When investors search for Uphold exchange review, the main question is whether the platform’s promise of multi-asset access actually delivers in 2025. Uphold has positioned itself as more than just a crypto exchange—it combines cryptocurrencies, stocks, precious metals, and even carbon credits in a single account. For traders who are tired of maintaining multiple apps, Uphold acts as a one-stop portfolio hub.

Unlike some platforms that focus only on crypto or only on equities, Uphold’s appeal lies in its ability to let users move between asset classes instantly. In practice, this means you could sell Ethereum and buy Tesla stock within seconds, without going through USD first. That kind of flexibility has become a big talking point in recent reviews.

Features That Define Uphold in 2025

Uphold’s strongest value proposition is its cross-asset functionality. With one login, users can hold Bitcoin, U.S. equities, or commodities like gold. For people who want exposure beyond digital assets, this is a rare offering.

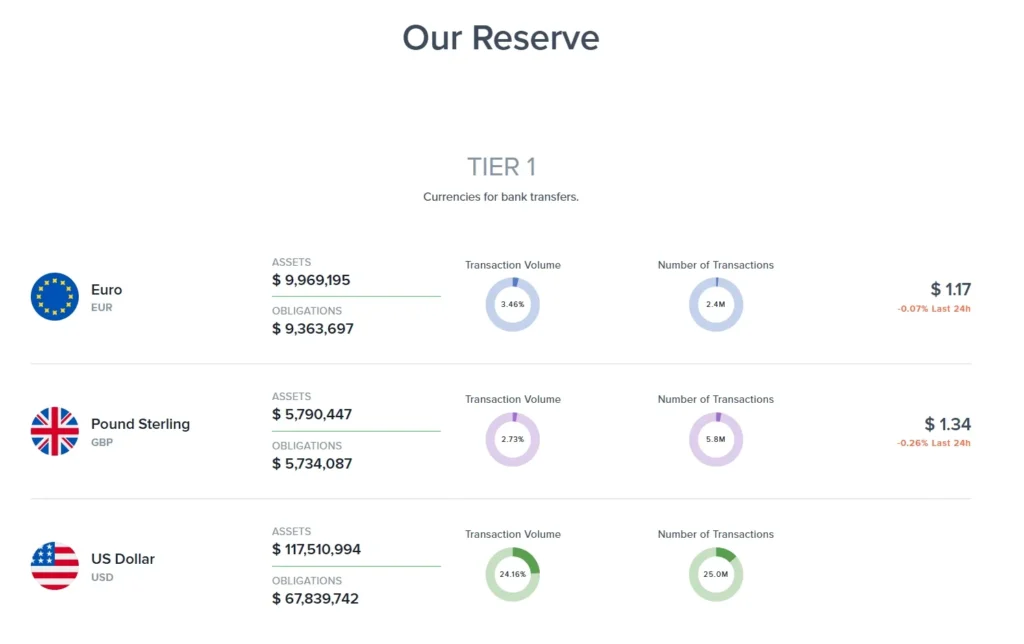

Another feature often highlighted in Uphold exchange review articles is the platform’s transparency. Uphold maintains a real-time “proof of reserves” dashboard, showing customers that their funds are fully backed. In an era where trust is fragile, this gives users more confidence than platforms that hide behind vague policies.

Additionally, the app integrates fiat on-ramps and supports debit card deposits, making it easier for both U.S. and international customers to get started.

Uphold Exchange Review: Fees and Spreads

Unlike some competitors with complicated tiered commissions, Uphold uses a spread-based model. Instead of charging a fixed trading fee, the costs are included in the buy and sell prices. On major crypto pairs like BTC/USD or ETH/USD, spreads average between 0.8% and 1.2%. For less liquid assets like altcoins or commodities, spreads can be higher.

This simplicity appeals to beginners who don’t want to calculate fee tiers. However, active traders sometimes criticize spreads as less transparent than flat fees. Still, many users accept this trade-off because of the convenience of managing crypto, stocks, and commodities in one place.

Uphold Exchange Review: Security and Compliance

Security remains a key concern in every Uphold exchange review. The platform emphasizes regulatory compliance, holding licenses in both the U.S. and Europe. This is attractive for investors who want a regulated and accountable service rather than an offshore exchange.

Uphold also offers industry-standard security measures such as two-factor authentication (2FA), encryption, and regular audits. More importantly, the proof-of-reserves feature distinguishes it from exchanges that simply ask for blind trust.

Supported Assets and Market Reach

By 2025, Uphold supports more than 250 cryptocurrencies, including Bitcoin, Ethereum, XRP, and popular altcoins. Beyond crypto, it allows trading in U.S. equities, precious metals, and even environmentally focused assets like carbon credits. This broad coverage makes it stand out against typical crypto-only exchanges.

Global accessibility is another plus. Uphold accepts fiat deposits from dozens of countries, enabling users across the U.S., Europe, and Asia to fund accounts via bank transfers, debit cards, or crypto wallets.

Uphold Exchange Review: Pros and Cons

| Pros | Cons |

|---|---|

| Multi-asset platform with crypto, stocks, and metals | Spread fees can be higher than flat-fee models |

| Cross-asset conversion without USD as a middle step | Lacks advanced tools for professional traders |

| Strong regulatory compliance and proof of reserves | Customer support can be slow to respond |

| Over 250 cryptocurrencies supported | Spreads on less liquid assets are costly |

Final Thoughts: Is Uphold Worth It in 2025?

This Uphold exchange review makes it clear that the platform is not trying to be the cheapest option—it is trying to be the most versatile. For users who want to trade crypto alongside equities or metals, Uphold delivers a unique solution. Its spread-based fees might not appeal to professional day traders, but casual investors appreciate the simplicity.

In 2025, Uphold remains a strong choice for people who value regulatory compliance, transparency, and the ability to diversify their portfolio in one account. If your priority is convenience and multi-asset access, Uphold stands out. If you’re chasing ultra-low fees or advanced trading tools, there may be better options.