Can You Use USDT Without Exchange — and Is It Legal?

With the global crackdown on illicit crypto use and rising regulatory scrutiny, the question isn’t just how to use USDT without exchange — it’s whether you can do so within the bounds of the law. The answer? Yes, but it depends on jurisdiction, platform compliance, and how you’re spending it.

Tether (USDT) remains one of the most used stablecoins globally, but using it for real-world payments without going through traditional exchanges often dances on the edge of regional regulation. Let’s explore what’s permitted, what’s gray, and where you need to be careful.

Use USDT Without Exchange: The Regulatory Drivers Behind Using USDT Directly

Why are more users seeking ways to use USDT without exchange? It’s not just about convenience. In many cases, people are trying to bypass banking restrictions, avoid unnecessary exchange fees, or gain privacy in transactions. But regulators are watching.

From the SEC to FATF guidelines, regulators want stablecoin transactions to meet the same AML (Anti-Money Laundering) and KYC (Know Your Customer) standards as traditional finance. This means users — and platforms — must be selective.

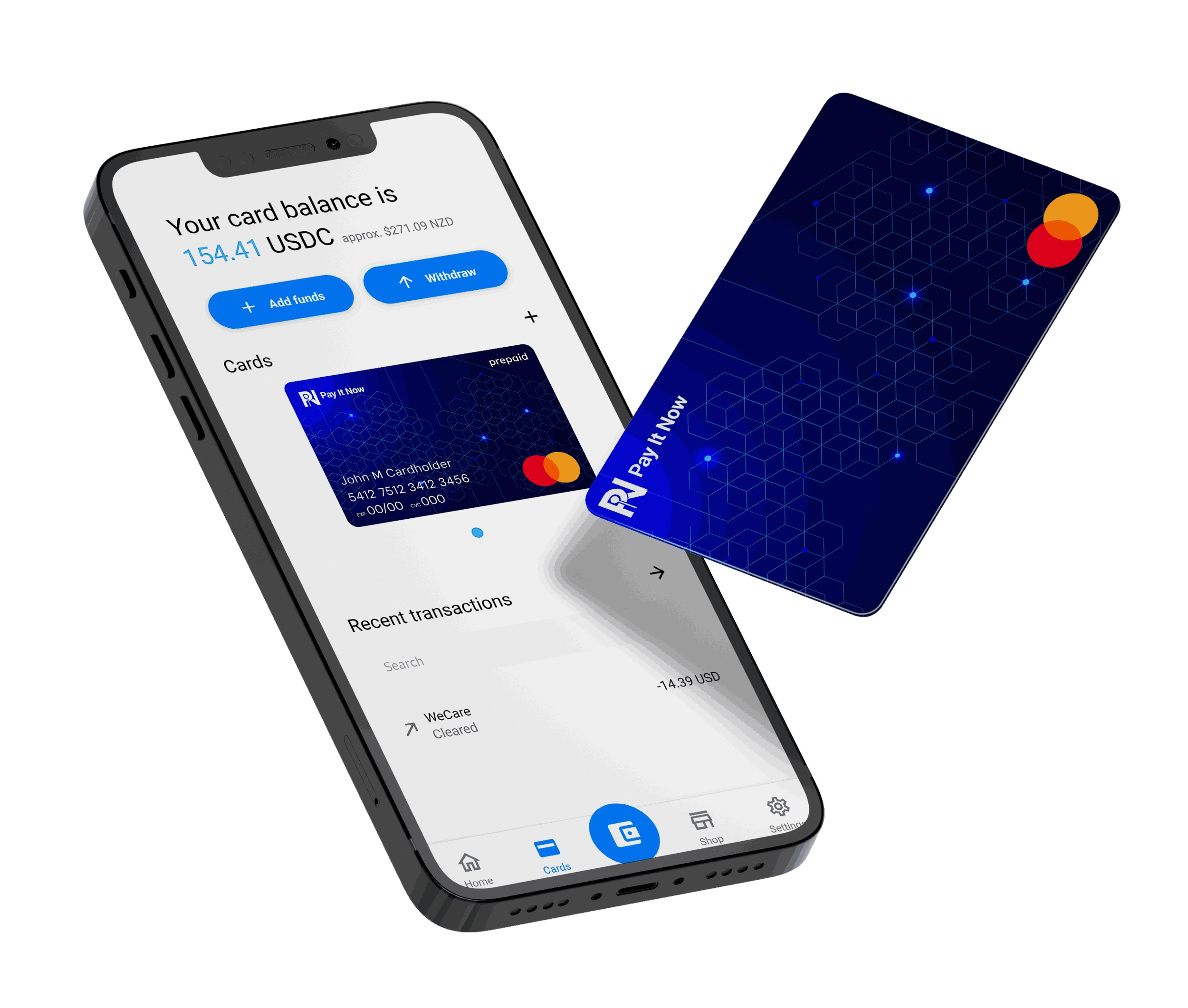

Crypto Cards and Legal Compliance

Crypto-linked debit cards have become one of the safest and most compliant ways to use USDT without exchange. Issuers like Crypto.com and Binance partner with licensed financial institutions to offer cards that are fully KYC-compliant and integrated into Visa or Mastercard networks.

These cards convert USDT at the point of sale, meaning users technically avoid exchanges, but still comply with money transmission laws. For legal users, this offers the best of both worlds: spendability and regulatory peace of mind.

USDT and Gift Cards: Still Legal, But Monitor the Source

Gift card platforms like Bitrefill and Coinsbee offer indirect but effective methods to spend USDT. Legally speaking, these platforms operate in a gray area depending on jurisdiction.

Most don’t require full KYC unless you’re transacting large amounts. But users should always verify whether the site is licensed to operate in their region — especially in the EU, UK, or US, where digital asset sales are increasingly monitored.

Using USDT for Freelancing and P2P Payments: Legal with Caution

