Staking and yield farming are no longer niche experiments in the crypto world. By 2025, they’ve matured into core strategies for both retail investors and institutions seeking reliable passive income. The top 10 staking & yield platforms represent a spectrum of choices: from centralized exchanges that prioritize convenience, to decentralized protocols designed for transparency, flexibility, and self-custody.

These platforms are more than just income opportunities. They reinforce blockchain security, unlock liquidity through innovative derivatives, and integrate with the broader DeFi ecosystem. Choosing between them requires balancing yields, risks, and personal investment goals. Let’s take a closer look at the platforms shaping staking and yield in 2025.

Top 10 Staking & Yield Platforms in 2025

1. Binance Staking

Source: 99Bitcoin

Binance continues to dominate as the go-to platform for entry-level and active crypto investors. Its staking options cover nearly every major proof-of-stake asset, including Ethereum, Solana, BNB, Cardano, and Polkadot. Users can choose between flexible staking, which allows instant withdrawals, and fixed-term staking, which typically offers higher returns.

Yields on Binance range widely—from modest percentages on large-cap tokens to double-digit returns on smaller assets. The platform’s strength lies in accessibility: anyone with a Binance account can start staking within minutes. Still, because it’s a centralized exchange, investors must accept custodial risks and regulatory uncertainties.

2. Coinbase Staking

Source: Coinbase

Coinbase appeals to investors who want simplicity, regulation, and a user-friendly interface. Its staking services cover core assets like Ethereum, Cardano, Solana, and Cosmos, with average returns between 2% and 6%. The platform makes it easy for beginners by handling all technical aspects, including validator management and reward distribution.

Although Coinbase charges higher fees compared to some competitors, its reputation for compliance and strong security standards continues to attract cautious investors. For many, the trade-off between lower APYs and higher safety feels like a reasonable choice—especially for those new to crypto staking.

3. Kraken Earn

Kraken has built trust over years of secure operations, and its staking product, Kraken Earn, reflects this reliability. It supports a selection of key assets such as Ethereum, Polkadot, Kusama, and Cardano. Yields usually fall between 2% and 12%, depending on the asset and lock-up conditions.

Kraken’s edge lies in its balance between transparency and performance. While it offers fewer coins than Binance or Coinbase, its long-standing reputation for security appeals to investors who prioritize stability. For those who see staking as a steady, long-term strategy, Kraken Earn remains a consistent choice.

4. Lido Finance

Source: Altcoinbuzz

As a pioneer in liquid staking, Lido has become a cornerstone of DeFi in 2025. It allows users to stake assets like Ethereum, Solana, and Polygon, while receiving liquid tokens (such as stETH or stSOL) that can be used across decentralized finance protocols. Yields typically range from 4% to 8%.

The advantage of Lido is flexibility: investors can earn staking rewards while keeping their assets liquid and usable in lending, trading, or farming strategies. However, concerns over centralization and reliance on smart contracts remain. Despite these debates, Lido’s dominance in liquid staking makes it an indispensable player in today’s market.

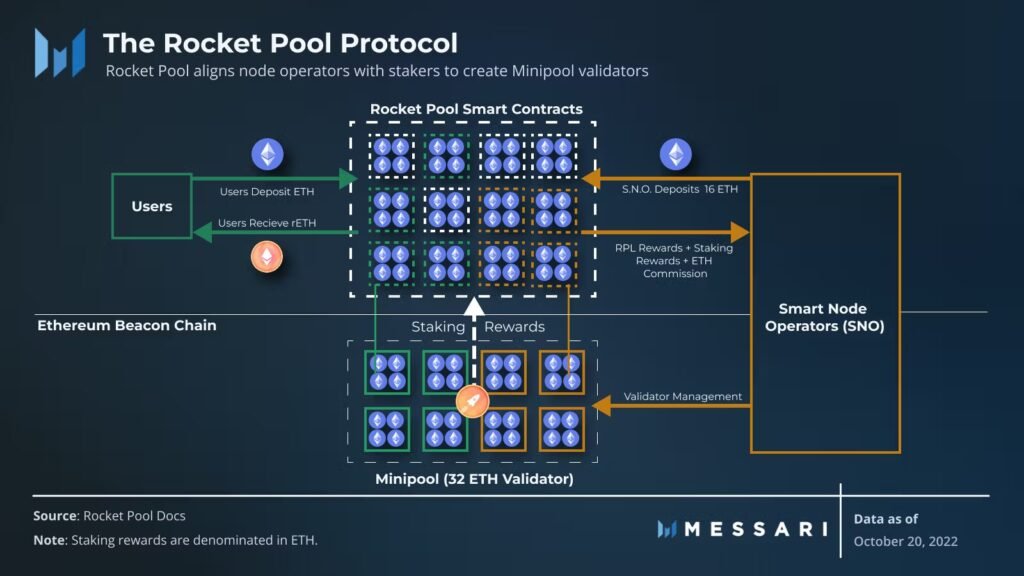

5. Rocket Pool

Source: Messari

Rocket Pool stands as the decentralized counterpart to services like Lido, focusing entirely on Ethereum staking. It’s accessible even for small investors, with minimum requirements as low as 0.01 ETH, and offers competitive yields between 3% and 6%. For those who want to run validator nodes, Rocket Pool also provides opportunities to participate directly in Ethereum’s infrastructure.

The project’s decentralized design and use of rETH tokens make it appealing to investors who want liquidity without sacrificing control. While its scope is narrower than Lido’s, Rocket Pool has become a trusted option for ETH-focused stakers who value independence and decentralization.

