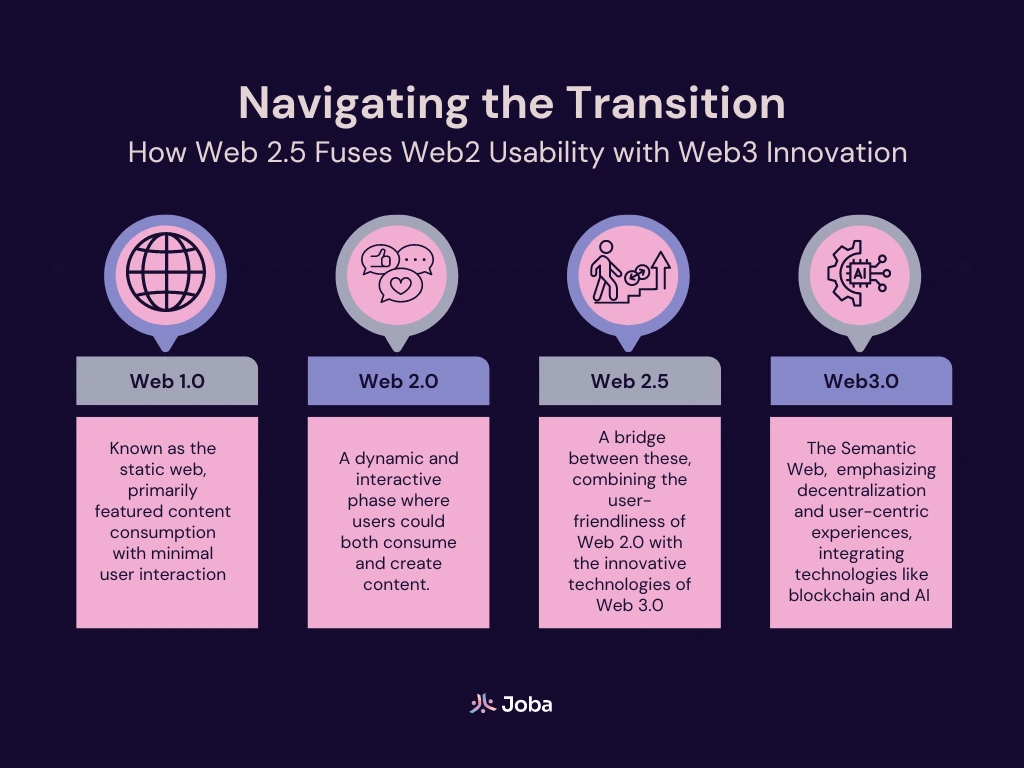

You’ve probably heard of Web2 — the traditional internet we use daily. Web3? The bold, decentralized vision where users control their data and assets. But now there’s Web2.5 trend, and while it sounds like a version number nobody asked for, it’s turning into a legal and regulatory topic worth watching.

Startups are pitching it. Major brands are testing it. And regulators? They’re still figuring out what to make of it.

So what is Web2.5 — and what kinds of legal implications does it introduce?

What Is Web2.5, Legally Speaking?

Web2.5 blends centralized Web2 infrastructure with elements of Web3 — namely blockchain-based assets, on-chain transactions, and token economies — but in a custodial, accessible, and often fiat-friendly way.

From a legal lens, this hybrid approach introduces new regulatory questions:

- Are platforms offering securities or utility tokens?

- Who owns an NFT if it’s held in a custodial wallet?

- Does fiat-to-NFT functionality invoke money transmitter laws?

Web2.5 isn’t just a UX decision — it’s a regulatory balancing act.

Why Web2.5 Trend Appeals to Businesses (and Raises Eyebrows)

Web3’s friction is well-known: wallet setup, volatile gas fees, and poor onboarding. Web2.5 says, “Let’s smooth it out” — by hiding complexity behind traditional infrastructure.

But this smoother path often comes at a legal cost.

Business Upside:

- Familiar payment methods reduce KYC friction.

- Easier onboarding means faster growth.

- Blockchain involvement adds marketing and monetization perks.

Legal Risk:

- Custody of digital assets brings compliance responsibilities.

- Platform-issued tokens may fall under securities law scrutiny.

- User agreements often blur the line between true ownership and platform control.

Key Legal Questions Surrounding Web2.5 Trend

1. Custodial Ownership

If a company holds the user’s wallet keys, who legally owns the NFT or token?

Most Web2.5 models use custodial wallets — convenient, yes, but they may undermine claims of ownership. This creates liability questions in the event of hacks, platform shutdowns, or disputes.

2. Securities Compliance

Even utility tokens, if sold with expectations of future value, could meet the Howey Test — meaning they may be unregistered securities.

Startups offering “tokenized rewards” or “NFT access passes” could unintentionally be entering SEC territory, especially in the U.S.

3. AML / KYC Obligations

Accepting fiat for digital assets — even indirectly — could place a platform in the role of a money transmitter, triggering compliance with anti-money laundering (AML) and know-your-customer (KYC) laws.

Using Stripe doesn’t absolve platforms if the end product is a transferable token.

4. Terms of Service Discrepancies

Many Web2.5 platforms use catch-all legal disclaimers, but vague or inconsistent terms around digital asset rights can be risky — especially in regions with consumer protection laws.

Real-World Web2.5 Examples — and the Legal Implications

- Reddit Avatars

NFTs issued on Polygon — but controlled by Reddit wallets. Legal concern: custodial risk and asset recovery policies. - Starbucks Odyssey

A loyalty program that includes blockchain-based stamps. Legal concern: Do these stamps function as tradable assets or are they marketing incentives? - Instagram’s NFT Pilot (RIP)

Meta tried showcasing NFTs on user profiles. It was shut down quietly — possibly due to moderation, IP, or compliance uncertainty.

Regulatory Outlook: Global Fragmentation, Evolving Rules

No single regulatory framework governs Web2.5 — and that’s a big part of the problem.

- U.S.: Securities and Exchange Commission (SEC) is aggressive but inconsistent.

- EU: MiCA is rolling out but still ambiguous on hybrid models.

- Asia: Rapid experimentation, but strict when crossing into digital payments.

Until global alignment occurs, Web2.5 platforms must thread the needle — with help from experienced legal counsel.

Conclusion: Web2.5 — Legal Stepping Stone or Risky Workaround?

Web2.5 isn’t a regulatory escape hatch — but it might be a transitional model toward compliance-ready Web3 adoption. It reflects the industry’s attempt to reconcile usability with innovation, all while trying not to trip over complex laws written before NFTs or tokens even existed.

Still, the risks are real. Custody issues. Securities exposure. Jurisdictional chaos. Platforms that fail to treat Web2.5 as a legal structure — not just a UX choice — could face regulatory action down the line.

In short: Web2.5 is not just a technical layer — it’s a legal experiment. And one worth watching closely.

Relevant Link : Here