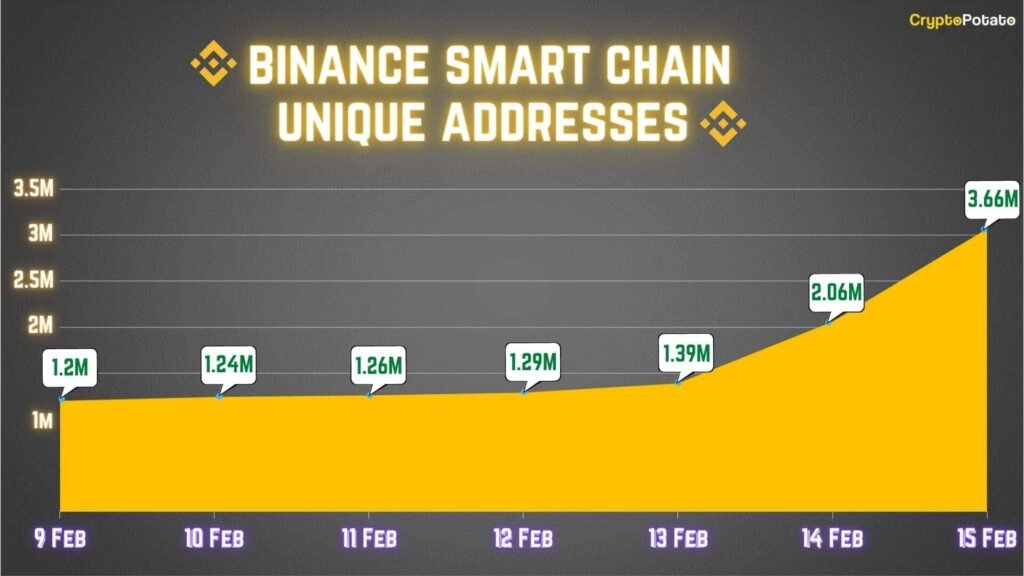

5. Binance Smart Chain (BSC)

Source: Cryptopotato

Binance Smart Chain has carved out a reputation as the “affordable Ethereum.” With Delegated Proof of Stake, it achieves fast block times and minimal fees, making it attractive for developers launching consumer-friendly dApps. Its ecosystem is packed with DeFi protocols, token exchanges, and retail-facing applications. The main criticism is centralization, given Binance’s influence over the chain. Still, BSC’s user adoption and activity levels prove it is not only surviving but thriving as a practical alternative for developers priced out of Ethereum.

6. Top 10 Smart Contract : Tezos

Tezos stands out with its self-amending blockchain, allowing upgrades without contentious hard forks. This innovation makes it a model of governance flexibility, ensuring the network can evolve smoothly over time. Its Liquid PoS mechanism balances efficiency with security, while its eco-friendly design has drawn attention in digital art and sustainability sectors. Adoption has been slower compared to flashier networks, but Tezos’ ability to adapt organically through community governance positions it as a long-term player.

7. Stellar

Source: Ledger

Stellar specializes in cross-border payments and financial inclusion. With its Federated Byzantine Agreement, Stellar achieves lightning-fast settlements at very low costs, making it perfect for remittances and micropayments. While it cannot handle the complexity of Ethereum-style smart contracts, its focus on global payments makes it a unique competitor. Banks and fintech firms increasingly use Stellar for bridging fiat and digital currencies, cementing its role in financial infrastructure rather than consumer-facing dApps.

8. Top 10 Smart Contract : Polygon

Source: The Block

Polygon is Ethereum’s most successful scaling solution, extending its reach through sidechains and Layer-2 technologies. Developers benefit from Ethereum’s massive community while avoiding congestion and high gas fees. Polygon supports DeFi, NFTs, and gaming applications that need fast, affordable transactions without abandoning Ethereum altogether. Its biggest limitation is its dependency on Ethereum’s ecosystem, but that same tie also ensures its relevance in the broader multi-chain environment.

9. Algorand

Algorand emphasizes sustainability, scalability, and simplicity. Its Pure Proof of Stake consensus offers near-instant finality and eco-friendly operations. Governments and enterprises experimenting with blockchain often gravitate to Algorand for its balance of efficiency and green technology. While its ecosystem is not as large as Ethereum or Solana, its focus on real-world adoption—such as digital currencies and carbon-tracking initiatives—gives it a unique edge in the 2025 landscape.

10. Top 10 Smart Contract: Avalanche

Avalanche redefines blockchain customization with its subnet architecture, enabling developers to create application-specific chains. Its Avalanche consensus model provides high throughput and near-instant finality, appealing to both DeFi innovators and enterprises. Subnets allow regulatory compliance or specialized environments while still connecting to the broader Avalanche network. The complexity of managing subnets can be challenging, but its flexibility makes Avalanche one of the most promising Ethereum alternatives for Web3 infrastructure.

Comparison Table – Top 10 Smart Contract

| Platform | Programming Language | Consensus Mechanism | Permission Type | Speed (TPS) | Advantages | Disadvantages | Key Use Cases |

|---|---|---|---|---|---|---|---|

| Polkadot | Rust, Substrate | Nominated PoS | Permissionless | ~1,000+ | Interoperability, scalability | Smaller dev ecosystem | Cross-chain apps, DeFi |

| Hyperledger | Go, Java, Node.js | BFT variants | Permissioned | Varies | Enterprise-grade security, modularity | Limited public dApps | Finance, healthcare, supply chain |

| Cardano | Haskell, Plutus | Ouroboros PoS | Permissionless | ~250 | Formal verification, eco-friendly | Slower adoption | Government, education |

| Solana | Rust, C, C++ | Proof of History + PoS | Permissionless | 65,000+ | Ultra-fast, low fees | Occasional outages | DeFi, NFTs, gaming |

| BSC | Solidity (EVM-based) | Delegated PoS | Permissionless | ~160 | Low-cost, large adoption | Centralization concerns | DeFi, retail dApps |

| Tezos | Michelson, SmartPy | Liquid PoS | Permissionless | ~1,000 | Self-amending, on-chain governance | Slower ecosystem growth | Digital art, sustainability |

| Stellar | Stellar Smart | Federated BFT | Permissionless | ~1,000+ | Cheap, instant payments | Limited contract complexity | Cross-border payments, remittances |

| Polygon | Solidity (EVM-based) | PoS Sidechains | Permissionless | ~7,000+ | Ethereum scaling, low fees | Reliant on Ethereum | DeFi, NFTs, gaming |

| Algorand | TEAL, Python, Go | Pure PoS | Permissionless | ~6,000 | Sustainable, near-instant finality | Smaller ecosystem | Finance, government, green apps |

| Avalanche | Solidity, Rust, Go | Avalanche PoS | Permissionless | ~4,500+ | Subnets, customizable chains | Complexity of subnets | DeFi, enterprise, Web3 infra |

Conclusion – Top 10 Smart Contract

The blockchain world in 2025 is no longer dominated by a single network. Ethereum continues to set the standard, but the top 10 smart contract platforms demonstrate how competition is driving innovation in speed, cost efficiency, governance, and sustainability. Solana excels in high-speed performance, Cardano in academic rigor, Polkadot in interoperability, and Algorand in eco-friendliness. Meanwhile, platforms like Hyperledger and Stellar are proving that enterprise and financial applications require different approaches altogether.

The future is not about one winner but about a multi-chain ecosystem where each platform thrives in its niche. Developers, enterprises, and investors must choose based on use case rather than brand recognition—because in 2025, blockchain is not one-size-fits-all.