6. Figment

Source: The Block

Figment is widely regarded as one of the most professional validator services in the industry. Supporting chains such as Ethereum, Solana, Cosmos, Near, and Polkadot, it is a favorite among institutions that require reliability and clear reporting. Yields average between 4% and 12%, depending on the network.

Transparency is a hallmark of Figment’s service. It offers detailed performance histories and prioritizes security measures, including slashing protection. While retail investors often access Figment through partner platforms, its institutional focus highlights the increasing role of staking in mainstream finance.

7. Stakefish

Stakefish is a global validator that has built a reputation on technical excellence and broad coverage. It supports assets including Ethereum, Solana, Cardano, and Cosmos. Typical yields fall within the 4% to 10% range.

The platform is especially appealing to experienced stakers who want professional-grade infrastructure without relying on centralized exchanges. With a strong validator presence across multiple networks, Stakefish emphasizes decentralization and reliability, though its more technical setup may feel less approachable for beginners.

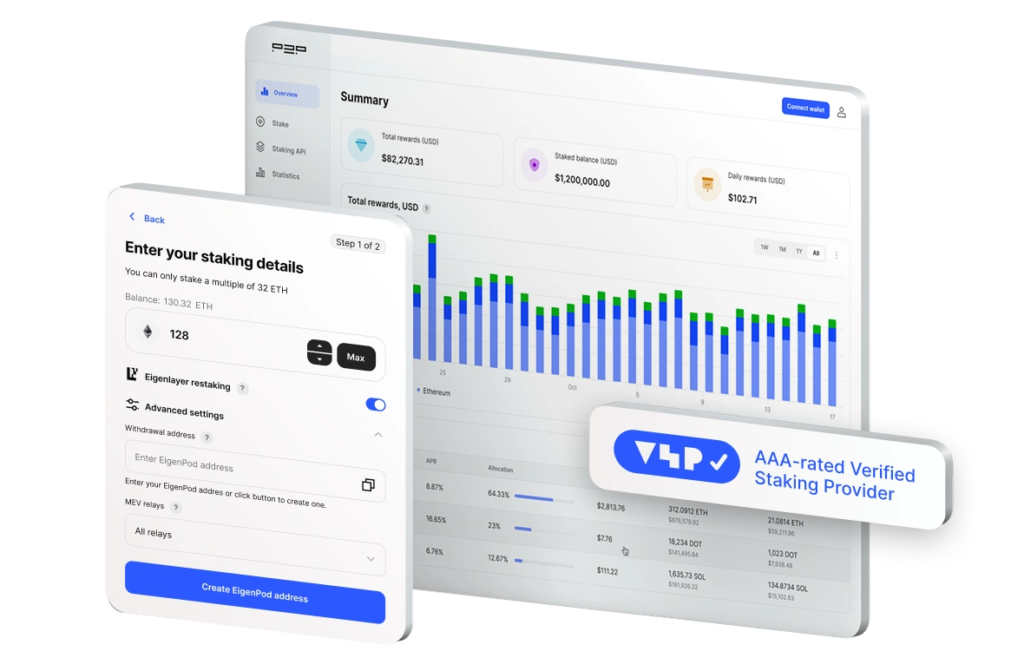

8. Top 10 Staking & Yield : P2P.org

Source: P2P

P2P.org markets itself as a premium validator service, catering to both institutions and sophisticated retail investors. It provides staking for Ethereum, Solana, Polkadot, and Cosmos, offering yields between 4% and 12%. Key features include slashing protection and advanced analytics dashboards that help investors monitor performance.

Its professional infrastructure and transparent approach make it especially attractive to large-scale investors who need more than just yield—they need assurance of operational security. As institutional adoption of staking grows, platforms like P2P.org have positioned themselves as trusted partners.

9. Top 10 Staking & Yield : Marinade Finance

Marinade Finance is the leading liquid staking solution for Solana. By offering mSOL, it gives investors the ability to earn staking rewards while maintaining liquidity for use across Solana’s DeFi ecosystem. Yields generally range from 6% to 8%.

The strength of Marinade lies in its ecosystem integration. mSOL is accepted across a wide range of Solana-based lending, trading, and farming platforms, creating opportunities for investors to compound yields. The drawback is concentration risk—since it’s tied exclusively to Solana, it’s less suitable for those seeking multi-chain diversification.

10. Top 10 Staking & Yield : Ankr Staking

Ankr has become one of the most versatile liquid staking providers in the market, supporting Ethereum, Binance Smart Chain, Polygon, Avalanche, and others. It issues liquid tokens like aETH and aBNB, enabling users to stake assets while staying active in DeFi. Yields typically range between 3% and 9%.

What makes Ankr unique is its dual role: not just a staking platform, but also an infrastructure provider for Web3 developers. This ecosystem approach has made Ankr a favorite for investors seeking flexibility alongside broader blockchain utility. For multi-chain users who want staking to connect seamlessly with other activities, Ankr stands out as a balanced solution.

Conclusion – Top 10 Staking & Yield

The top 10 staking & yield platforms in 2025 highlight how far the crypto economy has evolved. From exchange-based simplicity with Binance and Coinbase, to the decentralized strength of Rocket Pool and Lido, to institutional validators like Figment and P2P.org—the range of options reflects the diversity of investor needs.

Whether the goal is maximizing yields, keeping assets liquid, or ensuring long-term security, there is a platform tailored for every type of participant. What unites them all is their role in shaping a financial landscape where crypto is no longer just held—it is put to work. In 2025, staking and yield are not just opportunities for passive income, but essential tools for participating in the future of finance.