Freelancers receiving USDT and individuals sending P2P payments often bypass exchanges — but this can trigger legal concerns depending on tax reporting laws.

In many countries, stablecoin income is still taxable. Whether you’re paying a contractor or receiving payments via TRC-20 or ERC-20, be sure to keep documentation. Unreported crypto income is increasingly targeted by tax authorities worldwide.

Platforms facilitating these transactions, such as escrow or gig marketplaces, may also fall under money service business (MSB) rules — meaning you, the user, should ensure they’re registered.

Merchant Acceptance of USDT — Regulated but Promising

Direct merchant acceptance of USDT is limited but growing. Companies using processors like NOWPayments or CoinPayments can accept USDT while remaining regulatory-compliant, often with automatic fiat conversion to reduce volatility and reporting complexity.

In countries with clear crypto frameworks (like Switzerland, Dubai, or Singapore), merchants can legally accept stablecoins as payment. In others, like the U.S., they must meet strict compliance standards or partner with intermediaries.

Shopify merchants, for example, can plug in crypto payments, but each one is responsible for ensuring their checkout process follows applicable tax and consumer protection laws.

Legal Pitfalls of Skipping Exchanges

What if you use USDT without exchange and without any KYC or audit trail? That’s where legality begins to fray. Anonymous or high-volume transactions done peer-to-peer can raise red flags with financial watchdogs.

Increased scrutiny from governments means that just because you can doesn’t mean you should — at least not without understanding the laws in your region. Countries like the U.S., Germany, and Japan have strict stablecoin oversight. Others are still building their frameworks.

Final Word: Yes, You Can Use USDT Without Exchange — If You Stay Legal

Regulation doesn’t mean restriction — it means clarity. And as the legal environment matures, using USDT without exchange is becoming not only feasible but also legitimate in many scenarios.

Whether it’s via cards, gift platforms, or merchant payments, the trick is staying within legal rails. Verify licensing, follow tax laws, and understand platform compliance — because the real win is using your crypto and sleeping well at night.

Relevent news: Here