The buzz around virtual crypto card has been around for a while. Many people still dismiss them as flashy, impractical tech that looks cool but doesn’t really solve anything. But things have changed. In 2025, we’re seeing a different reality—one where virtual crypto cards are not only functional, but becoming an everyday tool for freelancers, global remote workers, and crypto-savvy consumers. And increasingly, Money Move is part of that shift.

Myth 1: Using a Virtual Crypto Card Is Too Complicated

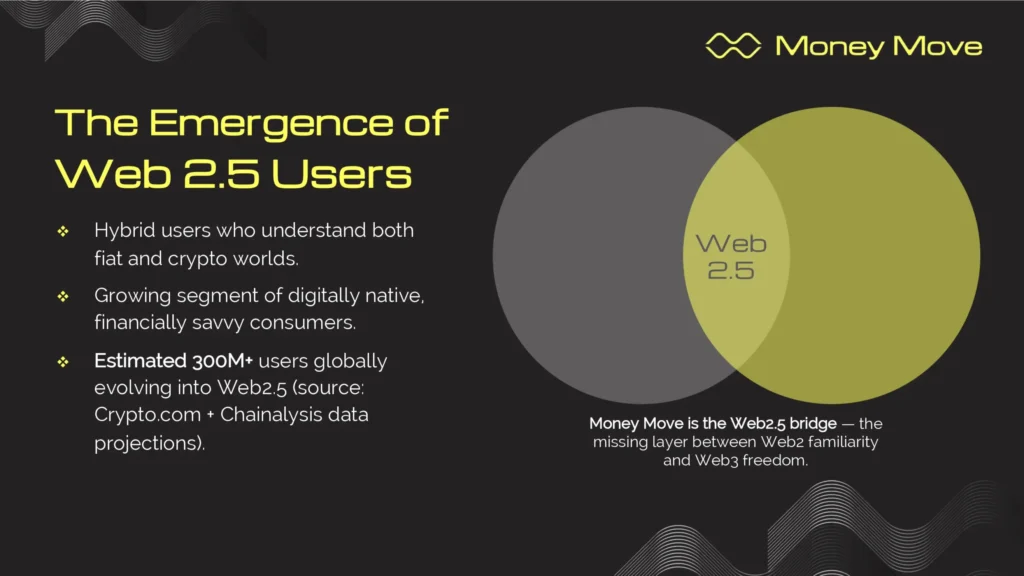

One major barrier has always been usability. From complex onboarding processes to clunky interfaces, early platforms made crypto cards feel like a chore. But innovation has caught up. Many platforms today—especially those embracing the Web2.5 model—are making UX their priority.

The Reality: Money Move Delivers Simplicity with Substance

This is where Money Move enters the picture. The platform doesn’t just offer a virtual crypto card—it reimagines what using one should feel like. Instead of requiring users to top up wallets or manually convert tokens, Money Move handles everything behind the scenes. Once you initiate a payment, the system triggers a real-time conversion at market rate, instantly pushing fiat value into traditional networks like Visa. You get to use your crypto like cash—and keep full ownership via your non-custodial MPC wallet.

Its DeAI-powered risk engine continuously monitors every transaction, flagging risks without slowing the process. T+0 settlement means your asset becomes spendable almost instantly. In short, it’s the kind of fluid, intuitive system that 2025 users expect.

Myth 2: Virtual Crypto Cards Aren’t Safe

Security remains a major concern—and rightly so. Mismanagement, frozen assets, or platform failures have made users wary. Money Move addresses this head-on with a non-custodial wallet structure powered by MPC technology, ensuring users maintain full control over their funds. Even in the event of platform disruption, your assets remain secure and accessible—because they’re never stored in a centralized vault to begin with.

Why Money Move’s Architecture Matters

Unlike many platforms that put themselves in the middle, Money Move takes a very different approach—and that matters. Its wallet system is based on MPC (multi-party computation), which sounds technical, but here’s the gist: users don’t give up control. They hold their own keys, their own funds. Nothing gets frozen, nothing gets rerouted, unless they say so. And even with all that decentralization, it still checks the boxes on compliance, meaning users can use it globally without constantly hitting regulatory roadblocks. It’s a rare case of having both freedom and security in one place.

So while myths persist, the truth in 2025 is this: virtual crypto cards are becoming essential tools—and platforms like Money Move are showing exactly how they should work.

Relevant News: Should You Still Care About Virtual Crypto Cards in 2025?