Vietnam Crypto Law 2025: What’s Changed—and Why It Matters

Not long ago, Vietnam’s stance on digital assets felt like a patchwork of cautious warnings and informal practices. But that era is over. In 2025, the Vietnam crypto law introduces structured VDA rules that reshape the regulatory landscape.

From licensing requirements to formal trading supervision, the contrast between past ambiguity and today’s rules-based system offers insight into Vietnam’s shifting priorities.

1. Definition of Digital Assets: Then vs. Now in Vietnam Crypto Law

Credit from CryptoSlate

Before 2025:

There was no legal definition for digital assets. Bitcoin and other tokens were seen more as speculative instruments than recognized financial assets. The legal limbo left users operating in a risky grey area.

In 2025:

The law now formally defines Virtual Digital Assets (VDAs), drawing a line between utility tokens, asset-backed tokens, and payment-related tokens. This move gives investors and regulators shared language—and clearer expectations.

2. Trading Legality: Informal to Regulated

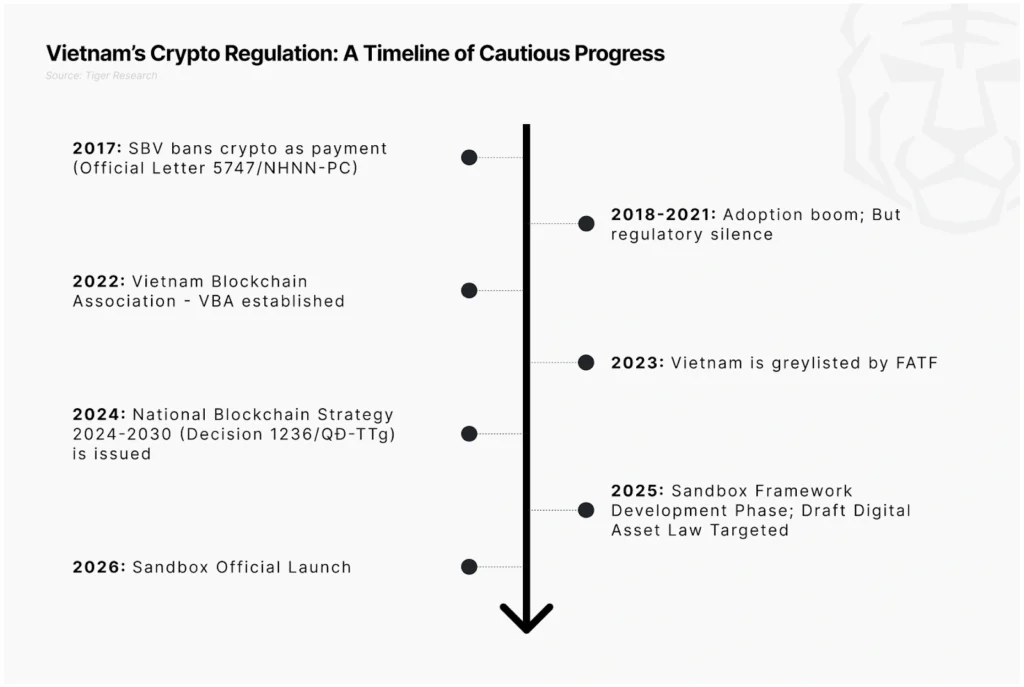

Credit from Tiger Research Reports

Before 2025:

Crypto trading wasn’t officially banned, but it wasn’t protected either. Platforms operated locally without oversight. Users bore full risk in case of hacks, fraud, or exit scams.

In 2025:

Crypto trading legal status in Vietnam is formalized. Licensed platforms must comply with anti-money laundering laws and KYC verification. Authorities now monitor transactions through registered exchanges.

3. Licensing and Business Entry

Credit from TronWeekly

Before 2025:

There were no clear VDA licensing requirements in Vietnam. Startups operated on assumptions or loosely followed international practices. This led to uneven standards and limited consumer protection.

In 2025:

Crypto firms must now apply for VDA licenses through the Ministry of Finance. The process includes meeting financial stability criteria, data security checks, and regular compliance audits. Unlicensed operations face fines or shutdowns.

4. User Protection: Lacking vs. Structured

Before 2025:

If a user lost funds due to exchange failure or a scam, legal recourse was limited. Most platforms had no insurance, and courts lacked the regulatory basis to intervene.

In 2025:

Consumer protection is now part of the regulation framework. Platforms are legally accountable for security breaches. Registered entities must implement fund segregation and disclose operational risks.

5. Public Perception: Suspicion to Acceptance

Credit from Cointelegraph

Before 2025:

Crypto was seen by many in Vietnam as a high-risk gamble, often associated with fraud or financial crime. Government warnings were common, discouraging widespread adoption.

In 2025:

With regulation in place, public perception is shifting. Younger investors and fintech innovators now see digital assets as legitimate tools. Still, concerns about complexity and overregulation persist, especially among small players.

6. Government Oversight: Reactive vs. Proactive

Before 2025:

Agencies responded to crypto-related issues only when problems surfaced. Coordination between ministries was fragmented, and enforcement was weak.

In 2025:

The Vietnam crypto law mandates oversight from the State Bank, Ministry of Finance, and Ministry of Public Security. A shared compliance taskforce ensures real-time enforcement and ecosystem stability.

Conclusion: Why the Vietnam Crypto Law 2025 Matters Now

Vietnam’s transition from informal crypto practices to structured governance through the Vietnam crypto law and VDA rules in 2025 marks a maturing phase for the country’s digital economy.

For investors, the shift brings greater legal certainty. For startups, it raises the bar—but also opens doors to legitimacy and scale. As Vietnam continues refining its rules, the world will be watching how this fast-growing market balances innovation with risk.